The International Maritime Organization’s (IMO) decision to lower the Sulphur cap of marine fuel across the globe will be one of those few landmark moments which trigger a whole set of smaller trends, reshaping the oil market so as to make it leaner and more efficient. The IMO 2020 transformation will bring confusion to the refiners’ books – sophisticated refiners will seize the opportunity to buy cheaper sour crudes, whilst less sophisticated sites will see their feedstock bills rise in the tumultuous years of 2020-2021. In the upcoming weeks and months, we will be looking at how IMO 2020 influences oil markets as the implementation date draws nearer.

The last time IMO lowered the marine fuel Sulphur cap was in 2012, dropping it from 4.5 percent to 3.5 percent. Now the 2020 decrease is substantially more marked, a sevenfold drawdown to 0.5 percent. Such an abrupt move should lead to a manifest disjunction between high-sulphur and low-sulphur streams, which is exactly what most of us have predicted – yet one might even say that so far it was the opposite that came around. This lack of market clarity amid a plethora of signals obfuscating the true direction in which the shipping industry is headed will cast a long shadow over the oil industry, raising the risk that the first months of 2020 will be a rough ride for everyone involved.

Point #1: Pricing Has Gone Awry Due to the US Sanctions

Before we dwell into the peculiarities of IMO 2020 itself, let’s just…

The International Maritime Organization’s (IMO) decision to lower the Sulphur cap of marine fuel across the globe will be one of those few landmark moments which trigger a whole set of smaller trends, reshaping the oil market so as to make it leaner and more efficient. The IMO 2020 transformation will bring confusion to the refiners’ books – sophisticated refiners will seize the opportunity to buy cheaper sour crudes, whilst less sophisticated sites will see their feedstock bills rise in the tumultuous years of 2020-2021. In the upcoming weeks and months, we will be looking at how IMO 2020 influences oil markets as the implementation date draws nearer.

The last time IMO lowered the marine fuel Sulphur cap was in 2012, dropping it from 4.5 percent to 3.5 percent. Now the 2020 decrease is substantially more marked, a sevenfold drawdown to 0.5 percent. Such an abrupt move should lead to a manifest disjunction between high-sulphur and low-sulphur streams, which is exactly what most of us have predicted – yet one might even say that so far it was the opposite that came around. This lack of market clarity amid a plethora of signals obfuscating the true direction in which the shipping industry is headed will cast a long shadow over the oil industry, raising the risk that the first months of 2020 will be a rough ride for everyone involved.

Point #1: Pricing Has Gone Awry Due to the US Sanctions

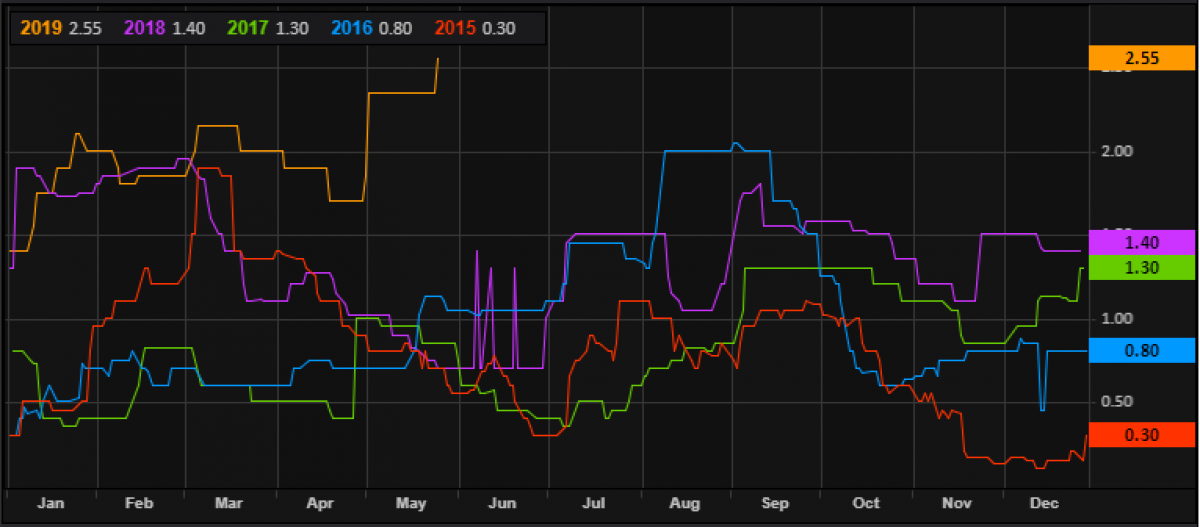

Before we dwell into the peculiarities of IMO 2020 itself, let’s just take a look at how wildly unpredictable oil prices can be. There is no better example than the Urals pricing throughout the first five months of 2019. Urals was generally expected (by oilmen and reputed analysts/oil services companies alike) to start dipping against Dated in 2019, attaining an average annual discount to Dated Brent of roughly -2 USD per barrel and then plummet even further in 2020, when the IMO Rules come into effect, to some -4 USD per barrel. Bear in mind that this should be an annual average, allowing for even wider movement amplitudes.

Graph 1. Urals Quotes vs Dated Brent 2015-2019.

Source: Thomson Reuters.

Yet the exact opposite has happened – Urals has moved into previously unattainable territories, especially in the Mediterranean where it currently trades around +1 USD per barrel against Dated Brent. The underlying reason is quite easy to pinpoint – the Trump Administration’s sanctions against Venezuela and Iran have shaken up the market and resulted in a very tangible medium and heavy sour tightness. As a result, crudes which traditionally were traded at a discount of several dollars per barrel in the previous years are now climbing up to Brent parity. Remember our Doba story – the Chadian crude traded at a -4 USD per barrel discount to Brent in Q4 2018, now it already hovers above a +2 USD per barrel premium.

Graph 2. Kirkuk Monthly OSP Discounts vs Dated Brent Quotes 2015-2019.

Source: Thomson Reuters.

And here comes the vital differentiation – Doba is very sweet (0.1 percent Sulphur) and it could be argued that its prices skyrocketed as Chinese refiners start to reorient African crude streams towards themselves in preparation for IMO 2020. Yet heavy streams which are more sulphurous saw similar surges over the past couple of months. The Colombian Vasconia cannot stop appreciating as missing Venezuelan volumes need to be replaced – in this, Colombian and Ecuadorian crudes are of primary interest for US, Japanese and other refining powerhouses. The Iraqi Kirkuk crude, the Sulphur content of which generally oscillates between 2.5-3 percent, is already trading at almost Dated Flat levels if we add the inevitable trader’s margin to the Iraqi OSP.

Graph 3. Vasconia vs Dated Brent 2015-2019.

Source: Thomson Reuters.

Attentive readers will have noticed by now that we have omitted light crudes from our review. Looking at the pricing development of Bonny Light, one must observe that it has largely moved out of its 5-year average zone in April-May when Iranian barrels have already disappeared from the market, creating a gap of more than 1mbpd. Hence, Bonny’s surge is palpably less robust than that of heavier and more sulphurous crudes, which is understandable given that the overwhelming majority of new US crude streams is light and is pushing Nigerian crudes from traditional market outlets, last but not least the massive American market itself.

Graph 4. Bonny Light vs Dated Brent 2015-2019.

Source: Thomson Reuters.

Point #2: The Future of Fuel Oil

There remain doubts whether high sulfur fuel oil (HSFO) as we know it would remain a widely consumed product or would it move towards obsolescence. Most probably there will not be a “global” answer to the question and most regions would find their own tailor-made solutions. In addition to Chinese refiners already producing VLSFO, most leading Asian refiners, i.e. the South Korean Hyundai Oilbank, Japanese Idemitsu and Showa Shell, and Taiwanese CPC have been preparing for a H2 2019 startup of IMO-compliant marine fuel production. In Europe, only ExxonMobil (Antwerp), Repsol (La Coruna and Bilbao) and Saras (Sarroch) have been installing new units to ensure there are no IMO 2020-related supply shortages. The rest will most probably rely on a custom-made gasoil-fuel oil blend.

For more than 2 years, starting from the October 2016 IMO decision onwards, little was known about the preferences of port authorities in terms of scrubbing technology and in general presence thereof. Yet now it is becoming increasingly clear that open-loop scrubbers (i.e. the vessels that use seawater to neutralize SOx and dropping the results thereof into the sea without any subsequent treatment) seem to be a bad choice – the Asian shipping hubs of Fujairah and Singapore, as well as China, California, Massachusetts and Belgium have all banned their usage within their jurisdiction. This, of course, does not ban their usage per se, thus vessels can still dump the effluent into the sea once they have passed the territorial water frontier, still, the current market preference seems to be for hybrid scrubbers.

Point #3: Watch Out for Shipping Costs

On the back of a very healthy global shipbuilding portfolio and ample demand for new vessels (so far), the cost of shipping a new IMO 2020 environment will loom large for the shipping companies. If on average an oil tanker consumes 40-60 mt per day of marine fuel, the increase in aggregate voyage costs might be anywhere between 0 and 400 000 USD for one given route. And that is not all. Refiners will tackle the challenge of producing on-spec 0.5 percent Sulphur marine fuel differently, many will use different refinery streams to blend the optimal fuel together whilst some would simply change the refinery slate towards a lighter one (look no further than the Greek Aspropyrgos refinery which has been revamping its operations to move from a medium sour to a light sweet feed stream).

The ceteris paribus cost of a seaborne voyage – the Worldscale rate between any two given navigable points – will inevitably change, too. The current set of Worldscale shipping rates is calculated on the basis of 2018 HSFO bunker prices, whilst the next year’s routes should be already based on VLSFO, pointing towards a quite hefty price increase down the line. These developments should seemingly compel some shippers to look at LNG as a fitting replacement of HSFO – in fact several Norwegian tanker operators like Odfjell are already doing this and given the abundance of potential Russian LNG projects they might be joined by the Russians, too. Thus, do not be surprised if the Baltic/North Sea area, an emission control area (ECA) for quite some time already, will gradually gravitate towards liquefied gas.