This week’s market sentiment was in many ways influenced by the IMF’s cutting global growth rates to their lowest since 2009 (at 3 percent), dropping them for the fifth consecutive time already this year. The root cause has barely changed – unresolved US-China trade tensions with significant potential for further sanctions, and we have already seen a freight rate explosion (almost all continents witnessed actual freight rates doubling or tripling after COSCO was listed by the Trump Administration). Sure, the freight panic has subsided a bit this week as refiners simply cut their spot purchases because exorbitant rates rendered many crudes economically unviable, but in the current circumstances, one never knows when the next great sanctioning blow could come.

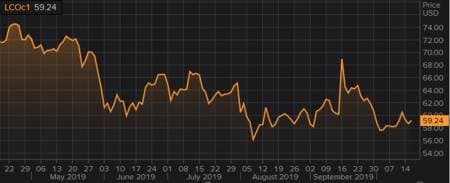

Apparent advances in Brexit talks boosted the market on Monday-Tuesday, yet initial positive reports were played down by both the European Union and Ireland, claiming that there is still a lot of work to be done. As a consequence, the global benchmark Brent traded at $59.2-59.5 per barrel, whilst US benchmark WTI was assessed at $53.2-53.5 per barrel Wednesday afternoon.

1. India Finding it Hard to Wake Up from its Slumber

- Once the projected to be the world leader in oil demand growth, Indian crude imports have fallen to 3.9mbpd, plummeting to the lowest level since August 2017.

- As India’s industrial production moved into negative territory in August 2019, Delhi is desperately…

This week’s market sentiment was in many ways influenced by the IMF’s cutting global growth rates to their lowest since 2009 (at 3 percent), dropping them for the fifth consecutive time already this year. The root cause has barely changed – unresolved US-China trade tensions with significant potential for further sanctions, and we have already seen a freight rate explosion (almost all continents witnessed actual freight rates doubling or tripling after COSCO was listed by the Trump Administration). Sure, the freight panic has subsided a bit this week as refiners simply cut their spot purchases because exorbitant rates rendered many crudes economically unviable, but in the current circumstances, one never knows when the next great sanctioning blow could come.

Apparent advances in Brexit talks boosted the market on Monday-Tuesday, yet initial positive reports were played down by both the European Union and Ireland, claiming that there is still a lot of work to be done. As a consequence, the global benchmark Brent traded at $59.2-59.5 per barrel, whilst US benchmark WTI was assessed at $53.2-53.5 per barrel Wednesday afternoon.

1. India Finding it Hard to Wake Up from its Slumber

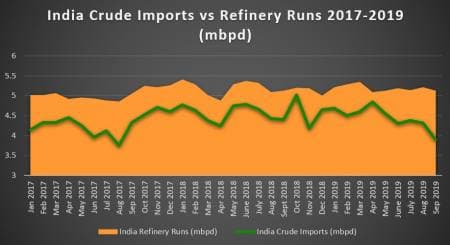

- Once the projected to be the world leader in oil demand growth, Indian crude imports have fallen to 3.9mbpd, plummeting to the lowest level since August 2017.

- As India’s industrial production moved into negative territory in August 2019, Delhi is desperately trying to find new sources of growth which would derisk it from the US-China trade war debris, so far to no avail.

- This year’s YTD average monthly import rate is at 4.45mbpd, almost 3 percent lower than that of 2018.

- Next month, however offers more promise for India as preliminary data show imports bouncing back to 4.406mbpd, with US exports to India reaching an all-time high of 0.412mbpd in the month.

- Concurrently, the head of Indian Strategic Petroleum Reserves flaunted the idea that the US could aid India in doubling its strategic crude reserves.

- Despite filling up only 55 percent of the 5.33 million tons worth of strategic reserves across 3 storage sites, the Indian SPR wants to boost its reserves by a further 6.5 million tons.

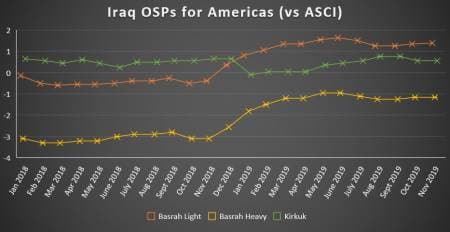

2. Iraqi November OSPs Break Records… Again

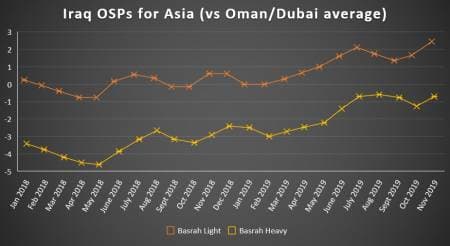

- Iraqi state oil marketing company SOMO has lifted its November-loading official selling prices in line with Saudi Aramco hikes, bringing Basrah crudes to their most expensive in 7 years.

- The Asia-Pacific November OSP for Basrah Light was raised by 80 cents per barrel, to a premium of 2.45 per barrel (the 2018 average OSP was Oman/Dubai flat).

- Basrah Light, too, was hiked substantially enough to hit another all-time high, this time due to a 55 cents per barrel rise to a $-0.6 per barrel discount to Oman/Dubai.

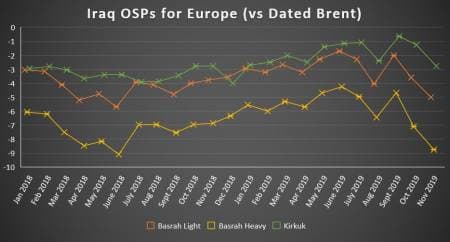

- The Asian price hike comes amid SOMO reaching a 4.5-year in Basrah deliveries to Europe in September, loading only 8.3 MMbbls Europe-bound crude.

- SOMO has dropped European prices for Basrah Light and Basrah Heavy by 1.4 and 1.65 per barrel, respectively, signalling that the Asian demand will be a crucial factor in the upcoming months, too, as Asian refiners continue to seek readily available spot cargoes following the Abqaiq drone attack.

- Almost mirroring Saudi Aramco, SOMO rolled over the US-bound OSPs for Kirkuk and Basrah Heavy whilst hiking the Basrah Light OSP by 5 cents to a $1.4 per barrel premium to ASCI.

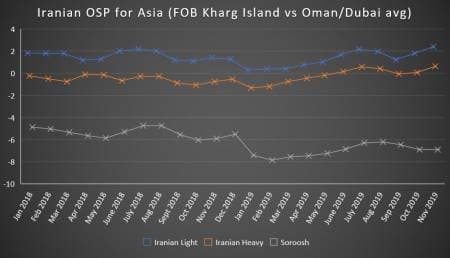

3. Iran’s November OSPs Even Sweeter for Remaining Buyers

- The Iranian national oil company NIOC has also increased November-loading OSPs for cargoes destined to Asian buyers, albeit sticking to its policy of widening spreads vis-a-vis Saudi crudes.

- Both Iranian Light and Iranian Heavy OSPs were increased by 60 cents per barrel month-on-month to a 2.4 and 0.65 per barrel premium against Oman/Dubai respectively, as NIOC expects Chinese crude demand to pick up in Q4 2019 amid China’s weakening compliance with US sanctions.

- The Iranian Light-Arab Light spread rose to its highest ever at -0.60 per barrel, despite the former’s superior quality.

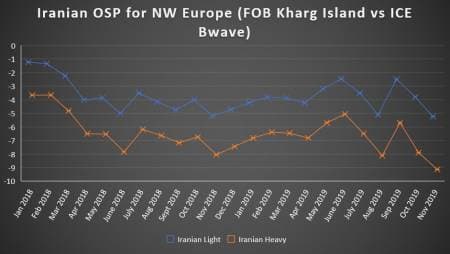

- Despite remaining an irrelevant market outlet, NIOC dropped NW Europe-bound OSPs by 1.25-1.45 per barrel so as to adhere to the general Middle Eastern NOCs’ trend.

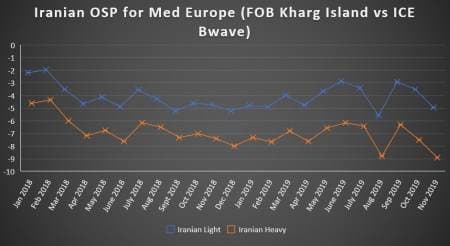

- The November Mediterranean OSP, relevant because Turkey continues to buy Iranian crude, were lowered by $1.4-1.45 per barrel m-o-m, with Iranian Heavy plummeting to an all-time low of a $-8.9 per barrel discount to Dated.

- September 2019 has seen the arrival of 12 Iranian cargoes to ports across the world, bouncing back to a 0.4mbpd export rate, with China taking in half of all the vessels.

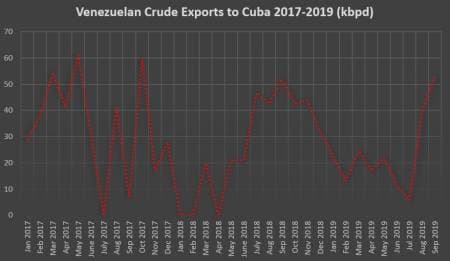

4. Venezuela Reaches Out to the Caribbean

- We have reported throughout the past weeks that Venezuela is struggling with high crude stocks in its only-functional José Terminal and it seems that PDVSA has found a way to get rid of excesses.

- PDVSA has ramped up exports to Cuba to 54kbpd in September, saving the island nation from a severe shortage which forced Cuban authorities to ration fuel distribution in the country.

- PDVSA has also returned to the usage of the Isla Refinery in Curacao, which despite being idled for some months already, will most probably serve as a transshipment hub for further exports.

- With only a minimal number of tanker companies ready to cooperate with PDVSA, the Venezuelan NOC is frantically moving out crude away from the José Terminal as both the PetroPiar and Petrosinovensa upgraders saw their restart in early October.

- Simultaneously, barter agreements with PDVSA have intensified (the Indian Reliance being the last one to join) whereby the Venezuelan NOC provides crude in return for diesel supplies.

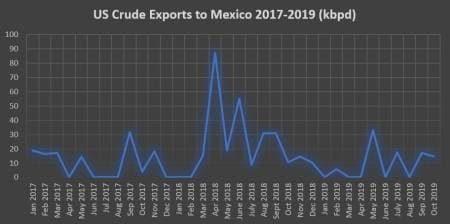

5. Did Mexico Really Stop Importing Crude?

- The Mexican Energy Ministry has announced last week that Mexico has stopped importing crude, in a bid to emphasize the success of President Lopez Obrador’s energy independence drive.

- Mexico has been buying occasional cargoes of US crudes and bringing them to Dos Bocas in Veracruz, averaging 24kbpd in 2018.

- The only problem with the Energy Ministry’s announcement is that it is not true – even in October 2019 there was one 0.5MMbbl delivery to Dos Bocas.

- Last month also witnessed an Aframax cargo from the Galveston Lightering Area, chartered by Vitol to Dos Bocas, where US crudes are routinely blended into heavier Mexican streams to improve the crude’s quality.

- The Mexican government is seeking to externalize an image whereby it no longer needs US imports yet production from its predominantly light new fields offshore still needs years to hit the market.

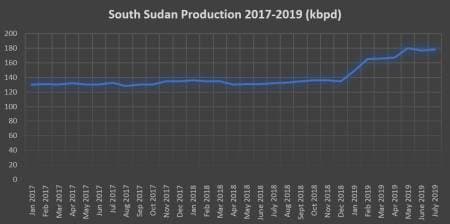

6. Trafigura Wants to Get Into South Sudan

- Continental sub-Saharan Africa is emerging as one the most interesting regions for oil traders that are squeezed out of usual markets by ever-assertive national oil companies.

- The Swiss trader Trafigura is intent to join the hydrocarbon rush in South Sudan, reportedly willing to commit 500 million in a future cash-for-oil structure.

- Trafigura would participate in the development of the 0.2 Bbbls Heglig field, currently producing around 30kbpd, as Sudapet seeks to bring output back to the pre-independence levels of 60-70kbpd.

- With Venezuela sanctioned, Iraqi Kurdistan squeezed internally by the Iraqi federal authorities and Angola curbing its advance payment enthusiasm, Eastern Africa is emerging as the traders’ favorite for cheap crude.

- South Sudan intends to auction 8 new blocks in the Upper Nile and Equatoria regions in 2020, with roadshows presenting the licences starting already late October.

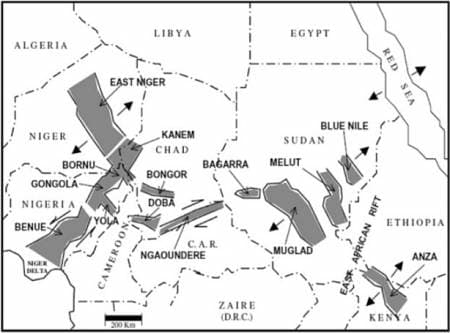

7. Nigeria Confirms First-Ever Northern Oil Discovery

- Nigerian state oil company NNPC announced its Kolmani River oil discovery in the mainland’s Gongola rift basin, the first discovery ever to be located outside of the traditional Niger Delta area and its offshore continuation.

- Along with block operator Shell, NNPC claims to have found light sweet oil of 38-41 API density, confirming that apart from gas Kolmani River also contains recoverable oil reserves.

- The Kolmani River-1 well was spudded 20 years ago, discovering 33 BCf of natural gas with significant upward potential, yet was idled by Shell which wanted to focus on offshore projects.

- The Gongola Basin straddles the border between Niger and Nigeria and NNPC hopes that despite numerous security risks the basin would attract more international interest.

- Rendering Nigerian oil policy as contradictive as it can get, NNPC’s announcement of a second onshore discovery within one month coincides with President Buhari’s push to increase taxation on foreign majors by means of amending the current PSA regime.