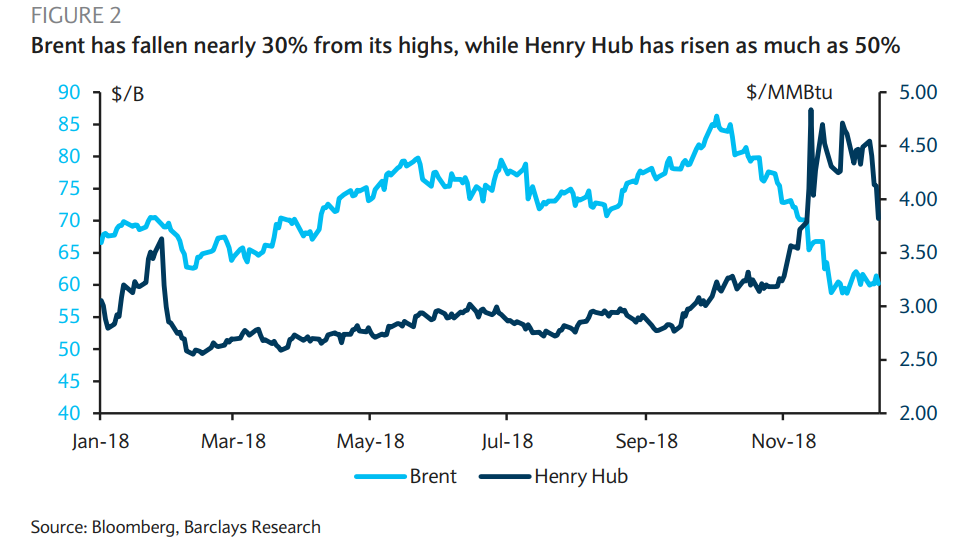

The price ratio between crude oil and natural gas has changed dramatically in the past few weeks, as crude prices have crashed at a time when natural gas prices hit multi-year highs. The ratio between the two prices could have consequences for a variety of natural gas and petrochemical projects, potentially leading to delays or cancellations.

Oil typically trades at a premium relative to natural gas, but at the end of November, the price ratio of Brent crude to Henry Hub gas fell to its lowest level since 2009. “The relative price of oil and gas affects the economics of various infrastructure investments across the energy industry, and the recent falloff might act as a fly in the ointment to development plans in the short term and could lead to delays,” Barclays said in a report.

The reasons for the plunge in oil prices have been discussed at length in this column and elsewhere – demand looks shaky, U.S. supply is soaring and oil traders are skeptical about the ability and willingness of OPEC+ to balance the market.

Meanwhile, natural gas has gone in the opposite direction over the past two months or so. Low inventories, high demand and seasonal factors have dramatically tightened the market for natural gas in the United States. Prices hit $4.70/MMBtu in November, up 60 percent since September.

In other words, Brent has lost more than half of its price premium to Henry Hub in the last few months.

(Click to enlarge)

There could be fallout for proposed LNG projects because of this development. The fall of global crude prices has also dragged down global LNG prices (LNG prices are still influenced by crude benchmarks). So, we have falling LNG prices around the world, but rising natural gas prices in the United States. The business case for exporting LNG from the U.S. has always been about taking advantage of a cheap feedstock, and selling it abroad at a higher price.

With costs for the feedstock rising, and the landing price falling, the economics of building new LNG projects in the U.S. have taking a hit. January NYMEX gas prices are trading $4/MMBtu below Asian contract LNG prices, a differential that was as high as $9/MMBtu this past summer. The window for profits on shipping LNG from the U.S. to Asia has not entirely closed, but the business case looks a lot less compelling.

Related: Saudi Oil Minister: Crude Stocks Should Drop Very Soon

That isn’t a big deal for LNG export terminals already online, but it could cause developers of new projects to think twice. “Recent history suggests that the contraction in the oil-gas ratio could lead to project delays, particularly for those projects that are further behind in the process,” Barclays notes.

However, there are several reasons why this could merely be a temporary problem. First, the oil-to-gas pricing ratio could rebound. “[W]e believe this oil-gas ratio is due for a retracement, as we see the price movements in oil and gas as overdone,” Barclays said.

The investment bank sees the Brent-Henry Hub ratio doubling from around 15 times to 27-28 times by the second quarter of 2019. The OPEC+ cuts should help rescue oil prices to some degree, while record-setting natural gas production should replenish inventories after the winter season and push prices back down. Barclays sees Brent rising to $75 per barrel in the second quarter of 2019 while gas could fall back to as low as $2.67/MMBtu, allowing oil to regain its strong premium over gas.

A second reason why the lower oil-to-gas pricing ratio may not deter LNG investment is that most LNG developers look at futures prices several years out, and the futures curve for oil-to-gas several years from now still looks convincing, even as the near-term differentials have deteriorated. As such, developers may been unbowed as they plan new projects.

Related: $50 Oil Won’t Kill U.S. Shale

Nevertheless, the sudden downturn in project economics could still force some delayed decisions. “Although we believe the Brent-Henry Hub will revert in the coming months, the current downturn represents a potential headwind to those US LNG export projects looking to reach final investment decision (FID) over the next year and become one of the ‘second wave’ of LNG terminals,” Barclays concluded.

To top it off, the U.S.-China trade war may magnify uncertainties. China is set to be the largest source of LNG demand growth going forward, so “long-term supply contracts from Chinese offtakers will be critical to underwriting financing for second wave US LNG projects,” Barclays says. China has already slapped a 10 percent tariff on American LNG, a levy that could rise to 25 percent if the two sides can’t come to an agreement by March.

There are several dozen LNG projects planned in North America, totaling $275 billion in potential investment, according to Barclays’ calculations. Obviously, not all – or even most – of those projects will move forward. But the suddenly weak oil-to-gas pricing ratio, combined with the U.S.-China trade war, acts as “an additional hindrance to development,” the investment bank concludes.

By Nick Cunningham of Oilprice.com

More Top Reads From Oilprice.com:

- Iran Is Facing A Lot More Than Just Sanctions

- Aramco Fights To Protect Asian Market Share Ahead Of Cuts

- Major LNG Shortage Increasingly Likely