Friday May 11, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Shale productivity continues to improve

(Click to enlarge)

- U.S. shale production continues to rise, helped along by ongoing improvements in the initial production (IP) rates of new wells.

- That allows for higher overall oil production even if the drilling rate fails to rise.

- For instance, a new well in the Bakken averages more than 600 barrels per day of production in the first month of operation, up from 400 b/d a few years ago. Similar trends have played out across all the major shale basins.

- The EIA says that IP rates have generally improved for ten years in a row.

2. Shareholders rewarding companies that pay them

(Click to enlarge)

- Shareholders have pressured the oil industry to spend cautiously, hoping to put an end to years of aggressive growth-at-all-costs strategies.

- Companies that have decided to return cash to shareholders in the form of buybacks and dividends have seen their share prices soar above their competitors.

- Anadarko (NYSE: APC), for example, announced a major $2.5 billion share buyback program in September 2017, a program that was increased to $3 billion recently. Since September, Anadarko…

Friday May 11, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Shale productivity continues to improve

(Click to enlarge)

- U.S. shale production continues to rise, helped along by ongoing improvements in the initial production (IP) rates of new wells.

- That allows for higher overall oil production even if the drilling rate fails to rise.

- For instance, a new well in the Bakken averages more than 600 barrels per day of production in the first month of operation, up from 400 b/d a few years ago. Similar trends have played out across all the major shale basins.

- The EIA says that IP rates have generally improved for ten years in a row.

2. Shareholders rewarding companies that pay them

(Click to enlarge)

- Shareholders have pressured the oil industry to spend cautiously, hoping to put an end to years of aggressive growth-at-all-costs strategies.

- Companies that have decided to return cash to shareholders in the form of buybacks and dividends have seen their share prices soar above their competitors.

- Anadarko (NYSE: APC), for example, announced a major $2.5 billion share buyback program in September 2017, a program that was increased to $3 billion recently. Since September, Anadarko has seen its share price rise by 70 percent.

- Anadarko’s stock has outpaced the rest of the industry and has also seen stronger gains than even the price of oil.

3. Tesla hopes to take cobalt use to zero

(Click to enlarge)

- Tesla (NASDAQ: TSLA) said a few weeks ago that it wants to bring its use of cobalt down. “We think we can get cobalt to almost nothing,” Elon Musk said.

- Cobalt prices have skyrocketed as car manufacturers strain cobalt supply chains. Cobalt is a key ingredient in the batteries used in electric vehicles.

- Cobalt prices have tripled since 2016.

- Battery makers are shifting from cobalt to nickel, although nickel prices have also jumped by 50 percent over the past two years.

- Tesla has plenty of problems (manufacturing bottlenecks, and heightened scrutiny over its cash burn rate), but Tesla’s batteries have some of the highest energy densities in the industry.

4. Iran production in the spotlight

(Click to enlarge)

- The U.S.-led coalition knocked roughly 1 million barrels per day of Iranian oil supply offline between 2011 and 2015. The lifting of sanctions following the Iran nuclear deal, beginning in 2016, allowed Iran to restore that lost output.

- The big question after Trump’s withdrawal from the deal is how much Iranian supply is put at risk.

- Estimates vary from nearly nothing (Barclays sees a modest 150,000 bpd reduction in 2019) up to 1 mb/d. Most analysts split the difference and see around 400,000 to 500,000 bpd of reduced supply over the next year.

- The sanctions start to bite in August (for financial transactions) and in November (for oil sales), but the U.S. Treasury has told companies and countries that want waivers that they need to begin reducing purchases now.

5. Permian gas production soaring

(Click to enlarge)

- Natural gas prices remain subdued even after a sharp drawdown in inventories from the cold winter. That is because production is skyrocketing, both in the Marcellus and Utica Shales, and in the Permian Basin because of so much associated oil drilling.

- Natural gas output in the Permian is rising so quickly that prices are collapsing. Gas is “getting incredibly cheap again versus oil and refined products,” John Kilduff, founding partner at Again Capital, told Bloomberg. Shale companies “are just going to try to give it away.”

- Gas flaring in the Permian could rise by a factor of five over the next year. But state regulations could force companies to throttle back on production to avoid too much flaring.

- In this sense, the glut of gas could slow oil production in the Permian.

- “Permian growth may actually be limited by the ability to flare gas,” Matthew Portillo, managing director of exploration and production research at Tudor Pickering, told Bloomberg. “Basically, the pipes don’t point in the right direction. And the pipes that are available are getting full.”

6. Brent needs more oil

(Click to enlarge)

- The Brent oil benchmark is the marker for a long list of regional oil prices in various parts of the world. Two-thirds of the world’s oil is priced based on movements in the Brent contract.

- Brent, in turn, is formulated by real barrels coming out of several North Sea oil fields, most of which are in decline. The fields are expected to lose 500,000 bpd by 2025.

- Declining output is a vulnerability for the importance of the benchmark, particularly as more U.S. oil is exported (boosting the relevance of WTI) and as China’s Shanghai contract gains traction.

- The Troll field was recently added into the formula for Brent, adding 200,000 bpd to the contract.

- Some analysts see Statoil’s (NYSE: STO) Johan Sverdrup field as a key lifeline for the Brent benchmark.

- The field will begin production in 2019 and will eventually add up to 600,000 bpd. As of now, there is no indication that Johan Sverdrup will be added to the pricing formula.

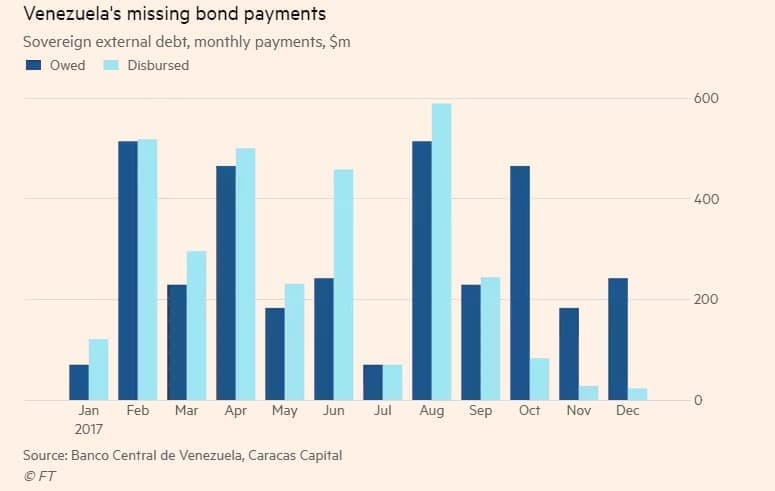

7. Venezuela debt threatens catastrophic oil declines

(Click to enlarge)

- Venezuela’s oil production has declined to about 1.4 million barrels per day, or down roughly 500,000 bpd from the third quarter of 2017 and off nearly 1 mb/d since 2015.

- Most analysts have already factored in additional losses on the order of a few hundred thousand barrels per day by the end of the year. But recent actions from creditors trying to seize Venezuela’s assets for missed payments threatens much steeper losses.

- ConocoPhillips (NYSE: COP) moved this week to take control of PDVSA’s processing and shipping terminals on several Caribbean islands. PDVSA recalled some oil tankers to avoid having them seized as well.

- Separately, creditors who have not received payment on debt that matured over the past year just filed a lawsuit in a New York court. Up until recently, creditors had approached the issue with caution. “It is now open season on PDVSA,” Russ Dallen of Caracas Capital, an investment bank, told the FT. “This will start an avalanche of legal actions.”

- The bottom could fall out on Venezuelan production. There is a great deal of uncertainty over what happens next, but it now seems likely that we will soon see extremely steep decline rates.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.