Hedge funds are clearly bracing for even harder times for the battered oil market as bearish bets keep piling on. According to data from research firm S3 Partners, short sellers have added more than $460 million to their short-interest positions since the start of February, with short positions tripling since the beginning of the year.

This represents the largest move of its kind in the sector since June 2019 when the oil market first sunk into bear territory.

And it’s a clear indication that money managers believe the energy market woes are far from over.

Investor disenchantment with the U.S. oil and gas sector is old news, though it now appears to have reached a fever pitch. Saddled with a high debt burden, which--coupled with its checkered record of paying back investors and the inability of many producers to spend within cash flows--has made the sector fall out of favor with investors.

Source: CNN Money

Record bearishness

To get an idea of just how negative investor sentiment has turned towards the sector, consider that its favorite benchmark, the Energy Select Sector SPDR Fund (XLE) is now down 24% in the year-to-date vs. -7% return by the broader market’s benchmark S&P 500 Index (SPX) with XLE is barely positive over the past decade. The Bank of America now reckons the energy sector has underperformed the broader market by the biggest margin in almost 80 years.

Meanwhile, VanEck Vectors Oil Services ETF (OIH) and S&P Oil & Gas Exploration & Production ETF (XOP), two exchange-traded funds considered proxies for US energy, have drawn particular attention from the shorts with 40% of their outstanding shares now sold short.

Short interest in OIH, an ETF that tracks oilfield services companies, climbed 9% to $233 million, or almost 40 per cent of its shares. Meanwhile, bearish bets against XOP, an ETF that tracks oil and gas explorers and producers, have surpassed $1billion, or nearly half its float. Related: OPEC Source: No Wednesday Deal

According to S3 data, energy companies that have come into the crosshairs of the shorts in recent weeks include Range Resources and Southwestern Energy, both large producers of natural gas that have been left exposed by the plummeting prices of the commodity. Others with big short positions are Callon Petroleum and Matador Resources, two companies that operate in the prolific Permian shale oil play.

Short Squeeze

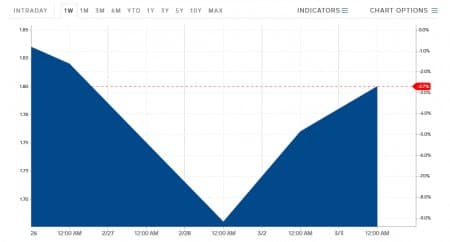

The extreme bearishness surrounding the sector has to do with persistently low fossil fuel prices as well as the ravages of the coronavirus outbreak. WTI crude oil, the US benchmark, fell below $45 a barrel on Friday to a four-year low and is now down more than 27% since the beginning of the year. Meanwhile, U.S. natural gas prices recently sunk to historic lows beneath $1.70/MMBtu.

Fears of a synchronized slowdown by the global economy have multiplied after an emergency cut in rates by the Fed failed to rally the market. On Tuesday,the Federal Reserve slashed interest rates by 0.50 percent to a range of 1-1.25 percent in an attempt to stay ahead of disruptions and economic slowdown caused by the rapidly spreading coronavirus. Still, the S&P 500 finished the day 2.8% down.

But the energy bears could soon find themselves in a world of pain. Related: How Fossil Fuels Power The Internet

Whereas the equity markets were indifferent to the rate cuts, the energy markets seem to have gotten the memo.

WTI is up 2.16% on Tuesday’s session at 10.30 amET to $48.10/barrel while Brent crude has gained 1.75% to trade at $52.77/barrel. Meanwhile, natural gas prices are enjoying a rare rally, up 1.22% to $1.83/MMBtu.

The rally though might have little to do with the rate cuts but are likely the result of lower-than-expected inventory builds of 1.7 million barrels for the week ending February 28, compared to analyst expectations of a 3.333-million-barrel build in inventory. In the previous week, the API estimated a smaller than expected build in crude oil inventories of 1.3-million barrels, while the EIA’s estimates were more bullish, reporting a smaller build of 500,000 barrels for the week.

(Click to enlarge)

Source: Business Insider

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- How Fossil Fuels Power The Internet

- The $4 Trillion Carbon Capture Opportunity

- Morgan Stanley Expects Near-Zero Oil Demand Growth In China In 2020