Friday April 13, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

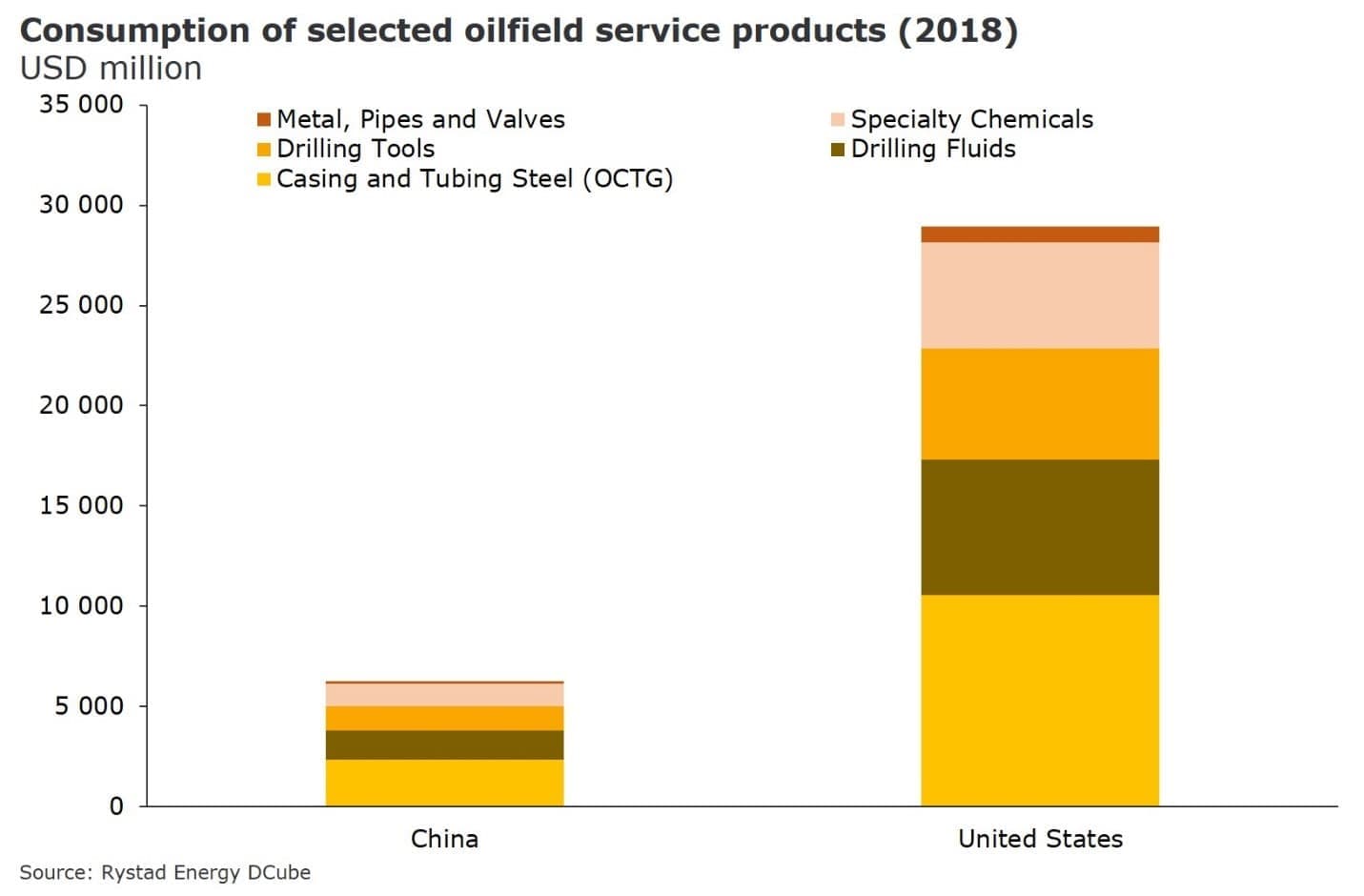

1. U.S. oilfield services to lose business in China

(Click to enlarge)

- U.S. oilfield service companies have more to lose from the tariff war with China than their Chinese counterparts.

- The U.S. has listed some 1,300 Chinese exports that could face tariffs, and China responded with potential tariffs on U.S. plastics, petrochemicals, petroleum products and specialty chemicals, among other things.

- “For an oil and gas industry looking to rebound in a higher oil price environment, these tariffs necessitate monitoring. More specifically, oilfield service companies must now take pause,” says Matthew Fitzsimmons, VP Oilfield Service Research at Rystad Energy.

- Rystad pointed to Ecolab (NYSE: ECL), Hexion, NOV, and Clariant as potential losers. For instance, NOV reported $561 million in revenues in 2017 from their fiberglass and composite tubular business in China, Rystad Energy says.

- “The giant service company NOV was anticipated to have over $650 million in annual revenues from China for the remainder of the Trump presidency. A trade war between the two nations could certainly impact their ability to grow in this market,” Fitzsimmons said.

2.…

Friday April 13, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. U.S. oilfield services to lose business in China

(Click to enlarge)

- U.S. oilfield service companies have more to lose from the tariff war with China than their Chinese counterparts.

- The U.S. has listed some 1,300 Chinese exports that could face tariffs, and China responded with potential tariffs on U.S. plastics, petrochemicals, petroleum products and specialty chemicals, among other things.

- “For an oil and gas industry looking to rebound in a higher oil price environment, these tariffs necessitate monitoring. More specifically, oilfield service companies must now take pause,” says Matthew Fitzsimmons, VP Oilfield Service Research at Rystad Energy.

- Rystad pointed to Ecolab (NYSE: ECL), Hexion, NOV, and Clariant as potential losers. For instance, NOV reported $561 million in revenues in 2017 from their fiberglass and composite tubular business in China, Rystad Energy says.

- “The giant service company NOV was anticipated to have over $650 million in annual revenues from China for the remainder of the Trump presidency. A trade war between the two nations could certainly impact their ability to grow in this market,” Fitzsimmons said.

2. Bullish bets hit record

(Click to enlarge)

- Brent oil prices jumped over $70 per barrel this week, which comes on the heels of a massive buildup in bullish bets.

- Speculative net length across WTI and Brent futures is actually down 8 percent since January, however, hedge funds and other money managers have pushed bullish bets in Brent futures to a record high. The ratio of longs to shorts for Brent skyrocketed above 20:1.

- Digging deeper, over the last few months, long bets have held steady, but shorts have liquidated their positions.

- In other words, there are relatively few major investors who are betting on oil prices dropping right now. The shorts have been squeezed out. This has coincided with the recent run up in oil prices.

- The flip side is that, collectively, speculative positions look overstretched, raising the risk of a price correction.

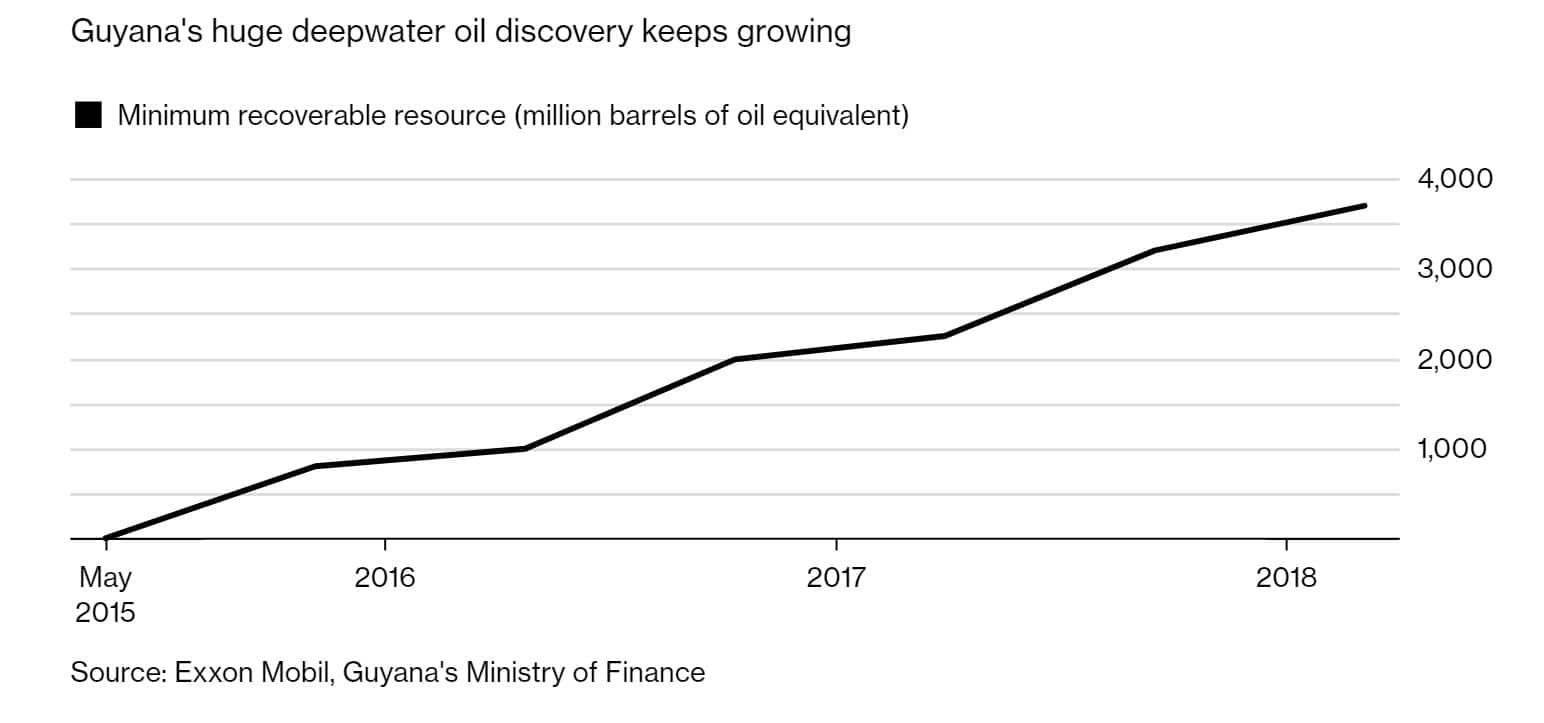

3. ExxonMobil threatens to overrun Guyana

(Click to enlarge)

- One of ExxonMobil’s (NYSE: XOM) top priorities for the next few years is developing the series of major oil discoveries it has recorded in Guyana.

- However, the IMF recently advised Guyana to change its tax laws because the state is giving away too much to Exxon.

- Because it is a small country with a population of less than 1 million, a per capita income of $4,000 and almost no experience dealing with multinational oil companies on deals this big, Guyana has agreed to fiscal terms way more generous than the international standard, the IMF said.

- The Fund suggested Guyana issue a moratorium on new exploration until it can rewrite its tax laws.

- Still, Guyana is expected to take in $700 million annually by the late 2020s from Exxon’s first project, equivalent to the country’s entire tax take in 2016, according to Bloomberg.

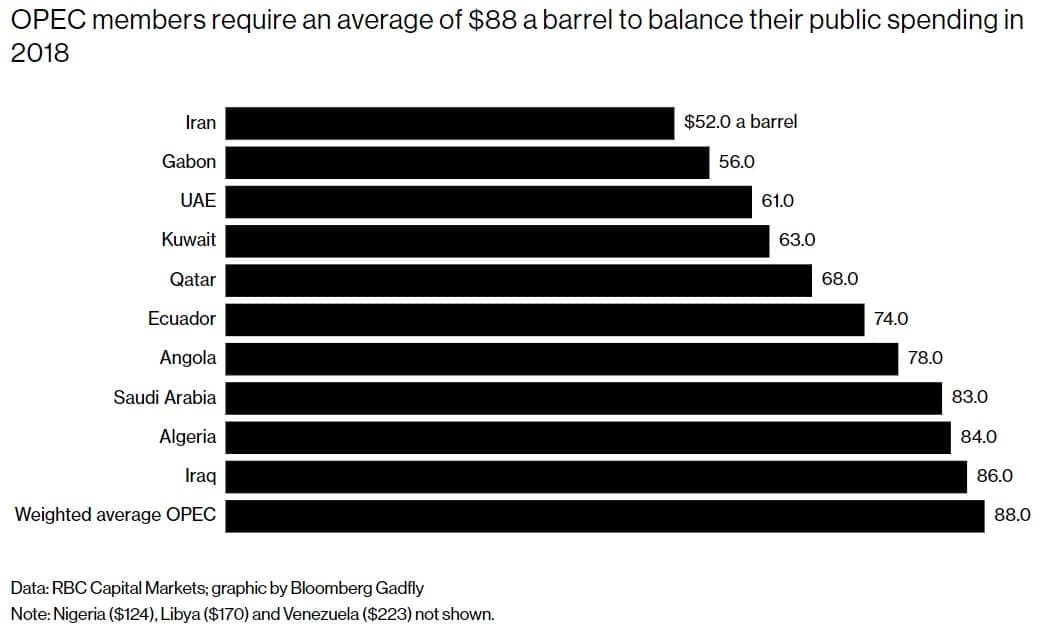

4. OPEC wants higher oil prices

(Click to enlarge)

- Bloomberg reported this week that Saudi Arabia is unofficially targeting an $80 per barrel oil price.

- That makes sense because so many OPEC countries have fiscal breakeven prices above that threshold, including Saudi Arabia.

- Production costs from OPEC members is typically incredibly low, but because oil makes up such a large part of their budget, they need high oil prices to balance the books.

- Bloomberg Gadfly estimates that the weighted average breakeven price for the entire cartel is $88 per barrel.

- In the past, the group has hesitated to restrain output over fears it might spark a strong response from U.S. shale. That is exactly what is happening now, but the group clearly feels that ceding some market share is offset by higher revenues.

- Moreover, the Permian is starting to face some midstream bottlenecks, which could force the industry to throttle back on production. That could really work in OPEC’s favor if higher prices come along with a slowdown in U.S. shale.

5. Permian bottlenecks force discount

(Click to enlarge)

- Oil production in the Permian basin has been growing so quickly that the region is running out of space on the few pipelines that can carry the crude away.

- With pipeline capacity nearing its limits, oil prices in Midland are trading at a $9-per-barrel discount relative to prices in Houston, the largest discount since data collection on Houston began in 2016.

- There are a handful of major pipeline projects in the works, but relief won’t come until the end of the year at the earliest.

- The IEA has predicted that the discount could worsen as we move into 2019.

- Ultimately, U.S. shale growth could slow without a resolution.

6. Trump administration undermining ethanol industry

(Click to enlarge)

- The Trump administration has sent some shockwaves through the biofuels industry, favoring oil refiners in their dispute against federal law requiring the use of ethanol.

- The EPA has granted several waivers to refiners, among them one who faced bankruptcy and another that did not.

- The waivers have rattled the market for ethanol credits, which are purchased by refiners in lieu of direct purchases of ethanol. As the federal government weakens requirements that refiners buy ethanol credits, the market for these credits has become highly volatile, and prices have fallen by more than half since last year.

- Some farmers argue that they are facing steeper losses from the damage to the ethanol market than they are from the Chinese tariffs on American soy and corn, though, to be sure, the American farmer is now getting hammered on both fronts.

7. Gulf of Mexico production on the rise

(Click to enlarge)

- Oil production from the U.S. Gulf of Mexico rose to 1.65 million barrels per day (mb/d) in 2017, the highest annual total on record.

- The EIA expects output to continue to rise this year and next, and the offshore Gulf of Mexico will account for 16 percent of total U.S. oil production.

- The rig count in the region plunged by more than 60 percent between 2014 and 2017, and new projects dwindled.

- Seven new projects came online in 2016, and only two in 2017.

- But investment and development are on the mend – an estimated four projects will come online this year and six more in 2019. Still, the rig count is not expected to rebound to pre-2014 levels.

- Output will rise to 1.7 mb/d in 2018 and 1.8 mb/d in 2019, with production coming from new fields.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.