Peru has struggled for over a decade to build its hydrocarbon sector and boost crude oil reserves and production. 2020 was particularly difficult for the Andean country’s crisis-ridden petroleum industry. Ongoing social conflict, notably in Peru’s northeastern Amazon, the COVID-19 pandemic, and ongoing infrastructure outages all impacted hydrocarbon output. Those issues were amplified by the Latin American country’s long-running political crisis and the socioeconomic fallout from the pandemic.

Like its Latin American neighbors, Peru’s economy was harshly impacted by the pandemic. The Andean country’s 2020 gross domestic product contracted by over 11% despite Peru being one of the first regional countries to initiate a lockdown to mitigate the spread of the coronavirus. That was worsened by softer commodity prices, with metals mining being a key economic driver, as the world slumped into a pandemic-induced recession. Peru’s planned economic recovery depends not only on restarting activity in the Andean country’s economically crucial mining sector but bolstering production in the strife-torn petroleum industry. By September 2020, crude oil production had fallen to a multi-decade low of 29,165 barrels daily as violent protests against the petroleum industry in Peru’s Amazon forced oilfields and pumping stations to be shuttered. While crude oil output fell sharply, Peru’s natural gas production continued to grow, reaching 1.3 million cubic feet daily for September 2020, well above the April 2020 low of 790 million cubic feet daily. In 2020, data from PeruPetro shows that Peru’s national oil production averaged 39,738 barrels per day, which is 25% lower than 2019. That sharp decline in crude oil output combined with the March 2020 oil price collapse weighed on Peru’s economy.

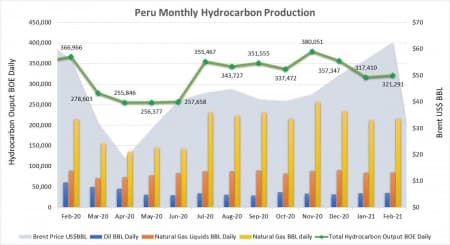

Related: Oil Prices Fall As Bearish Sentiment Returns In February 2021, Peru’s hydrocarbon production demonstrated that it was on the road to recovery. That month’s oil production (Spanish) climbed by 1% month over month to 35,388 barrels per day while natural gas liquids remained relatively flat - only gaining 0.34% at 85,430 barrels of oil equivalent daily. It was natural gas (Spanish) which experienced the largest gain, rising 1.8% to 1.25 million cubic feet per day. That saw Peru’s total hydrocarbon output for February 2021 hit 321,660 barrels of oil equivalent per day which was a 1% increase compared to a month earlier.

Source: PeruPetro and U.S. EIA.

Despite those steady gains the Andean country’s oil and natural gas production was still substantially lower than pre-pandemic levels. Peru’s February 2021 crude oil output was 42% lower than for the comparable period in 2020 while natural gas liquids were 5% less, although natural gas production remained stable. As a result, the Latin American country’s total combined hydrocarbon production for that month was 12% lower than for February 2020, indicating there is a considerable journey ahead for Peru’s hydrocarbon sector for it to recover to pre-pandemic production.

Related: Ad Companies Are Boycotting Big Oil

A key headwind for the petroleum industry is the considerable community dissent and lack of social license in Peru’s Amazon. This is because a large portion of the Andean country’s proved oil reserves and operational oilfields are in the Amazon basin. According to data from Peru’s hydrocarbon regulator PeruPetro, 48% of the country’s proved oil reserves, totaling 344,500 barrels, is in the Amazon. The latest production data for February 2021 shows that roughly a quarter of Peru’s oil is extracted from the Amazon with 20.5% from the northeastern jungle which is the region most affected by the unrest. That explains why the substantial social conflict in Northeastern Peru coupled with a distinct lack of social license has significantly impacted Peru’s crude oil output.

In November 2020, industry body Peru’s National Society of Mining, Petroleum, and Energy issued a communication (Spanish) claiming that the country’s petroleum industry was in crisis. In that statement, it asked the national government in Lima as well as the communities in Peru’s northern Amazon to find a means of resolving the issues which were fueling the violent protests which forced the shuttering of regional oil production. To address that conflict, Lima introduced a $1.7 billion six-year plan to improve resources and infrastructure in Amazonian communities, with a focus on addressing the issues sparking violence. Earlier this year, industry body the Peruvian Hydrocarbons Society (SPH – Spanish initials) released a statement (Spanish) calling on Lima to simplify administrative procedures and adjust the royalty as well as remuneration structure of contracts. This, the SPH believes, will be important to attracting and facilitating investment in Peru’s hydrocarbon sector to ensure crude oil reserves will expand and production will return to pre-pandemic levels.

Expanding Peru’s hydrocarbon production has been identified as a key part of helping the country to recover from the COVID-19 pandemic. While the Andean country has not focused on building its oil industry in the same way Ecuador, Colombia, Brazil, and Argentina have, it possesses considerable petroleum potential. The country is located on one of the most prolific hydrocarbon trends in South America, the sub-Andean megatrend. It is that trend that has endowed Venezuela, Colombia, Ecuador, and Argentina with their considerable petroleum resources. There have been 18 sedimentary basins identified in Peru. PeruPetro has determined they contain 421,667 barrels of proved and possible oil reserves as well as estimated recoverable petroleum resources of over 14 billion barrels.

The considerable economic fallout from the pandemic coupled with the impact of Peru’s political crisis on the economy has left the country in crisis. Now, the recent oil price rally makes restarting its oil industry a top priority. While production is rising, Lima needs to attract substantial foreign investment if operations are to return to a pre-pandemic level. February 2021’s oil output alone was well below, almost half, of what it had been for that month in 2020 before the pandemic hit Peru. To generate the required investment Lima needs to create greater political stability, it needs to ensure a good regulatory environment and to eliminate the violence and protests that have plagued operations in Peru’s northeast.

By Matthew Smith for Oilprice.com

More Top Reads From Oilprice.com: