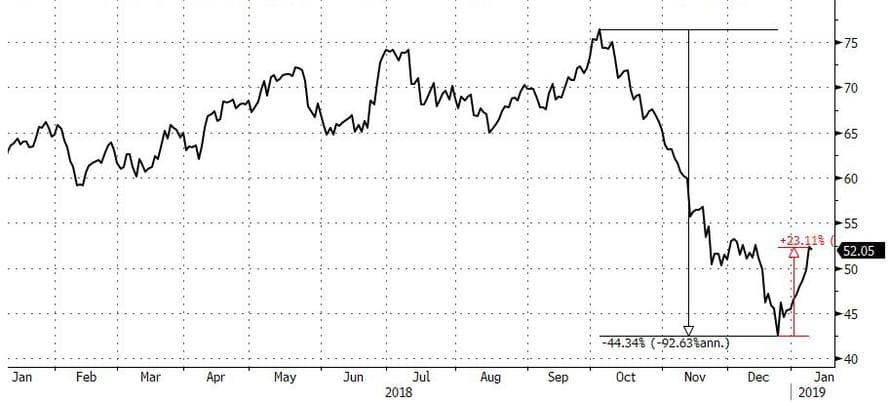

After crude suffered a near record, 44% plunge in the fourth quarter, one which left commodity funds reeling and both OPEC and oil exporting nations in a panic, oil stormed back into bull market territory, as investors who’d abandoned crude just a month ago were lured back by an OPEC-led campaign to bring runaway supplies in check coupled with algos who turned from net short back to long.

WTI crude closed above $52 a barrel, staging a powerful, 23% recovery after hitting an 18-month low on Christmas Eve. Brent, likewise, finished the day up 22% since bottoming out.

(Click to enlarge)

After ending 2018 in a deep bear market, oil sharply reversed course on signs that oil exporters will follow through on last month’s pledge to slash production, with Saudi Energy Minister Khalid Al-Falih repeating that the plan was on track Wednesday even if DOE energy stocks showed a smaller drop in inventory than expected. The bigger catalyst in recent weeks, however, was hope that the U.S.-China trade war may be ending, boosting demand from the world's largest oil importer adding to oil’s momentum, even if hopes that the just concluded trade talks would lead to any immediate resolution turned out to be false.

“‘Sentiment went from completely negative a couple of weeks ago to very positive right now,” said Matt Sallee, a portfolio manager who helps oversee $16 billion in energy assets for Kansas-based Tortoise. “Everyone’s just focused on the Saudis and they seem quite determined."

There's hope... and then there is reality which saw a whopping 10.6 million barrel surge in distillates and over 8 million barrels of gasoline added this week, numbers which were generally ignored by the market, which instead has been focusing on the recent plunge in the dollar, the result of a far more dovish Fed, which has helped support oil prices as the dollar decline made commodities priced in the U.S. currency more affordable.

“There is further upside to come in prices, as we see more evidence coming through that members of OPEC+ are complying with their new production cut,” said Warren Patterson, senior commodities strategist at ING Bank NV. “We see the market largely balanced over the first half of 2019.”

However, while all of these factors were well known and thus certainly already priced in, and hardly moving, the real catalyst for the recent surge higher in oil may have a different culprit: the same one that was blamed for oil's precipitous crash - algos. Related: China’s Gas Pivot Is Starting To Pay Off

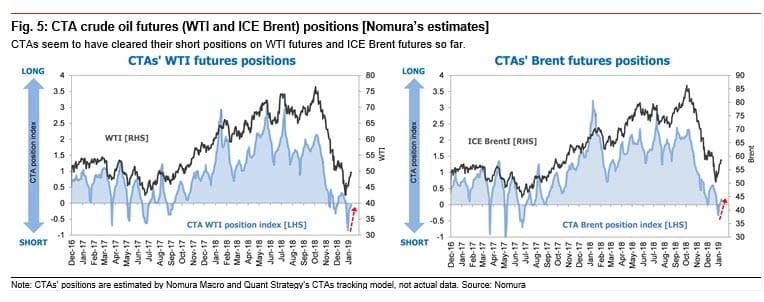

As Nomura's quant strategy team writes overnight, it has identified that "net short positions on WTI futures accumulated by CTAs have been wiped out" and that "most of the bearish payers have also exited the crude oil futures market." That may explain the sharp rebound as the marginal sellers are now turning long.

(Click to enlarge)

However, as Nomura also points out, for WTI to maintain levels over $50, "systematic trend-followers would need to keep stably accumulating fresh long positions" and that would require an extended move higher, something which after the recent 10 day surge, is unlikely.

Finally, according to Nomura, other major short-term players such as global macro HFs appear to be taking a “wait-and-see” approach by leaving their positions flat. The bank's conclusion: "we doubt CTAs’ 'solo-play' to buy the futures can support WTI levels above $50 going forward."

If the Japanese bank is right, the fledgling oil bull market will be rather short-lived.

By Zerohedge.com

More Top Reads From Oilprice.com:

- Darkening Outlook For Global Economy Threatens Crude

- Something Extraordinary Is Happening In Jet Fuel Markets

- The Natural Gas Crash Isn’t Over