Friday April 6, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Major projects are back, but in scale downed form

(Click to enlarge)

- The oil industry is once again willing to spend on large projects, but this year’s megaprojects are going to be slightly less massive.

- Wood Mackenzie estimates that 30 major projects will receive final investment decisions this year, down just a bit from 32 last year, but more than the combined total from 2015-2016.

- The cost of the average project will decline sharply to $2.2 billion from $2.7 billion last year and as high as $9.3 billion in 2009.

- The average breakeven price will be about $44 per barrel in 2018, compared to $52 per barrel in 2017.

- In short, the industry is willing to spend, but only on lower-cost and profitable projects.

2. Venezuela production falls again

(Click to enlarge)

- Venezuela’s oil production fell by another 100,000 bpd in March, worse than expected. That takes output down to 1.51 million barrels per day, down more than 600,000 bpd from 2016 levels.

- Venezuela is also a big (involuntary) contributor to the OPEC cuts. OPEC’s collective output fell by 170,000 bpd in March to just 32.04 mb/d, the lowest total in nearly…

Friday April 6, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Major projects are back, but in scale downed form

(Click to enlarge)

- The oil industry is once again willing to spend on large projects, but this year’s megaprojects are going to be slightly less massive.

- Wood Mackenzie estimates that 30 major projects will receive final investment decisions this year, down just a bit from 32 last year, but more than the combined total from 2015-2016.

- The cost of the average project will decline sharply to $2.2 billion from $2.7 billion last year and as high as $9.3 billion in 2009.

- The average breakeven price will be about $44 per barrel in 2018, compared to $52 per barrel in 2017.

- In short, the industry is willing to spend, but only on lower-cost and profitable projects.

2. Venezuela production falls again

(Click to enlarge)

- Venezuela’s oil production fell by another 100,000 bpd in March, worse than expected. That takes output down to 1.51 million barrels per day, down more than 600,000 bpd from 2016 levels.

- Venezuela is also a big (involuntary) contributor to the OPEC cuts. OPEC’s collective output fell by 170,000 bpd in March to just 32.04 mb/d, the lowest total in nearly a year.

- That has allowed OPEC to post a compliance rate well in excess of 100 percent and has allowed Iraq to overproduce without too much scrutiny.

- Venezuela remains the “biggest risk factor” to global supply, according to the IEA, and its output declines are expected to continue.

3. Texas is driving U.S. oil production

(Click to enlarge)

- The U.S. shale story, at this point, is really a Texas shale story. U.S. oil production is set to jump to 10.7 mb/d in 2018 and then up to 11.3 mb/d in 2019.

- The all-time record, on an annual basis, was 9.6 mb/d set back in 1970.

- But the spike in shale output is really coming from Texas, which averaged 3.5 mb/d in 2017, and added 300,000 bpd last year, more than the other 49 U.S. states and the federal offshore in the Gulf of Mexico combined.

- Over the past decade, North Dakota has emerged as a significant shale producer, although the Bakken was hit harder than Texas during the 2014-2017 downturn.

- New Mexico, more recently, has come onto the scene, as the Permian stretches across the Texas-New Mexico border.

4. Iran struggles to take oil production to next level

(Click to enlarge)

- Iran successfully added about 1 mb/d of new supply after the removal of international sanctions at the beginning of 2016, but output has been flat for the past year.

- Of course, Iran signed onto the OPEC accord that limited production just shy of 4 mb/d. But Iran would be hard pressed to boost output beyond that level anyway without significant levels of new investment from international companies.

- To date, Iran has only signed two deals: one with Total SA (NYSE: TOT) for a natural gas project at the South Pars field, and one with Russia’s Zarubezhneft - a modest deal that could add 48,000 bpd.

- Iran has been unable to attract huge levels of investment that it hoped to achieve after the 2015 nuclear deal. Now the Trump administration is threatening to keep investment on the sidelines for the foreseeable future.

- Ripping up the nuclear deal could put 400,000 to 500,000 bpd of Iranian oil in jeopardy.

5. Brazil to add new supply

(Click to enlarge)

- Oil production in South America has been declining since 2015, with Venezuela as the most glaring example.

- But Brazil, already the largest producer on the continent, is expected to add new supply from new oil fields.

- Rystad Energy predicts 9 percent annual supply growth in Brazil between 2017 and 2020, “fully driven by sanctioned fields starting to produce in the short to medium-term.”

- Reforms and liberalization in Brazil passed in 2016 have opened up the country to international investment, making Brazil one of the most prized areas for offshore oil drilling in the world.

- The most recent offshore auction attracted strong interest from the oil majors, with ExxonMobil (NYSE: XOM) spending nearly $850 million for a single block.

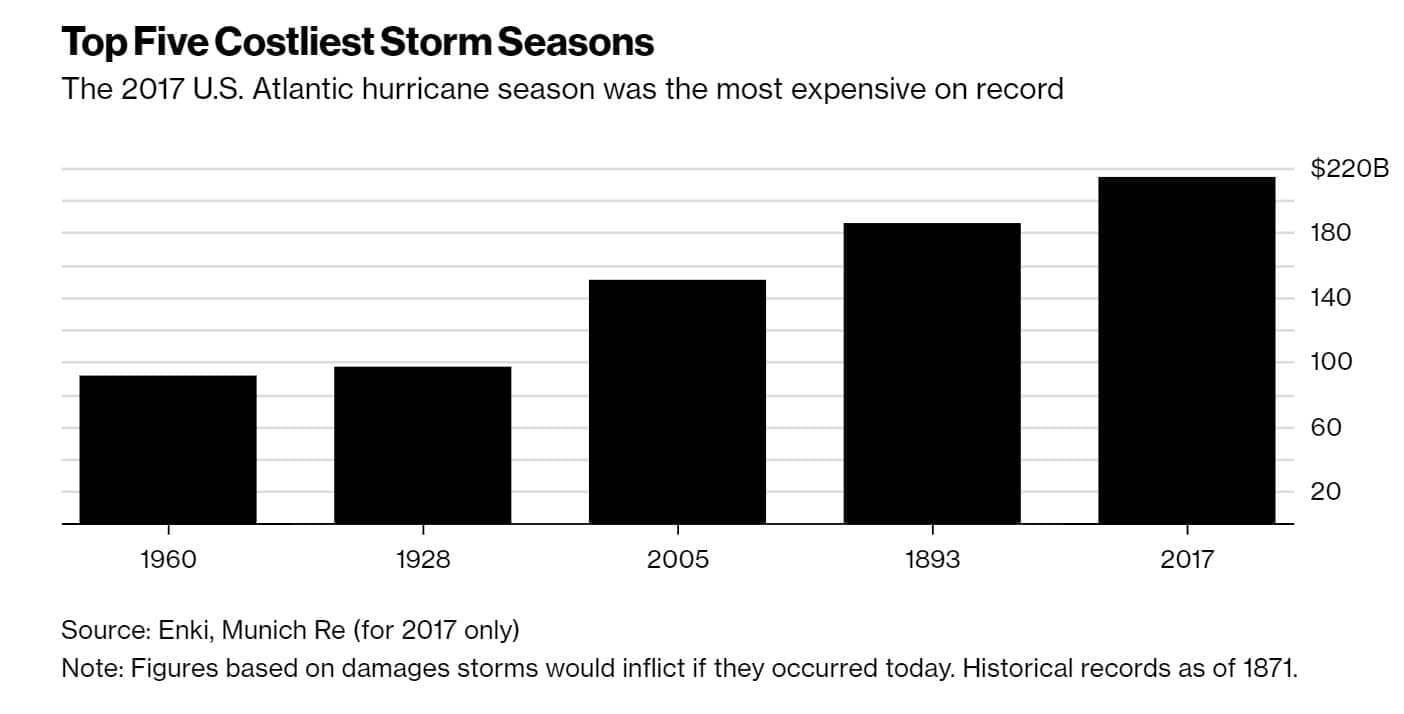

6. 2018 hurricane season expected to be active

(Click to enlarge)

- Colorado State University said that the 2018 hurricane season could be active, a worrying prospect for parts of the U.S. still recovering from the record-breaking damage caused by the 2017 storms.

- In 2017, the U.S. suffered a record high $215 billion in damages from hurricanes, notably from Harvey, Irma and Maria.

- As of now, the models suggest seven storms could become hurricanes this year, with three potentially rising to Category 3 or stronger. And there is a 63 percent chance that the U.S. continent is hit by a major hurricane, up from the 20th Century average of just 52 percent.

- The models could obviously be wrong, but they could underestimate the number of storms just as they could overestimate. Last year, the model predicted four hurricanes and two major ones, when in reality, there were 10 hurricanes, six of them major.

- In other words, the models are predicting a more active hurricane season this year than they did at this point last year.

- The ramifications could be significant, given the massive damage to oil refineries along the Gulf Coast in 2017.

7. Oil prices drop on trade war, rebound

(Click to enlarge)

- Oil prices collapsed at the start of the week after China’s twin tariff announcements, first targeting $3 billion in U.S. goods, including pork. A day later, China announced more comprehensive tariffs aimed at $50 billion worth of U.S. goods, including soybeans.

- Benchmark prices collapsed by about 4 percent on the news, although rebounded on Wednesday and Thursday on reports that the U.S. and China were quietly negotiating before enacting the tariffs.

- Also, the EIA reported a sharp drop in crude oil inventories, a weekly decline of 4.6 million barrels. The bullish reported added some positive sentiment to trading.

- Inventories are expected to continue to decline for the rest of this year, after a hiatus in the first quarter.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.