U.S. West Texas Intermediate crude oil futures are in a position to close lower for the week. Some of the selling pressure was generated by a confirmation of last week’s dramatic technical closing price reversal top.

The traditional supply/demand fundamental news was mixed. However, the main determinant of the direction appears to have been lower appetite for risky assets in response to worries over an escalating trade war between the United States and China.

A combination of news events helped fuel a two-sided trade before the market turned decisively lower for the week.

Prices plunged at mid-week after China proposed a broad range of tariffs on U.S. goods that increased fears of a trade war. However, the market began to mount a comeback after the release of a friendly government inventories report and a massive turnaround in the U.S. stock market.

According to the U.S. Energy Information Administration, U.S. crude inventories fell by 4.6 million barrels in the week-ended March 30. Analysts were expecting an increase of 246,000 barrels.

The EIA data showed the drop in inventories was fueled by a rise in refinery crude runs which jumped by 141,000 barrels per day. Refinery utilization rates rose by 0.7 percentage points.

Gains may have been limited by a report of a 3.666 million barrel build at the Cushing, Oklahoma futures storage hub.

The market received additional support from a report showing OPEC oil production fell in March to…

U.S. West Texas Intermediate crude oil futures are in a position to close lower for the week. Some of the selling pressure was generated by a confirmation of last week’s dramatic technical closing price reversal top.

The traditional supply/demand fundamental news was mixed. However, the main determinant of the direction appears to have been lower appetite for risky assets in response to worries over an escalating trade war between the United States and China.

A combination of news events helped fuel a two-sided trade before the market turned decisively lower for the week.

Prices plunged at mid-week after China proposed a broad range of tariffs on U.S. goods that increased fears of a trade war. However, the market began to mount a comeback after the release of a friendly government inventories report and a massive turnaround in the U.S. stock market.

According to the U.S. Energy Information Administration, U.S. crude inventories fell by 4.6 million barrels in the week-ended March 30. Analysts were expecting an increase of 246,000 barrels.

The EIA data showed the drop in inventories was fueled by a rise in refinery crude runs which jumped by 141,000 barrels per day. Refinery utilization rates rose by 0.7 percentage points.

Gains may have been limited by a report of a 3.666 million barrel build at the Cushing, Oklahoma futures storage hub.

The market received additional support from a report showing OPEC oil production fell in March to an 11-month low due to declining Angolan exports, Libyan outages and a further slide in Venezuelan output.

The mid-week rally started to pick up steam on Thursday, bolstered by a further recovery in the U.S. stock market and Saudi Arabia’s unexpected price hike in crude prices. However, a stronger U.S. Dollar helped limit gains.

Early Friday, the crude oil market was giving back some of the gains in reaction to the news that President Trump had ordered U.S. trade officials to consider an additional $100 billion in tariffs on China, escalating tensions with China.

Based on the early price action, it looks as if the direction of the crude oil market into Friday’s close is likely to be determined by investor appetite for risk.

Additional factors that could influence the price action are concerns over rising U.S. production, the possibility of weaker global economic growth and supply-side issues amid a backdrop of falling inventories.

With the fundamentals seemingly offsetting each other and investors a little confused about how to play the trade war game, the technical chart pattern may have more of an influence on the market this week and the next.

Weekly Technical Analysis

(Click to enlarge)

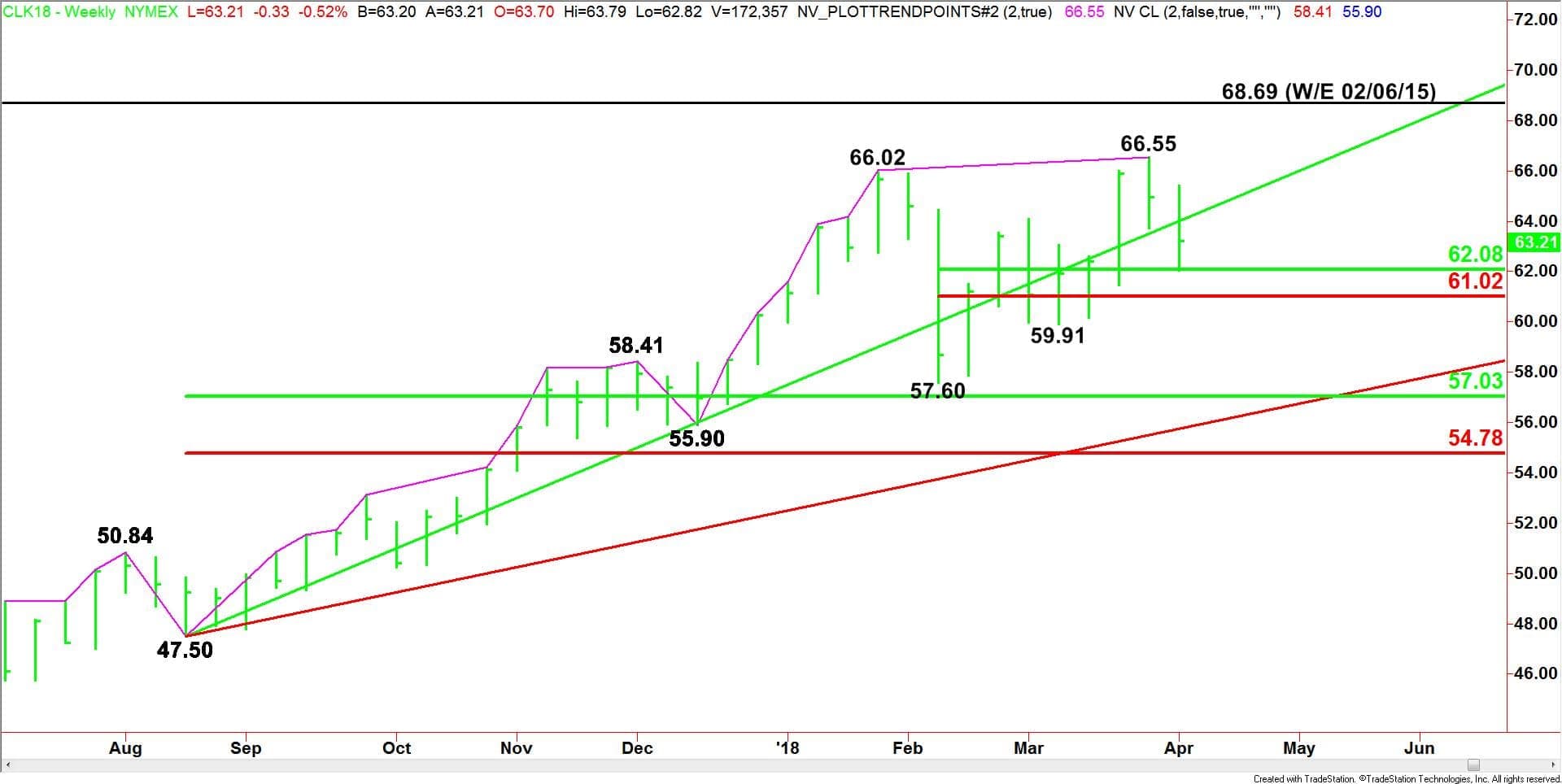

The main trend is up according to the weekly swing chart. However, last week’s closing price reversal top and this week’s subsequent confirmation has shifted momentum to the downside.

A trade through $66.55 will negate the closing price reversal top and signal a resumption of the uptrend.

A trade through $59.91 will change the minor trend to down. This move will confirm the shift in momentum. A move through $57.60 will reaffirm the minor trend.

The main trend changes to down on a trade through $55.90.

The short-term range is $57.60 to $66.55. Its 50% to 61.8% retracement levels at $62.08 to $61.02 are support. The upper level at $62.08 stopped the selling this week.

The main range is $47.50 to $66.55. Its retracement zone at $57.03 to $54.78 is the primary downside target.

Weekly Technical Forecast

Based on this week’s price action, the direction of the crude oil market next week is likely to be determined by trader reaction to the uptrending Gann angle at $64.50.

A sustained move under $64.50 will indicate the presence of sellers. If this move creates enough downside momentum then look for a retest of $62.08, followed by $61.02.

The selling pressure should increase under $61.02 with the first target coming in at $59.91.

Over time, a sustained move under $61.02 will eventually lead to a test of at least $57.03.

Overcoming and sustaining a move over the Gann angle at $64.50 will signal the return of buyers. This move could trigger a retest of $66.55. This price is a potential trigger point for an acceleration into $68.69.