Swings and roundabouts, what more can you say. After last week’s massive drop – last week witnessed the biggest day-to-day decline of 2019 – oil prices were rising again in the first half of the trading week. The US came out of the long Memorial Day weekend with news about Cushing being flooded, raising the stakes for refiners and transportation companies alike. As US refineries get ready for the summer driving season (on the back of a pervasive heavy crude shortage), the negative impact of shutting down refineries along the rivers of Arkansas and Mississippi runs quite high. Concurrently, the US-China trade war rages on, as do speculations about the future of the OPEC+ production cut agreement.

On Wednesday, China’s claim that it would use pressurize the US in the sphere of rare earth metals pushed global benchmark Brent back on the defensive, with Brent trading in the 66.8-67 USD per barrel interval, whilst WTI traded around 57.2-57.4 USD per barrel.

1. South Korean Government Subsidizes non-Middle East Purchases

- South Korea extended its freight rebate option for domestic refiners until 2021, in a move that underpins Seoul’s willingness to insulate its firms from sanctions-entailed losses.

- The rebate amounts to 2 USD per barrel, effectively making nullifying the freight differential on intercontinental arb supplies.

- The rebate initially started as a means of weaning South Korea off its dependence on Middle Eastern crude,…

Swings and roundabouts, what more can you say. After last week’s massive drop – last week witnessed the biggest day-to-day decline of 2019 – oil prices were rising again in the first half of the trading week. The US came out of the long Memorial Day weekend with news about Cushing being flooded, raising the stakes for refiners and transportation companies alike. As US refineries get ready for the summer driving season (on the back of a pervasive heavy crude shortage), the negative impact of shutting down refineries along the rivers of Arkansas and Mississippi runs quite high. Concurrently, the US-China trade war rages on, as do speculations about the future of the OPEC+ production cut agreement.

On Wednesday, China’s claim that it would use pressurize the US in the sphere of rare earth metals pushed global benchmark Brent back on the defensive, with Brent trading in the 66.8-67 USD per barrel interval, whilst WTI traded around 57.2-57.4 USD per barrel.

1. South Korean Government Subsidizes non-Middle East Purchases

- South Korea extended its freight rebate option for domestic refiners until 2021, in a move that underpins Seoul’s willingness to insulate its firms from sanctions-entailed losses.

- The rebate amounts to 2 USD per barrel, effectively making nullifying the freight differential on intercontinental arb supplies.

- The rebate initially started as a means of weaning South Korea off its dependence on Middle Eastern crude, which ran as high as 80-85 percent several years ago.

- In January-March 2019, South Korean imports from Middle Eastern countries dropped to 72.5 percent and are expected to drop even further after it stopped buying Iranian crude.

- Supplies from the United States, once touted instrumental in replacing Middle Eastern barrels, averaged 0.325mbpd in Jan-May 2019, increasing fourfold from H1 2018.

2. Total Seeking to Offload Third of Kashagan Stake

- Just several weeks after the French oil major Total committed to buying the $8.8 billion African portfolio of Occidental Petroleum should the Anadarko takeover take place, it is reported to seek a Kashagan stake sale.

- According to Reuters sources, Total intends to sell a third of its 16.8 percent stake in the Kashagan operating company NCOC, with the aim of mustering at least $3 billion.

- This fits ideally with Total CEO Pouyanne’s stated aim of offloading higher-cost production so as to render the oil major’s upstream profitable even in case of a downturn.

- Due to its structural complexity and three botched start-ups, Kashagan is the most expensive offshore oil-producing project ever, having cost shareholders some $50 billion.

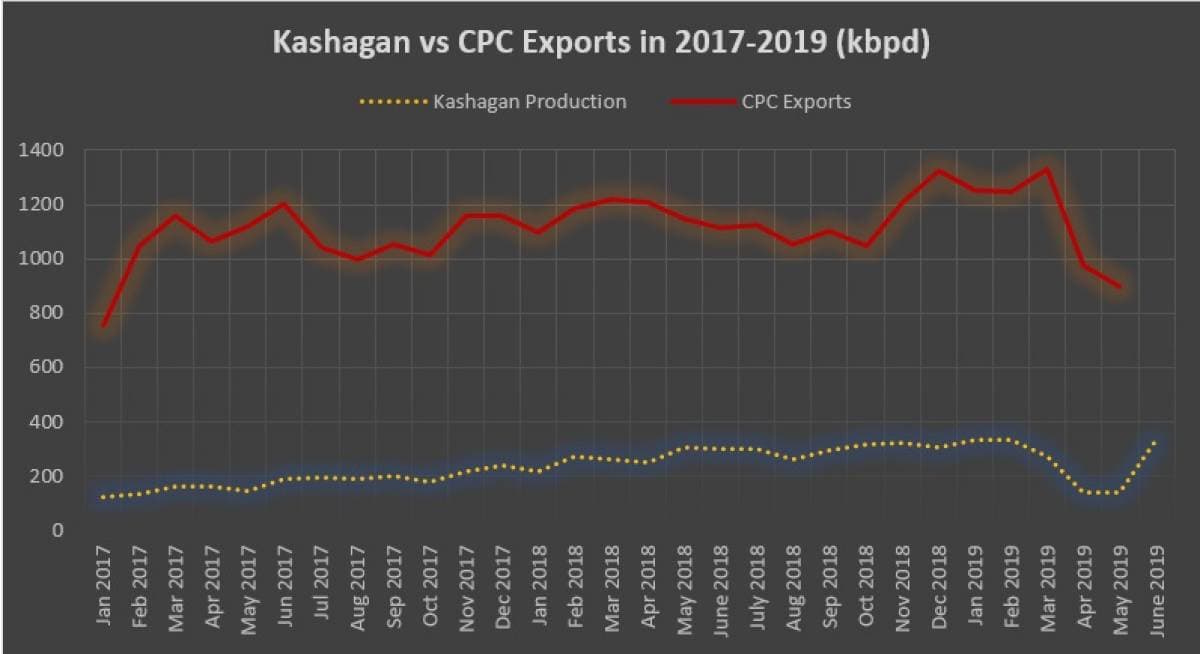

- Kashagan output averaged 313kbpd in Q1 2019 and should average 209kbpd in maintenance-heavy Q2 2019, to be followed by some 340-350kbpd in Q3.

- The operation company NCOC expects the Kashagan field reach phase one plateau production of 370kbpd in the second half of 2019.

3. Japan Goes for Ecuadorian Crude

- Japanese refiners have set an all-time record for monthly Ecuadorian purchases, having bought at least 2.7 million barrels of Napo crude in May 2019.

- In a temporary bid to replace lost Iranian volumes, Showa Shell and Fuji Oil have found a suitable Iranian Heavy replacement in the Ecuadorian Napo.

- Napo is significantly heavier and somewhat less sulphurous than Iranian Heavy (19° API and 2 percent Sulphur against 29° API and 2.2-2.3 percent Sulphur).

- Japan depends on Middle Eastern suppliers even more tangibly than South Korea, with 90 percent of its H1 supplies so far coming from the Middle East.

- Despite the increasing Ecuadorian volumes, several Japanese oil ministry dignitaries stated that UAE’s Upper Zakum will be the most likely candidate to replace Iranian crude.

- Importing Ecuadorian volumes is primarily due to the ongoing medium sour crude tightness as Napo still comes at a 6-7 USD per barrel discount to Basrah Light or Upper Zakum.

4. Petrobras Selling 2 Fields in Oil-Prolific Campos Basin

- Brazil’s national oil company Petrobras is nearing the divestment of its Pampo and Enchova fields in the oil-prolific Campos Basin

- Enchova and Pampo were discovered in 1976 and 1977, respectively, making the heavy oil-containing (20 API) one of the most mature offshore assets to be divested in Petrobras CEO Castello Branco’s 2019-2023 divestment plan.

- The two fields currently produce 40kbpd and local media sources indicate that the independent Trident Energy seems currently the most probable bid winner.

- Concurrently, Petrobras intends to cut its stake in the NOC’s fuel distribution subsidiary Petrobras Distribuidora (BR) in a public share offering.

- Petrobras currently owns 71 percent of BR and is seeking a share lower than 50 percent by the end of the divestment program.

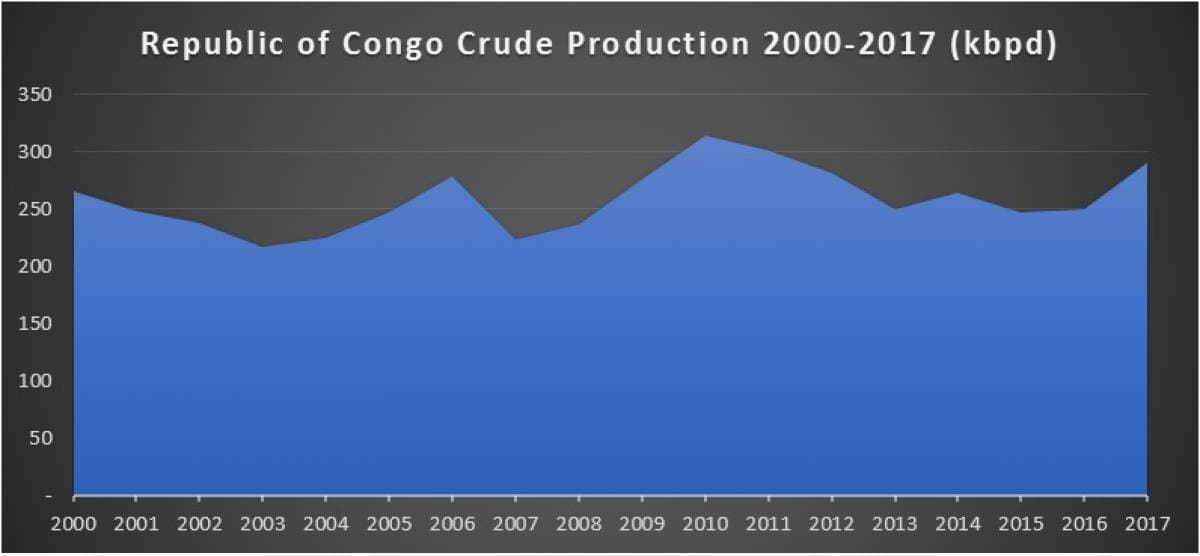

5. Congo-Brazzaville Is Courting Russian Oil Companies

- Following a bilateral meeting between the Presidents of the Russian Federation and the Republic of Congo, LUKOIL’s entry into Brazzaville’s oil sector seems increasingly likely.

- Congo is concurrently persuading Russia to build a 1300-kilometer product pipeline that would connect Pointe-Noire on the Atlantic shore with the northern city of Ouesso.

- The Congolese Djeno has become a staple diet of Chinese coastal refineries – the availability of such a lucrative market underlies the exploration MoU signed between the Congolese national oil company SNPC and LUKOIL.

- Even though Congo has tangibly eased the pressure on its producers by means of a new 2016 hydrocarbons law, it is still far from enjoying the fruits of its hydrocarbon-rich offshore zone.

- Similarly to neighboring Angola, nearly all of Congo Brazzaville’s oil revenues do not reach the nation’s economy and are used for debt servicing.

6. Algeria Hikes June OSPs Amid Firm Asian Demand

- The Algerian national oil company Sonatrach raised its June-loading official formula price for the nation’s flagship Saharan Blend grade by 45 cents to a 0.8 USD per barrel premium over Brent.

- The June 2019 OSP is the highest in more than one year and comes amid robust demand for Saharan Blend from China, India and other Asia pacific consumers.

- Due to frequent bad weather loading halts Sonatrach’s May exports are so far 0.143mbpd lower month-on-month at 0.44mbpd, almost half of this year’s peak tallied in February 2018 (0.86mbpd).

- Out of the total May exports, only three went to Asia (2 to Singapore and 1 to South Korea), with France, UK and the United States accounting for most of Algerian exports.

- Algeria’s oil and gas sector is still waiting for a new permanent government, with rumours circulating that current Sonatrach head Rachid Hachichi is just a temporary solution.

7. Groningen Earthquake Brings Output End Closer

- Last week’s 3.4 magnitude earthquake some miles away from the Dutch giant natural gas field Groningen will most probably speed up the phasing out of continental Europe’s once-largest producing field.

- Initially, the first political decision to wind down Groningen production, with a gradual phaseout schedule until 2030, was born January 2018 after an earthquake of the same magnitude.

- The Dutch Economic Ministry has already suggested bringing the total closure a couple of years earlier than 2030.

- This gas year’s production quota stands at 19.4 BCm, down some 2.2 BCm y-o-y, whilst the proposed 2019/2020 was sety at 15.9 BCm.

- This, however, might be revised as increasingly adverse public opinion propels to government to cut production to 4-5 BCm by 2022 already.

- The anticipated closure will leave 400-500 BCm of natural gas in the ground.