The spiraling tensions between the United States and China have rocked the crude market, reinforcing concerns that global demand growth might turn even weaker than feared. Market analysts have been quick to calculate that slapping a 5-percent tariff on US exports would imply a $3 per barrel additional cost to American barrels, rendering them economically inexpedient. The ongoing trade row hit global benchmark Brent much weaker than it did WTI, as the imposition of crude tariffs presumes Chinese demand growth for non-US barrels that are overwhelmingly priced against Brent.

Strong refinery runs in the US and a bigger-than-expected drawdown of US crude inventories has put new steam into the market, with crude prices bouncing back to growth by the middle of this week. Minor successes notwithstanding, the focus is still on the US-China trade war although it seems it would be unwise to expect any palpable resolution in the foreseeable future. Global crude benchmark Brent traded at $60-60.3 per barrel on Wednesday afternoon, whilst WTI was assessed at $56.2-56,4 per barrel.

1. Malaysia Becomes China’s Blending Spot

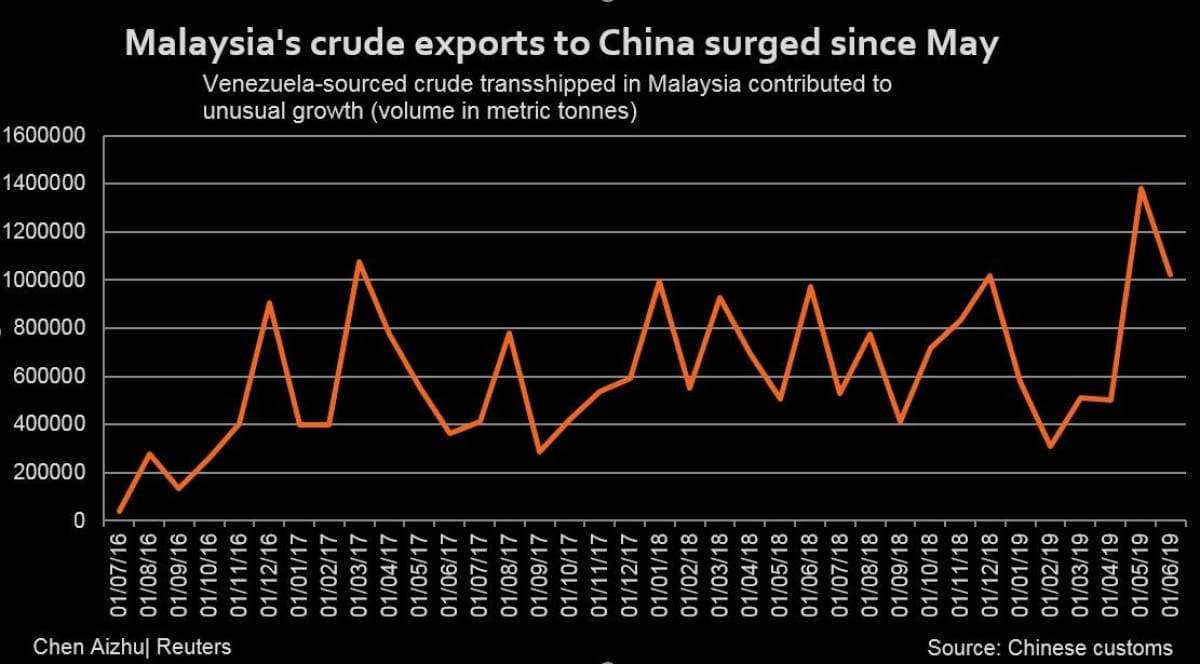

- Reuters has reported on a rather odd jump in China’s crude imports from Malaysia in July 2019, despite the latter’s declining production and the appreciation of the benchmark Tapis crude against its peers.

- It is estimated that as much as 500 000 metric tons, i.e. more than a third, of the putatively Malaysian volumes comes from…

The spiraling tensions between the United States and China have rocked the crude market, reinforcing concerns that global demand growth might turn even weaker than feared. Market analysts have been quick to calculate that slapping a 5-percent tariff on US exports would imply a $3 per barrel additional cost to American barrels, rendering them economically inexpedient. The ongoing trade row hit global benchmark Brent much weaker than it did WTI, as the imposition of crude tariffs presumes Chinese demand growth for non-US barrels that are overwhelmingly priced against Brent.

Strong refinery runs in the US and a bigger-than-expected drawdown of US crude inventories has put new steam into the market, with crude prices bouncing back to growth by the middle of this week. Minor successes notwithstanding, the focus is still on the US-China trade war although it seems it would be unwise to expect any palpable resolution in the foreseeable future. Global crude benchmark Brent traded at $60-60.3 per barrel on Wednesday afternoon, whilst WTI was assessed at $56.2-56,4 per barrel.

1. Malaysia Becomes China’s Blending Spot

- Reuters has reported on a rather odd jump in China’s crude imports from Malaysia in July 2019, despite the latter’s declining production and the appreciation of the benchmark Tapis crude against its peers.

- It is estimated that as much as 500 000 metric tons, i.e. more than a third, of the putatively Malaysian volumes comes from Venezuela and was blended with other crudes so as to conceal its origin.

- Several „teapot” refineries in Shandong have been increasingly seen taking Malaysian blends in the past weeks.

- Also corroborating the claim is the fact that not Malaysia’s widely marketed grades like Kimanis or Labuan top the list of Chinese imports, rather the Nemina grade which (along with Singma Blend) was virtually unknown until 2018.

- Concurrently, deliveries of Venezuelan crude in July dropped 110kbpd month-on-month to 165kbpd, in what was initially perceived as China’s fear of US retaliation.

- Preliminary August data indicate that straightforward Venezuelan exports will drop even further as only three vessels have left for China this month.

2. Brazil Clears All Familiar Faces for Upcoming Licensing Round

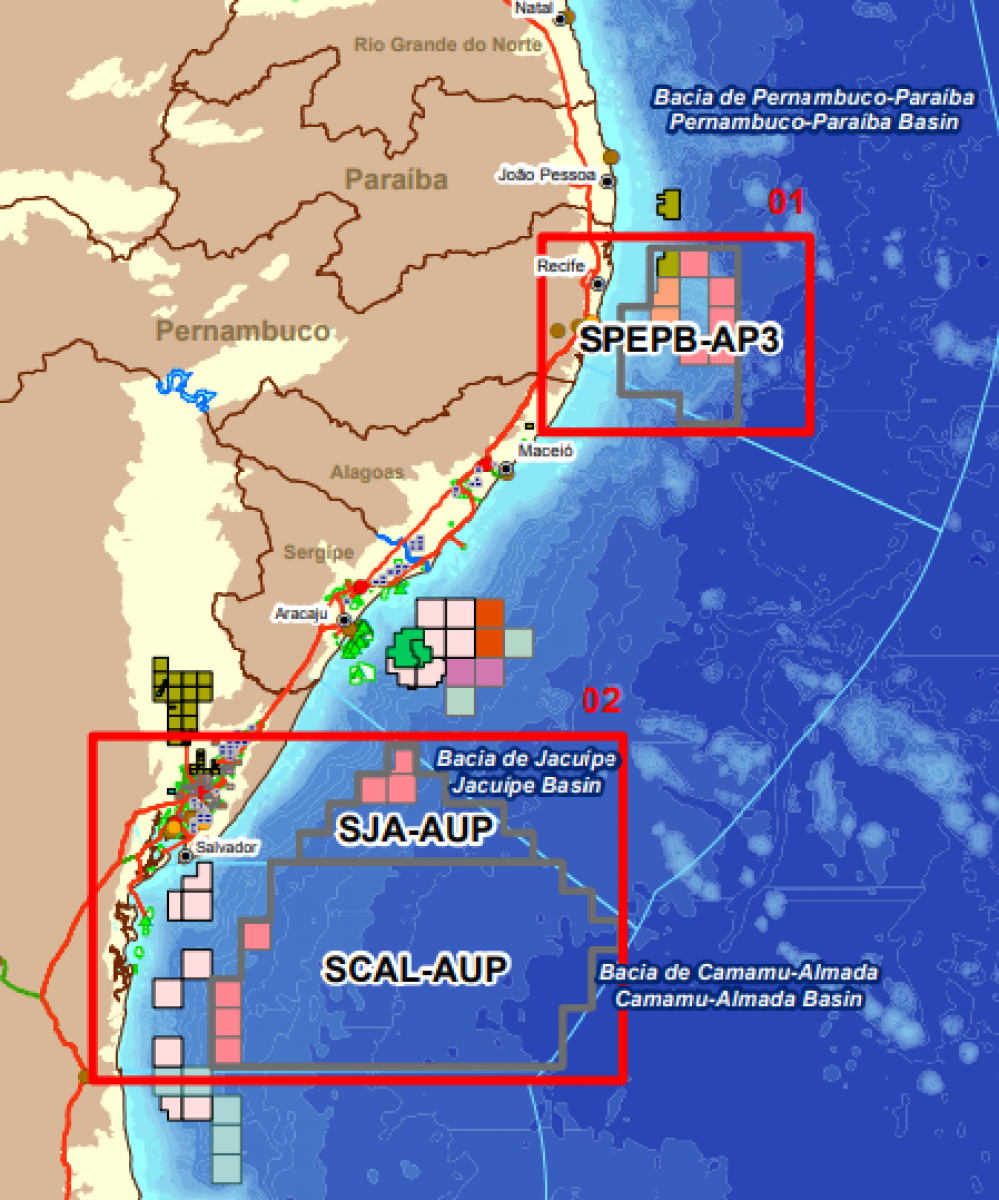

- Brazil’s National Agency of Petroleum (ANP) has cleared 12 international oil firms for a concession licensing round that is assumed to take place October 10.

- 36 offshore exploration blocks will be up for grabs, as part of the total drive to soften the overreach of national oil company Petrobras by allocating un/underdeveloped fields to majors.

- Interestingly, all of the firms that saw themselves cleared – including but not limited to Equinor, Total, BP, Repsol, Chevron, ExxonMobil, CNOOC, Shell and others – already participate in offshore projects in Brazil.

- Previously it was rumored that the pre-salt licensing round might be postponed to 2020 as the government would like to prioritize the Transfer of Rights Petrobras asset-stripping auction (also scheduled for October).

- Two-thirds of the deepwater blocks offered are located in the Santos and Campos basins, with most of the total reserves (70 billion barrels of oil) assumed to be in those deposits.

3. Nigeria Drops September OSPs Amid Softening Demand

- Nigerian state oil company NNPC has lowered its official selling prices for September-loading cargoes as producers in Nigeria continue to experience rare difficulty in marketing their crudes.

- The month-on-month cuts are less drastic than they were for August cargoes, with main export streams like Qua Iboe or Bonny Light cut by 14-18 USD cents per barrel.

- Nigerian crudes are dropping primarily because demand Asian demand is softening in traditional outlets like China or India, on the back of lackluster European imports.

- As highlighted in previous week’s Oil Insider, Nigeria’s latest addition to its crude slate Egina has been enjoying robust demand in Europe and its September OSP actually rose 17 cents to a $2.04 premium against Dated Brent.

- The October loading programs that surfaced so far indicate an overall export drop from September, perhaps squeezing the supply ahead of IMO 2020 would push Nigerian crudes upward.

- Last week also saw the inauguration of Nigeria’s new oil minister Timipre Sylva who vowed to eradicate conflicts between the state and its cash cow NNPC.

4. Mexico Takes Special Care to Time K-Factor Surge Well

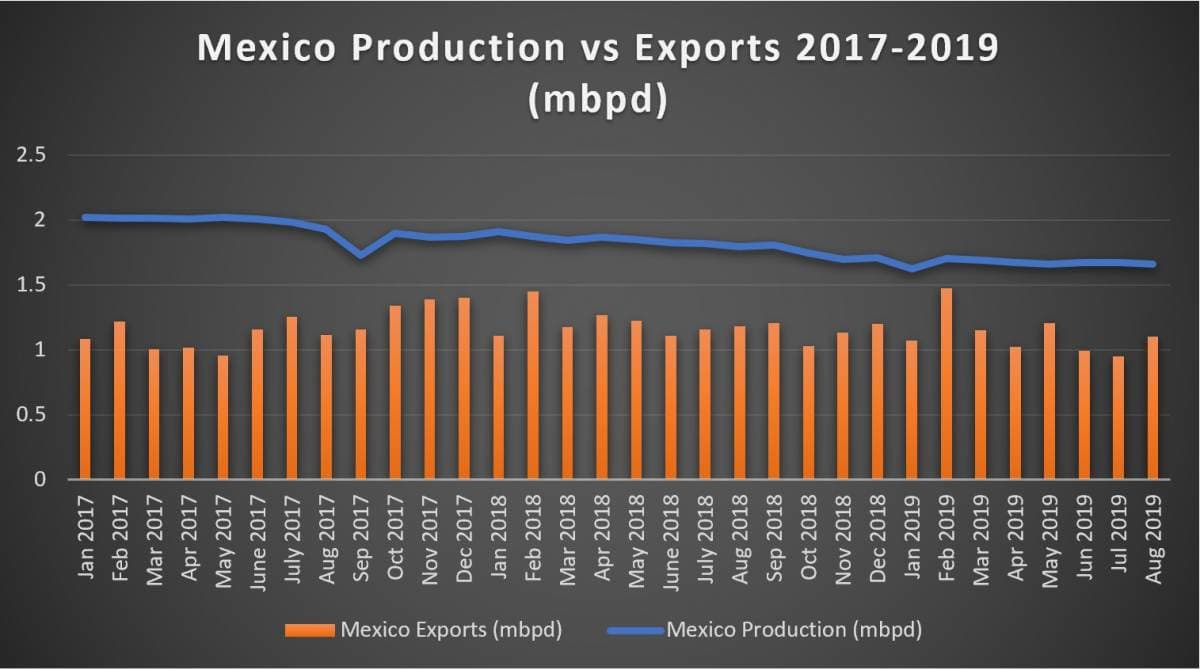

- PMI International, the trading arm of Mexico’s national oil company PEMEX, has sizeably increased its formula adjustments, also knows as K-factors, for September-loading cargoes.

- The K-factors for USGC-bound Maya were hiked $5.25 per barrel month-on-month (to $4.5 USD per barrel) in one of the most drastic increases recently, with Maya surpassing both Isthmus and Olmeca.

- The medium sour Isthmus (33 API, 1.2 percent Sulphur) was raised $1.25 per barrel m-o-m, whilst light Olmeca was simply rolled over from August at $4.45 per barrel.

- Asia-bound September K-factors saw less dramatic action as Maya was decreased by 50 cents to $-4.6 per barrel, whilst Isthmus was cut 25 cents to $0.05 per barrel.

- PMI took quite some time to publish September’s K-factors as it was more than a week overdue issuing them – presumably due to the drastic drop in American HSFO cracks.

- Based on actual data Mexico’s crude exports in August 2019 will bounce back from a weak June-July where it dropped below 1mbpd, with current estimates putting it at 1.1mbpd.

5. Greece Tries Again With Privatization

- The Greek government will seek once again to privatize the country’s national oil company Hellenic Petroleum after it failed to do so in the 2018-2019 tendering process.

- For reasons still unclear (the government’s official version was that it was due to developments in the international environment), neither of the Vitol-Sonatrach and Glencore-Carlyle Group consortia presented a final bid for the oil company.

- One of the key (profitable) refiners in the Mediterranean region, Hellenic Petroleum runs 3 refineries in Greece – the 140kbpd Aspyropyrgos, the 100kbpd Elefsis and the 72 kbpd Thessaloniki one.

- Athens, currently seeking well-placed advisors for the process, now appears more flexible in the way the privatization might take place (including mergers) and has expressed readiness to fully sell its 35.5 percent stake held by its development fund.

- A Greek private firm POIH is also selling part of its 35.5 percent stake, preferring to retain approximately a half of its current holding.

- The privatization of Hellenic seems to be a key element in Athens’ troubled partnership with the European Commission as it remains one of 5 five „key” reforms to be implemented until the EC allows Greece to introduce long-sought tax cuts.

6. Rosneft Mulling Mozambique Expansion

- A very interesting story might be unfolding in Russia, as information started trickling down about Rosneft’s next international move amid a Kremlin visit of President Filipe Nyusi of Mozambique.

- The one-day event saw an array of documents signed, amongst them a ministerial agreement to cooperate in matters relating to geology and mineral resources, as well as Rosneft committing to long-term cooperation with Mozambique’s National Oil Institute.

- Rosneft also signed an MoU with Mozambique’s national oil company ENH on the development of the African country’s offshore gas deposits, despite already participating in the appraisal of three blocks, together with ExxonMobil (A5-B, Z5-C, Z5-D).

- Igor Sechin, the CEO of Rosneft and concurrently one of the most influential people in Russian politics, spent almost 3 years working as a military assistant in Mozambique in the early 1980s and speaks Portuguese fluently.

7. South Sudan Discovers New Field

- The Chinese national oil company CNPC announced a new discovery in South Sudan’s Melut Basin near the Ethiopian border, adding 300 MMbbl to the African nation’s oil reserves tally.

- The Adar exploration well was spudded to a total depth of 1 320 meters, and its production potential might be further buttressed by two further wells to be drilled in the upcoming years.

- Thus CNPC consolidates its position as South Sudan’s leading oil producer, currently producing 77 percent out of the country’s 185kbpd output.

- Luckily for CNPC, the Adar discovery is located conveniently close to Blocks 3 and 7 operated by the Chinese firm.

- It also has to be pointed out that the timing of the discovery announcement takes place against the background of lackluster E&P deals (Oranto, SFF), Total renouncing on entering South Sudan and a licensing round being held in just two months.