A string of crises has engulfed Peru, Latin America’s sixth-largest economy, since the start of 2020. If the marked impact of the COVID-19 pandemic on Peru were not enough, it now finds itself rocked by a succession crisis. By mid-November 2020 the Andean country had three presidents in a week after congress removed Martín Vizcarra from office. This incited considerable civil unrest and left the country leaderless at a crucial juncture. The impact of the pandemic on the economy and government measures taken to contain the spread of the coronavirus are expected to cause the gross domestic product to contract by a worrying 14%. The pandemic has starkly highlighted Peru’s social and economic fissures, particularly the division between rich and poor in Latin America’s fifth most populated country. These events have fueled considerable internal conflict and dissent which are spilling over into Peru’s oil industry. The Andean country’s hydrocarbon sector has long been a focal point for conflict because a large portion of onshore operations is in Peru’s Amazon Basin. Local indigenous communities have long opposed the industry because of significant environmental damage and a lack of equitable distribution of resources, leading to violent protests against oil companies and the central government. These events are all having a sharp impact on the performance of Peru’s oil industry, which considering the considerable economic impact of the COVID-19 pandemic on the economy is of increasing importance to the Andean country. In late-November 2020 Peru’s peak industry body the National Society of Mining, Petroleum and Energy released a statement claiming (Spanish) the oil industry was in crisis and imploring Lima to resolve the issues impacting the increasingly economically important sector. While the central government during August 2020 agreed to establish a regional working group, increase investment in local infrastructure and bridge the income gap for poor indigenous communities, it appears that little real progress has been made. That can be blamed on the leadership succession crisis playing out in Lima which is significantly disrupting decision making.

While those decisions saw the violent August 2020 protests, which forced PetroTal to shutter operations at its Bretaña oilfield in Block 95, draw to a close allowing operations to recommence, dissent continues to simmer. A key reason for this discontent is the environmental damage linked to oil industry operations in Loreto. An independent report (Spanish), released in February 2020, claimed there have been 474 oil spills in Peru’s Amazon along the route of the crucial NorPeruano Pipeline and blocks owned by private oil companies. It is alleged Peru’s central government’s oil spill reporting system is inadequate, relying on self-reporting by oil companies meaning the full environmental damage of industry operations cannot be accurately measured. There is also a distinct lack of regional resources and investment by the Lima central government in infrastructure despite the oil industry in Peru’s Amazonian regions producing around (Spanish) 61% of the country’s hydrocarbon output in 2019. In fact, for that year Peru’s petroleum industry generated (Spanish) 2% of the country’s gross domestic product and 8% of exports by value. It is also responsible for a sizable portion of Lima’s fiscal revenues. For these reasons, community dissent toward the central government and oil industry remains high and there is considerable potential for further civil unrest and violence which will likely be focused on petroleum infrastructure. Related: Will Biden Seal The Fate Of The U.S. Shale Patch?

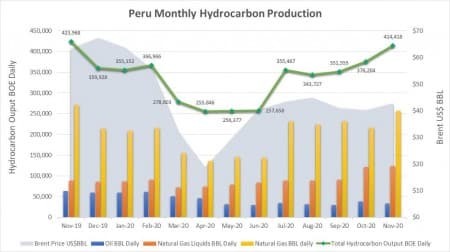

The impact of these developments, notably the lack of national leadership, is weighing on industry operations. For November 2020, Peru’s oil production (Spanish) plunged 11.5% quarter over quarter and by a whopping 47% compared to a year earlier to an average of 33,484 barrels daily. Natural gas output (Spanish), despite gaining 19% compared to a month prior, was still down by 5% year over year averaging just under 1.5 million cubic feet daily.

Source: Petroperu and U.S. EIA.

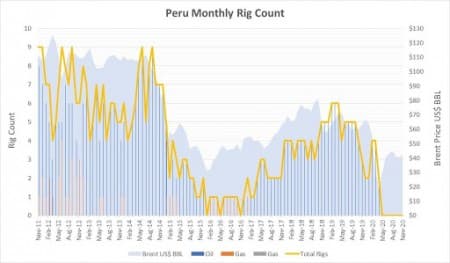

Those sharp declines underscore the impact of Peru’s ongoing crisis on its oil industry. Despite plans earlier in 2020 to reactivate the hydrocarbon sector and boost activity it appears that activity remains weak. The Baker Hughes rig count is a useful de-facto measure of industry activity. According to the latest November 2020 data, there were no operational drilling rigs in Peru, and there have not been any since May 2020.

Source: Baker Hughes and U.S. EIA.

The Baker Hughes rig count does not count cable tool rigs, very small truck mounted rigs, or rigs that can operate without a permit. For a rig to be counted it must be completing drilling activity during most of the week and cannot be in transit, rigging up, or in non-drilling activities. This explains why no active rotary rigs were counted by Baker Hughes, Peru keeps pumping crude oil albeit at reduced volumes. Upstream oil company Frontera Energy ceased pumping crude at Block 192 after the end of the first quarter of 2020 because of a community blockade, while PetroTal is restricting operations at Block 95 because of the threat of further community unrest. It appears that crisis engulfing Peru’s hydrocarbon sector will continue for the foreseeable future.

The chaos surrounding the presidential succession coupled with the severe impact from the COVID-19 pandemic is preventing Lima from formulating an appropriate response to manage the headwinds afflicting the domestic petroleum industry. This is preventing Lima from effectively implanting policies aimed at addressing the grievances which triggered violent protests in August 2020. Those events, along with a long history of environmental damage in Peru’s Amazon, are only serving to magnify dissent toward Lima among communities in the region and antagonism toward the oil industry. For these reasons, Peru’s oil industry will remain in crisis. These headwinds will deter urgently needed investment leading to weaker oil production as well as a lack of exploration and development activity vital to boosting reserves.

By Matthew Smith for Oilprice.com

More Top Reads From Oilprice.com:

- Mexico Is Quietly Pushing Out Foreign Oil Investors

- Oil Jumps On Crude Inventory Draw

- Goldman Turns Bullish On Oil: Sees $65 Brent In 2021