In October I published an Oilprice article detailing one of the key drivers for the relentless Merger and Acquisition (M&A), activity occurring within the Upstream Exploration and Production (E&P) industry. There are a number of reasons for the big companies to be paying up to acquire smaller players, but the one on which I focused was the need for acquiring companies to increase reserves. For many it’s just not happening through the drill bit, thanks in no small part to declining acreage quality, something I discussed in Oilprice a year ago.

Many companies pulled forward their Tier I drilling locations when oil prices were lower, $40-$50 per barrel, to maximize returns and well payouts. This leaves them drilling secondary Tier II targets that seldom have the potential of Tier I. With present production not being replaced through drilling success in many cases, companies falling short have had no choice but to exercise the M&A lever.

In this article we will take a look at the companies that may be in the running to take out Crownrock LP, a Midland basin-focused private E&P. A feeding frenzy has burst forth upon the Permian, following ExxonMobil's, (NYSE:XOM) purchase of Pioneer Natural Resources, (NYSE:PXD). We will also pick a logical favorite from the announced candidates. We will even introduce a new potential entrant in the Permian M&A sweepstakes for Crownrock. I will give you a hint, they sold all their Delaware basin acreage a few years ago, in a push to “Green up” their portfolio. A decision they may now be regretting. Let’s dig in.

The pursuit of Crownrock

The latest trophy to come under the M&A microscope is Crownrock LP, a privately held Midland basin producer with about 100K acres in a four-county block that includes, Martin, Midland, Howard, and Glasscock counties. Crownrock's current production equates to 150K BOEPD, which is an attractive feature as well. Recent articles note that Crownrock could go out for $10-15 billion, making it a big bite for any potential acquirer if you take Chevron, (NYSE:CVX) and XOM out of the picture. (Not a sure bet by any means, but let’s agree those two have a lot on their respective plates right now.)

Crownrock website

A number of possible bidders have been in the rumor mill recently. The list is pretty long, and includes Devon Energy, (NYSE:DVN), ConocoPhillips, (NYSE:COP), Marathon Oil, (NYSE:MRO), Occidental Petroleum, (NYSE:OXY), and now Diamondback Energy, (NYSE:FANG) have been put forward as potential acquirers.

OXY appears to be in the lead if the recent WSJ article by Lauren Thomas is on track. The OXY corporate jet touched down in Omaha last weekend, and it doesn’t take a lot of imagination to derive the purpose of the visit. OXY doesn’t carry a lot of cash on the books, and there is no way Crownrock goes out for a straight stock swap. From a purely financial perspective, OXY needs this right now like a hole in the head, having only just brought their $18 billion in debt down to manageable proportions, and with still billions outstanding with Buffett's Preferred shares. Still, you can’t predict when a plum will fall from the tree, and the set of companies with Crownrock’s assets is starting to thin out, as the WSJ article notes.

“The company is one of the last remaining sizable private companies in the Permian, alongside Endeavor Energy Resources. Before the shale boom took off, Dunn accumulated leases in the region before trading and swapping land to build the enviable position Crownrock now sits on in a coveted part of the basin.”

From a survival perspective, OXY may not have a choice other than to dip into Buffett’s bank account once more. The deals are getting bigger, and recent articles have suggested that OXY might be potentially in play earlier this year, with CVX taking a look. After Chevron took out Hess, (NYSE:H) only just last month, that notion’s off the table hopefully. Coming up with other potential suitors would be a challenge given OXY's $70 billion Enterprise Value-EV. There has also been some scuttlebutt about OXY and MRO as well. OXY might also be looking to increase the oil-weighting of its production. One way not to get bought out is getting too big to be bought out, and Crownrock or Marathon might just tick that box for OXY.

Just as a side note, a merger between Devon and Marathon would make a lot of sense. The two companies have very complementary acreage in a number of shale basins, notably the Permian, Eagle Ford, and the Williston. The stock prices of both companies are depressed now thanks to the current volatility in the oil market, making a stock and debt swap a fairly painless way to merge. Devon has a pretty good track record with stock swap M&A, having done it with WPX Energy in 2020.

Getting back to Crownrock, there are a couple of companies where Crownrock's acreage would make a perfect bolt-on. Diamondback is primarily a Midland basin producer with core acreage very complementary to Crownrock’s. A look at Crownrock’s Howard Country acreage would be a real advantage in achieving new horizons in lateral length. In their discussion on their activity, Crownrock notes the emphasis on what is now in the top tier in lateral lengths-

“During 2022, Crownrock spent $951.6 million on drilling, completing, and equipping wells. Approximately $25.4 million of that was used to drill 11.9 net and complete 4.9 net vertical wells. The remaining $926.2 million was used to drill 138.5 net horizontal wells at an average length of approximately 11,200 feet and complete and equip 121.1 net horizontal wells at an average lateral length of approximately 10,000 feet.”

Summary

The M&A cycle continues at full speed. Private companies are being gobbled up right and left. I think most of the larger companies will either get bigger or get bought out. With stock prices in the tank the way they are now it wouldn't surprise me to see the momentum shift back to public companies. With Crownrock going out potentially in the $15 billion upper range, that's a per acre price of nearly $160K per acre. If that becomes the going rate, what's Devon worth with ~400K Permian acres? $64 billion? Probably not with the company's capitalization at $28 billion right now. Still, the imagination can run wild.

In summary, I have long argued that U.S. and particularly Permian assets are undervalued by the market. If CR goes out for anything close to $160K per acre, the dials are going to have to be reset on a number of current players in this basin.

Ok now let’s sort through the top candidates for Crownrock.

Your takeaway

While Crownrock would make a lot of sense, in terms of acreage and production for FANG, the only path I see to accomplish it, is printing stock. At current FANG prices that would equate to about 95 mm new shares, or increasing the current float by about half. I can’t imagine the current shareholder base of FANG being too happy about that dilution.

That could be attenuated somewhat by some asset sales. FANG has ~150K acres in the Delaware that might fetch a significant part of the $12-15 billion that Crownrock will likely tally up. It may be something for them to consider as the CEO of Crownrock is looking to cash out of the business and is going to want some spendable cash. A lot of it, I expect.

Could they do it with debt? Maybe, but it would crush the stock in my view, as they are already carrying ~$6 billion in LT debt. FANG is generating between $6-7 billion of EBITDA on a forward basis. The CR production would bring another $2.2 billion, so perhaps a combination of shares, asset sales, and debt would do the trick. The debt part would be interesting as FANG only has a revolver of about $1.6 billion.

What about a bidding war for Crownrock? OXY management has proven in the past that it doesn't take no for an answer. Like I said, on a financial basis OXY needs another $12-15 billion in debt like a hole in the head, but these are frenzied times and assets are going up for sale that just won't be there a couple of years from now. And as we all know...who can resist a sale? Things could get interesting in this scenario.

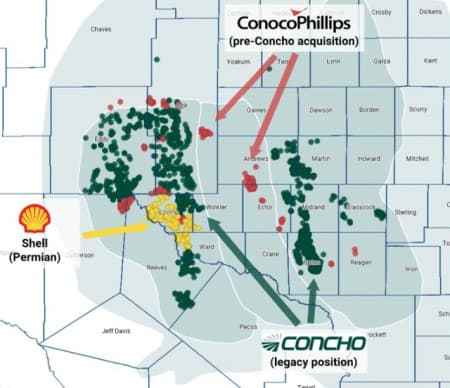

COP is the dark horse here, and my actual favorite. With nearly $10 billion on the balance sheet they could slide right in, and printing a few billion in stock wouldn't make much of a blip on their ~1.1 billion share float. The COP Permian footprint is pretty revealing as well. Crownrock’s Howard County acreage would open a new horizon for them in the Midland basin and definitely increase the oil weighting of their portfolio. Let's not count COP out in the hunt for Crownrock.

COP filings

Finally, I teased you earlier with an-so far, unannounced potential competitor for Crownrock, and the slide above is a tip-off for the identity of this new entrant. I am of course talking about Shell, (NYSE:SHEL). A few years ago Shell sold that gorgeous Loving County, Texas acreage (highlighted in yellow above) to COP for nearly $10 billion in a fit of “Green Madness.” The people who pulled that stunt are now, “pursuing other interests.” COP has just gone to town since developing this asset and making some great wells.

Shell has the same problem other Super Majors have. They are not replacing their daily output, and shale-particularly the oil-rich Midland basin has been proven to be a star in helping companies with this problem. This is pure oilfield “spitballin” on my part, but the essential elements are in place. With nearly $30 billion in cash on the books, Shell could just write a check for Crownrock.

I don’t think we will have long to wait for an outcome. What will be interesting is watching the next shoe to drop - Endeavor Resources. I doubt the wait will be too long for that one either.

By David Messler for Oilprice.com

More Top Reads From Oilprice.com:

- Venezuelans Vote to Claim Sovereignty Over Oil-Rich Region of Guyana

- Russia Set To Boost Diesel Shipments By 28% in December

- Consumer Reports: EVs Are Less Reliable Than Gasoline Cars