After the uncertainty and stress of the past weeks, the mid-February oil market is definitely showing signs of a more favorable working environment for all of us. Saudi Arabia has provided some comfort to the markets, stating it would cut production below 10mpb, more than 0.5mbpd than it had initially agreed to during the OPEC/OPEC+ Vienna Agreement, easing concerns about global supply getting way out of balance. Even though US sanctions do continue to weigh on Venezuela, it has managed to reroute somewhat its exports, making the pressure on global benchmarks more manageable.

(Click to enlarge)

Source: Reuters.

1. US Crude Stocks Rise Further

(Click to enlarge)

- US Commercial crude stocks have risen 1.3 MMbbl w-o-w to 447.2 MMbbl during the week ended February 1, almost 25 MMbbl above the 5-year stock average.

- Robust exports have mitigated somewhat the stock buildup, increasing 0.93mbpd from the week earlier, to reach 2.9mbpd.

- In the meantime, the EIA raised its 2019 annual forecast for US crude production to 12.4mbpd, stating that Permian and eastern New Mexico will spearhead the output growth.

- The EIA estimates 2020 will witness a further 0.8mbpd production increase, bringing output levels at that point to 13.2mbpd.

- Gasoline inventories rose again by 0.5MMbbl to 258MMbbl, with net gasoline production dropping 48kbpd week-on-week.

- On the other hand, distillate stocks have dropped again during the…

After the uncertainty and stress of the past weeks, the mid-February oil market is definitely showing signs of a more favorable working environment for all of us. Saudi Arabia has provided some comfort to the markets, stating it would cut production below 10mpb, more than 0.5mbpd than it had initially agreed to during the OPEC/OPEC+ Vienna Agreement, easing concerns about global supply getting way out of balance. Even though US sanctions do continue to weigh on Venezuela, it has managed to reroute somewhat its exports, making the pressure on global benchmarks more manageable.

(Click to enlarge)

Source: Reuters.

1. US Crude Stocks Rise Further

(Click to enlarge)

- US Commercial crude stocks have risen 1.3 MMbbl w-o-w to 447.2 MMbbl during the week ended February 1, almost 25 MMbbl above the 5-year stock average.

- Robust exports have mitigated somewhat the stock buildup, increasing 0.93mbpd from the week earlier, to reach 2.9mbpd.

- In the meantime, the EIA raised its 2019 annual forecast for US crude production to 12.4mbpd, stating that Permian and eastern New Mexico will spearhead the output growth.

- The EIA estimates 2020 will witness a further 0.8mbpd production increase, bringing output levels at that point to 13.2mbpd.

- Gasoline inventories rose again by 0.5MMbbl to 258MMbbl, with net gasoline production dropping 48kbpd week-on-week.

- On the other hand, distillate stocks have dropped again during the week ended February 1, this time by 2.2 MMbbl to 139MMbbl, almost 5 MMbbl below the 5-year average.

2. NIOC Follows Saudi Lead with March Pricing

(Click to enlarge)

- NIOC has moved its March-loading official selling prices according to the trend set up Saudi Aramco, rolling over the price of Iranian Light and hiking Iranian Heavy for Asia.

- Asia-bound Iranian Light remained at a premium of 40 cents to the Oman/Dubai average, whilst Iranian Heavy was increased by 45 cents month-on-month, 5 cents more than Aramco did with its Arab Medium March OSPs.

- Cargoes destined for NW Europe witnessed only cosmetic changes, with both Iranian Light and Iranian Heavy dropped by 5 cents to -3.85 and -6.45 USD per barrel vs ICE Bwave, respectively.

- The last time an Iranian cargo hit Northwest Europe was in July 2018 with a 2 MMBbl Iranian Light cargo arriving to the French port of Antifer.

- Following Saudi Aramco’s price hike on its March Mediterranean prices, most notably Arab Heavy rising by -1.15 USD per barrel month-on-month, Iran opted for higher Med prices, too.

- Mediterranean-bound Iranian Light cargoes will be supplied at -3.95 USD discount to ICE Bwave in March, down 95 cents from February, whilst Iranian Heavy fell by 85 cents to a -6.8 discount to ICE Bwave.

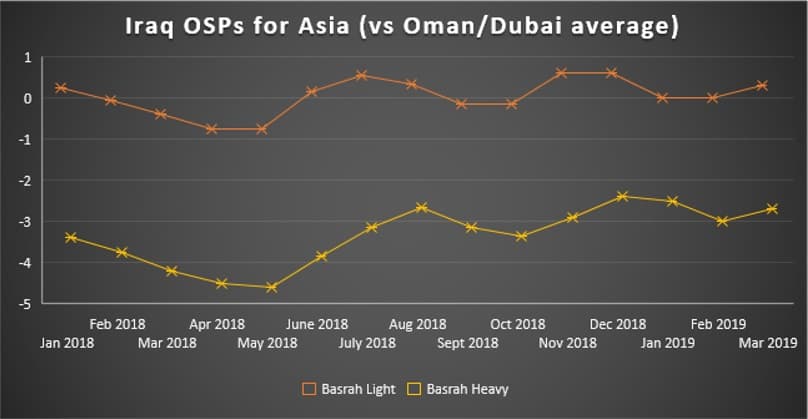

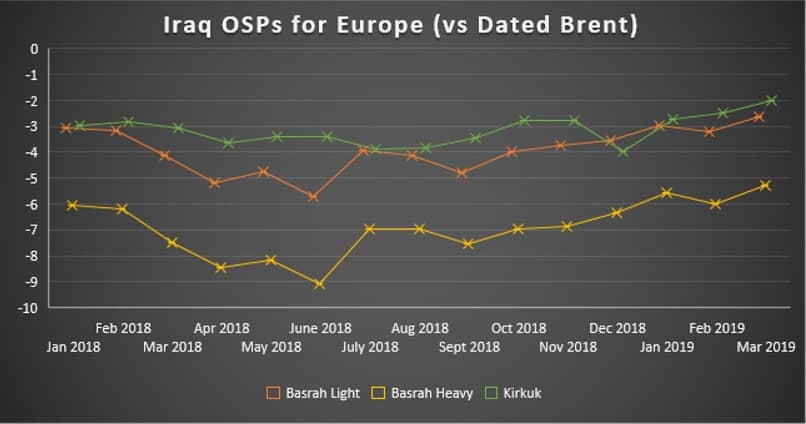

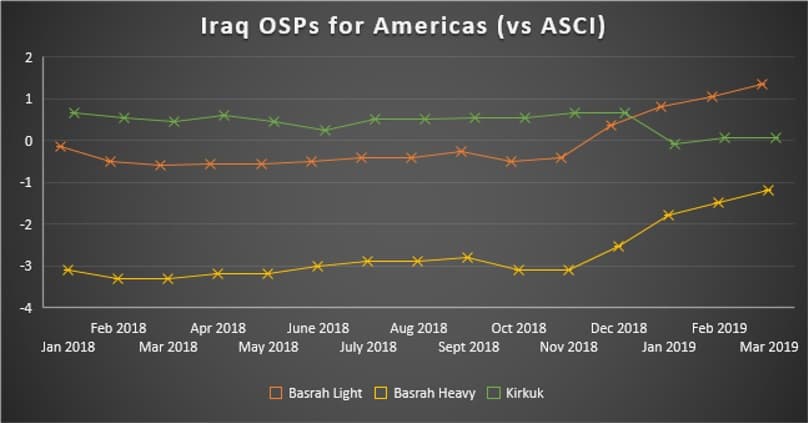

3. Iraq Raises All Its Prices

(Click to enlarge)

- SOMO, the Iraqi state oil marketer, has raised all its March-loading prices across all continents, albeit refraining from drastic Saudi Aramco-like price hikes in Europe.

- Asia-bound March OSPs for both Basrah Light and Basrah Heavy were lifted by 30 cents, i.e. less than the 40 cent hike of Kuwait’s KPC, Iran’s NIOC on Iranian Light and Saudi Aramco on Arab Medium.

- This marks the second consecutive month when the Basrah Light-Arab Medium discount widens, rising 10 cents month-on-month to reach 0.15 USD per barrel in March 2019.

- SOMO has increased its Americas-bound OSPs for Basrah Light and Basrah Heavy by 30 cents to reach +1.35 and -1.2 USD per barrel, respectively, whilst rolling over the Kirkuk OSP from February.

- Europe witnessed the sharpest increases month-on-month, albeit somewhat mitigated by the fact that SOMO prices are not separated into NW Europe and Mediterranean prices, with Basrah Light increased by 55 cents to -2.65 USD per barrel.

4. UAE OSPs

(Click to enlarge)

- UAE’s state-owned oil company ADNOC has cut its retrospective official selling prices on Murban, Das and Upper Zakum grades by 20-30 cents compared to Dubai.

- ADNOC set the January 2019 OSP at 60.95 USD per barrel, with the 1.87 USD premium vs front-month Dubai shrinking by 31 cents compared to December 2018.

- The premium for ADNOC’s other light sour grade, Das, saw an even steeper cut, dropping 36 cents to 1.22 USD per barrel vs front-month Dubai, to a monthly selling price of 60.3 USD per barrel.

- With trading roughly corresponding to the December level of premiums, medium sour Upper Zakum saw its premium to Dubai rise by 4 cents to 62 cents per barrel, to a monthly OSP of 59.7 USD per barrel.

- The United Arab Emirates leads the OPEC pack, along with Saudi Arabia, in cutting production according to the OPEC/OPEC+ agreement, pumping 3.07mbpd in January 2019, down a hefty 180kbpd from December 2018.

5. Keystone Pipeline Shut for Leaks

- Two concurrent pipeline leaks in Missouri have curtailed Canadian pipeline crude exports to the United States, pushing the prices of Canadian prices down.

- Around 50 barrels of crude have leaked from TransCanada’s 590kbpd Keystone pipeline, forcing a closure that is still ongoing after the February 06 incident.

- The 164kbpd Platte pipeline from Casper to Guernsey, Wyoming was also shut for three days following a leak, however, has been put back into operation on February 8.

- TransCanada still did not determine a planned date for the Keystone pipeline section’s return to service.

- Due to the pipeline closures, Western Canadian Select has dropped from a high of 9.23 USD per barrel against March CMA on February 5 to a low of -11 USD per barrel on February 12.

- Adding to the pressure on WCS, the Roxana, Illinois-based 356kbpd Wood River refinery that routinely runs Canadian crude caught fire on Sunday during maintenance, forcing it to operate at reduced rates longer than expected.

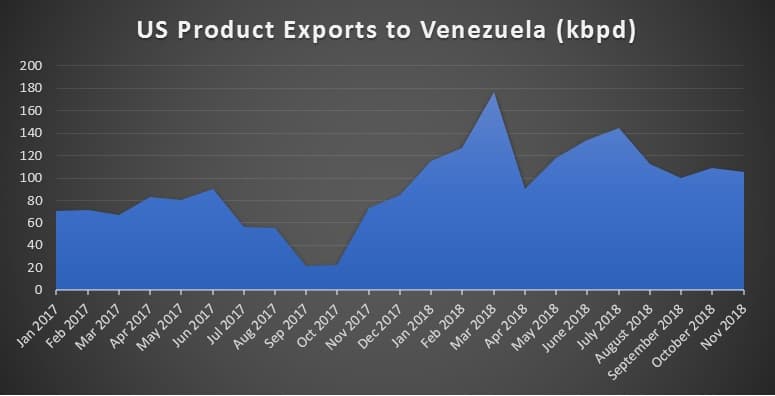

6. Venezuela Looking Globally for Naphtha

Source: EIA.

(Click to enlarge)

- Venezuela’s state oil company PDVSA has intensified its global quest to find new suppliers of naphtha, a key element in its crude export operations.

- Before the onset of US sanctions Venezuela used to buy more than 100kbpd of naphtha from the United States, used to dilute its bitumenous Orinoco crude.

- Most private companies have given up on potential naphtha supplies to Venezuela out of concern for US sanctioning the relevant entity.

- Still, according to market sources the Spanish major Repsol did manage to supply a limited amount of gasoline to Venezuela, however, it is very unlikely to continue doing so.

- PDVSA has reached out to fellow national oil company, the Algerian Sonatrach, to supply it with some sort of diluent for fear of losing 0.2-0.3mbpd of production simply because it would be unable to blend it in a transportable quality.

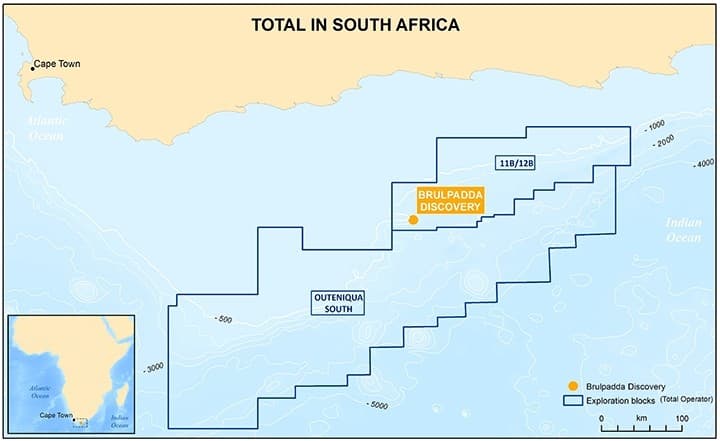

7. South Africa Hits First Offshore Success

Source: Total.

(Click to enlarge)

- The French oil major Total seems to have opened up a new offshore province off the South African seacoast, most likely predominantly gas-bearing.

- The Brulpadda-I (“Bullfrog” in Afrikaans), some 180km off Mossel Bay, has hit 57 meters of net gas condensate pay at a depth of approximately 3.6km, unearthing resources of around 1 billion boe.

- Total started to drill on the Block 11B/12B already in 2014, however due bad weather and thereto related rig limitations had to change the drilling unit.

- The semi-submersible Deepsea Stavanger drilling platform brought the wildcat to an all-around favorable conclusion.

- Given that Total also operated the adjacent Outeniqua South block, there is a huge upside potential of further discoveries in offshore South Africa by the French major.

- Total’s partners in Blocks 11B/12B are Qatar Petroleum (25 percent), CNR International (20 percent) and a South African consortium of companies named Main Street (10 percent).

- Even though the find is gassy, it definitely serves the plans of South Africa as it would feed into the Mossel Bay gas-to-liquids plant, cutting South Africa’s future LNG needs.