Friday April 20, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. $100 oil means expensive gasoline

(Click to enlarge)

- Reports that Saudi Arabia is considering $100 per barrel as a goal would translate into prices at the pump in the U.S. at about $3.60 per gallon.

- That is more than $1 per gallon more than current average prices, and as Bloomberg Gadfly notes, it would seriously cut into demand. Not only would higher prices undercut consumption, but the fact that U.S. employment is essentially at its maximum and the U.S. economy is potentially in the waning stages of a period of expansion, higher gasoline prices would not easily be absorbed by consumers without affecting demand.

- In prior cycles in which gasoline prices were that high, it did not last long. To take a variation on an old adage, the cure for high prices is high prices.

- Over the long run, the falling cost of EVs will cut into oil demand, but an unexpected jump in crude prices to $100 per barrel would no doubt accelerate that trend. In other words, Saudi Arabia could reap profits in the short run but would be shooting itself in the foot over the long run.

2. Frac sand supply strained but set to grow

(Click to enlarge)

- The…

Friday April 20, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. $100 oil means expensive gasoline

(Click to enlarge)

- Reports that Saudi Arabia is considering $100 per barrel as a goal would translate into prices at the pump in the U.S. at about $3.60 per gallon.

- That is more than $1 per gallon more than current average prices, and as Bloomberg Gadfly notes, it would seriously cut into demand. Not only would higher prices undercut consumption, but the fact that U.S. employment is essentially at its maximum and the U.S. economy is potentially in the waning stages of a period of expansion, higher gasoline prices would not easily be absorbed by consumers without affecting demand.

- In prior cycles in which gasoline prices were that high, it did not last long. To take a variation on an old adage, the cure for high prices is high prices.

- Over the long run, the falling cost of EVs will cut into oil demand, but an unexpected jump in crude prices to $100 per barrel would no doubt accelerate that trend. In other words, Saudi Arabia could reap profits in the short run but would be shooting itself in the foot over the long run.

2. Frac sand supply strained but set to grow

(Click to enlarge)

- The Permian Basin has suddenly been hit with a raft of bottlenecks up and down the supply chain.

- Frac sand supplies are constrained, leading to inflated prices. However, according to Rystad Energy, the bottleneck should ease later this year.

- An estimated 52 million tons of frac sand capacity is set to come online this year, expanding frac sand supply by nearly 40 percent.

- Much of the new mines are located in Texas, dramatically reducing the distances that sand supplies have to travel. For years, Texas drillers imported sand from Wisconsin.

- While sand supplies could rise, there are a series of other bottlenecks – labor, completion crews, rigs, trucks and, crucially, pipelines – that Permian drillers will have to contend with, all of which could hamper shale growth.

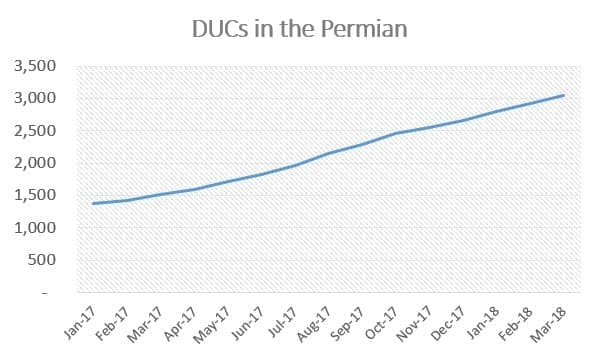

3. DUCs in the Permian

- The number of drilled but uncompleted wells (DUCs) has been rising sharply in the Permian over the past year, a reflection of the strained market for drilling services.

- The DUC backlog in the Permian more than doubled between January 2017 (1,383) and March 2018 (3,044).

- That stands in sharp contrast to the more marginal increase in DUCs in the Eagle Ford (from 1,229 to 1,507) and the decline in the Bakken (from 808 to 716).

- The DUC backlog represents a volume of supply that has yet to hit the market. While these wells could be completed later this year, leading to a rush of supply from the Permian, the rising total also suggests that Permian drillers are facing constraints.

4. Mexico’s oil industry sees political risk

(Click to enlarge)

- Mexico’s oil production has been in decline for more than a decade, with the losses accelerating after the oil market downturn began in 2014. Mexico’s output peaked at 3.4 million barrels per day in 2004 and fell to 1.9 mb/d in 2017.

- Mexico is hoping to attract major investment from international companies to revive oil production, particularly in deepwater offshore.

- Mexico has held around a dozen oil auctions, awarding more than 100 contracts to foreign oil companies. The government hopes the contracts will result in upwards of $93 billion in investment.

- The upcoming presidential election has the oil industry on edge because the frontrunner has promised to put an end to the auctions.

- The spreads on some Mexican bonds have climbed this year as investors worry about what a shift in the political landscape will mean for the creditworthiness of both the sovereign and state-owned Pemex.

5. Brent timespreads increase

(Click to enlarge)

- Oil prices hit fresh highs this week on the combined news of falling U.S. crude and gasoline inventories, rumors that Saudi Arabia wants $100 oil and festering geopolitical tension in the Middle East.

- The tightness is showing up in the timespreads for Brent futures. The spread between June and July contracts for Brent jumped to 73 cents per barrel on Thursday, the strongest one-month spread since December.

- “It shows how much tighter supply is and has a geopolitical risk premium built in,” UBS AG analyst Giovanni Staunovo told Bloomberg. “It’s a combination of both factors.”

- This state of backwardation is an indication that oil traders and investors are worried about short-term supply, and a steeper backwardation could itself help drain inventories.

6. Surging U.S. oil exports help reduce net inflows

(Click to enlarge)

- U.S. net petroleum imports – including crude oil, refined products and natural gas liquids – has declined sharply over the past few years, dipping to just 3.7 million barrels per day (mb/d) in 2017.

- That is lowest level of net imports since 1971. It is also sharply down from a highpoint in 2005 when net imports hit a record high 10.1 mb/d.

- Surging U.S. oil production cuts net imports in two ways – by reducing the need to import crude for domestic consumption and also by leading to higher exports, which cuts the import bill on a net basis.

- Imports of light, sweet crude fell significantly because that is the type of crude coming out of U.S. shale fields.

- Higher refining runs also cut the need for product imports. Refining runs have increased at a faster rate than domestic consumption, resulting in higher exports of gasoline and diesel.

- Total petroleum product exports averaged 5.2 mb/d in 2017, a record high.

7. EV sales see record quarter

(Click to enlarge)

- In the first quarter of 2018, the U.S. sold the most EVs ever recorded at 54,000, a jump of 32 percent year-on-year.

- Tesla (NASDAQ: TSLA), despite its manufacturing problems, continues to outsell its competitors, with sales of 5,100 Model 3s in the first quarter.

- Total U.S. sales hit an all-time monthly high in March at over 25,000, according to the Fuse.

- The figures were all the more impressive because the first quarter typically sees a seasonal dip in sales, often dropping by as much as 20 percent between the fourth quarter and the first. This year only saw a 2 percent dip relative to the fourth quarter of 2017.

- EVs captured 1.3 percent of overall auto sales in the first quarter.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.