Friday August 30, 2019

1. BP exits Alaska, ending 6 decades of operations

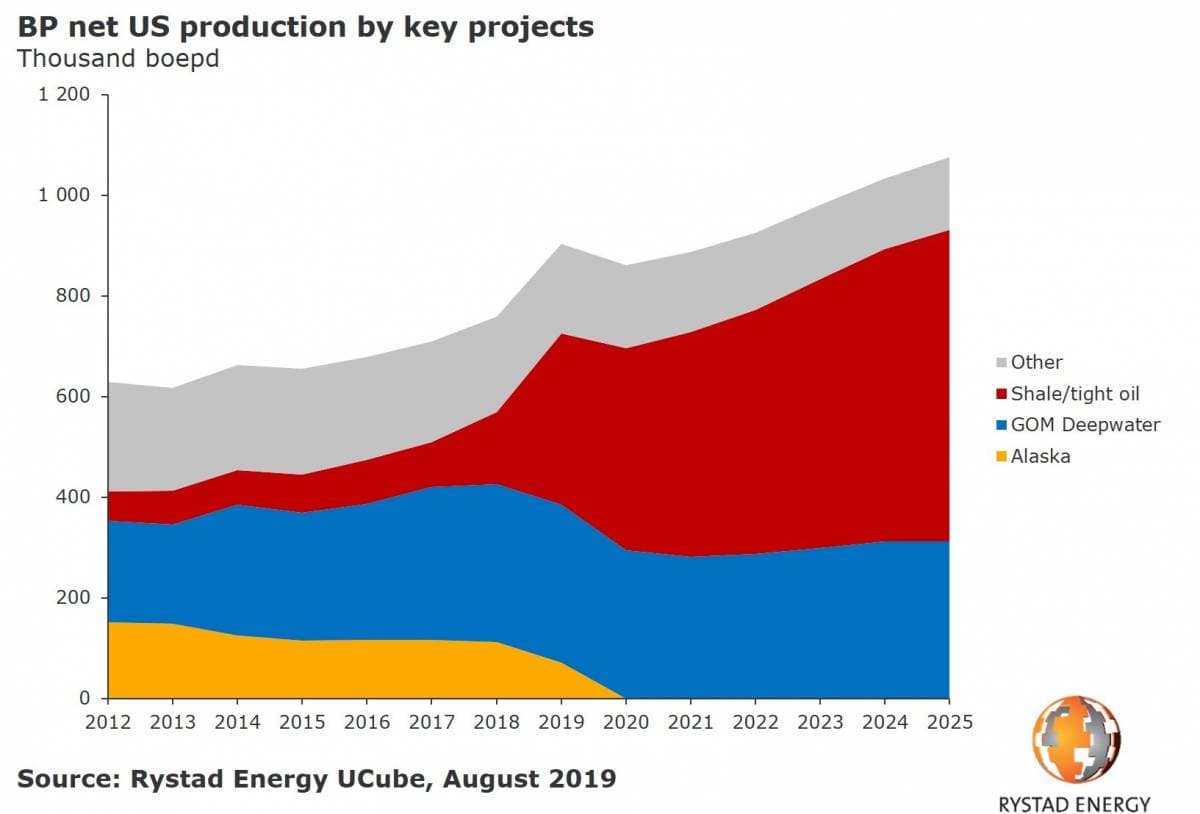

- BP (NYSE: BP) agreed to sell its Alaska operations to privately-held Hilcorp Energy Co. for $5.6 billion. The deal comes a year after BP bought up $10 billion worth of U.S. shale assets from BHP Billiton.

- The move is seen as a pivot away from mature, conventional operations to shale drilling. It is also the latest in a series of moves by the oil majors to exit such operations, including in Canada’s oil sands and the UK and Norwegian North Sea.

- Going forward, the majors are betting on the growth of shale. Risks abound, however. Unlike conventional assets, which see annual decline rates on the order of 5 percent, shale wells can decline by 70 percent in their first few years, which means that spending must remain elevated to keep production growing.

- By the mid-2020s, shale could make up as much as 50 percent of BP’s production, up from 15 percent in 2018 and just 10 percent in 2012.

2. Nickel sees supply gap opening up

- Nickel prices are up 35 percent since June over concerns about an ore export ban in Indonesia.

- Indonesia has shipped around 180kt year-to-date, according to Bank of America Merrill Lynch, or about 8 percent of global supply.

- But the bullish case for nickel is also based on long-term fundamentals. “The nickel market is in deficit after a long period of surpluses and we remain structurally bullish on a view that…

Friday August 30, 2019

1. BP exits Alaska, ending 6 decades of operations

- BP (NYSE: BP) agreed to sell its Alaska operations to privately-held Hilcorp Energy Co. for $5.6 billion. The deal comes a year after BP bought up $10 billion worth of U.S. shale assets from BHP Billiton.

- The move is seen as a pivot away from mature, conventional operations to shale drilling. It is also the latest in a series of moves by the oil majors to exit such operations, including in Canada’s oil sands and the UK and Norwegian North Sea.

- Going forward, the majors are betting on the growth of shale. Risks abound, however. Unlike conventional assets, which see annual decline rates on the order of 5 percent, shale wells can decline by 70 percent in their first few years, which means that spending must remain elevated to keep production growing.

- By the mid-2020s, shale could make up as much as 50 percent of BP’s production, up from 15 percent in 2018 and just 10 percent in 2012.

2. Nickel sees supply gap opening up

- Nickel prices are up 35 percent since June over concerns about an ore export ban in Indonesia.

- Indonesia has shipped around 180kt year-to-date, according to Bank of America Merrill Lynch, or about 8 percent of global supply.

- But the bullish case for nickel is also based on long-term fundamentals. “The nickel market is in deficit after a long period of surpluses and we remain structurally bullish on a view that demand from EV manufacturers for pure Class 1 material will increase faster than nickel producers are adding capacity,” Bank of America Merrill Lynch wrote in a note.

- “To that point, the mismatch between supply and demand increases is set to reach 610kt by 2025,” the investment bank said.

3. Recession risk grows

- A Wall Street Journal survey of economists finds that the belief in recession is at its highest point ever recorded.

- The treasury yield curve is now fully inverted, with short-term treasuries yielding more than longer-dated bonds and notes.

- While there is still not enough evidence to solidly suggest that a recession is near, individual data points continue to throw up worrying signs. The latest sign is a contraction in the markets for luxury real estate and retail. Nearly half of all consumer spending is done by the top 10% of earners, according to Mark Zandi, chief economist at Moody’s Analytics.

- “If job growth slows any further, unemployment will begin to rise, (the middle earners) will pack it in, resulting in an economic downturn,” Zandi told CNBC.

4. U.S. gasoline demand hits record levels

- The EIA revealed a mostly bullish report this week. Crude oil inventories fell by 10 million barrels, significantly more than forecasted. Gasoline stocks fell by 2.1 million barrels, and distillate stocks fell by 2 million barrels.

- Part of the decline can be chalked up to a steep drop in imports for the week, which helped drain inventories. Meanwhile, oil production jumped to 12.5 mb/d, a new record.

- But solidly bullish data can be found in consumption levels, which continue rise to new record highs.

- “In our view, the (positive) trends on the demand side are currently more relevant: stocks of gasoline and middle distillates each declined by over 2 million barrels last week,” Commerzbank wrote in a note. “At 10.6 million barrels per day, implied gasoline demand thus achieved a new record high. This is likely to lend continued support to the oil price.”

5. Coal production in decline

- More than 40 percent of the coal produced in the U.S. comes from 16 mines in the Powder River Basin (PRB), according to the EIA. Four companies own more than half of those mines, including Peabody Energy (NYSE: BTU), Arch Coal (NYSE: ARCH), Cloud Peak Energy (OTCMKTS: CLDPQ) and Blackjewel.

- All four of those companies have faced financial troubles as the U.S. coal sector is in the midst of terminal decline. Cloud Peak and Blackjewel filed for bankruptcy this year. Peabody and Arch are proposing a joint venture to cut cost.

- Coal from the Powder River Basin was once thought to be more insulated and more competitive than coal from Appalachia. It had lower sulfur content, giving it a leg up given federal air quality limits. It was also cheaper and more abundant. But coal from PRB has also suffered.

- Total U.S. coal production peaked in 2008, and PRB coal peaked at 496 million short tons, falling to 324MMst in 2018.

- The decline comes as coal’s use in the U.S. electricity sector continues to contract, falling from 48 percent of total electricity in 2008 to just 28 percent in 2018. The EIA forecasts that share to decline to 24 percent in 2019 and 2020.

- Coal production in the PRB could decline by 12 percent this year.

6. Oil industry nervous about Colorado law

- Earlier this year, Colorado passed SB181, a law that overhauls regulatory governance in the state over oil and gas. It gives counties and cities greater authority to oversee siting for drilling. The legislation also prioritized safety, public health and the environment.

- The law is making the industry nervous. “Commodity prices certainly impact all of us all over the country,” Dan Haley, CEO of Colorado Oil and Gas Association, told the state’s governor at an industry event. “But what I see often from financial analysts is the sort of legislative, political tensions in Colorado impacting markets here.” He added: “There is a lot of talk out there of people wanting to ban fossil fuels. It makes our folks nervous.”

- So far, nine local governments have passed some form of a drilling moratorium in the state, according to S&P Global Platts.

- Platts notes that the political fight might not be all that impactful. Weld County is home to the vast majority of drilling activity, home to 88 percent of the state’s oil production and 36 percent of its gas output. All five county commissioners are allies of the industry.

- The most likely regulatory hurdles could show up in Boulder and Broomfield counties, which produce a fraction of that in Weld County.

7. Brazil capitalizes on U.S.-China trade war

- Brazil’s stock market is up roughly 25 percent over the past year, making it the top emerging market. Other emerging market stock indices have fallen 7 percent in that time frame, according to Bloomberg. Notably, Brazil’s GDP is only up 0.9 percent.

- Brazil is benefitting from the U.S.-China trade war. With American soybeans cut off, China has turned to Brazil. Low interest rates are also helping. Brazil’s exports to China have climbed by 20 percent.

- It has been years since investor confidence in Brazil has been this high, Bloomberg argues.