Have you ever celebrated an event too much? The next day isn’t always very fun. Sometimes the most enjoyable events in life such as holiday parties, weddings and birthdays are followed by terrifically awful mornings necessitating a nice long nap.

The same goes for oil and stock markets in February following a January which included an 8% jump in S&Ps and the best gain for WTI (nearly 18%) on record. So far February has included a 1% drop in WTI, flat S&Ps, earnings forecasts downgrades for 1Q and a growing chorus of negativity from financial commentators of all shapes and sizes. A quick scan of the newswires this week offers a call from fund manager Kyle Bass that the US will enter a recession in 2020, a note from Morgan Stanley’s head equity strategist that ‘earnings recession is here’ and results from a Duke University survey of US CFOs stating they overwhelmingly expect a recession in the next two years.

Wasn’t it only four short weeks ago that a newly dovish US Fed was going to place a theoretical disco ball over global risk markets and lead us to a wonderfully bullish 2019? Have the facts of the market outlook changed substantially since the calendar turned to February 1?

We don’t think so. While there are obviously nagging bearish factors at work such as anemic growth, high existing crude oil and gasoline supplies and the US/China trade battle the truth is that the two key themes driving crude oil prices in 2019- a dovish US Fed and OPEC+ production…

Have you ever celebrated an event too much? The next day isn’t always very fun. Sometimes the most enjoyable events in life such as holiday parties, weddings and birthdays are followed by terrifically awful mornings necessitating a nice long nap.

The same goes for oil and stock markets in February following a January which included an 8% jump in S&Ps and the best gain for WTI (nearly 18%) on record. So far February has included a 1% drop in WTI, flat S&Ps, earnings forecasts downgrades for 1Q and a growing chorus of negativity from financial commentators of all shapes and sizes. A quick scan of the newswires this week offers a call from fund manager Kyle Bass that the US will enter a recession in 2020, a note from Morgan Stanley’s head equity strategist that ‘earnings recession is here’ and results from a Duke University survey of US CFOs stating they overwhelmingly expect a recession in the next two years.

Wasn’t it only four short weeks ago that a newly dovish US Fed was going to place a theoretical disco ball over global risk markets and lead us to a wonderfully bullish 2019? Have the facts of the market outlook changed substantially since the calendar turned to February 1?

We don’t think so. While there are obviously nagging bearish factors at work such as anemic growth, high existing crude oil and gasoline supplies and the US/China trade battle the truth is that the two key themes driving crude oil prices in 2019- a dovish US Fed and OPEC+ production cuts- are still very much intact. This week the one and only Mohamed El-Erian commented that he thinks the Fed’s next rate move will be a cut- rather than an increase- in 2020. This forecast clearly implies a certain degree of bearishness about the health of the global economy. But as we’ve argued in recent notes- a dovish US Fed and tight global crude supplies have outweighed shaky economic confidence in the past.

As for OPEC+ we are seeing headlines hinting that Venezuelan exports continue to tumble and hints from the Saudi’s that they’ll drive another 200k bpd of reductions in February. Brent spreads have extended their recent gains and continue to forecast a reasonably strong physical market in the second half of 2019. The head of commodities at Citi offered a note to clients this week suggesting that fundamentals remain strong and prices can be expected to move higher due to what they estimate as a current 1m bpd in unplanned supply outages.

On the bearish side, we continue to watch US/China trade relations move towards a pact being made and can’t help but think of the old saying ‘buy the rumor, sell the news.’ It does seem to us that recently bullish market action could simply become the victim of a thousand cuts if traders are underwhelmed by a future trade agreement and a drop in corporate earnings creates a self-fulfilling slow down in economic activity. We continue to monitor these risks and know that traders are still nervous about downside given the bearish skew in the oil options market and flat yield curve in credit markets.

Like all hangovers, the currently sideways oil market action will inevitably end prices will once again trend lower or higher. Whenever the market decides to wake up, we think risk will be tilted slightly higher.

Quick Hits

- Oil prices moved slightly higher this week with WTI trading near $53 while Brent traded near $62. Both grades look technically strong trending moderately above their 50-day moving averages but below their 100-day moving averages.

- Demand concerns persist which manifested this week in OPEC reducing their demand forecast for 2019 by 240k bpd to 30.6m bpd. Saudi Arabia is reportedly working to get their production below 10m bpd in February after averaging 10.2m bpd in January. Total OPEC compliance with production cuts was 86% in January.

- Russia’s Energy Minister reaffirmed the country’s commitment to production cuts this week stating they aim to cut by 90k-100k bpd in February versus their production of 11.8m bpd in October.

- US and global spread markets diverged this week as OPEC production cuts kick in while US producers move at full speed. The prompt 6-month Brent spread is currently backwardated by about 10-cents / month while the same spread in WTI is in contango of about 20-cents / month. The two structures highlight the contrast of tightening global fundamentals while US fundamentals remain soft.

- Speaking of an oversupplied US market, the EIA recently forecast US crude production (which currently runs 11.9m bpd) at 12.4m bpd for 2019 and 13.2m bpd for 3020.

- President Trump said he was open to postponing the March 1 trigger of additional tariffs on Chinese goods of talks between the two parties seem productive. There was also an indication that Trump could sign a deal to avoid another US government shutdown with only $1.3b in additional US/Mexico border security funding despite having asked for a $5b wall. Markets welcomed the news with S&Ps hitting new YTD highs near 2,740.

- In currency markets the US Dollar continues to trade at high levels and put bearish pressure on oil. This has surprised us somewhat following the US Fed’s recent dovish turn and is being caused by expectations that other G10 central banks will also turn more accommodative. A SocGen bond strategist was quoted in Bloomberg this week summing up the news with “the problem for dollar bears is that there is a chronic shortage of currencies to like… Lower bund yields, not to mention weak growth, political uncertainty and Brexit, make a good set of reasons to hate the euro as much as you hate the dollar.”

DOE Wrap Up

- Recent DOE data continues to land with a bit of a thud as US crude supplies and gasoline supplies remain bearishly high. US crude stocks in the Cushing trading hub and US gasoline stocks in the New York trading hub remain stubbornly high and will continue to keep a lid on prices as long as demand growth is moderate.

- US crude stocks increased by 1.3m bbls last week to 447m and are higher y/y by 6%.

- The increase in supplies came despite continued low exports as Canadian shipments decline and Venezuelan barrels are being re-routed to China. Total imports ran 7.15m bpd which is about 400k bpd lower than their 6-month average.

- Exports, meanwhile, spiked bullishly to 2.9m bpd which is about 500k bpd above their 6-month average.

- Cushing stocks suffered the worst of the bearish flows increasing by 1.5m bbls to 42.7m.

- The US currently has 26.6 days of crude oil supply on hand (+0.5 w/w) which is higher by about 5% y/y.

- On the demand side, US refinery consumption increased by 170k bpd w/w to 16.6m bpd and is higher y/y by 2% over the last three weeks.

- US refining margins are running $7/bbl for gasoline and $27/bbl for distillates. In overseas markets the gasoil/brent crack traded near $16/bbl this week.

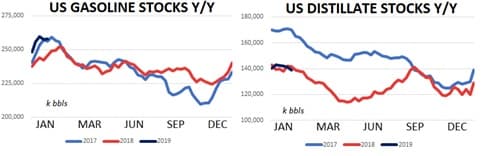

- US gasoline stocks increased by 450k bpd w/w and are higher y/y by about 6% over the last three-week period. The eastern coast of the US remains particularly saturated with gasoline supplies as stocks are now higher by about 9% y/y in the region.

- Distillate inventories fell by 2.2m bbls and are flat y/y over the last month.

- US gasoline demand + exports fell by 200k bpd to 10.0m bpd and are higher y/y by about 2% YTD.