Last week we wrote about Oil’s Big Week highlighting the importance of the OPEC+ and Trump/Xi G20 meetings which transpired in the last few days. Unfortunately the week’s events seem to have provided a short-term sugar high for markets but neither generated a fundamentally strong outcome for the oil.

On the OPEC+ side, we noted that traders seemed to be pricing in an expected production cut of about 1m bpd and that anything below 500k bpd or above 1.5m bpd would generate a bearish or bullish reaction. The surprise came in the bearish form as the Saudi’s have failed to get Russia on board with group production cuts on Thursday, but managed to secure a deal on Friday morning. The market sorely needs conviction from its primary exporters to reduce supplies and so far there’s a serious lack of cooperation on this front.

As disappointing as the OPEC+ meeting was on Thursday, the cartel managed to get its members and partners on board and agreed on a 1.2 million bpd cut. Despite the fresh deal, remain concerned about the health of the oil market- and the global economy- following the soft truce reached by Trump and Xi at their G20 meeting in Argentina. President Trump took to Twitter following the meeting and expressed a variety of contradictory signals but stock, bond and commodity markets seemed sick of the mixed messages.

In the U.S., the S&P jumped from 2,650 up to 2,800 after Trump announced that significant progress had been made between the two leaders…

Last week we wrote about Oil’s Big Week highlighting the importance of the OPEC+ and Trump/Xi G20 meetings which transpired in the last few days. Unfortunately the week’s events seem to have provided a short-term sugar high for markets but neither generated a fundamentally strong outcome for the oil.

On the OPEC+ side, we noted that traders seemed to be pricing in an expected production cut of about 1m bpd and that anything below 500k bpd or above 1.5m bpd would generate a bearish or bullish reaction. The surprise came in the bearish form as the Saudi’s have failed to get Russia on board with group production cuts on Thursday, but managed to secure a deal on Friday morning. The market sorely needs conviction from its primary exporters to reduce supplies and so far there’s a serious lack of cooperation on this front.

As disappointing as the OPEC+ meeting was on Thursday, the cartel managed to get its members and partners on board and agreed on a 1.2 million bpd cut. Despite the fresh deal, remain concerned about the health of the oil market- and the global economy- following the soft truce reached by Trump and Xi at their G20 meeting in Argentina. President Trump took to Twitter following the meeting and expressed a variety of contradictory signals but stock, bond and commodity markets seemed sick of the mixed messages.

In the U.S., the S&P jumped from 2,650 up to 2,800 after Trump announced that significant progress had been made between the two leaders and then fell immediately back down to 2,650 after Trump dubbed himself a ‘Tariff Man’ who would continue to hawkishly pursue his anti-China trade policies despite the economic consequences. But what will happen if Mr. Market- who has long been warning about the negative consequences of protectionist trade policies- finally gets fed up with the policies and anti-trade rhetoric of Mr. Trump? Trump can still push risk markets higher with hopeful messages for now, but what if they get tired of his anti-trade act and begin to feel top-heavy after stocks and bonds have enjoyed an almost uninterrupted run for the last nine years? When Trump was elected many analysts were certain that his tough stance on China would generate a global recession. Instead, S&Ps are up about 20% since he was inaugurated and U.S. economic growth has jumped north of 3%. Nevertheless, recent events in equities, fixed income and commodities suggest to us that Mr. Market is indeed growing weary of the President’s more combative Twitter musings against a backdrop of tighter credit conditions, slowing global growth and depressed corporate earnings forecasts. Bond traders are absolutely screaming recession this point and have pushed the US 2yr/10yr spread to its lowest level since 2007.

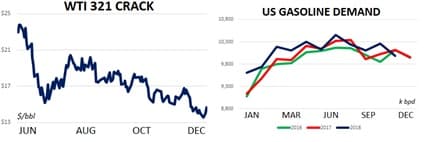

This week’s DOE data revealed that U.S. crude oil inventories declined for the week for the first time in more than two months. The relentless stockpiling was due largely to sagging demand and Thursday’s data was indeed a welcome positive break. There was a disturbingly bearish item in the data, however, where it was revealed that U.S. domestic gasoline exports + domestic demand actually fell y/y in November. Oil bulls will simply need better data than this in order to push the prices higher no matter how dovish Mr. Trump’s tweets may or may not turn. In the end, Mr. Market will have the final say. And he seems to be getting fairly grumpy heading into 2019.

Quick Hits

- Oil prices were volatile this week with WTI in the low $50s while Brent traded near $60. Futures for both grades are suffering from technical weakness as recent losses have led their 50-day moving averages to cross below their 200-day moving averages for the first time since June ’17 (preceding a drop to $45 for Brent.)

- Hedge funds cut net length in ICE Brent contracts last week by 14k contracts (7%) and added to NYMEX WTI net length by 2.5%. The addition to WTI length was the first time that funds have been net buyers of either grade over a weekly period since September.

- Bloomberg’s OPEC production estimates for November have rolled in and place the group’s overall effort at 33.13m bpd for a m/m decline of about 10k bpd. Saudi production averaged 11m bpd for a record high and a 300k bpd m/m increase. Iranian crude output fell from 3.3m bpd to 3.1m bpd. Venezuelan output was virtually flat at 1.2m bpd. Nigeria production fell 40k bpd to 1.76m bpd. Libyan output was flat near 1.2m bpd and Iraqi output fell by about 160k bpd to 4.5m bpd.

- Spread markets continue to highlight that markets are oversupplied and forecast near-term inventory builds. This week the prompt Brent contract traded at a $1 discount to the futures set to expire in six months representing its lowest print of 2018.

- Options markets continue to reveal major downside concerns with 25 delta puts trading at a 9-vol premium to 25 delta calls. This is a sharp departure from the options just a month ago when the skew was bearish but comparatively flat and suggests that there is still a significant amount of downside hedging coming from dealers, producers and speculators. The current shape of the options curve also presents an attractive trade for anyone bullish on crude oil in the form of selling pricey put options.

- Macro-economic pressure is clearly still a major bearish input for oil markets at the moment and US Dollar strength persists as a key contributor. This week the index strengthened to 97.0 and is only a ½ point below its 18-month high. Similar levels of US Dollar strength preceded the oil market’s last crash in 2015. Bond markets have begun to price in US Fed rate decreases in 2020 and those expectations could actually slow the US Dollar’s rally next year.

DOE WRAP UP

- US crude supplies pulled off a minor miracle last week – they actually declined! US crude supplies fell w/w by more than 7m bbls to 443m bbls and are slightly lower y/y following their first draw in more than two months. In the end, the most recent cycle of inventory builds added more than 56m bbls of crude oil to US tanks and illustrated- on a weekly basis- the need for aggressive action from the world’s major exporters to trim their supplies.

- Unfortunately the inventory draw seemed to be more driven by trading flows than tightening supplies or robust demand. US crude exports hit a record high of 3.2m bpd and its possible that some of this was just a backlog of US crude bound for China. (US crude exports hit their 2018-low of 1.2m bpd in August tariffs outlawed shipments to China.)

- The heightened exports led a 9m bbls inventory draw in PADD III (which includes the Houston area) meaning the rest of the US actually added supplies.

- Crude oil inventories in the Cushing hub highlight the continued surplus of US crude despite the inventory draw in the US Gulf Coast. Crude stocks in the WTI delivery hub jumped about 1.7m bpd and at 38m bbls are at their highest level since January.

- US producers are still pumping at warp speed and supplied 11.7m bpd of crude last week.

- Gasoline inventories remain bearishly high and jumped more than 1.5m bbls to 227m bbls (+6% y/y.)

- Distillate stocks are still comparatively tight despite a 4.5m bbl w/w build. Overall supplies are lower by about 1% y/y.

- On the demand side, US refiner demand was slightly lower w/w and printed 17.49m bpd. Overall demand is better by about 300k bpd but still not good enough to mop up the massive amount of shale crude coming on line.

- US gasoline demand was depressed in November and was actually lower y/y by about 1%.