Remember when oil markets used to be driven by oil headlines? What quaint times. We used to write about things like Middle East supply outages, OPEC deals and crude backlogs in Cushing. We’d discuss the financial health of frackers, daily supply/demand balances, refinery maintenance season and monthly Chinese imports. It was all very last season. 2017 stuff. And in August of 2019 where trade disputes and inverted yield curves rule, it somehow feels passé.

Brent crude oil has tumbled about 20% since April and it’s hard not to credit the deterioration of US/China relations for much of the slide. While it’s true that daily supply/demand balances have turned bearish in the last few months, it’s difficult to imagine oil prices taking this sort of tumble in the absence of a negative macro backdrop. Crude production in Libya has dropped sharply this summer while Venezuela is producing just 760k bpd and Iranian exports have been strangled basically to 0 bpd. There are certainly some bullish spots in the crude market which physical traders have dealt with by keeping prompt Brent and US gasoline structure comfortably backwardated. This week the front 1-month Brent spread traded near +50 cents while the prompt 1-month US gasoline spread was near +11 cents, so perhaps it’s not all that bad out there. Nevertheless, these tight spots in the physical markets are being overwhelmed by macro and if you happen to be bullish on oil you certainly didn’t make any money this summer.

On…

Remember when oil markets used to be driven by oil headlines? What quaint times. We used to write about things like Middle East supply outages, OPEC deals and crude backlogs in Cushing. We’d discuss the financial health of frackers, daily supply/demand balances, refinery maintenance season and monthly Chinese imports. It was all very last season. 2017 stuff. And in August of 2019 where trade disputes and inverted yield curves rule, it somehow feels passé.

Brent crude oil has tumbled about 20% since April and it’s hard not to credit the deterioration of US/China relations for much of the slide. While it’s true that daily supply/demand balances have turned bearish in the last few months, it’s difficult to imagine oil prices taking this sort of tumble in the absence of a negative macro backdrop. Crude production in Libya has dropped sharply this summer while Venezuela is producing just 760k bpd and Iranian exports have been strangled basically to 0 bpd. There are certainly some bullish spots in the crude market which physical traders have dealt with by keeping prompt Brent and US gasoline structure comfortably backwardated. This week the front 1-month Brent spread traded near +50 cents while the prompt 1-month US gasoline spread was near +11 cents, so perhaps it’s not all that bad out there. Nevertheless, these tight spots in the physical markets are being overwhelmed by macro and if you happen to be bullish on oil you certainly didn’t make any money this summer.

On the Trump side of things, The Donald pushed markets lower at the end of last week by ordering US companies to start looking for alternatives to doing business with China and attacking his own appointed Fed Chairman for what he views as overly high interest rates. Both sides of the US/China dispute also announced plans to escalate trade barriers and the oil market got directly involved when China announced that it would- for the first time- place tariffs on imports of US crude oil.

We’re obviously concerned about the trade war worsening as both sides back themselves into respective corners and it’s hard to tell at this point who has the weaker hand. China’s manufacturing sector seems to be suffering more than the US manufacturing sector under heightened tariffs. However, China’s leadership has the luxury of not having to answer to voters while Trump’s re-election bid will obviously be made more difficult if US GDP, confidence and employment data continue to slide. The US President loves to tout the strength of the US economy at his rallies, but the message could lose strength after the last twelve months have delivered negative returns for major US stocks indexes while monthly job gains are having their worst year since 2010 (to be fair this is at least somewhat due to lower unemployment.) These numbers are certainly putting pressure on Trump and we saw evidence of that this week when the President signaled an interest in resuming talks with Beijing.

Boris Johnson seemed to speak for investors everywhere at the G7 when he told reporters “we’re in favor of trade peace on the whole and dialing it down a bit.” Can either side ‘dial at down a bit’ given their current positions? We aren’t sure. But we’re confident this story will continue to dominate the commodity markets until peace can be made.

Quick Hits

- Oil prices sank at the end of last week, falling below the $60/bbl mark following Trump’s twitter feed. Brent crude then stabilized near $59 on Tuesday which is basically flat for the month of August and lower by $16 since the April peak at $75.

- US stock markets suffered massive losses yet again at the end of last week, with the S&P 500 falling to 2,850 for a 6% loss over the last month. The market rebounded about 20 points on Monday and Tuesday after Trump seemed to extend an olive branch towards Beijing.

- Overseas, the Shanghai Composite was actually higher last week trading near 2,900 (flat for the last month) while the Euro Stoxx 50 moved lower by about 1% to 3,330 and the Nikkei sank towards 20,200.

- The decline in equities did not, however, translate into higher bond prices and the US 10yr yield was stuck near 1.50%.

- Brent spreads markets continued to trade in comfortable backwardation which belies the relentless news flow we hear about how awful the global economy is. The prompt 1-month brent spread was near +50 cents this week while the prompt 6-month spread yielded about 20-cents backwardation per month.

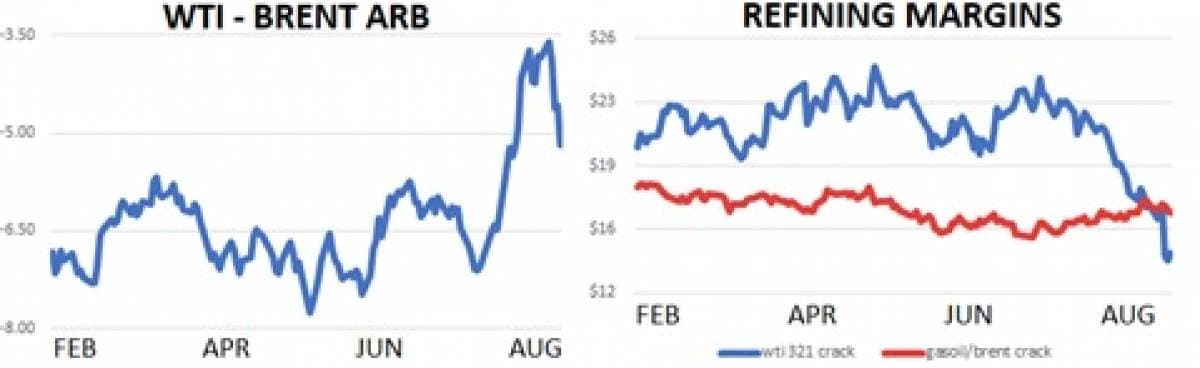

- In diff markets, the WTI-Brent arb fell to -5.00. WTI structure had been strengthening in recent weeks as new takeaway capacity in the Mid Continent had helped pull barrels towards the US Gulf Coast for export.

- Refining margins in the US continued to sink into the gutter. This week the WTI 321 crack (turning 3 barrels of crude oil into 2 barrels of gasoline and 1 barrel of distillate) paid refiners about $14/bbl. Bad news in a market where demand is already lower by 250k bpd YTD. In Europe margins are looking slightly better with the gasoil/brent crack trading near $17/bbl.

DOE Wrap Up

- US crude stocks fell 2.7m bbls last week to 438m and are higher y/y by 7% over the last four-week stretch.

- Inventories in the Cushing delivery hub fell for a fourth straight week this time by 2.5m bbls in a move to 42m. Cushing stocks are lower by an impressive 11m barrels over the last two months.

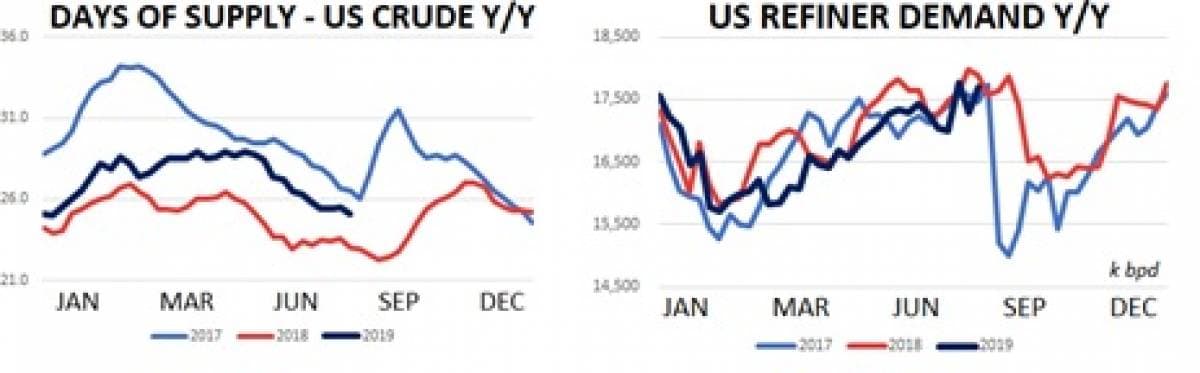

- The US currently has 25.1 days of crude oil supply on hand The average of 25.4 days of crude supply on hand over the last four weeks is higher y/y by 9%.

- Traders imports 7.2m bpd of foreign crude into the US last week and exported 2.8m bpd yielding net imports of 4.4m bpd. Net imports have averaged 4.7m bpd over the last four weeks and 4.3m bpd so far in 2019.

- Domestic crude production came in at 12.3m bpd for the third straight week.

- US refiner demand saw a solid uptick of 400k bpd last week to 17.70m bpd and is lower y/y by 2% over the last four-week period.

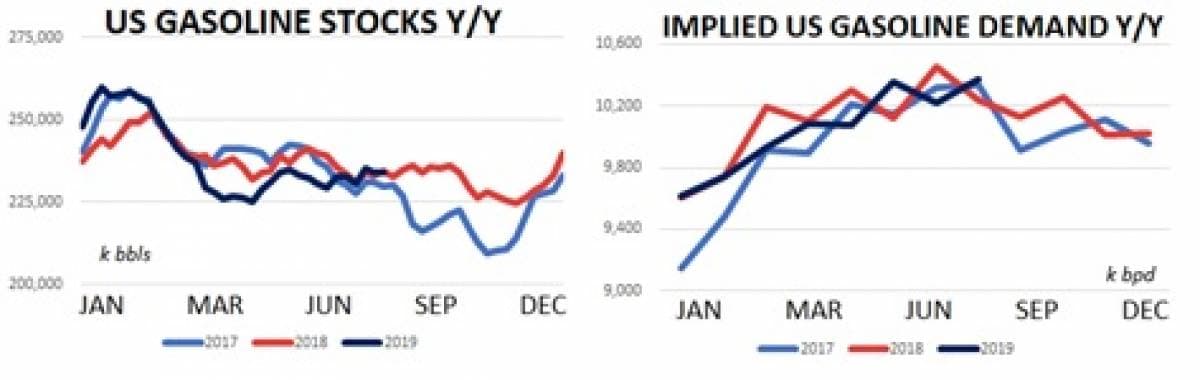

- US gasoline inventories increased by 300k bbls last week to 234m and are flat y/y over the last four-week period.

- The US currently has 24.2 days of gasoline supply on hand which is slightly lower y/y.

- Domestic gasoline demand + exports was printed 10.3m bpd last week and is averaging 10.4m bpd over the last four weeks which is higher y/y by 2% over the last four weeks.

- Distillate inventories also continued to climb moving higher w/w by 2.6m bbls. Distillate stocks are higher y/y by 8% which could offer some insight into how badly the US agricultural sector is struggling due to the US/China trade war.