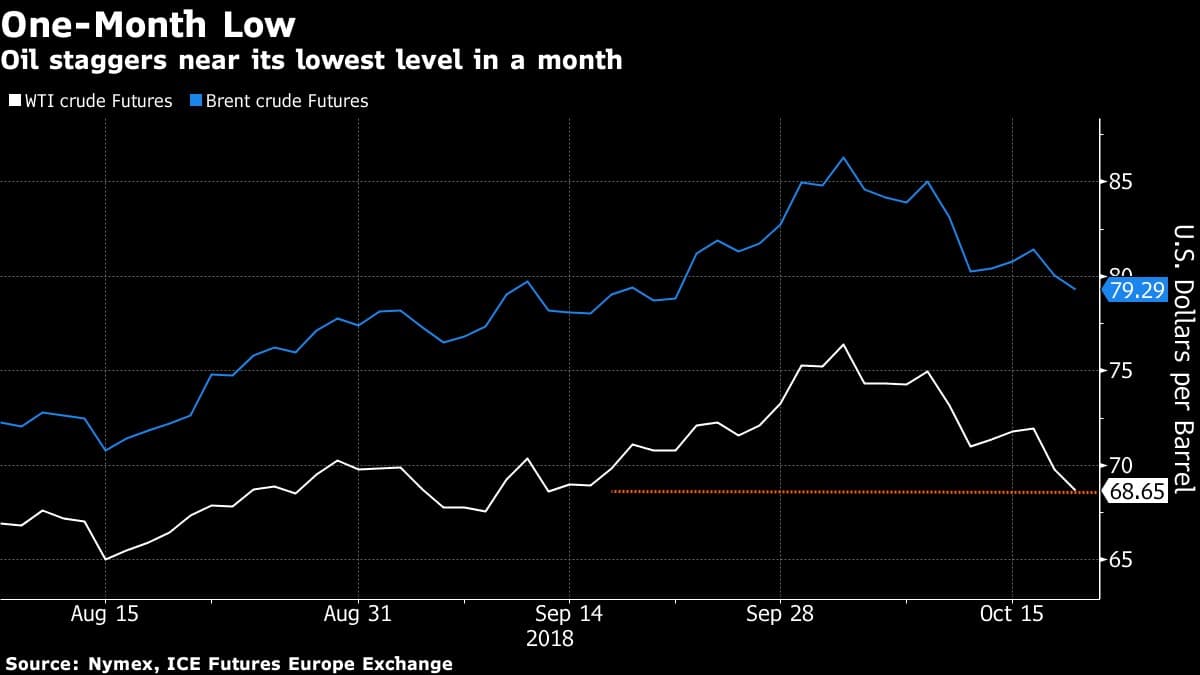

The disappearance and alleged dismembering of Saudi dissident Jamal Khashoggi by people connected to Crown Prince Mohammad bin Salman has generated a lot of media buzz throughout the week, however markets were quite reluctant to react palpably. U.S. crude inventories, however, have put crude prices under significant pressure, having increased by a total of 20 million barrels within the past six weeks due to the autumn refinery maintenance season.

(Click to enlarge)

Overall, crude fell to a one-month low after market sentiment cooled over Iranian supply loss fears but remained cautious about trade wars potentially limiting economic activity in 2019. There were some positive signs, such as China increasing its refinery throughput in September to a record-high 12.5 mbpd, but downward pressures hit the market harder as WTI ended the week trading around $69 per barrel, whilst Brent hovered around $79 per barrel.

1. US Crude Stockpiles Surge for Fourth Week in a Row

(Click to enlarge)

- This week’s 6.5 million-barrel U.S. stock surge to 416.4 million barrels was all the more noteworthy for happening against the background of US Gulf of Mexico production shut-ins.

- Crude exports fell back to 1.8 mbpd, to a four-week rolling average of 2.2 mbpd, whilst net imports bounced back from last week’s lowpoint to 7.6 mbpd.

- U.S. gasoline stocks finally drew this week by 2 MMbbl to 234.2 MMbbl, but remain roughly 12 million barrels above…

The disappearance and alleged dismembering of Saudi dissident Jamal Khashoggi by people connected to Crown Prince Mohammad bin Salman has generated a lot of media buzz throughout the week, however markets were quite reluctant to react palpably. U.S. crude inventories, however, have put crude prices under significant pressure, having increased by a total of 20 million barrels within the past six weeks due to the autumn refinery maintenance season.

(Click to enlarge)

Overall, crude fell to a one-month low after market sentiment cooled over Iranian supply loss fears but remained cautious about trade wars potentially limiting economic activity in 2019. There were some positive signs, such as China increasing its refinery throughput in September to a record-high 12.5 mbpd, but downward pressures hit the market harder as WTI ended the week trading around $69 per barrel, whilst Brent hovered around $79 per barrel.

1. US Crude Stockpiles Surge for Fourth Week in a Row

(Click to enlarge)

- This week’s 6.5 million-barrel U.S. stock surge to 416.4 million barrels was all the more noteworthy for happening against the background of US Gulf of Mexico production shut-ins.

- Crude exports fell back to 1.8 mbpd, to a four-week rolling average of 2.2 mbpd, whilst net imports bounced back from last week’s lowpoint to 7.6 mbpd.

- U.S. gasoline stocks finally drew this week by 2 MMbbl to 234.2 MMbbl, but remain roughly 12 million barrels above same-week 2017 levels.

- The reason behind the long-awaited gasoline stock drop lies in strong exports, increasing almost 150 kbpd per week to 1.2 MMbpd, whilst imports fell 300 kbpd w-o-w, to an average rate of 394 kbpd.

- For the fourth week in a row, distillate stock declined, falling w-o-w by 827 Mbbl.

2. Iran goes all in to remain in Europe with November OSPs

(Click to enlarge)

- Iranian state oil company NIOC has set its November OSPs at the widest discount to Saudi Aramco’s official selling prices in the last 18 years.

- The discount offered on Iranian Light to Northwest Europe dropped a whopping -1.2 USD per barrel, whilst Iranian Heavy delivered to the same destination came down even steeper, by -1.30 USD per barrel, to a groundbreaking -8.05 USD per barrel against the Oman/Dubai average.

- The November discount on the Iranian Heavy price for NW Europe is more than double that of January 2018 (-3.95 USD per barrel).

- Iranian crude exports fell by approximately 260kbpd in September 2018, to a low of 1.72 mpbd.

- October so far seems even bleaker, with Iranian exports averaging about 1.33 mbpd.

- Still, not everything is lost for Iran, as Reuters data show data that sixfold the average volume of cargoes (roughly 20 million barrels) is currently destined for the Chinese port of Dalian.

3. The Battle for India Begins

(Click to enlarge)

- Saudi Arabia’s Energy Minister Khalid al-Falih stated following a meeting with India’s Prime Minister Narendra Modi and Oil Minister Dharmendra Pradhan that Riyadh is fully committed to meet India’s demand.

- According to media reports, Saudi Aramco plans to supply India with additional 4 million barrels in November.

- Saudi Arabia wants to sweeten its takeover of missing Iranian volumes by investing in India’s petrochemical and downstream segment, as well as help build up its strategic storage system.

- India aims for 2 strategic storage facilities with an aggregate capacity of 6.5 million tons through a joint partnership of Indian company and a third-party investor.

- However, India is in no rush to leave Iranian imports – having imported roughly 10 million barrels in October, it is set to import 8-9 million barrels in November.

- Iran’s commercial attractiveness might be further buttressed by India’s currency problems, the rupee has fallen 15 percent this year, making imports ever-expensive.

- Iran has been using the Indian rupee in oil-related deals since 2013, in sanctions-stricken circumstances this has provided an important lifeline for the embattled Teheran regime.

4. China Becomes Largest Gas Importer in World

(Click to enlarge)

- China overtook Japan as world’s top natural gas importers based on January-August 2018 data, having surpassed global #3 South Korea last year.

- In Jan-Aug China imported 57.18 million tons of natural gas (both pipeline and LNG), whilst Japan brought in 56.45 million tons.

- China has been ramping up gas utilization, emitting half as much CO2 as the traditional Chinese choice - coal, for almost two years now as a crucial element in its air pollution decrease policy.

- China’s lead will widen even further in 2019-2020: Petrochina concluded a 22-year LNG supply deal with Qatar and will start getting Russian pipeline gas via the Power of Siberia pipeline from Dec 2019.

- Bloomberg New Energy Finance predicts that by 2030 China’s LNG imports alone would make it the world’s biggest gas importer, reaching 82 million tons.

- Amid fears of a potential U.S. LNG ban, China can easily supplant American volumes as they currently make up a mere 2.2% of its LNG intake.

5. Saudi Arabia Adds 3Mbpd Export Capacity

(Click to enlarge)

- Saudi Aramco has opened its Muajjiz terminal to the south of the Yanbu port complex, bringing its total export capacity to 15 mbpd.

- The bulk of Saudi production is still located in the Eastern part of the country, however, should there be a need for Aramco fully utilizing its 5 mbpd East-West oil pipeline (now it transports roughly 2mbpd), Eastern ports can fully accommodate additional volumes.

- Muajjiz will load Arab Light and Arab Super Light grades, which then will be shipped to the Ain Sukhna terminal in Egypt and the Sumed pipeline, to access European markets.

- Muajjiz is Saudi Arabia’s first significant endeavor in relocating crude export facilities from the Persian Gulf, insulating the country’s exports from any tension flare-up over the Hormuz Strait.

6. Large Gas Find in North Sea Leaves Total Wrong-footed

(Click to enlarge)

- Total’s offshore Glendronach discovery in September, having drilled at a depth of 4.3km, marks the largest gas discovery in the past ten years in the UK North Sea.

- Having hit a high-quality gas column of 42 metres net pay, the field’s reserves are estimated at 1Tcf of gas, allowing for a gross peak production of 150 MMCf per day.

- Total, the operator of the block with a 60% share (INEOS and SSE hold 20% each) will bring the field onstream next year, just one and a half years after drilling has started.

- Using synergies from previous projects, namely the Laggan-Tormore fields, by means of a 22-mile subsea tie-back of the producing wells to Laggan-Tormore, it will send the gas to the onshore Shetland Gas plant.

- The irony of the situation is that just this July Total voiced its aspiration to sell a 20 percent stake in Laggan-Tormore, allocating Bank of America Merrill Lynch to run the sale.

7. Russia wants to use LNG in space

- The LNG craze seems to be extending to cosmic spheres, too, as the Russian pipeline gas monopoly Gazprom is in talks with space company Roscosmos over LNG usage.

- The explosion hazard of LNG is significantly lower than that of kerosene or even hydrogen, whilst its density is roughly in between the two (kerosene is twice lighter).

- According to Gazprom, LNG is more competitive than kerosene price-wise and also much more environmentally friendly.

- Moreover, its vaporization point is significantly higher than that of liquid hydrogen, making it all the more attractive for cryogenic equipment.

- Roscosmos vowed to present its first methane-fueled rocket engine by 2025.