Now there is a calm after the storm that sent the oil market a couple of months back. On the one hand, there is an increasing amount of public utterances pointing towards an OPEC+ production cut prolongation. Should the Middle East’s leading producers be persuasive enough to ensure Russia is onboard for the new output curtailment, the markets would be palpably rejuvenated. There is already a sense of that, with leading Russian officials and company CEOs talking of a $30 billion price-drop risk in case of no extension. On the other hand, however, collateral damage from the US-China trade war continues to sully global demand prospects, which, together with US commercial crude stocks jumping to 2-year highs managed to counteract all positive developments so far.

Wednesday witnessed a further weakening of oil prices as the market reacted to API’s anticipated US crude inventory buildup. As a consequence, global benchmark Brent has traded around 60.6-60.8 USD per barrel, whilst WTI was assessed in the 51.7-51.9 USD per barrel interval.

1. Chinese Crude Imports Drop Back to Norm

- China’s crude imports dropped a hefty 11 percent month-on-month to 9.51 mbpd in May 2019 from the all-time record of 10.68mbpd reached in April 2019.

- Despite the commissioning of 400kbpd Hengli and 400kbpd Zhejiang independent refineries, imports in May were hindered by high inventory levels and deal-killing backwardation.

- This June will most probably remain…

Now there is a calm after the storm that sent the oil market a couple of months back. On the one hand, there is an increasing amount of public utterances pointing towards an OPEC+ production cut prolongation. Should the Middle East’s leading producers be persuasive enough to ensure Russia is onboard for the new output curtailment, the markets would be palpably rejuvenated. There is already a sense of that, with leading Russian officials and company CEOs talking of a $30 billion price-drop risk in case of no extension. On the other hand, however, collateral damage from the US-China trade war continues to sully global demand prospects, which, together with US commercial crude stocks jumping to 2-year highs managed to counteract all positive developments so far.

Wednesday witnessed a further weakening of oil prices as the market reacted to API’s anticipated US crude inventory buildup. As a consequence, global benchmark Brent has traded around 60.6-60.8 USD per barrel, whilst WTI was assessed in the 51.7-51.9 USD per barrel interval.

1. Chinese Crude Imports Drop Back to Norm

- China’s crude imports dropped a hefty 11 percent month-on-month to 9.51 mbpd in May 2019 from the all-time record of 10.68mbpd reached in April 2019.

- Despite the commissioning of 400kbpd Hengli and 400kbpd Zhejiang independent refineries, imports in May were hindered by high inventory levels and deal-killing backwardation.

- This June will most probably remain along the lines of May, with backwardation continuing to curtail Chinese market activity – luckily Chinese refiners still have stocks to digest.

- Overall Asian crude demand dropped almost 2mbpd month-on-month, too, with May crude demand amouting to 24.8mbpd, down from April’s record level of 26.7mbpd.

- In January-May 2019, China imported 15 million tons more than in Jan-May 2018, amounting to a 7.7 percent y-o-y hike, whilst its relatively tiny export stream has completely dried up.

2. SOMO Raises July-loading OSPs for Asia

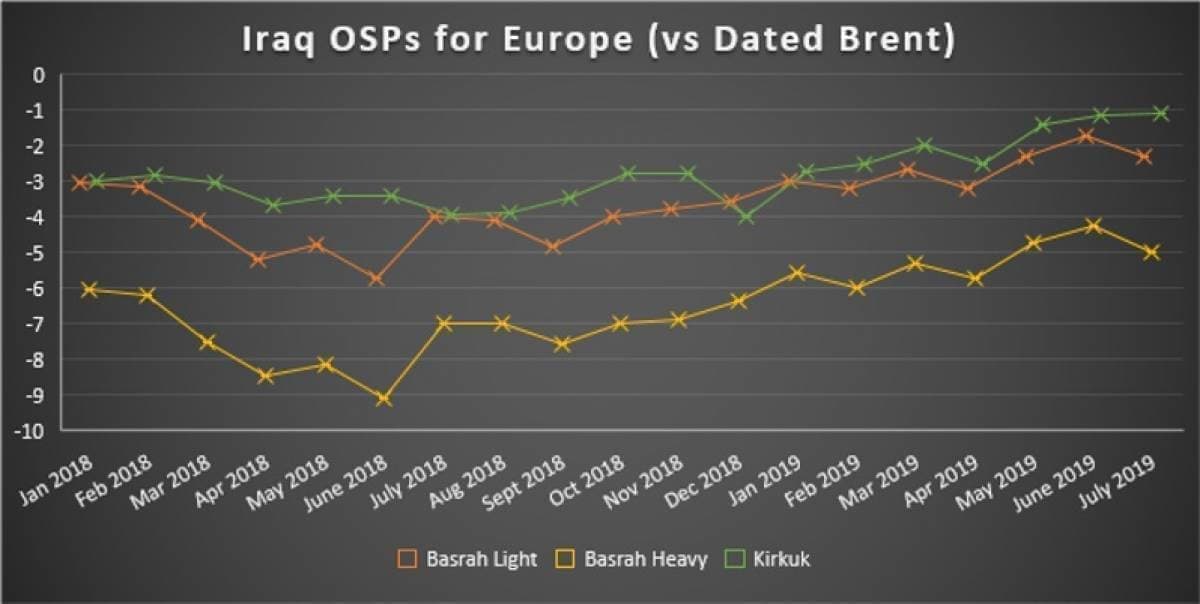

- Following through with Saudi Aramco’s price indications, the Iraqi state oil marketer raised its Asia-bound July-loading official selling prices, whilst dropping Basrah Light and Heavy prices for all other destinations.

- July-loading Basrah Light cargoes to Asia were set at a $2.1 per barrel premium to the Oman/Dubai average, whilst Basrah Heavy cargoes were hiked 70 cents m-o-m to a $-0.7 per barrel discount.

- Interestingly, Basrah Light OSPs for Europe were dropped by 60 cents (fully in line with Arab Medium), whilst Basrah Heavy was decreased even further, by 70 cents to a $-4.95 per barrel discount against Dated Brent.

- Interestingly, Kirkuk July OSPs for both Europe and the Americas were raised, albeit insignificantly – by 5 cents m-o-m for the latter (to $-1.1 per barrel against Brent) and by 10 cents for the former (to a $0.55 premium against ASCI).

- Iraq’s May crude exports dropped to 3.334mbpd, down 9 percent month-on-month from April’s 3.647mbpd level.

3. Kuwait Shadows Aramco July-loading OSPs

- In line with Saudi Aramco’s recent move, the Kuwaiti national oil company KPC raised the July-loading OSP of its flagship crude KEB by 50 cents to a $1.65 per barrel premium against the Oman/Dubai average.

- By doing so, KPC has maintained the KEB-Arab Medium spread at $-0.3 per barrel, having gradually narrowed it down from $-0.5 per barrel a year ago.

- The tie-up to Saudi moves was also evident in Kuwait’s pricing of European OSPs – Mediterranean-bound cargoes were hiked 20 cents m-o-m to $-1.15 per barrel (FOB Sidi Kerir), just as Aramco’s Arab Medium.

- Kuwaiti crude exports seem to be bouncing back from a weak May (1.822mbpd), with 2.2mbpd exported so far in June, roughly on level with that of April (2.16mbpd).

4. Oxy Goes Big on Colombia

- US oil firm Occidental Petroleum has entered 4 exploration and production blocks in the Putumayo Basin of Southern Colombia

- Located on the Ecuadorian border in jungle-like conditions, the Terecay, PUT-9, Tacacho and Mecaya blocks will continue to be operated by partner Amerisur despite Oxy buying 50 percent of its participation.

- Amerisur has been working for some years to build the Oleoducto Binacional Amerisur (OBA), a pipeline which would connect the south of Colombia with the TransEcuadorian Oil pipeline.

- Thus, if the crude moves from the exploration phase to production, it would be marketed from the Ecuadorian terminal of Balao.

- If previous surveys are to be taken as a basis, the blocks will most likely contain 50-200 MMbo of heavy oil, similar to the one Ecuador markets as Napo (19 degrees API, 2 percent Sulphur).

5. South Korea Weighs Its Light Crude Options

- Judging by the past few months’ imports, South Korea’s light sweet portfolio will tilt naturally towards having a bigger share of Kazakhstani/Russian CPC Blend and the American WTI.

- Even with the Brent/Dubai EFS rising to 12-month highs last week – as high as 4.5 USD per barrel – South Korea’s appetite for European sweet grades is counterbalanced by Middle Eastern producers hitting many-year high with their OSPs.

- With IMO 2020 looming on the horizon, the Sakhalin-produced Sokol (36 API, 0.3 Sulphur) remains South Korea’s top sweet pick, with CPC (45 API, 0.6 Sulphur) moving into second place and WTI into third.

- The portfolio revamp comes against the background of Iran being subjected to US sanctions and South Korea striving to wean itself off Middle Eastern crude dependence.

- In the long-term, however, South Korea might be compelled to turn back to Middle Eastern producers as its refiners (SK Innovation, Hyundai Oilbank) are bringing onstream their heavy oil upgraders.

- Hyundai Oilbank’s 80kbpd solvent deasphalting unit is already functional, whilst SK’s 40kbpd vacuum residue desulphurization unit is expected to be done by Q2 2020.

6. LUKOIL Enters Offshore Congo, Mulls Ghasha Buy-In

- As we have indicated two weeks ago, the Russian private major LUKOIL has moved into Congo’s offshore by buying 25 percent in the Marine XII license block.

- LUKOIL bought the stake from New Age, joining the ranks of project operator ENI (65 percent) and the state oil company SNPC (10 percent).

- The ENI-operated Marine XII block is located some 20 kilometers from the Congolese shore at water depths of 30-90 meters.

- Marine XII comprises five discovered fields, among them two producing (Litchendjili and Nene) with a total 2P reserve base of 1.3 billion barrels.

- Now producing around 30kbpd, the block is expected to peak around 2025-2026 with a production plateau of 100kbpd.

- On the sidelines of the Saint Petersburg Economic Forum, Lukoil CEO Vagit Alekperov also stated his company is seeking to buy a minority stake in ADNOC’s Ghasha sour gas project.

7. Angola Launches Long-Mooted Licensing Round

- Angola has officially launched its new offshore licensing round, comprising 10 blocks in the Namibe and Benguela basins (blocks 10, 11, 12, 13, 27, 28, 29, 41, 42 and 43).

- The African nation’s first pre-salt auction since 2011, the licensing round is widely seen as Angola’s best bid to stall production declines as the other licensing rounds planned for 2020-2023 are located in less oil-prolific areas.

- Angola’s hydrocarbon regulator ANPG will offer nine onshore blocks in the Congo and Kwanza basins, to be followed by 12 additional ones in 2023.

- Yet it is widely expected that if anything can resurrect Angola’s production portfolio, it is its deepwater resource base.

- The bidding process will start October 2 and ANPG would most likely announce the licensing round results before the end of 2019.

- Apart from open-to-all licensing rounds, the Angolan state has a back-up option: of the total 55 blocks it intends to farm out, only 31 will be distributed via bidding, the rest is up for direct negotiation.