The total number of active drilling rigs for oil and gas in the United States rose this week, pressing pause on a declining rig pattern, according to new data that Baker Hughes published on Friday.

The total rig count rose by 4 to 585 this week, compared to 680 rigs this same time last year.

The number of oil rigs remained unchanged this week, after falling by 6 in the week prior. Oil rigs now stand at 479, down by 61 compared to this time last year. The number of gas rigs rose by 4 this week to 101, a loss of 34 active gas rigs from this time last year. Miscellaneous stayed the same at 5.

Meanwhile, the Energy Administration Administration (EIA) released its U.S. inventory report on Wednesday, recording a hefty draw of 12.2 million barrels for the week to June 28.

The inventory change compared with an inventory build of 3.6 million barrels estimated for the previous week, when the EIA also saw fuel inventories rising, which weighed on oil prices. For the last week of June, the EIA estimated draws in fuel inventories. Gasoline inventories shed 2.2 million barrels in the week to June 28, which compared with a build of 2.7 million barrels for the previous week.

Primary Vision's Frac Spread Count, an estimate of the number of crews completing wells that are unfinished, fell in the week ending June 28, from 246 to 237.

Drilling activity in the Permian remained unchanged with the number of active rigs clocking in at 305. The count in the Eagle Ford rose by 3 this week, rising to 49 active rigs.

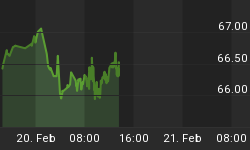

Oil prices were relatively flat on Friday, ticking up slightly on an optimistic EIA inventory report earlier in the week, as well as concerns emanating from the Middle East and Hurricane Beryl in the Gulf of Mexico. At 1:21 p.m. ET, the WTI benchmark was trading up 0.04% at $83.91, while Brent was trading down 0.11% at $87.33.

ADVERTISEMENT

More Top Reads From Oilprice.com:

- U.S. Energy Production Chalks Up Another Record

- In Full War Mode, Israel To Double Gas Exports, Expand Production

- Australia Could Be Hit by Natural Gas Shortage in 2027