The energy complex this week had a little bit of something for everybody this week. Bullish investors were rewarded with a surge in crude oil prices. Bearish investors celebrated another steep decline in natural gas. Neutral gasoline investors were satisfied with a sideways market.

The week started with low expectations due to the U.S. Thanksgiving holiday. This holiday-shortened week has historically been highlighted by extremely low volume and volatility.

Natural gas futures started the ball rolling on the downside with four consecutive lower closes. The market looked promising early in the month but a series of disappointing weather forecasts and storage reports drove prices sharply lower.

Crude oil prices started the week flat with many traders trying to balance the bullish news about a production cut extension next week by OPEC, and the bearish news about low demand and rising U.S. production.

However, bullish traders got a break when U.S. WTI crude oil surged to a two-year high as North American markets tightened on the partial closure of the Keystone pipeline connecting Canadian oilfields with the United States.

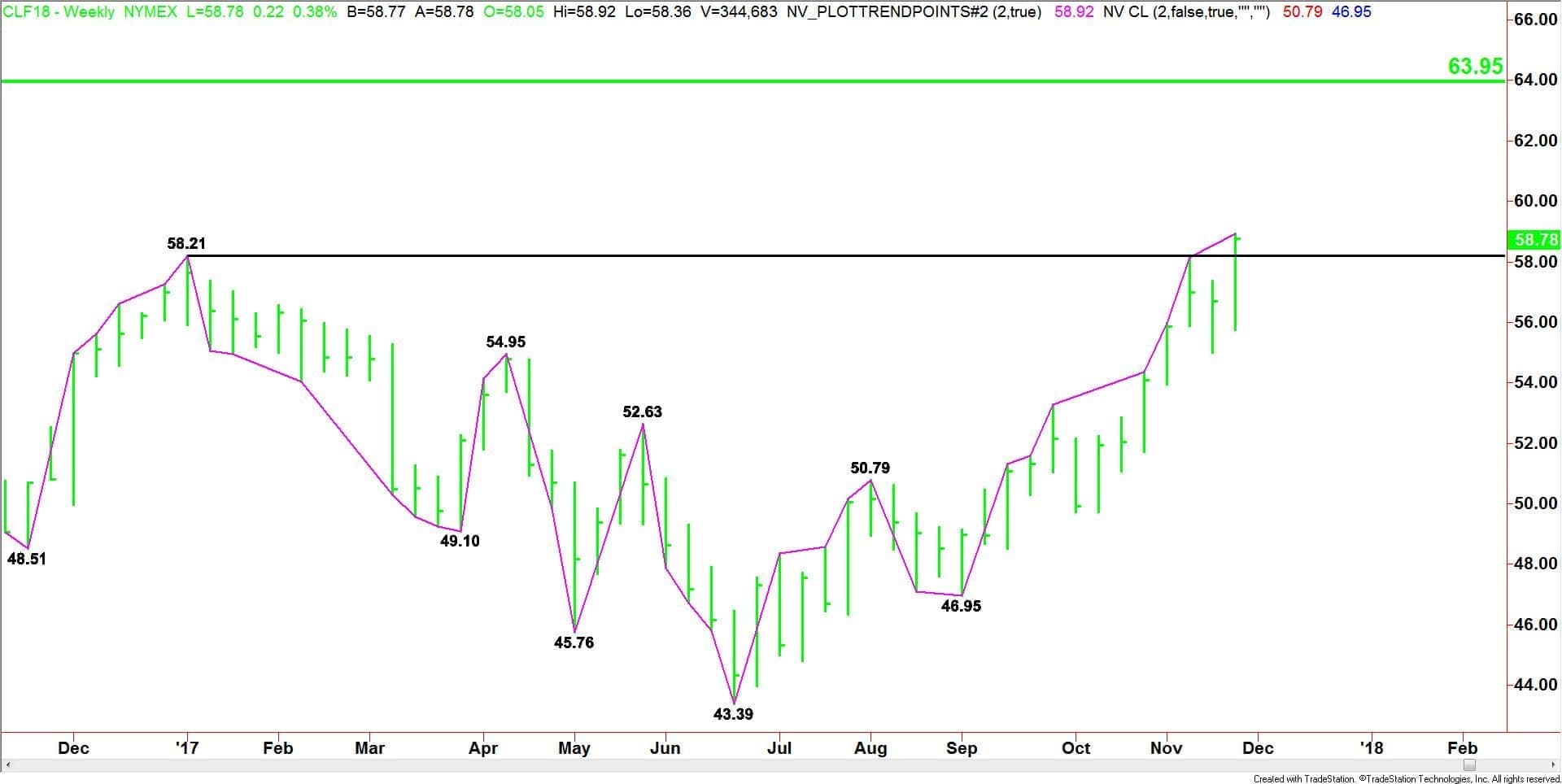

January West Texas Intermediate Crude Oil Futures

(Click to enlarge)

The main trend is up according to the weekly swing chart. The uptrend was reaffirmed this week when buyers took out the previous top at $58.21. The main bottom remained at $46.95. The primary upside target is $63.95.

A break back under…

The energy complex this week had a little bit of something for everybody this week. Bullish investors were rewarded with a surge in crude oil prices. Bearish investors celebrated another steep decline in natural gas. Neutral gasoline investors were satisfied with a sideways market.

The week started with low expectations due to the U.S. Thanksgiving holiday. This holiday-shortened week has historically been highlighted by extremely low volume and volatility.

Natural gas futures started the ball rolling on the downside with four consecutive lower closes. The market looked promising early in the month but a series of disappointing weather forecasts and storage reports drove prices sharply lower.

Crude oil prices started the week flat with many traders trying to balance the bullish news about a production cut extension next week by OPEC, and the bearish news about low demand and rising U.S. production.

However, bullish traders got a break when U.S. WTI crude oil surged to a two-year high as North American markets tightened on the partial closure of the Keystone pipeline connecting Canadian oilfields with the United States.

January West Texas Intermediate Crude Oil Futures

(Click to enlarge)

The main trend is up according to the weekly swing chart. The uptrend was reaffirmed this week when buyers took out the previous top at $58.21. The main bottom remained at $46.95. The primary upside target is $63.95.

A break back under $58.21 will signal the return of sellers. It will also indicate that this week’s rally was fueled by short-covering rather than aggressive new buying. If anyone did buy the breakout to the upside and it broke back under $58.21 then these traders would be trapped. This could eventually lead to more aggressive selling pressure as they struggle to get out of their bad positions.

Another sign of weakness at this point on the chart will be a higher-high, lower-close, otherwise known as a technical closing price reversal top.

(Click to enlarge)

The Gann angle chart supports the uptrend on the swing chart. It indicates that crude oil has been moving higher at a pace of about $1.00 per week since the $46.95 the week-ending September 1.

During the week-ending December 1, the Gann angle moves up to $59.95. Crossing to the strong side of the angle will put the January WTI futures contract in an extremely bullish position.

On the downside, the best uptrending support angle comes in at $53.45. Since the main trend is up, buyers are likely to come in on a test of this angle.

Conclusion

The momentum at the end of the week strongly suggests the rally will extend into next week. The only signs of weakness will be a break back under $58.21 or a closing price reversal top. These moves will not mean the trend is changing to down, but they will be strong signs that the selling is greater than the buying at current price levels.

Basically, we’re looking for a strong rally on a sustained move over $59.95 and for weakness to develop on a sustained move under $58.21.

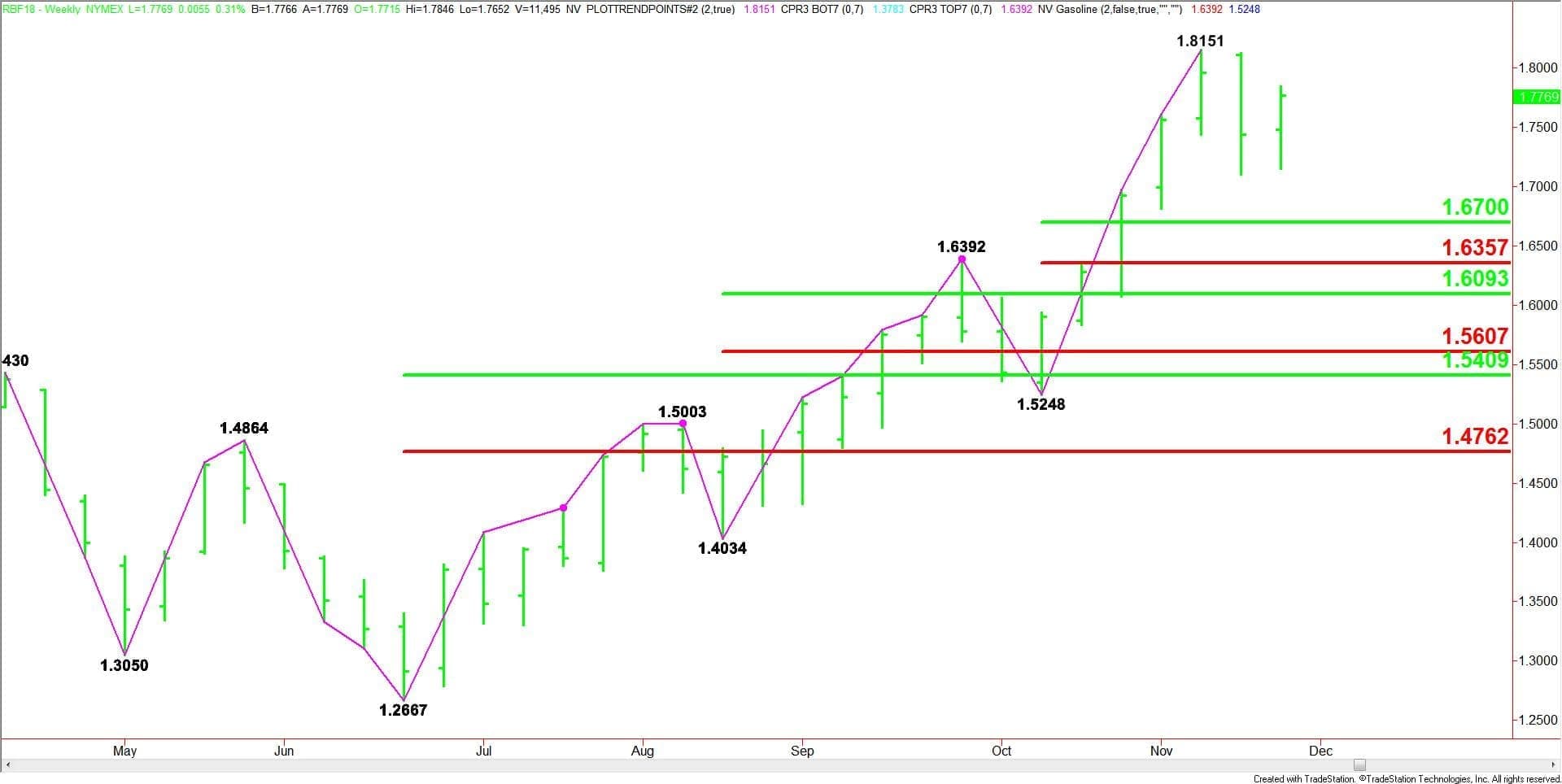

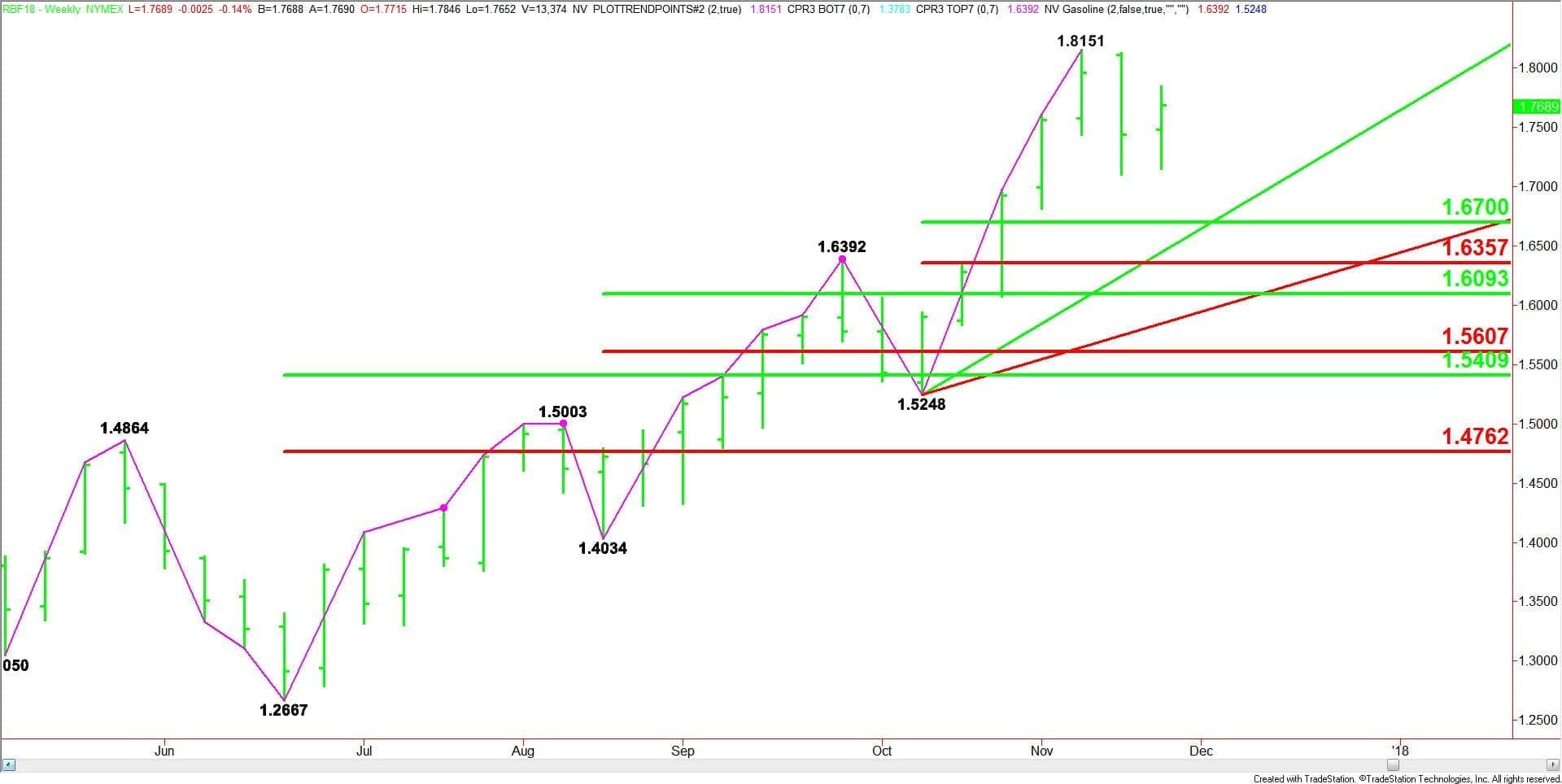

January RBOB Gasoline Futures

(Click to enlarge)

The main trend is up according to the weekly swing chart. A trade through $1.8151 will signal a resumption of the uptrend. A trade through $1.5248 will change the main trend to down.

The short-term range is $1.5248 to $1.8151. Its retracement zone at $1.6700 to $1.6357 is the primary downside target. Since the main trend is up, buyers are likely to step in on a test of this zone.

(Click to enlarge)

The nearest Gann angle support this week comes in at $1.6648. This angle is moving up $0.02 per week. Like the retracement zone, a test of this angle could attract new buyers since the main trend is up.

Conclusion

The new high in crude oil and the price action in gasoline indicates a divergence between the two markets. This makes sense since crude oil is being driven higher by a shortage due to issues with the Canadian pipeline. This hasn’t affected the refineries yet so there has been no effect on gasoline production.

The pipeline shutdown and increased demand from the refineries for gasoline production could send crude oil price soaring. Gasoline prices will rise if a shortage of crude oil hurts fuel production.

January Natural Gas Futures

(Click to enlarge)

The main trend is down according to the weekly swing chart. A trade through $3.321 will change the main trend to up. A move through $2.983 will signal a resumption of the downtrend. The next major target is $2.720.

Just two weeks ago, natural gas futures were in a position to challenge a key top at $3.450. However, increased production coupled with low demand due to average temperatures has wiped out all of the month’s gains. The January Natural Gas market is now in a position to challenge what some thought was the seasonal low at $2.983.

Taking out this level with conviction will set up the market for a further decline. Prices will have to stabilize and form a solid support base before we’ll have any confidence in any rally. Additionally, this market is not likely to have a sustainable rally this winter unless the weather turns cold for a considerable period of time.

Periodic cold blasts may cause a few short-covering rallies, but the trend is not likely to change to up unless there are several weeks of high demand.