Brace yourself for a post-waivers era of total Iranian sanctions – this is the key message that the Trump Administration wants to convey to the global oil and gas community. It might be a subtle ruse to wrestle out further concessions from China and India, it might be a less subtle way of obfuscating the failure of another US-backed anti-Maduro coup in Venezuela (and that is quite something given the overall incompetence and crookery of the current Venezuelan elite) or it may well be the truth. Only time will tell.

(Click to enlarge)

We will see next week whether the threat will be carried through and how China, India, Turkey and other concerned parties will react if it is. What is undeniable however, is the spike in crude oil prices earlier this week, hitting a six-week high after the White House announced the end of all Iran sanctions waivers. By Wednesday crude prices had retreated somewhat on the back of an expected robust US commercial crude stock buildup, with Brent trading around $71.8-72 per barrel, whilst WTI was trading in the $63.4-63.6 per barrel interval.

1. Russia’s Crude Quality Botchup Shakes European Market

(Click to enlarge)

- Europe experienced an unexpected form of market panic due to a rare excess concentration of organic chlorides in the world’s largest trunk pipeline, the Druzhba pipeline supplying Central Europe from Russia.

- Reportedly, the 1.2mbpd pipeline was contaminated at the Samara-Unecha section…

Brace yourself for a post-waivers era of total Iranian sanctions – this is the key message that the Trump Administration wants to convey to the global oil and gas community. It might be a subtle ruse to wrestle out further concessions from China and India, it might be a less subtle way of obfuscating the failure of another US-backed anti-Maduro coup in Venezuela (and that is quite something given the overall incompetence and crookery of the current Venezuelan elite) or it may well be the truth. Only time will tell.

(Click to enlarge)

We will see next week whether the threat will be carried through and how China, India, Turkey and other concerned parties will react if it is. What is undeniable however, is the spike in crude oil prices earlier this week, hitting a six-week high after the White House announced the end of all Iran sanctions waivers. By Wednesday crude prices had retreated somewhat on the back of an expected robust US commercial crude stock buildup, with Brent trading around $71.8-72 per barrel, whilst WTI was trading in the $63.4-63.6 per barrel interval.

1. Russia’s Crude Quality Botchup Shakes European Market

(Click to enlarge)

- Europe experienced an unexpected form of market panic due to a rare excess concentration of organic chlorides in the world’s largest trunk pipeline, the Druzhba pipeline supplying Central Europe from Russia.

- Reportedly, the 1.2mbpd pipeline was contaminated at the Samara-Unecha section of the pipeline, with 400 000 – 1 000 000 metric tons of crude containing 30-40 times more dichloroethane than the Russian standard.

- By the end of last week, every Central European country that is supplied by the Druzhba had shut its transportation and took steps to activate state reserves to cope with the force majeure.

- The Russian transportation monopoly Transneft said it might take at least a month to clean up the crude in the pipelines, all the more so as no Central European refiner is ready to refine the contaminated crude.

- Urals loadings out of the Baltic port of Ust-Luga were also affected by the chloride contamination, with several cargoes rejected due to excessive chloride levels.

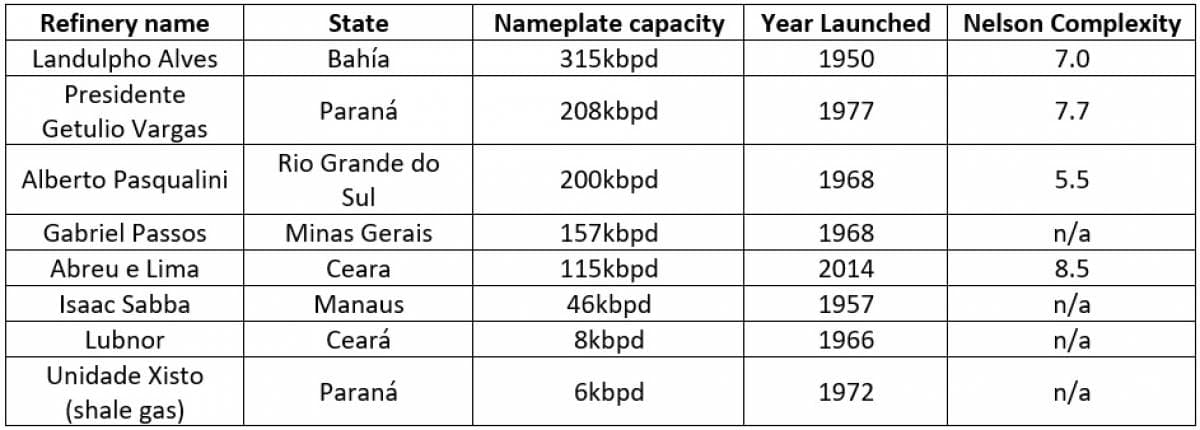

2. Petrobras Selling its Refineries

(Click to enlarge)

- The Brazilian state oil company Petrobras is planning to sell more than half of its domestic refining capacity, namely 8 refineries across the country (out of the total 13) with 1.1mbpd of installed capacity.

- In May 2018 Petrobras announced its intention to sell the 4 largest refineries in the list above, yet was forced to put the plan on the back burner following a federal court injunction.

- Even though the injunction is still in power, Petrobras believes that it is now the optimal time for privatization, regardless of negative public opinion on the matter.

- Chinese companies are expected to invest heavily in the biggest capacity units – on the back of CNPC already participating in the 150kbpd Rio de Janeiro refinery, currently under construction.

- Petrobras owns the overwhelming majority of refining capacity in Brazil, only three tiny refineries with an aggregate capacity of 34kbpd are beyond the NOC’s control.

- Petrobras full divestment plan for 2020-2024 is expected to be issued in Q4 2019, with further sell-offs expected along the way.

3. BP Expanding in West Africa

(Click to enlarge)

- The Gambian government has granted BP the A1 offshore exploration block, stripped 2 years ago from African Petroleum under the pretext of it being expired.

- The A1 block has had a very tumultuous history – African Petroleum wanted to drill its first Alhamdulilah well in 2013, yet the Gambian government abruptly cancelled the permit before the launch.

- Then African Petroleum got the exploration rights back in 2016, only to have them deprived a year later following the ouster of former President Yahya Jammeh.

- The Gambian authorities estimate the A1 and A4 blocks contain up to 3 billion barrels of oil.

- Despite neighboring Senegal ramping up drilling activity, The Gambia has seen no exploratory drilling since 1979 when Chevron drilled a dry Jammah-1 well.

4. Libya’s May-loading OSPs: As if nothing happened

(Click to enlarge)

- Amid the ever-robust Med Urals spread which has been at a premium to Brent throughout April, Libya’s national oil company raised most of its May-loading official formula prices.

- Esharara, the production of which has bounced back after a lengthy shutdown, has seen its OSP hiked by 10 cents to a -0.05 discount vs Dated, the highest in the last 12 months.

- Es Sider, Melittah, Mesla and Sarir also witnessed 10 cent increases, with Bu Attifel rolled over from April at a 0.95 USD per barrel premium.

- Already six April-loading vessels have set sail for China, with half of them loaded with Sarir, with singular voyages of Melittah and Amna also moving in that direction.

- Late March the CEO of Libya’s NOC Mustafa Sanallah claimed that they are producing 1.2mbpd of crude, which is largely corroborated by the exports volumes averaging 1.17mbpd so far in April.

- Field Marshal Khalifa Haftar’s offensive on Tripoli seems to be fizzling out, despite the cautious backing from President Trump who has hailed “Haftar’s counterterrorism efforts”.

5. Algeria Issues its May OSPs and Fires Sonatrach CEO

(Click to enlarge)

- Algeria’s national oil company Sonatrach hiked its retroactive official selling prices for May-loading prices of its flagship Saharan Blend crude by 35 cents to a 0.35 USD premium against Brent.

- The last available May-loading cargoes were reported to have been traded at a 0.5 USD per barrel premium against Dated.

- After Algerian crude exports peaked in February, they have gone back to the usual 0.55-0.65mbpd monthly interval.

- Reliance has been active on the Algerian market, buying 4 Suezmax cargoes this month, with 2 Aframaxes also setting sail towards Canada and Chile.

- The interim President of Algeria Abdelkader Bensalah has sacked the CEO of Sonatrach Abdelmoumen Ould Kaddour, an ally of former Algerian leader Abdelaziz Bouteflika.

- Despite naming Rachid Hachichi as the new Sonatrach CEO, heretofore the NOC’s head of E&P, the move created waves of uncertainty as Kaddour’s Sonatrach revamp strategy was just about to give palpable results.

6. ADNOC Launches Second Licensing Round

(Click to enlarge)

- The UAE national oil company ADNOC has launched its 2nd oil and gas licensing round, offering 5 blocks for prospective bidders – 3 offshore and 2 onshore spread out over more than 34 000km2.

- The 1st licensing round saw contracts awarded to ENI, OMV, PTT, Bharat Petroleum, IOC, INPEX and Occidental Petroleum.

- Based on preliminary exploration and appraisal data, the blocks covered in the 2nd round contain at least 290 targeted reservoirs and 92 prospects.

- ADNOC sees the 2nd licensing round as an inevitable part of ramping up production capacity from the 4mbpd it has set for 2020 to 5mbpd by 2030.

- Interestingly, the two onshore blocks are providing for a separate licensing procedure for conventional and unconventional hydrocarbon discoveries.

7. Shell Moving Into Untapped USGC Deepwater Territory

(Click to enlarge)

- Shell, Chevron and Equinor have announced a significant deepwater discovery after drilling the Blacktip exploratory well in one of the USGC’s least appraised parts.

- Blacktip encountered a net oil par of more than 400 feet (125 meters) at a water depth of 6216 feet (1900 meters).

- Located some way off the Perdido hub at the southern part of the Almanios Canyon, Blacktip would most likely need a separate production platform as there is no viable tie-back option.

- Since Blacktip is Shell’s second discovery in the Perdido Corridor of the US Gulf after last year’s Whale find.

- Neither of the stakeholders disclosed the estimated reserves of the discovery, yet given its similarity to the 400MMbbl Whale field it might be around the same volume.

- As the shale acreage matures, USGC deepwater will see an increase in investment and drilling activity in the upcoming years.