The uncertainty surrounding OPEC/OPEC+ negotiations in Vienna strengthened the overwhelmingly bearish sentiment in oil markets this week, but a larger than expected cut has sent oil prices soaring. The failure to reach an agreement on Thursday had buttressed fears of oversupply in 2019, but Friday’s agreement seems to have calmed markets somewhat.

OPEC+ managed to iron out a 1-1.2mbpd production cut deal, moving WTI towards 54 USD per barrel and Brent up to 63 USD per barrel.

1. US Crude Exports Break 70-Year Trend

(Click to enlarge)

- After a spectacular 10-week streak, US commercial crude inventories finally decreased, much to the joy of everyone, by 7.3 MMbbl week-on-week to a total of 443.2 MMBbl.

- Crude exports have established an all-time weekly high of 3.2mbpd, climbing up some 0.6-0.7mbpd from the past weeks.

- On the back of a dramatic drop in crude imports to 1.7mbpd, the United States has become a net exporter of crude for the first time since 1949.

- Saudi Arabia and Iraq witnessed the largest drops in exports to US, falling w-o-w by almost 600kbpd.

- Even though the US is expected to rebound back into net importer status next week, this marks the beginning of a new trend as American producers are edging closer to 12mbpd output.

- Gasoline stocks have risen for the first time in the past three weeks, by a 1.7 MMBbl to 226.3 MMbbl amid stagnant refinery runs and relatively weak gasoline demand.

2. Saudi Aramco…

The uncertainty surrounding OPEC/OPEC+ negotiations in Vienna strengthened the overwhelmingly bearish sentiment in oil markets this week, but a larger than expected cut has sent oil prices soaring. The failure to reach an agreement on Thursday had buttressed fears of oversupply in 2019, but Friday’s agreement seems to have calmed markets somewhat.

OPEC+ managed to iron out a 1-1.2mbpd production cut deal, moving WTI towards 54 USD per barrel and Brent up to 63 USD per barrel.

1. US Crude Exports Break 70-Year Trend

(Click to enlarge)

- After a spectacular 10-week streak, US commercial crude inventories finally decreased, much to the joy of everyone, by 7.3 MMbbl week-on-week to a total of 443.2 MMBbl.

- Crude exports have established an all-time weekly high of 3.2mbpd, climbing up some 0.6-0.7mbpd from the past weeks.

- On the back of a dramatic drop in crude imports to 1.7mbpd, the United States has become a net exporter of crude for the first time since 1949.

- Saudi Arabia and Iraq witnessed the largest drops in exports to US, falling w-o-w by almost 600kbpd.

- Even though the US is expected to rebound back into net importer status next week, this marks the beginning of a new trend as American producers are edging closer to 12mbpd output.

- Gasoline stocks have risen for the first time in the past three weeks, by a 1.7 MMBbl to 226.3 MMbbl amid stagnant refinery runs and relatively weak gasoline demand.

2. Saudi Aramco OSPs

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

- Saudi Aramco came into the spotlight with its January 2019 official selling prices, bringing most of its crudes to levels unseen for almost a year.

- The Saudi-style hardball is seen by some as an attempt to beat off potential incursion of US grades into Asia-Pacific, with cuts on light Arab grades exceeding all expectations.

- Having cut Arab Light to Asian markets by 1 USD per barrel and Extra Light by 1.5 USD per barrel, Saudi Aramco has put the pressure on other producers to cut prices in case they do not want to see their market share swallowed up by the Saudis.

- For NW European buyers Saudi Aramco has hiked the price of Arab Heavy by 1.2 USD per barrel month-per-month, whilst increasing the Arab Medium premium by 90 cents.

- Arab Light saw a 60 cent increase, whilst Arab Extra Light went up by 20 cents against ICE Bwave.

3. UAE Lowers November OSPs in Unison

(Click to enlarge)

- Abu Dhabi’s national oil company ADNOC has cut retroactive prices for November 2018 by some 30-50 cents per barrel on its three main grade.

- The light sour Murban saw its premium to front-month Dubai cut by 47 cents, in line with trading this month as the grade mostly traded at a roughly 40-45 cent per barrel discount to the OSP.

- Similarly, the discount of light sour Das over Dubai was cut by 52 cents to 1.79 USD per barrel, to reach 67.35 USD per barrel.

- Medium sour Upper Zakum saw its discount over Dubai shrink by 32 cents, reaching 0.74 USD per barrel.

- Given the aggressive pricing policy Saudi Arabia has set from January onwards, ADNOC’s premiums over front-month Dubai are estimated to shrink even further in the upcoming month.

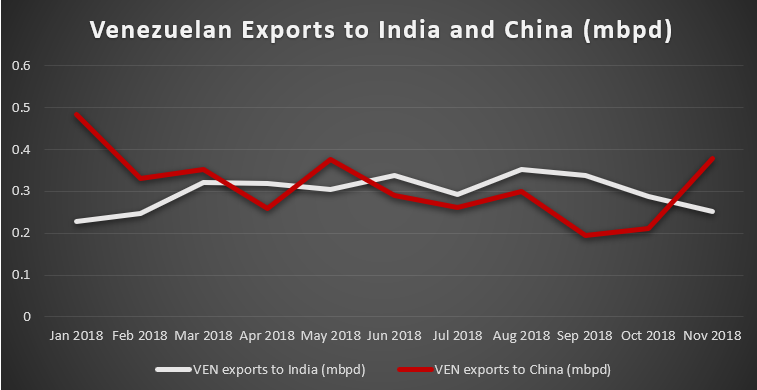

4. Rosneft Voices its Discontent with Venezuelan Supply Allocation

(Click to enlarge)

- In a visit to Venezuela that was deliberately kept low-profile, Rosneft CEO Igor Sechin begrudged Venezuela’s non-fulfillment of its crude allocation obligations towards the Russian company.

- According to Sechin, despite a plethora of problems (José terminal damage, blackouts, liquidity issues) Caracas has so far honored its commitments vis-a-vis China.

- Moreover, during a September visit China, President Nicolas Maduro has pledged to ramp up exports to China to 1mbpd.

- Despite Russia providing Venezuela with 17 billion USD since 2006, mostly in advance payments, Caracas prefers to prioritize China.

- Rosneft supplies Venezuelan crude to its Nayara Refinery in Vadinar, as well as reselling it to the Indian refinery giant Reliance.

- Luckily for Venezuela, the Jose terminal is back onstream (thanks to replacement parts from India) and Venezuelan supplies to India should bounce back in the upcoming months.

- Moreover, President Maduro conducted a lightning trip to Moscow this week, signing another agreement with Rosneft to boost production at its Venezuelan JVs.

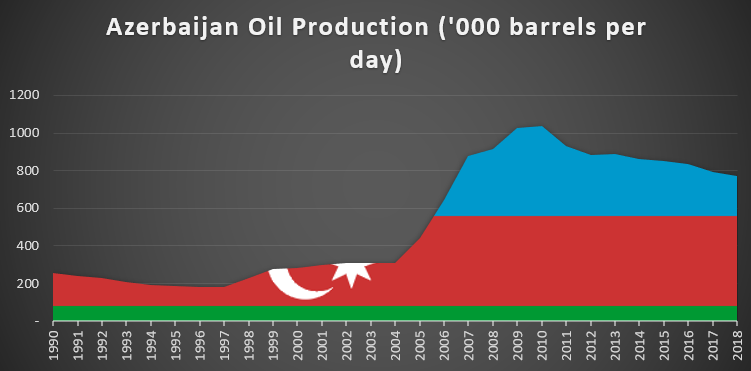

5. US Oil Majors Quit Azerbaijan

(Click to enlarge)

- ExxonMobil and Chevron are poised to sell their stakes in the Azeri-Chirag-Guneshli (ACG) oil field, Azerbaijan’s largest, seeking buyers for their respective 6.8 percent and 9.57 percent.

- This would largely mean the beginning of the end for Azerbaijan’s 1994 „contract of the century”, with all American participants gone or seeking an exit.

- Falling oil production and a dearth of new top-level discoveries are the main reasons why Exxon and Chevron seek an Azerbaijani exit, buttressed by an increasingly statist Azeri government that advances the national oil company SOCAR.

- After reaching an all-time high of 1.04mpb in 2010, Azeri oil output has been gradually falling, with 2018 production expected to average 0.77mbpd.

- BP, the operator of ACG, is unlikely to leave Azerbaijan anytime soon, however, other participants (Equinor, Itochu, ONGC Videsh etc.) might be tempted to follow suit.

- Concurrently to selling its ACG part, Chevron is also selling its 8.9 percent interest in the Baku-Tbilisi-Ceyhan pipeline, most likely to be scooped up by SOCAR or the Turkish TPAO.

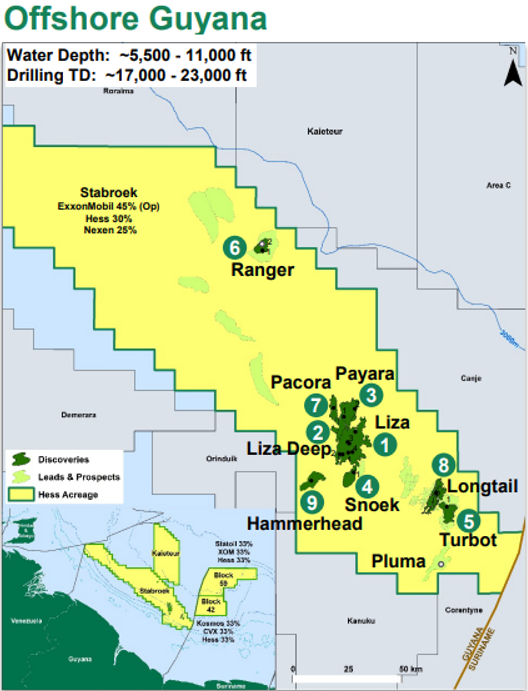

6. ExxonMobil Discovers 10th Guyana Field in 3 Years

(Click to enlarge)

Source: Hess Corporation.

- The Pluma well turned out to be ExxonMobil’s 10th consecutive Stabroek Block discovery, bringing total Stabroek reserves from 4 billion to 5 billion boe.

- Encountering a 37 meter high-quality sandstone oil-bearing reservoir, Pluma was drilled at a depth of 5 013 meters (16.5k feet) in water depth of approximately 1000 meters (3.34k feet).

- Given its proximity to the Turbot well, Pluma will most likely be developed jointly with Turbot and Longtail.

- The nascent production hub will most likely expand in the future, as the next drilling well will be Tilapia-1, some 5 kilometers away from Longtail.

- First production from the flagship Liza discovery will start in 2020 at a level of 120kbpd, to be ramped up swiftly to reach 750kbpd by 2025.

- ExxonMobil is the operator of the Stabroek block with a 45 percent share, Hess Corporation holds 30 percent and the CNOOC-controlled Nexen the remaining 25 percent.

7. Heavy Rains Shut Down Libyan Output

(Click to enlarge)

- Stormy conditions have hit Libyan oil production hard, with most export terminals shut in throughout the week.

- As a consequence, Libyan oil output fell by 300kbpd week-on-week because of bad weather, with production at the El Sharara field halved to 150kbpd.

- Thus, storms have brought down production from 1.4mbpd in November 2018 to 0.9mbpd currently.

- With minimal storage capacity in place, the Ras Lanuf, Es Sider, Zueitina and Zaqiya terminals were struggling to cope with the incoming flows of crude.

- Last week the Libyan NOC experienced similar problems, with all major ports having been closed for three days.

So much for the Numbers Report. We will see you next week with a new portion of fresh energy insights.