2018 was a year of surprises for oil. We began with most traders and commentators convinced that $100 crude was a very real risk and ended the year with a 30% market correction as supplies increased and demand concerns metastasized. Perhaps it’s fitting that the most influential person in oil markets this year wasn’t an OPEC leader, hedge funder or Big Oil CEO but someone with a background in Real Estate and Reality Television who puts ketchup on his steak.

The most influential person in oil markets this year was undoubtedly Donald Trump. He pushed markets both lower and higher with his policies and Twitter feed. The three risks he created drove prices for the year and may continue to do so as we begin 2019.

Donald’s first risk was an increasingly hawkish stance towards Iran which looked to rip up the JCPOA and reimpose sanctions driving Iranian exports to 0 bpd. The threat of lost Iranian barrels was a critical driver of oil prices for the first eight months of the year as traders viewed the market as too thinly supplied. Remember that narrative? It seems like a distant memory, but it was only three months ago when nearly every piece of sell side research was mulling “$100 Crude?” Hedge funds piled into oil from the long side as they never have before and created a net long position of more than 1,000,000 contracts of NYMEX WTI and ICE Brent in anticipation. The risk was clear; Donald Trump has been a lifelong Iran hawk and he was going to undo his predecessor’s…

2018 was a year of surprises for oil. We began with most traders and commentators convinced that $100 crude was a very real risk and ended the year with a 30% market correction as supplies increased and demand concerns metastasized. Perhaps it’s fitting that the most influential person in oil markets this year wasn’t an OPEC leader, hedge funder or Big Oil CEO but someone with a background in Real Estate and Reality Television who puts ketchup on his steak.

The most influential person in oil markets this year was undoubtedly Donald Trump. He pushed markets both lower and higher with his policies and Twitter feed. The three risks he created drove prices for the year and may continue to do so as we begin 2019.

Donald’s first risk was an increasingly hawkish stance towards Iran which looked to rip up the JCPOA and reimpose sanctions driving Iranian exports to 0 bpd. The threat of lost Iranian barrels was a critical driver of oil prices for the first eight months of the year as traders viewed the market as too thinly supplied. Remember that narrative? It seems like a distant memory, but it was only three months ago when nearly every piece of sell side research was mulling “$100 Crude?” Hedge funds piled into oil from the long side as they never have before and created a net long position of more than 1,000,000 contracts of NYMEX WTI and ICE Brent in anticipation. The risk was clear; Donald Trump has been a lifelong Iran hawk and he was going to undo his predecessor’s driving oil into a bullish vortex. He gave his friends in Saudi Arabia a triple win in the form of higher prices, increased market share and isolating their key geopolitical foe and asked only that they help keep prices from getting out of control.

The Saudi/Trump connection brings us to risk two. The Saudis were obviously happy to step in and take Iran’s market share as prices increased due to the lost production and held up their end of the bargain by pushing their production to more than 11m bpd. Meanwhile the Trump White House did not. The Trump administration ultimately granted full waivers to Iran’s eight largest crude buyers which sent crude oil from a soft, oversupplied market into a full-blown bearish tailspin. This event coincided with the MBS’ brutal killing of U.S. journalist Jamal Khashoggi and it was incredible to watch the two parties remain in lock step as public scrutiny of their coziness reached a fever pitch. Going forward, we think the Trump/Saudi relationship will remain strong despite the Trump hoodwink, the Khashoggi killing and the OPEC deal to ultimately cut production. Both parties have nowhere else to go for strategic partnership and will have to make do together at least for the near term.

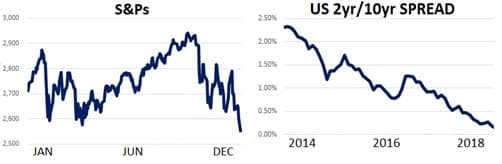

Trump’s third risk was to preside over the continued trade spat between the US and China which is rolling global risk assets and has bond traders forecasting (via the yield curve) a major economic slowdown. In recent weeks the fears/disappointment that the two countries will fail to put their differences aside and get back to business have increased after the Trump/Xi meeting at the G20 summit produced a short-term truce but no major progress towards an economically positive deal. Global equities are offering warnings signs with S&Ps down about 6% YTD while the Shanghai Composite is down more than 20%. The effects on the oil market were obvious as headlines citing “demand concerns” and unimpressive crude and gasoline demand data kept a lid on prices throughout the year. We have a hunch that this trend may continue into 2019 as the global economic recovery matures and financial conditions tighten.

There’s no question President Trump was the most influential person in oil markets in 2018 and it was largely to his benefit. US gasoline prices are low, markets are comfortably supplied and he gave his base of voters the type of Iran-anatagonizing they crave (despite the waivers.) Heading into 2019, however, we’re skeptical that the President will be able to shape crude oil dynamics in ways that are politically beneficial. Markets are growing tired of the US/China trade dispute and Saudi Arabia will make massive output cuts without fear of retribution from Washington. It may be difficult for Trump to make it through the year without a massive equity market selloff due to his trade disputes or a spike in gasoline prices due to his Iran/Saudi policies which ultimately triggered OPEC cuts. Beginning in January the President may do well to take his crude oil chips off the table and quit while he’s ahead.

Quick Hits- 2018 Review

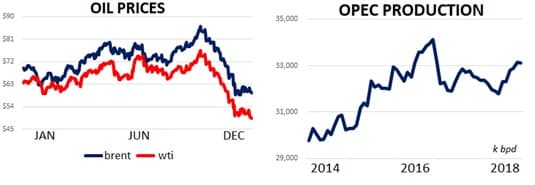

- Oil prices are set to end the year lower with Brent down about $7 since the start of the year to $60 while WTI has lost about $11 to move to $49. The year came in two parts with January - September showing strong gains as the Trump administration’s plans to put sanctions on Iran exacerbated the narrative the market was too thinly supplied. Phase 2 of 2018 began in October when Trump- after convincing the Saudi’s to pump more crude to ease prices prior to Iranian sanctions- granted waivers to Iran’s largest crude buyers and the effect of the excess barrels was multiplied by consistent concerns that the global economic recovery is losing steam.

- Brent crude ultimately dropped 31% from October 3rd to November 23rd to which OPEC+ responded with coordinated production cuts- led by the Saudis and Russia- to the tune of 1.2m bpd for the first 6 months of 2019. Prices were calm following the announcement suggesting that traders are interpreting the action as merely adequate. In the short term, we won’t be surprised if OPEC+ feels compelled to extend the cut beyond the original term of prices remain soft. In the long term, the move seems to further cement that North American frackers have the strategic upper hand against the Saudis.

- Speaking of frackers, US crude producers played a role in oversupplying which few predicted. US crude production hit 11.7m bpd in 2018 which is an incredible 2.4m bpd above their average effort in 2017.

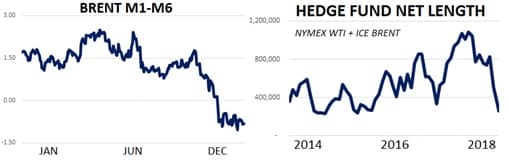

- Time spreads, like flat price, followed a bullish path through September moving aggressively into a backwardated structure. In October and November it all unraveled. The Brent 1-month / 6-month contract spread is currently trading 80 cents into contango which suggests to us that traders see the market as roughly in neutral for supply/demand dynamics in the near term.

- Speculative flows played a massive role in the market’s move this year with managed money pushing Brent to both its 2018-peak near $87 in October and its 2018-low of $57.50. Funds currently hold a combined net long position of NYMEX WTI + ICE Brent of 259k contracts representing a 75% drop since April and its lowest point since August 2015.

- Oil markets have suffered a relentless flow of negative news in the last three months but the critical measure of just how loosely or tightly supplied we are – Days of Cover – suggests that the market is essentially in neutral. US crude stocks can currently serve 25.5 days of demand which is 1.1 days below its 5yr average. This suggests to us that crude markets could actually have some upside risk in 2019 should the macro picture brighten and/or supply risks become realized.

- US crude stocks are right back in line with their 2017 giving OPEC+ virtually nothing to show for its last round of cuts. Total crude inventories currently stand at 441m bbls and increased by a total of 45m bbls in the fall and winter when seasonal norms call for inventory draws.

- As for refined products, US gasoline inventories are higher y/y by about 0.5% while distillate stocks are lower y/y by about 3%.

- On the demand side, US refiners consumed 16.95m bpd of crude in 2018 for a 350k bpd y/y improvement. On a more bearish note, US domestic gasoline consumption + exports improved by a meager 150k bpd to 10.1m bpd. Looking to 2019, we’re particularly concerned about the low margins available to US refiners in the gasoline market. US refiners are broadly making about $8-$10/bbl to produce gasoline right now which is unlikely to incentivize strong demand.

- Macro downside risks were a highlight of 2018 as traders across markets feared an increased likelihood of a global recession. This seems likely to persist as a theme in 2019 as well.

- Equities revealed the stress with S&Ps lower by about 6% YTD driven by a selloff of about 14% from September through mid-December.

- Bond markets are also flashing red as interest rates in the front of the curve increased on US Fed rate hikes while the back of the curve was comparably steady as traders saw diminished likelihood of tightening in 2019 and 2020. The end result was the flattest yield curve in terms of a US 2yr / 10yr spread that the market has seen in more than a decade.