The 6-month waivers granted by the Trump Administration to eight jurisdictions expired this weekend and the White House has made all but clear that it intends not to prolong any of the concessions. This puts Washington on a collision course with Tehran and complicated matters for the 5 countries which did avail themselves of their waivers and kept on buying Iranian crude (China, India, South Korea, Japan, Turkey). And it is not only geographic proximity that matters but also a very favorable price – for instance, India will have a hell of a time finding a similarly cheap source of crude unless Saudi Arabia eases its pricing and production policy.

As the endgame edges closer, let’s look at the developments of the past 6 months and assess where would a US „full-sanctions” course leave the relevant countries. It seems that Iran’s political elite still did not formulate a coherent course on how to counter American geopolitical pressure. Cognizant of Europe’s tacit backing which nevertheless (and they know it) will never translate into anything tangible on the geopolitical arena, Iran is shying away from an equally aggressive answer, despite making repeated claims about shutting down the Hormuz Strait. Recent statements from State Secretary Pompeo about calls for a regime collapse „coming from the Iranian people themselves” are pushing the Ayatollah to react assertively, yet the full conviction is still not there.

If you remember the last days of October 2018, the oil…

The 6-month waivers granted by the Trump Administration to eight jurisdictions expired this weekend and the White House has made all but clear that it intends not to prolong any of the concessions. This puts Washington on a collision course with Tehran and complicated matters for the 5 countries which did avail themselves of their waivers and kept on buying Iranian crude (China, India, South Korea, Japan, Turkey). And it is not only geographic proximity that matters but also a very favorable price – for instance, India will have a hell of a time finding a similarly cheap source of crude unless Saudi Arabia eases its pricing and production policy.

As the endgame edges closer, let’s look at the developments of the past 6 months and assess where would a US „full-sanctions” course leave the relevant countries. It seems that Iran’s political elite still did not formulate a coherent course on how to counter American geopolitical pressure. Cognizant of Europe’s tacit backing which nevertheless (and they know it) will never translate into anything tangible on the geopolitical arena, Iran is shying away from an equally aggressive answer, despite making repeated claims about shutting down the Hormuz Strait. Recent statements from State Secretary Pompeo about calls for a regime collapse „coming from the Iranian people themselves” are pushing the Ayatollah to react assertively, yet the full conviction is still not there.

If you remember the last days of October 2018, the oil market was crippled by uncertainty on what concessions the US would be willing to grant, similarly to the situation we see currently. The Trump Administration might in the end decide to grant waivers to a more restricted list of countries, yet their inability to box their corner goes on to prove that none of the parties involved were able to go directly against the American dictate. China has „made representations” to the US, the Indian government has asked Washington not to sway the ongoing general elections by a sudden Iran move, yet in the end they would grudgingly accept any outcome.

If the United States issue a new round of 6-month waivers, even with lower thresholds, their implementation would take place in a fashion consistent with what we saw in the past couple of months. Caution in the first two months, then ramping up imports beyond the nominal average threshold so as to compensate for the volumes lost in May-June, followed by a gradual decline by October (so as to make sure that no vessel gets stuck in the nets of US sanctions). As difficult as it may be to foresee the future when the actions of India or China contradict their economic interests, below we took a look at what do they stand to lose.

The biggest loser: China

(Click to enlarge)

China averaged 0.4mbpd in its purchases of Iranian crude in the six months between November 2018 and April 2019. Only four vessels were loaded in April, with one of them being an Aframax carrying only around 750kbbls of crude – compared to the 11 VLCCs loaded in March or even the 8 VLCCs in February. Despite the general belief that if no waivers were to be allotted, China would still continue buying Iranian crude, Beijing’s response so far had been remarkably timid. In a Global Times editorial, the Chinese political elite is calling for the “minimization” of damage to Chinese national interests in the Middle East, hardly a battle-cry given the outlet’s usually pugnacious tone.

(Click to enlarge)

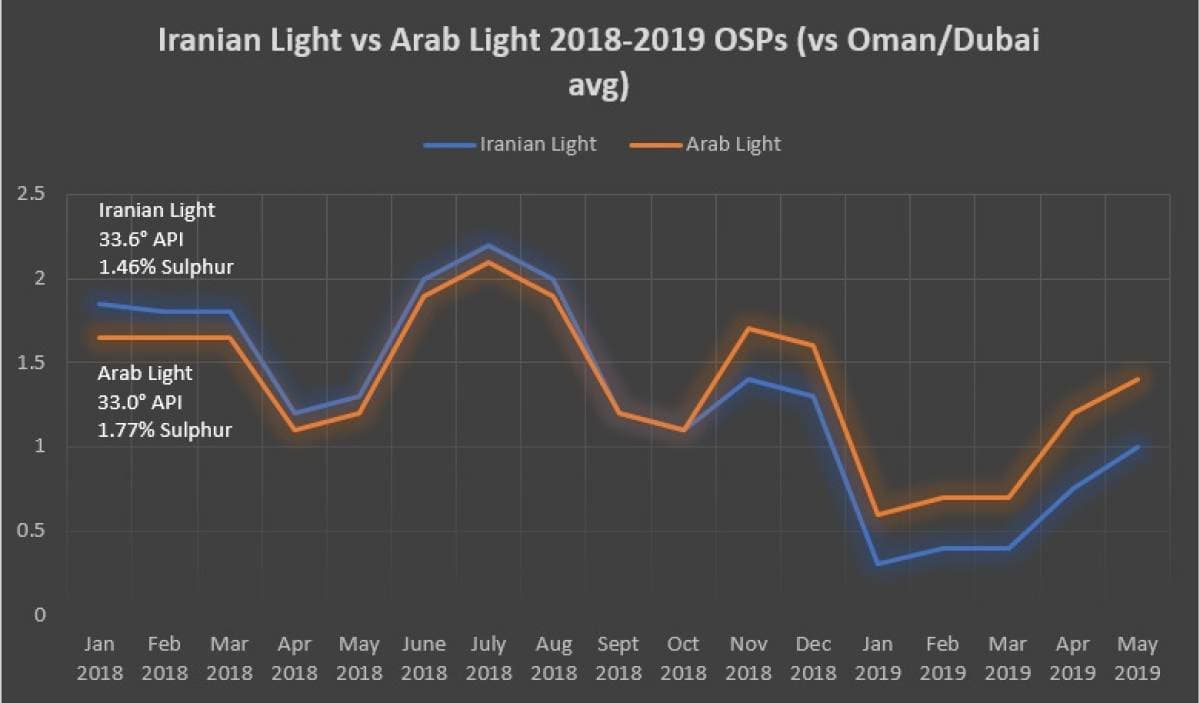

China would be the biggest loser of “no-waivers” because it is the biggest buyer of Iranian crude. For this, one need only to consider the choices China faces – if Iranian volumes are out, it can only realistically replace them with Saudi barrels. Arab Light, which is the closest Saudi lookalike to Iran’s flagship grade Iranian Heavy, is a bit heavier and more sulphurous yet even so yields a 0.4 USD per barrel premium on its May 2019 official selling price (historically it has been at a discount, as can be evidenced from early 2018 levels). Even if we are to omit other factors (Saudi Arabia using its privileged position to pursue an even more aggressive pricing policy), this would equate to a 5 mln USD loss every single month just on the basis of crude selection. Furthermore, it is needless to say that the removal of a 1.2-1.3mbpd medium sour stream would only ratchet up the already inflated prices of heavy and medium sour crudes.

Painful but manageable: Turkey

Just as much China is exercising prudence, treating Iran as a possible part of a grand quid-pro-quo of US-China trade war settlement, Turkey is treading carefully, being a nation under a US security umbrella. Turkey would definitely suffer financial losses were Iran to disappear from the list of suppliers, all the more so as President Trump’s designated partners in alleviating any market shortages – Saudi Arabia and the UAE – have fraught relations with Ankara following the murder of Jamal Khashoggi. Hence, Turkey has been actively courting Iraq, its neighbor and most likely partner in supplying everything Iran could not – Turkey’s foreign minister Mevlut Cavusoglu just concluded an Iraqi diplomatic tour, meeting Iraqi officials in Baghdad, KRG political elites and the governor of Basrah province.

(Click to enlarge)

By seeking a new “trade corridor” with Iraq, Turkey’s oil-related infrastructure that links it to Iraq becomes ever-important, be it boosting the Kirkuk-Ceyhan pipeline to its nominal throughput capacity or other ways of bringing Iraqi crude. This would come at a loss, too – the European price for Kirkuk has risen by 2 USD per barrel year-on-year from a -3.4 USD discount to Brent Dated in May 2018 to a -1.4 USD discount to Dated in May 2019 (with most of spot trading activity taking place at around -1 USD per barrel). Given that Turkey’s economy has just bumped into its first recession in a decade and the ongoing travails of the Turkish lira, Turkey will refrain from any serious confrontation with the White House and play it safe with Iraqi options.

The compliant: India

What has been said above regarding China is very much true for India, too, with one significant caveat – India, which has successfully used rupee-denominated transactions to circumvent US sanctions in the past, is now much less likely to engage in similar behavior. It has in fact underperformed its waiver, bringing in 0.275mbpd of Iranian crude instead of the allotted 0.3mbpd. Its oil and gas minister Dharmendra Pradhan stated last week that India would be compensated for the loss of Iranian crude by Saudi Arabia and the UAE, cognizant of the fact that many of India’s refineries are calibrated for Iranian crude and that the end of waivers would inevitably send ripples across the Indian economy and hike inflation. Briefly put, whatever happens, India will accept it.

(Click to enlarge)

The rest

Taiwan, Greece and Italy took the tacit warning implicit in the Trump Administration’s Iranian sanctions very seriously and did not import any Iranian volumes throughout the past six months. Of the three, Italy turned out to be the biggest surprise as in the pre-sanctions era it routinely took in 0.2mbpd of Iranian crude. South Korea and Japan also did not surprise anyone by refraining from taking any Iranian volumes in November-December 2018, restricting their active period on the Iranian months to mere 3 months out of the 6. Saudi Arabia already softened up the ground for further export ramp-ups in both countries, whilst Qatar supplant condensate exports should no waivers be issued.

(Click to enlarge)

Every single nation that availed itself of its 6-month waiver would welcome the prolongation of the waivers. Firstly, because Iranian crude and condensate is cheaper than any rival grades, despite being of better quality than Saudi or UAE crude. Secondly, because it is not that easy to cut ties to a market which supplied Asian partners for decades and to crudes which were the basis of Indian and Chinese refineries’ configuration. Thirdly, because politically it places all relevant nations into a difficult position – it is impossible to present one’s debilitation and helplessness as a sign of keeping things under control. I wish we knew what would happen after May 4th yet for us, those who are physically in the market, it would be better if the US issued a new set of waivers.