Friday May 31, 2019

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy and metals sectors. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Saudi Arabia gains market share in China

• China’s oil imports averaged 10.1 million barrels per day over the first four months of 2019, according to Standard Chartered, an increase of 8.9 percent year-on-year. In fact, China posted an all-time record high of 10.7 mb/d of oil imports in April.

• Saudi Arabia is playing a larger and larger role in the supply of oil to China for two reasons, both of which can be attributed to decisions made by the U.S. government. Sanctions on Iran have forced China to look for alternatives. Also, the U.S.-China trade war have scared away Chinese oil importers from American crude.

• In both cases Saudi Arabia has stepped into the void. Of the year-on-year increase of 826,000 bpd in oil imports in China, Saudi Arabia captured more than half of that increase at 453,000 bpd, Standard Chartered noted. Year-to-date, Saudi Arabia has exported 1.552 mb/d to China, making it China’s top supplier, surpassing even Russia.

2. U.S. shale burning through cash

• Roughly 9 out of 10 U.S. shale companies were cash flow negative in the first quarter of 2019, according to Rystad Energy.

• Rystad surveyed 40 top U.S.…

Friday May 31, 2019

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy and metals sectors. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Saudi Arabia gains market share in China

• China’s oil imports averaged 10.1 million barrels per day over the first four months of 2019, according to Standard Chartered, an increase of 8.9 percent year-on-year. In fact, China posted an all-time record high of 10.7 mb/d of oil imports in April.

• Saudi Arabia is playing a larger and larger role in the supply of oil to China for two reasons, both of which can be attributed to decisions made by the U.S. government. Sanctions on Iran have forced China to look for alternatives. Also, the U.S.-China trade war have scared away Chinese oil importers from American crude.

• In both cases Saudi Arabia has stepped into the void. Of the year-on-year increase of 826,000 bpd in oil imports in China, Saudi Arabia captured more than half of that increase at 453,000 bpd, Standard Chartered noted. Year-to-date, Saudi Arabia has exported 1.552 mb/d to China, making it China’s top supplier, surpassing even Russia.

2. U.S. shale burning through cash

• Roughly 9 out of 10 U.S. shale companies were cash flow negative in the first quarter of 2019, according to Rystad Energy.

• Rystad surveyed 40 top U.S. shale companies, and only 4 of them had positive cash flow. In the recent past, 20 percent had positive cash flow, so the first quarter marked a deterioration.

• “That is the lowest CFO we have seen since the fourth quarter of 2017,” says Alisa Lukash, Senior Analyst on Rystad Energy’s North American Shale team. “The gap between capex and CFO has reached a staggering $4.7 billion. This implies tremendous overspend, the likes of which have not been seen since the third quarter of 2017.”

• A few high-profile bankruptcies highlight the ongoing financial stress in the sector. In mid-May, Weatherford International said it was going to declare bankruptcy.

• More than 170 E&Ps have declared bankruptcy in North America since 2015, affecting $98 billion in debt, according to Haynes and Boone. While there was a huge spike between 2015 and 2017, the bankruptcy total has continued to grind higher, right up through the first quarter of 2019.

3. Vaca Muerta boom at risk in Argentina

• Argentina is often cited as the best candidate to replicate the shale boom outside of North America. Big names have committed billions of dollars to drill in the vast Vaca Muerta shale.

• But the boom is at risk because of the financial, currency and economic crisis in Argentina.

• A few hundred wells have been drilled in Argentina over the last six years. That is only a fraction of the wells drilled in the Eagle Ford, Marcellus or Permian basins over a similar time frame. The Eagle Ford posted more than 3,500 wells in a shorter timeframe.

• In the Vaca Muerta, production has climbed, but remains relatively modest.

• Argentina’s spiraling inflation and currency crisis have pushed bond yields to their highest level since their last default. Companies are having trouble attracting capital.

• The Argentine government has been forced to trim subsidies because of fiscal pressures, which puts the entire boom at risk. Many of more than 30 projects in the works remain the pilot phase, according to IEEFA.

4. Cost deflation drives down “finding costs”

• The cost of finding new oil and gas reserves has plunged over the last few years, dropping to a 10-year low in 2018.

• In 2018, the 116 largest E&P companies added more reserves to their resource base than in any year since 2009, according to the EIA, adding 10.3 billion barrels of oil equivalent (billion boe).

• The average exploration and development cost dropped to $15.20 per boe, roughly half of the level from five years ago.

• Morgan Stanley, among other analysts, argue that shale will be a deflationary force in the years to come. The resources are abundant, so the main cost determinant is the industrial process that follows extraction. Those processes can see costs decline as technology improves.

5. China threatens rare earths cutoff

• In retaliation for U.S. trade tariffs and barriers to Chinese tech giant Huawei, China seemed to issue a not-so-veiled threat to cut off rare earth elements this week. The 17 rare earth elements are used in high-tech gadgets and military hardware, making them a national security concern.

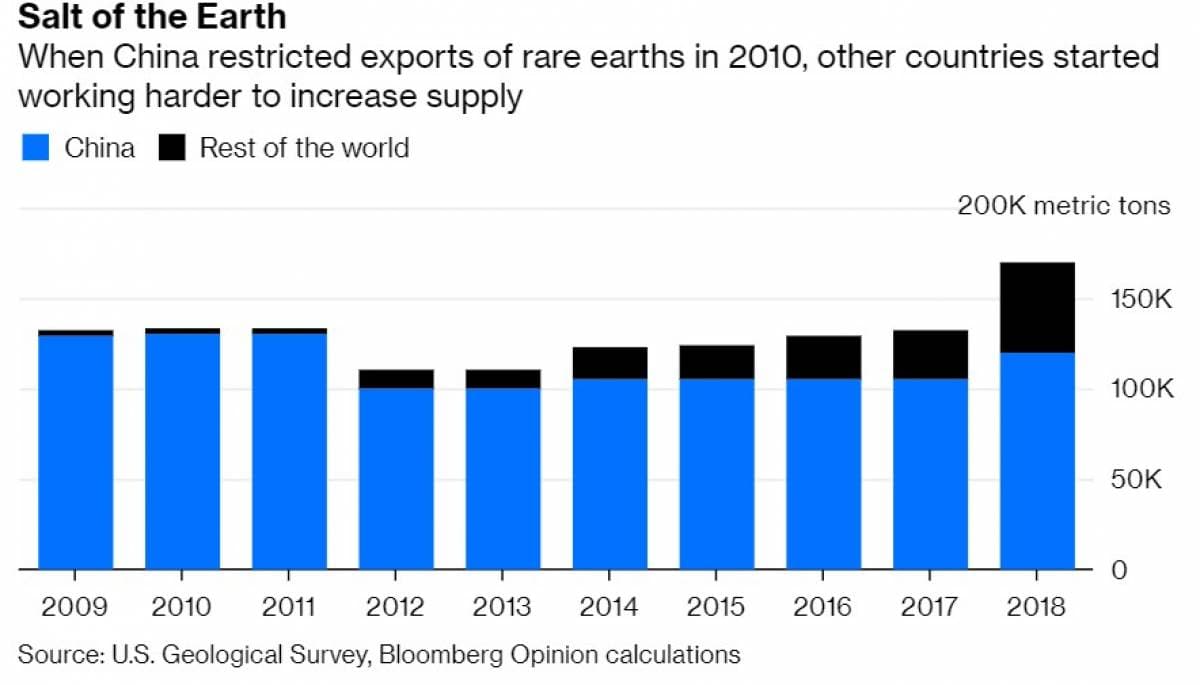

• China controls the vast majority of rare earth production and processing. But rare earths are not that rare, and when China cut off exports to Japan for a few weeks in 2010, it sparked a search for alternatives.

• In 2010, China accounted for 97 percent of rare earths supply. But consumption dipped as manufacturers tweaked their products to cut the use of rare earths. So, supply rose outside of China and demand took a hit.

• By 2018, China only accounted for 71 percent of rare earths supply. If Beijing moves forward on a cut off of exports to the U.S., it will almost certainly jump-start even more production elsewhere, including in U.S.

6. Australia takes over lithium race

• Chile was once the world’s largest producer of lithium, but Australia has moved into a dominant position.

• Chile has the world’s largest reserves, and production is relatively low-cost and high-quality. But production has been stagnant as the country’s producers, SQM (NYSE: SQM) and Albemarle (NYSE: ALB), have struggled, according to Reuters. SQM saw its share price plunge by 6 percent on May 23 when it announced plans to delay a project.

• Demand for lithium is supposed to triple by 2025 as the electric vehicle revolution spreads.

• Australia surpassed Chile in 2017 and hasn’t looked back. Four years ago, Chile accounted for 36 percent of the global market. Now, its share stands at 20 percent.

7. Agricultural prices rebound…but not for good reasons

• U.S. crop prices have rebounded in May, which should be welcome news for American farmers suffering from soaring debt, shrinking overseas markets and historically low prices.

• But the reason for the jump in prices, particularly for corn, is because of another crisis hitting the farm belt.

• Torrential rains and historic floods have battered the U.S. Midwest, destroying crops and leading to delays in plantings for 2019. That has commodity traders concerned about dwindling supplies.

• At this point in the growing season, farmers have typically planted 90 percent of their crop. But this year, that figure is down to 58 percent, largely due to the floods. “The delays are the worst on record,” Tracey Allen, an agricultural commodity strategist at JPMorgan, told the WSJ. “We’re in uncharted waters.”

• Corn futures are up more than 14 percent in May, and corn is set to close out the strongest month since June 2015. Wheat is up 13 percent.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.