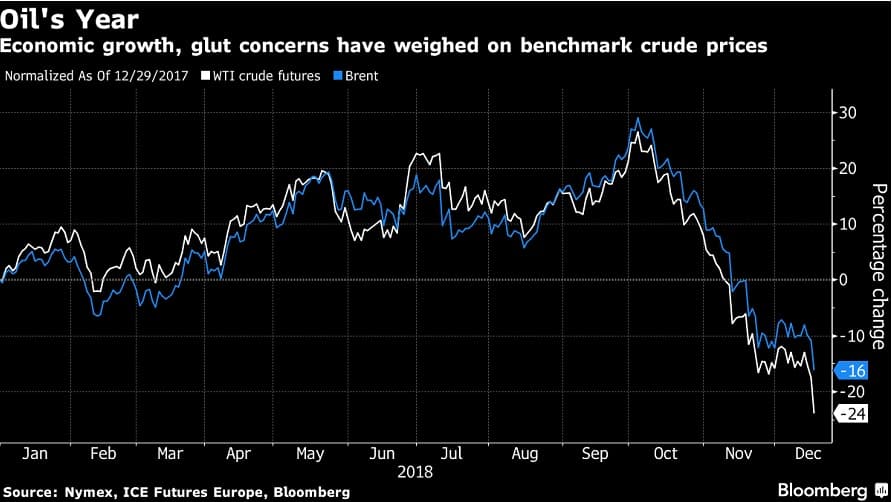

There we go again, another negative week for oil amid a generally negative market sentiment and fortifying fears that oversupply is imminent in Q1 2019. Bullish factors that include supply disruptions in Lybia taking out some 400kbpd of production and the OPEC+ production cuts were overwhelmed by concerns regarding US crude production volumes, an unexpected US commercial crude stock buildup (API announced a 3.45 MMbbl increase) and a global economic slowdown.

(Click to enlarge)

On Tuesday alone WTI witnessed a sharp 7 percent drop, whilst Brent decreased by 6 percent in one single day, making it one of the worst oil trading days of 2018. Crude prices have steadied a bit since then but it seems that the plethora of oil-related concerns will not allow for a quick recovery. On Wednesday WTI traded around 46.5-47 USD per barrel, whilst global benchmark Brent oscillated in the 56.5-57 USD per barrel interval.

1. Canadian Government Wants to Bail Out Producers (by Indebting Them)

(Click to enlarge)

- The Canadian government announced a 1.6 billion CAD ($1.2 billion) aid package to assist struggling oil producers amid insufficient takeaway capacity and Alberta production curtailments.

- This would involve 1 billion CAD allocated to energy exporters to cope with the challenges of maintaing production and finding new market outlets, as well as 0.5 billion CAD worth of commercial financing, both granted mostly by loans.

- Canadian…

There we go again, another negative week for oil amid a generally negative market sentiment and fortifying fears that oversupply is imminent in Q1 2019. Bullish factors that include supply disruptions in Lybia taking out some 400kbpd of production and the OPEC+ production cuts were overwhelmed by concerns regarding US crude production volumes, an unexpected US commercial crude stock buildup (API announced a 3.45 MMbbl increase) and a global economic slowdown.

(Click to enlarge)

On Tuesday alone WTI witnessed a sharp 7 percent drop, whilst Brent decreased by 6 percent in one single day, making it one of the worst oil trading days of 2018. Crude prices have steadied a bit since then but it seems that the plethora of oil-related concerns will not allow for a quick recovery. On Wednesday WTI traded around 46.5-47 USD per barrel, whilst global benchmark Brent oscillated in the 56.5-57 USD per barrel interval.

1. Canadian Government Wants to Bail Out Producers (by Indebting Them)

(Click to enlarge)

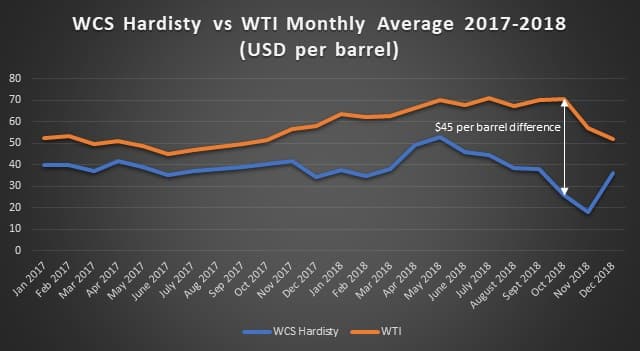

- The Canadian government announced a 1.6 billion CAD ($1.2 billion) aid package to assist struggling oil producers amid insufficient takeaway capacity and Alberta production curtailments.

- This would involve 1 billion CAD allocated to energy exporters to cope with the challenges of maintaing production and finding new market outlets, as well as 0.5 billion CAD worth of commercial financing, both granted mostly by loans.

- Canadian price differentials have narrowed following Premier Notley’s decision to cut 325kbpd of production in Alberta.

- As Premier Notley faces an election in May 2019, further and more solid steps are needed to appease disgrunted oilmen as new pipeline capacity will only be available after the elections, in Q4 2019.

- The WCS-WTI differential currently stands at -16.5 USD per barrel, a notable improvement over October’s average of -45 USD per barrel.

2. Chinese Crude Demand Reaches New Heights

(Click to enlarge)

- China’s crude demand (its own production and aggregate oil imports) reached a new record level of 14.1 mbpd in November, amid falling domestic output and rampant stockpiling.

- Domestic crude production decreased to 3.73 mbpd, resulting in a 1 percent decline year-on-year (the 2018 average is down by 1.6 percent compared to 2017).

- Rising oil imports were the main reason behind the record numbers, at 10.43mbpd they rose above the 10mpbd threshold for the first time in history.

- Refinery runs remained stagnant at 12.28mbpd in November, implying that up to 1.8mbpd worth of crude was stockpiled throughout the month.

- The 2018 refinery throughput average stands at 12.12mbpd, some 7 percent higher than the 2017 average.

- This week will mark the beginning of another massive boost to China’s refining sector after the 400kbpd Hengli Petrochemical refinery started operation on December 15.

3. Kuwait Reacts to Market with January OSPs

(Click to enlarge)

(Click to enlarge)

- KPC, the Kuwaiti national oil company, has cut January official selling prices for the Kuwait Export Blend (31 degrees API, 2.5 percent Sulphur) by 0.65 USD to -0.35 USD per barrel vs the average Oman/Dubai.

- The KEB-Arab Medium spread shrank to its narrowest in 5 years, reaching 30 cents per barrel, after throughout much of 2018 the discount was around 50 cents per barrel.

- Against Saudi Aramco’s 0.75 USD per barrel cut to Arab Medium in January and the OPEC/OPEC+ production cut taking place, KPC seems intent not to lose out on the Asian market.

- 90 percent of Kuwaiti crude is marketed in Asia, with South Korea and China leading the top importers list with 23 and 20 percent of KEB total sales goind there, with Japan and India taking 11-11 percent.

- The January OSP for the Kuwait Super Light crude was cut by 1.65 USD per barrel m-o-m, with the KSLC-AXL premium dropping to 35 cents from the hitherto set 50 cents per barrel.

4. Angola To Offer Offshore Blocks For The First Time in 7 Years

(Click to enlarge)

- Angola will offer up to 10 offshore blocks in the first upstream licensing to take place in the country since 2011.

- As the oil sector reform seems to lag behind a bit, the offering will be conducted by Sonangol, not the new State Oil & Gas Agency (ANPG) which should take over all licensing activity in the near future.

- Sonangol previously indicated that the next licensing round should also include onshore blocks – in the Congo, Namibe and Cunene basins.

- Having signed a memorandum of understanding with Exxon on the Namibe basin, the onshore blocks might be developed under a separate legal agreement.

- 15 onshore blocks were to be licensed in 2015 in the Lower Congo and Kwanza basins, however, the round was cancelled and brushed under the carpet in 2016-2018.

- As Angola’s crude exports are expected to reach a 12-year low at 1.3mbpd this month, the Angolan government is doing its utmost to revive national oil production.

5. ENI Hits Light Angolan Oil with Afoxé-I

(Click to enlarge)

- The latest discovery of Italian major ENI could bolster Angolan production plans, the Afoxé prospect located in Block 15/06 is estimated to contain 170-200 MMbbls.

- Lying some 120km off the Angolan coast, Afoxé is located 20km to the west of Kalimba, paving the way for the joint development of 450-500 MMbbls of oil reserves.

- The Afoxé wildcat hit 20 meters net pay of light sweet oil (37 degrees API as opposed to Kalimba’s 33 API) in Upper Miocene sandstones.

- Further discoveries are to be expected next year as ENI and its partners (Sonangol – 36.84 percent of shares, SSI Fifteen – 26.32 percent) plan to drill four new exploration wells in Block 15/06.

- ENI’s drilling success has allowed the company to carve out additional 400km2

6. Japanese Are Buying Into Baltic LNG

(Click to enlarge)

- Gazprom and Itochu signed a memorandum of understanding on the latter’s joining Baltic LNG, Gazprom’s most ambitious LNG project of late.

- Itochu will be the second Japanese company joining the 10mtpa capacity project, after Mitsui signed off its intention to join this September.

- According to latest comments from Shell, which together with Gazprom launched the project in 2017, the Anglo-Dutch company wants to hike the liquefaction capacity to 13mtpa.

- Baltic LNG would be located next to the Ust Luga terminal near St. Petersburg, mostly aiming to cover NW European LNG demand.

- Its competitive edge over other Russian LNG projects (all of them based on offshore production) lies in the fact that the natural gas would be sourced by pipeline from Gazprom’s production sites in Western Siberia and Yamal, to be then consequently liquefied in Ust Luga.

- With now a full setup of investors, first production is expected in 2022-2023.

7. Saudis To Take Over PDVSA’s Curacao Refinery

(Click to enlarge)

- Motiva Enterprises, the fully Saudi Aramco-owned US refining company, seems poised to take over Curacao’s 335 kbpd Isla refinery, heretofore managed by PDVSA.

- PDVSA struggles to meet its debt obligations and the usage of Isla might make it susceptible to seizure of cargoes destined for the refinery.

- During 2018, PDVSA has reportedly transferred custody over the fuel produced at Isla to the Curacao government, whilst the crude was transferred to Citgo, its US refining unit.

- PDVSA’s long-term lease of the Isla refinery runs out in December 2019, however a deal with Motiva stepping in should be expected by the end of January 2019.

- The Isla refinery was initially built in 1915 by Shell – previously Saudi Aramco’s JV partner in Motiva, so there is an indirect sense of restitution in Saudi’s using it to boost their global refining drive.