Oil & Gas: Cheap Tricks

As of this week, we are the proud producers of “freedom fuel”, the successor, it would seem, to “freedom fries”; or going back to the WWI era, ”Liberty Cabbage”, which replaced “sauerkraut”. It’s an overused and unoriginal title that represents fear.

But for investors, adding “freedom” into the fuel mix label is not helpful--it’s a cheap gimmick from cheap minds that cannot defy this basic truth: It’s going to take quite a lot of nerve to jump into energy stocks right now, as prices slide on geopolitical factors and despite (finally) a lower showing for US crude inventory this week.

If you’re looking at oil stocks right now, you’re looking at some pretty poor beats--in terms of price, earnings and expectations, and it’s all about exposure to overseas markets. That means that oil services companies are seeing the worst of it, while it is still possible to find more narrowly focused drillers who don’t have the same revenue exposure. It is, though, a double-edged sword because the drillers are extremely sensitive to weak oil prices, and adding “freedom” to brand label on American fuel isn’t boosting anyone’s confidence. (Indeed, money managers have reduced their net long position this month as bets that prices would rise were liquidated, and oil was set for its biggest monthly plunge downward in half a year, with Brent set to lose 11% in May and WTI, 13%.)

Nor is the “freedom” label explicitly being given to crude oil. Instead,…

Oil & Gas: Cheap Tricks

As of this week, we are the proud producers of “freedom fuel”, the successor, it would seem, to “freedom fries”; or going back to the WWI era, ”Liberty Cabbage”, which replaced “sauerkraut”. It’s an overused and unoriginal title that represents fear.

But for investors, adding “freedom” into the fuel mix label is not helpful--it’s a cheap gimmick from cheap minds that cannot defy this basic truth: It’s going to take quite a lot of nerve to jump into energy stocks right now, as prices slide on geopolitical factors and despite (finally) a lower showing for US crude inventory this week.

If you’re looking at oil stocks right now, you’re looking at some pretty poor beats--in terms of price, earnings and expectations, and it’s all about exposure to overseas markets. That means that oil services companies are seeing the worst of it, while it is still possible to find more narrowly focused drillers who don’t have the same revenue exposure. It is, though, a double-edged sword because the drillers are extremely sensitive to weak oil prices, and adding “freedom” to brand label on American fuel isn’t boosting anyone’s confidence. (Indeed, money managers have reduced their net long position this month as bets that prices would rise were liquidated, and oil was set for its biggest monthly plunge downward in half a year, with Brent set to lose 11% in May and WTI, 13%.)

Nor is the “freedom” label explicitly being given to crude oil. Instead, it’s about gas--and America’s LNG ambitions, which will be severely challenged by the trade war with China. In this case, “freedom” is supposed to buoy the industry’s concerns, but at heart, it is really an acknowledgement that there is a reason to worry.

Oil & Gas: Iran Conflict Bogeyman Loses Momentum, but Libya Fears Are Very Real

Washington has changed its tune on Tehran with the hawkish of the hawks, National Security Adviser John Bolton, saying the U.S. did not plan a military response to the alleged role of Iran in attacks on tankers at a UAE port earlier this month--even as he insisted that Iran was “most certainly” behind the attacks, with Pompeo alleging that the attacks were designed to raise the price of crude oil. This is Trump, once again, bringing things to the brink before backing away in a game of leverage. The risk this time is that the leverage game will be taken too far and the conflict will take on a life of its own, through a number of proxies. The Saudis and UAE are still trying to escalate this, but not too far--an act they are not fully in control of, particularly where it concerns the unhinged Saudi crown prince. Iraq, for its part, is caught in the middle here and on Thursday, condemned the statement of an emergency Arab meeting that sought to find unity against Iranian “interference”.

Libya is the easier conflict to track, and General Haftar is now seriously knocking on Tripoli’s front door, having advanced several kilometers closer to the center and fully armed to push back the GNA’s unified (but still fractious) militias. Haftar is also trying to buy more weapons with political capital from his external allies. While the UAE has clearly been shipping weaponry to Haftar, now the LNA general is trying to tap into Egypt for surface-to-air missiles. This is largely being reported by Qatari media, which is on the other side of this conflict, but we note that a recent move by Haftar to extradite a wanted terrorist to Egypt is likely the precursor to getting those missiles, which would nearly guarantee his victory over militia forces around Tripoli.

Renewables & Energy Metals

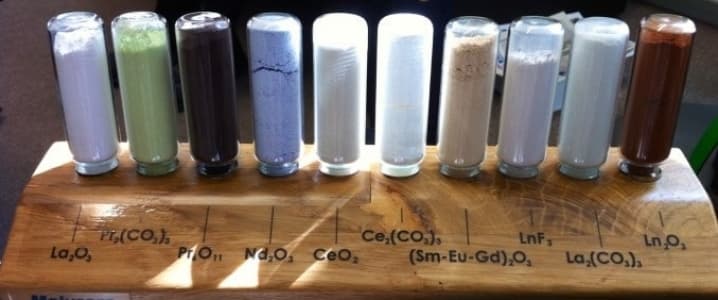

While the IEA has come out this week with good news for EV industry outlook, with numbers showing that the global EV fleet surged by 63% last year (45% of that in China), the trade war with China has gone beyond the rhetoric when it comes to attempting to cripple US strategic tech development by blocking America from precious Rare Earth metals.

This week, Beijing took what started as Chinese media speculation over rare earth metals one step further, issuing a direct warning to the US about its control over this precious, strategic supply chain. The US is entirely unprepared for this, with China controlling almost all rare earth metals, and the US extremely far behind in this game. It’s no coincidence that Trump was in Japan recently, courting the Japanese PM. This is the only reasonable alternative for Washington, because Japan has recently discovered major rare earth deposits at Minamitori Island. Estimates hold that there’s is enough of three of these rare earth metals to meet global demand for hundreds of years, assuming they can be mined safely. After all, they are 6-12 feet under the seabed, four miles beneath the surface of the ocean. This clearly isn’t an immediate-term solution. The only short-term solution here is to start stockpiling.

And back on the EV scene, Elon Musk is claiming that he is being covertly undermined by the fossil fuels industry, while a lobbying campaign in the state of Arizona targeting the EV industry and disguised as grassroots activism appears to have involved Chevron. In March, the Arizona Corporation Commission fielded letters of opposition to a proposed rule required utility companies to build public EV charging stations. The letters were designed to have been from “random” residents in a grassroots campaign, but instead were found to have been from Chevron retirees hired by a California lobbyist. This comes as Musk says that “powerful vested interested” in the oil camp are stepping up their attack on Tesla and the EV industry in general.