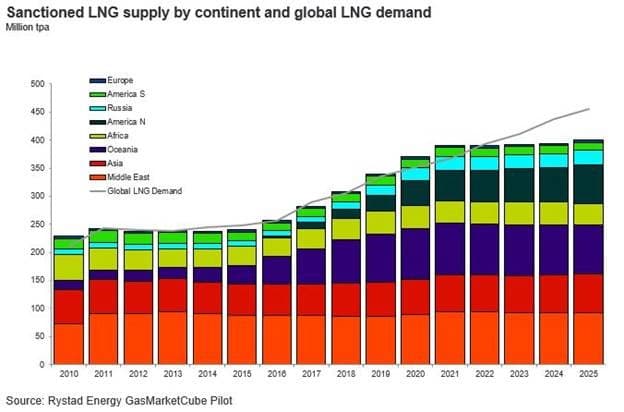

Liquefied natural gas (LNG) buyers’ willingness to commit to new long-term contracts has increased significantly during 2018 amid expectations of a tighter LNG market. Looking ahead to 2025, Rystad Energy argues a major shortage of liquefied natural gas is looking increasingly likely.

2018 was another bumper year for LNG with strong demand growth driven by Asia. While the market is projected to see very strong supply growth centered on flexible US LNG volumes over the next two years, global demand is growing even faster.

“Rystad Energy forecasts heightened risk of an emerging deficit of LNG supplies post 2022,” says Sindre Knutsson, senior analyst on Rystad Energy’s Markets team.

(Click to enlarge)

By the end of November 2018, contract volumes of long-term sales and purchase agreements (LT SPAs) were up by 38% on a year-on-year basis. Three quarters of these volumes were signed after 1 August, signaling expectations of tighter market among buyers.

(Click to enlarge)

The average duration of contracts has also increased, indicating that LNG buyers are less confident that they can get adequate LNG supply from the spot market. This represents a reversal from the trend seen in recent years.

“We expect LNG buyers to continue to seek flexible contracts, but that the large established Asian buyers – such as Japan, South Korea, Taiwan and China – will continue to rely on long-term contracts to ensure security of supply,” Knutsson adds.

The increased activity in commitment to new LT contracts will help developers to reach final investment decisions and to secure financing for new LNG projects, but such projects need to be firmed up very soon in order to avoid a shortfall. Assuming even a four-year construction period from investment decision, the market could tighten significantly from 2023.

While the increased commitment to new SPAs and higher average durations are indications of increased tightness in the LNG market, Rystad Energy still forecasts excess volumes over the next three years, driven by new US supplies. Less than one-third of the current US wave of supply has started up, leaving the lion’s share of new LNG production to flood the market over the next two years. This could turn around quite rapidly in 2022, as LNG demand growth outpaces sanctioned supply.

More Top Reads From Oilprice.com:

- Shale Growth Could Slow On Oil Price Meltdown

- Why Is China Losing Interest In Nuclear Power?

- Dark Horse In Battery Tech Could Beat Tesla

The PRC is doing a stall spin into economic recession with its money give-away to the third world. How do you collect on a road, or railroad for that matter?

Japan's economy is faltering, so is the rest of Asia's.

Europe is a financial disaster with its overspending to pay migrants welfare, because the jobs do not exist for those without skills or the language to enable communications. The only sector that is up in the European market is rape.

Remember the 1980s? Major U.S. banks were encouraged to invest in third world infrastructure and found out the hard way, you can't repossess a road---or what's already in a Swiss bank account.

I note that the graph indicated yuan . . . I find that interesting. Rystad evdently has an interest in kow towing to the PRC.

If the U.S. withdraws from Afghanistan, as it has from Syria, and continues that trend, the military operations tempo is headed for decline, meaning less oil and natural gas in that sector; which with speculation has been the drive on any increase along with OPEC playing around, some, but, still there is no real uptick in economic activity, except in the U.S. and the war by the Left against Trump may drag the U.S. back into stagnation.

Europe is headed for civil war, the PRC for absolute failure with its turn to communist inspired economics. The only hope for Asia is Japan.

The West is the world market place. And, the West is failing economically. Figure it out.