Oil prices continued to trend lower this week despite an extraordinary rift between OPEC’s largest producer and the world’s largest oil consumer. On October 2nd, Washington Post journalist Jamal Khashoggi went missing in the Saudi Arabian consulate in Turkey and is now reported by Turkish and U.S. media to have been killed at the hands of Saudi Royal guards with ties to Crown Prince MBS. Western condemnation of the event has been swift and the negative consequences for Saudi relations with many of their allies could be significant. After having spent last summer being toasted at the White House, on Wall Street, in Silicon Valley and Hollywood, MBS now carries serious reputational risk with U.S. and European ‘elites.’ This week the CEOs of JP Morgan, Blackstone, BlackRock, SocGen and U.S. Treasury Secretary Mnuchin (among many other government, media and financial institutions) announced their withdrawal from next week’s ‘Davos in the Desert’ financial conference and there was broad condemnation of the act from both Democrats and Republicans within the U.S. Congress.

Under different circumstances such a significant geopolitical crack between a major supplier and major consumer would cause massive waves in oil prices. In this instance, however, we think the market is right to discount the bullish risk of what reportedly happened to Khashoggi for two reasons; 1- neither the U.S. nor Saudi Arabia want to see higher oil prices and 2- both parties will prefer to be grudging…

Oil prices continued to trend lower this week despite an extraordinary rift between OPEC’s largest producer and the world’s largest oil consumer. On October 2nd, Washington Post journalist Jamal Khashoggi went missing in the Saudi Arabian consulate in Turkey and is now reported by Turkish and U.S. media to have been killed at the hands of Saudi Royal guards with ties to Crown Prince MBS. Western condemnation of the event has been swift and the negative consequences for Saudi relations with many of their allies could be significant. After having spent last summer being toasted at the White House, on Wall Street, in Silicon Valley and Hollywood, MBS now carries serious reputational risk with U.S. and European ‘elites.’ This week the CEOs of JP Morgan, Blackstone, BlackRock, SocGen and U.S. Treasury Secretary Mnuchin (among many other government, media and financial institutions) announced their withdrawal from next week’s ‘Davos in the Desert’ financial conference and there was broad condemnation of the act from both Democrats and Republicans within the U.S. Congress.

Under different circumstances such a significant geopolitical crack between a major supplier and major consumer would cause massive waves in oil prices. In this instance, however, we think the market is right to discount the bullish risk of what reportedly happened to Khashoggi for two reasons; 1- neither the U.S. nor Saudi Arabia want to see higher oil prices and 2- both parties will prefer to be grudging allies in order to marginalize their common foe Iran.

From the U.S. angle, President Trump’s Middle East policy is entirely dependent on positive relations with Saudi Arabia. Trump’s primary policy goal in the region is to antagonize the Iranian regime and he can’t simultaneously sanction the Iranians and the Saudis without creating a gigantic increase in gasoline prices- virtual suicide for an elected official. There are Republican Senators voicing a significantly more hawkish opinion on potential sanctions than Trump currently is, but pay them no mind. Trump’s approval rating among Republicans is still north of 90% and we can expect to see the Republican-led Senate ultimately get on board with whatever course the president chooses on this issue to stay in his good graces- and out of his twitter feed.

Substantially higher oil prices could also be detrimental to the Saudis on a long term basis for two reasons. Firstly, the kingdom has enjoyed massive geo-strategic gains against their ideological rival Iran in the last two years due to an extremely friendly White House and can be counted on to work to mend their ties to Washington to maintain those gains. They know step one for staying on Trump’s good side will be pumping at full speed to keep oil prices in check heading into U.S. midterm elections. From a longer term perspective, the Saudis are also aware that a spike in oil prices would accelerate its two primary existential threats, North American shale production and the shift to renewable energy. On the shale front, the Saudi’s are clearly endangered by the current-record setting rate of U.S. crude production at more than 11m bpd. A spike in prices north of $100 would allow more supply to be hedged forward and bring more tight oil to the market. On the renewables front, increases in wind, solar power and increased electric vehicle usage- while certainly not a potent threat in the next 2-3 years- pose a massive threat to the kingdom on a ten, twenty and thirty year horizon and high prices only work to accelerate that shift by making the economics of renewables more attractive on a relative basis.

The reported events of October 2nd are grisly and may very well have negative long-term consequences for MBS’ relationship with the west. As of Thursday even President Trump was taking a more accusatory role on the issue towards Saudi leadership. But our sense is that the two will most likely bury the dispute with a symbolic gesture (perhaps placing blame on a royal guard member) and do the best they can to continue as energy and geopolitical partners. If neither can afford higher oil prices and neither wants to cede ground to Iran, neither of them has a choice.

Quick Hits

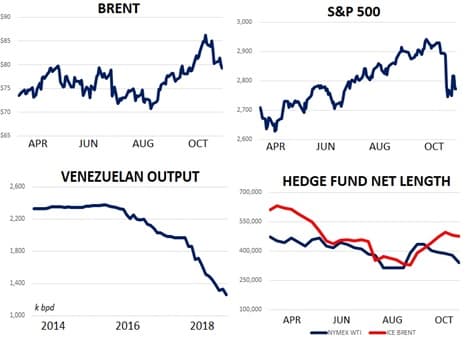

- Oil prices continued to tumble this week with Brent falling to $79 while WTI dropped to $68. The decline in macroeconomic confidence and recently bearish inventory reports have been the main negative influences on crude. Brent is down by about $7 over the last two weeks and higher by about $13 (roughly 21%) so far in 2018. From a technical standpoint the market still appears strong to us and it feels appropriate that some of the weaker bullish hands have been shaken out of the market after looking technically overbought in September. We think that that oil prices could easily strengthen towards the year-end as refiners come back on line from fall maintenance and demand increases.

- U.S. equity markets found some footing this week after suffering steep losses earlier this month. This is noteworthy because the selloff in global equities has been a massive bearish influence on crude so far this month. S&Ps traded near 2,775 late in the week which was lower by about 5% from their October 3rd peak of 2,944 and 60 points higher from their October 11th troth during last week’s drubbing. S&Ps are higher by 3% YTD. Unfortunately, overseas stocks are still showing signs of stress as the Shanghai Composite and Euro Stox 50 both reached YTD lows this week and the Nikkei slid to a small loss on the year.

- On the macro front we also saw red flags this week in the form of a new YTD low for copper prices and a spike in the U.S. 10yr yield back above 3.2%.

- We’re showing the chart of Venezuelan output to the right as a reminder that- despite all of the bearish headlines from the last two week’s- crude oil remains in a bull market that is undersupplied and eating away at inventories. Venezuelan production hit 1.25m bpd in September and is lower by 1.1m bpd since 2015. Iranian production is expected to sink below 2m bpd soon after reaching 3.8m bpd earlier in 2018. The EIA, IEA and OPEC all see crude inventories drawing through the end of 2018 and geopolitical risk remains high in MENA. We wouldn’t put a nail in the bull market coffin just yet.

- Hedge funds have been net sellers of both WTI and Brent over the last two weeks and seem to be unenthusiastic about oil prices in either direction. At present, we’d interpret current COT data showing that hedge funds are largely price neutral on crude oil and expect a sideways market. Net length in NYMEX WTI contracts is currently 20% below its 2yr average and net length in ICE Brent is currently 2% below its 2yr average. However, bearish positions for both contracts (as measured by gross short positions) are minimal and it would be wrong to interpret the lack of length in the market as evidence of bearishness. Funds simply seem content to sit on the sidelines for now and wait for the next trend to materialize.

DOE Roundup

- This week’s DOE data can be taken with a grain of salt after hurricanes severely disrupted refiner demand, crude output, transit flows and refined product demand

- What should not be taken with a grain of salt, however, is the continue bearish lean of WTI and gasoline time spreads, which suggest that US fundamentals are loosening

U.S. crude stocks jumped by about 6m bbls w/w and are now slightly above their 5yr seasonal average but 8% lower y/y. Much of this week’s build seem to be drive by a 600k bpd w/w drop in exports which was mostly due to hurricane activity and can be interpreted as mere ‘noise’ for now. On the production side there was also a slip due to storm activity as Gulf of Mexico production was shut in and overall supplies fell from 11.2m bpd to 10.9m bpd.

On the demand side U.S. refiners processed 16.3m bpd of crude for a slight uptick w/w despite the aforementioned storm activity. U.S. crude demand is higher by about 2.2% YTD and an ample supply of gasoline continues to keep pressure on margins with the WTI 321 crack yielding about $17/bbl.

(Click to enlarge)

We also thought it was critical to highlight the bombardment of WTI and U.S. gasoline spreads from the sell side this week as illustrators of the current health of the U.S. physical market. Cushing stocks jumped for a third straight week last week to 28.6m bbls and gasoline supplies remain abundant (+5% y/y.) Physical trading houses seem to be screaming that the US market is oversupplied in the short term.