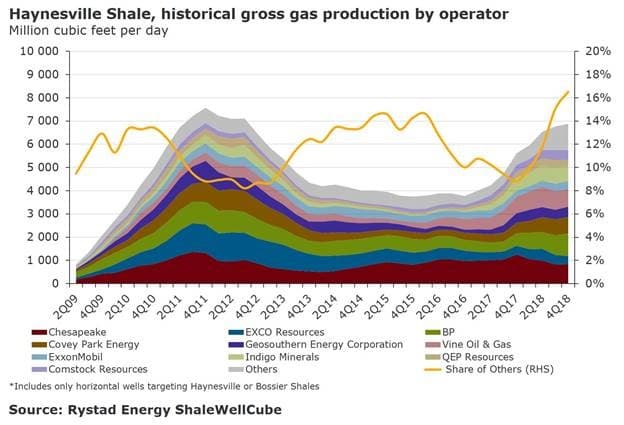

Gas production in the state of Louisiana in the southern U.S. will soon reach record heights thanks to an outstanding resurgence of the Haynesville shale play.

Rystad Energy research shows that the Haynesville Shale alone was able to add 1.85 billion cubic feet per day of gross gas production (Bcfd) between the fourth quarter 2016 and the fourth quarter 2017. Another 1.3 Bcfd was added last year. Production needs to increase by another 700 million cubic feet per day (MMcfd) in order to reach new all-time highs.

“We conclude that Haynesville Shale’s revival, for the second year in a row, looks sustainable. Supported by its proximity to a new LNG export terminal, gas production will continue to grow, and achieving new all-time high gas production levels should happen within a matter of months,” Rystad Energy partner Artem Abramov said.

(Click to enlarge)

Driven by Louisiana’s Sabine Pass LNG terminal on the Gulf Coast, US liquefied natural gas exports increased substantially in 2018. Rystad Energy forecasts US LNG production to surpass 40 million tons per annum (tpa) in 2019 as liquefaction capacity is set to double, including additions at Freeport, Cameron, Sabine Pass, Corpus Christi and Elba Island. While currently sanctioned LNG plants will produce about 65 million tpa by 2022, Rystad Energy forecasts production to reach 150 million tpa by 2030.

“The demand for US LNG is driven by the Asian market, where China, India and emerging markets will account for the largest portion of the growth. Rystad Energy forecasts global LNG demand to reach 560 million tpa by 2030, with Asia accounting for more than 75% of total volumes,” Rystad Energy senior analyst Sindre Knutsson said. Related: There Is Still Room To Run For Oil Prices

(Click to enlarge)

Prior to the collapse in U.S. gas prices back in the second half of 2008, Haynesville Shale was considered to be one of the world’s most prospective shale gas reservoirs, with the capability to drive growth in US gas production for years.

But low gas prices from 2009 to 2011 effectively derailed Haynesville’s growth prospects. After peaking in the fourth quarter 2011, gas production in Louisiana entered into a multi-year decline phase, losing almost 4 Bcfd by the fourth quarter 2016.

“Haynesville Shale is truly a different play today than it was in the first growth phase,” Abramov said. “Well productivity doubled from 2012 to 2018 measured in initial production rates and current estimated ultimate recovery (EUR). Even when productivity is normalized per perforated lateral foot, we observe 20-40% improvement over the last six years.”

(Click to enlarge)

Robust well productivity and low development costs for modern completions serviced by the “Big Three” frac services companies – Schlumberger, Halliburton and BJ Services – are central to the Haynesville renaissance.

“The clear trend we saw in Haynesville over the past six years has been a dramatic increase in the market share of Halliburton, Schlumberger and BJ Services,” Abramov said. “In 2015, Halliburton was able to increase its market share to 40% from 10%. Schlumberger reached a 28% market share in 2018. Combined, Halliburton, Schlumberger and BJ Services now account for 90% of the Haynesville market.”

More Top Reads From Oilprice.com:

- OPEC’s No.2 Boosted Production, Exports Just Before Cuts Began

- The 3 Continents Driving Global Energy Demand

- WoodMac: LNG Glut Not Likely In 2019