Natural gas inventories in the U.S. are at their lowest level since 2014 for this time of year, raising the possibility that the country enters the winter drawdown season with very few buffers that could prevent a price spike.

The natural gas market is highly seasonal, with inventories drawing down sharply in winter months, roughly November through March, while stocks build up in the late spring through early fall just in time for the next winter. Obviously, the exact pace of drawdown or replenishment depends on a lot of factors, including the swings in seasonal temperatures and the rate of production from shale gas drillers.

A few mild winters led to a glut of supply in 2015 and 2016, keeping prices subdued. In early 2016, for instance, Henry Hub traded below $2 per million btu (MMBtu).

This past winter, however, the market flipped, with extreme temperatures leading to a massive drawdown in inventories. On January 1, 2018, the U.S. consumed an all-time record high at 150.7 billion cubic feet, surpassing the previous record hit during the polar vortex in 2014.

There is a structural issue at play, to be sure. The U.S. continues to shut down coal-fired power plants, switching over to natural gas generation. Also, the abundance of shale gas has led to billions of dollars’ worth of investment into a variety of industrial activities, such as plastics, fertilizers and other petrochemicals. On top of that, the U.S. continues to ratchet up LNG exports, shipping more gas abroad. With each passing year, more and more gas is needed for electricity, industrial activity and for export.

That means that even though the gas market is highly seasonal, the peaks are getting higher while the troughs are also getting higher. Still, the deep freeze in early January led to an unusually high level of natural gas consumption.

(Click to enlarge)

As a result, we ended the winter season with gas storage levels at multi-year lows. Prices have remained pretty stable around the $3/MMBtu level, however, because the markets have factored in a record increase in natural gas production this year. A series of gas pipelines are set to come online in 2018 in the Marcellus shale, opening up new markets that will allow for higher levels of drilling. Pipelines from Western Pennsylvania and Ohio are stretching northwest into Michigan, south into Virginia and North Carolina and east towards the eastern seaboard. Related: How Important Are Egypt’s Gas Discoveries?

Soaring associated gas production in the Permian is also adding to supplies. U.S. gas production just hit another record high at 79.8 bcf/d last week, according to S&P Global Platts, with strong growth coming from the Permian.

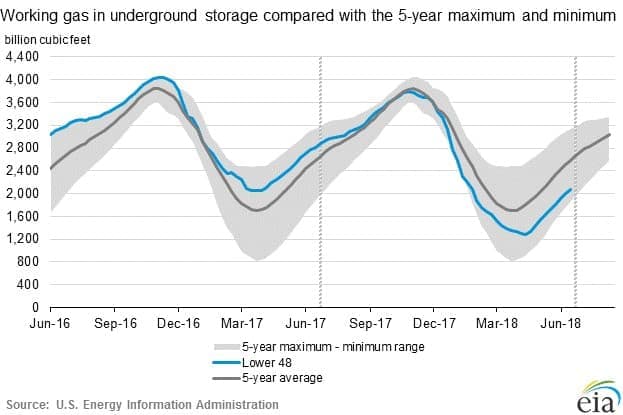

For now, though, gas inventories on hand do not offer a lot of cushion against an unexpected outage or a spike in demand in the upcoming winter season. Working gas in storage stood at 2,074 billion cubic feet as of June 22, or 735 bcf below last year’s level at this time, and 501 bcf below the five-year average.

(Click to enlarge)

The Wall Street Journal notes that above-average summer temperatures expected in July could put a strain on storage. The end result could be higher prices. “As we get deep into summer months, we get volatility,” Nicholas Koutsoftas, a portfolio manager at Cohen & Steers, told the WSJ. “Any deviation from the norm will cause big moves in the natural gas market.” Related: The Demand Downside For Oil Prices

If we get a hot summer, and consumers crank up the air conditioning, then we could enter the winter season with precious few stockpiles to fall back on. Or, if upstream gas production disappoints – and there is some evidence that such a problem is unfolding in the northeast – inventories will build this summer at a slower pace than expected. If that is followed by another freezing winter, gas stocks could fall to dangerously low levels and prices will inevitably have to rise.

The problem is, weather is hard to predict, especially more than a few weeks out. A mild winter could make all of these supply concerns a moot point. But, there is no way to know, other than to say low levels of storage significantly raise the odds of a supply problem. That means more volatility is in store, and potentially higher prices.

For now, though, the markets seem unmoved. Front-month Nymex gas contracts are still trading just below $3/MMBtu. It looks like it’s going to take something more dramatic to shake traders out of their slumber.

By Nick Cunningham of Oilprice.com

More Top Reads From Oilprice.com:

- How Important Are Egypt’s Gas Discoveries?

- 100-Year Old Tech Could Accelerate Electric Vehicle Boom

- An Unlikely Shale Frontier