Friday November 24, 2017

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

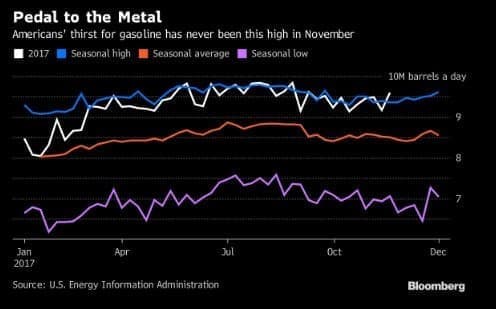

1. U.S. gasoline demand hits seasonal record

(Click to enlarge)

- Ahead of the Thanksgiving holiday, U.S. drivers filled up their tanks at the fastest rate in history for this time of year.

- Gasoline demand hit 9.6 million barrels per day in the week ending on November 17, a record high.

- Gasoline stocks are down to 210 million barrels, at the lower end of the five-year average range for this time of year.

- Refining runs are elevated, and gasoline production soared for the week. The robust figures could be a one-off anomaly due to the holidays, but demand looks strong, which should help drain crude inventories and boost prices.

2. Oil market in danger of slide if OPEC doesn’t deliver

(Click to enlarge)

- OPEC and Russia have raised expectations about their actions at the upcoming meeting to such a degree that anything short of an extension of the production limits through the end of 2018 will leave the oil market deeply disappointed.

- Adding to the danger is the fact that hedge funds and other money managers have staked out an incredible number of bullish bets on crude, exposing the market to downside risk.

- “Anything…

Friday November 24, 2017

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. U.S. gasoline demand hits seasonal record

(Click to enlarge)

- Ahead of the Thanksgiving holiday, U.S. drivers filled up their tanks at the fastest rate in history for this time of year.

- Gasoline demand hit 9.6 million barrels per day in the week ending on November 17, a record high.

- Gasoline stocks are down to 210 million barrels, at the lower end of the five-year average range for this time of year.

- Refining runs are elevated, and gasoline production soared for the week. The robust figures could be a one-off anomaly due to the holidays, but demand looks strong, which should help drain crude inventories and boost prices.

2. Oil market in danger of slide if OPEC doesn’t deliver

(Click to enlarge)

- OPEC and Russia have raised expectations about their actions at the upcoming meeting to such a degree that anything short of an extension of the production limits through the end of 2018 will leave the oil market deeply disappointed.

- Adding to the danger is the fact that hedge funds and other money managers have staked out an incredible number of bullish bets on crude, exposing the market to downside risk.

- “Anything but an extension supported by Russia would have a significant impact on the price,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S. “Not least due to the near record-long oil bet, which has left little room for error in terms of the communication from the OPEC ministers.”

- With the meeting a week away, reports that Russia is hesitating should be a cause for concern.

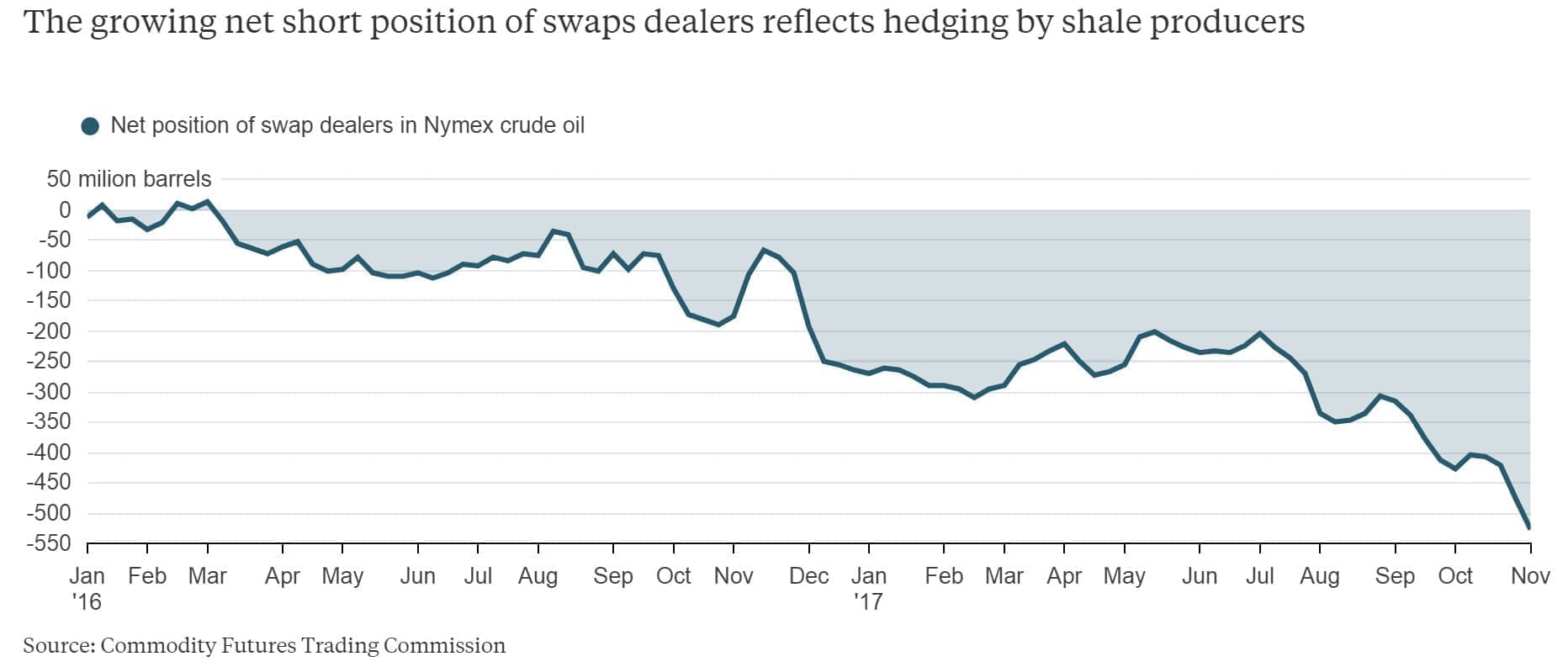

3. Shale hedging increased sharply in past three months

(Click to enlarge)

- The net short position of swaps dealers on the Nymex oil market, a sign of hedging, has spiked to more than 525 million barrels, according to Bloomberg Gadfly.

- In fact, the volume of hedging has soared in the past three months, with 2018 production hedges increasing by 29 percent, according to Standard Chartered.

- Hedging ensures some degree of stability for the shale industry – Standard Chartered said that nearly three quarters of the 2018 production for 66 companies it surveyed was hedged.

- The spike in hedging likely ensures that a steady dose of fresh shale supply is in store.

4. European oil producers take a hit from Norway’s sovereign wealth fund

(Click to enlarge)

- The STOXX Europe 600 Oil & Gas index slid immediately after Norway’s sovereign wealth fund proposed divesting of all oil and gas stocks.

- The nearly $1 trillion fund holds about $35 billion in oil and gas investments.

- The divestment alone isn’t the main concern, instead it is the signal that global capital is starting to grow wary of the vulnerability of oil price volatility, as well as the long-term viability of the oil industry.

- There is a variety of reasons for long-term concern – peak demand, the rapid rise of EVs, and increasingly stringent regulation related to climate change concerns (three factors that are obviously interrelated).

5. Keystone XL faces uncertain future, but pipelines needed

(Click to enlarge)

- The state of Nebraska approved the Keystone XL pipeline this week, seemingly handing a win to Canada’s desperate oil producers.

- Canadian oil production exceeds pipeline capacity to the U.S., forcing producers to ship their heavy oil by rail. The pipeline deficit is set to balloon from 330,000 bpd this year to 700,000 bpd by 2019.

- Keystone XL faces an uncertain future, with more litigation likely. But the pipeline is more needed than ever, particularly with dwindling heavy oil production in Venezuela and Mexico.

- Venezuelan output is in steep decline, while Mexico’s is eroding at a slower pace.

- U.S. refineries on the Gulf Coast that are equipped to handle heavy crude are hungry for Canadian output. Imports from Canada have doubled since 2010.

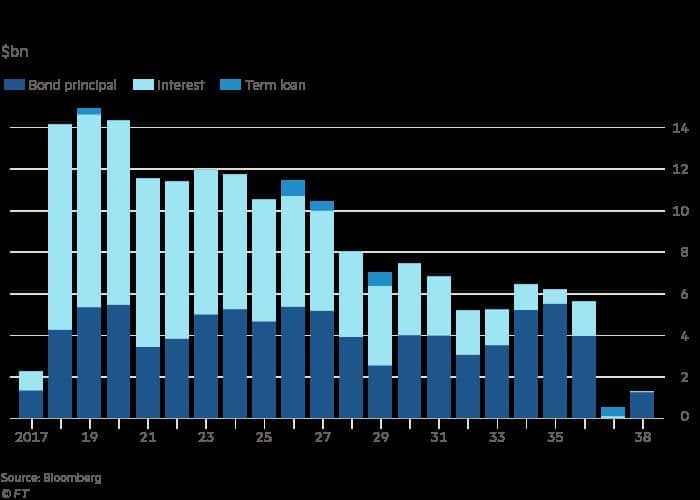

6. Venezuela debt looks insurmountable

(Click to enlarge)

- Venezuela defaulted on some debt payments last week, but we are only at the beginning of the story.

- Venezuela owes $64 billion to bondholders, more than $20 billion to China and Russia, along with $5 billion to multilateral lenders, according to the FT.

- The next steps are uncertain. Creditors could clamor to get at the front of the line, setting off a complex and messy series of cascading defaults.

- China and Russia have been lenient, but their generosity might not last forever if Venezuela prioritizes other creditors ahead of them.

- Meanwhile, international companies could get stiffed. Reuters reports that PDVSA is siphoning oil from its joint venture with Chevron (NYSE: CVX) to supply its domestic market, without any repayment.

- Two things are clear: the debt is too large for Venezuela to pay, and the country’s oil output is heading for a steep decline in 2018.

7. WTI makes small move into backwardation

(Click to enlarge)

- Brent has been in a state of backwardation – when front-month contracts trade at a premium to longer-dated oil futures – for several months, helping to accelerate the drawdown in global inventories. WTI has lagged behind, lingering in a narrow contango…until this week.

- WTI flipped into a backwardation after the spill of TransCanada’s Keystone pipeline. The initial report was a spill of 5,000 barrels, but by mid-week, TransCanada said that the 590,000 bpd pipeline would see deliveries cut by 85 percent in November.

- The outage of roughly 500,000 bpd for a few weeks will significantly tighten supplies to the U.S., and could help spark sharper inventory drawdowns. Spot prices surged on the news.

- That put a premium on front-dated oil futures, which is why WTI jumped into a state of backwardation.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.