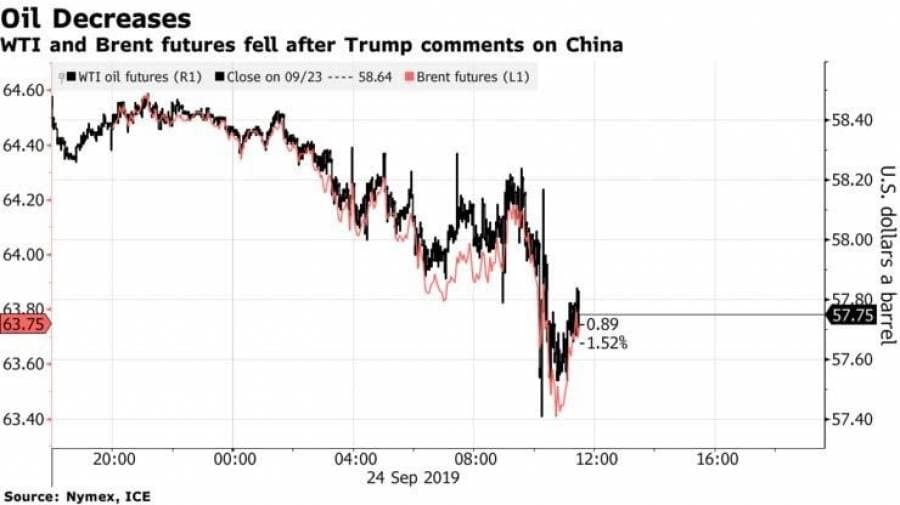

This week’s biggest news – Saudi Aramco managed to restore most of its affected production faster than anticipated and by Wednesday (September 25) is only missing some 0.2-0.3mbpd of output capacity. This has had a calming effect on markets and crude prices edged lower as immediate geopolitical risks of a regional confrontation between Saudi Arabia and Iran faded. The start of the UN General Assembly also provided ample indicative signals – US President Donald Trump criticised Chinese trade practices, all the while ruling out military action against Iran, which in turn, opened up a bit towards the US on the advice of European leaders. With the impending release of the Stena Impero vessel, held by Iranian authorities since July 2019, almost everything seemed to nudge oil prices downward.

Thus, amidst mixed information on the US commercial crude inventories last week, the general trend is now a gradually declining one. As a consequence, global benchmark Dated Brent traded around $60.4-60.7 per barrel Wednesday afternoon, whilst WTI was assessed within the $55.6-55.9 per barrel interval.

1. Refinery Fire Adding Salt to Venezuela’s Injury

- Just when it seemed that Venezuela can heave a sigh of relief as the world’s attention moved away from Latin America, a fire at its 635kbpd Amuay refinery has put the country’s remaining gasoline production at risk.

- The fire destroyed the hydrodesulphurization unit that provides VGO for gasoline production,…

This week’s biggest news – Saudi Aramco managed to restore most of its affected production faster than anticipated and by Wednesday (September 25) is only missing some 0.2-0.3mbpd of output capacity. This has had a calming effect on markets and crude prices edged lower as immediate geopolitical risks of a regional confrontation between Saudi Arabia and Iran faded. The start of the UN General Assembly also provided ample indicative signals – US President Donald Trump criticised Chinese trade practices, all the while ruling out military action against Iran, which in turn, opened up a bit towards the US on the advice of European leaders. With the impending release of the Stena Impero vessel, held by Iranian authorities since July 2019, almost everything seemed to nudge oil prices downward.

Thus, amidst mixed information on the US commercial crude inventories last week, the general trend is now a gradually declining one. As a consequence, global benchmark Dated Brent traded around $60.4-60.7 per barrel Wednesday afternoon, whilst WTI was assessed within the $55.6-55.9 per barrel interval.

1. Refinery Fire Adding Salt to Venezuela’s Injury

- Just when it seemed that Venezuela can heave a sigh of relief as the world’s attention moved away from Latin America, a fire at its 635kbpd Amuay refinery has put the country’s remaining gasoline production at risk.

- The fire destroyed the hydrodesulphurization unit that provides VGO for gasoline production, merely a couple of months after PDVSA managed to restart the unit thanks to other components located on site.

- The Amuay refinery was functioning at 20 percent of its nominal capacity before September 20, the damage has capped its future capacity at a mere 10 percent until the hydrodesulphurization unit is replaced.

- The fire broke out after a lightning-caused blackout struck the Paraguana peninsula, also taking out the 317MW Genevapca gas plant that supplies the refinery.

- With Amuay decapitated (it would be very difficult to rebuild the damaged units due to US sanctions) and the adjacent 305kbpd Cardon refinery shut down since July 2019, Venezuela’s refining sector seems to be on the brink of survival (again).

- Venezuela’s refinery runs bounced back from the gradual processing capacity decline of H1 2019, reaching 0.25mbpd before the fire.

2. China Reduces US Crude Imports Yet Refuses to Shut Door on Them

- Chinese imports of US crudes have halved year-on-year to 116kbpd in January-September 2019, en route to decrease even further as only one VLCC vessel was fixed so far for October.

- The Chinese NOC Unipec sold two of its late August-loading cargoes to Yeosu, South Korea and Sikka, India, yet did not grind US imports to a complete halt.

- Even after it became clear that the US-China trade talks are stalling for a much longer period, the Chinese oil company purchased a Suezmax of Alaska North Slope and kept the loader (September 27) of its Nordic Cross VLCC.

- Reuters quoted company sources that Unipec intends to keep on buying around 2 MMbbls of American crude from here onwards.

- This fits in well with Unipec’s fixing one vessel (2MMbbls aboard MT Wedyan) so far for October, even though rumor has it that Unipec would be interested in another US SPR release.

- The market’s interest in supplying China with US crude following the Saudi drone attacks might nevertheless push import volumes higher – both ExxonMobil and Equinor have sought to charter an October-loading vessel destined for China in the past week.

3. Nigeria October OSPs on the Rise

- Nigeria’s state oil company NNPC raised most of its October-loading official selling prices, with only four relatively marginal light sweet crudes (Obe, Ima, Asamatoru and Amenam) seeing their prices cut.

- Heavy sweet crudes saw the largest month-on-month increase with Ebok and Okoro increasing $1.74-2.02 per barrel, yet these are niche grades seeing only one 550kbbls loaders per month.

- The most significant market impact would be Escravos and Forcados being hiked $0.51 and $0.6 per barrel on the back of high European demand for VGO-rich crudes with low sulphur levels.

- Nigeria’s largest crude streams, Bonny Light (0.32mbpd) and Qua Iboe (0.23mbpd) witnessed more modest m-o-m increases, being raised by 27 and 23 cents per barrel respectively.

- Nigerian crude exports have risen to a 4-year high in September 2019, up 3 percent month-on-month, reaching 2.25mbpd amid a sudden swing in demand for light sweet crudes.

4. Costa Ricans To Decide if They Want Oil

- In a somewhat unusual twist of events, Costa Rica is trying to sort out whether its political class is right in banning oil and gas exploration altogether (until 2050) or the Latin American country should follow in the footsteps of Guyana.

- Costa Rica has been the face of Latin America’s green movement, producing 98% of its electricity from renewable sources – primarily hydropower but also geothermal (13%) and wind (7%).

- Yet as regional peers like Panama or the Dominican Republic kickstart their own campaigns to assess their hydrocarbon wealth, pro-exploration activists have been working to organize a nationwide referendum on the issue.

- Having mothballed its only refinery in 2011, Costa Rica now imports only some 50kbpd of oil products to cover its fuel needs, costing the national oil company Recope some $1.6 billion.

- According to a 2002 assessment (the year when exploration was banned) Costa Rica’s oil reserves in and around Moín and Río Blanco amount to some 3.2 Bbbls, equivalent to 160 years of the country’s current consumption.

5. Sri Lanka Buys First-Ever US Cargo

- Sri Lanka’s state-owned oil refining company Ceypetco has issued a tender (due October 08) to buy the Indian nation’s first-ever US crude cargo.

- Ceypetco is seeking to buy 700 kbbls of WTI, with a December 21-25 delivery period, to its 50kbpd Kelaniya refinery next to the capital Colombo.

- Sri Lanka’s refinery slate is composed primarily of UAE Murban and Saudi crudes, interspersed with seasonal purchases of Nigerian Akpo Blend and Algeria’s Saharan Blend.

- The root cause of Sri Lanka’s move towards the US lies in Murban reaching six-year highs as demand for it rose substantially following the attacks on Saudi Aramco’s crude infrastructure.

- Concurrently, Sri Lanka has been trying to get Equinor and Total to assess the hydrocarbon potential of its offshore Mannar Basin after Cairn Lanka’s 2015 abandonment of block SL-2007-01-001.

- The Sri Lankan government claims the Mannar Basin’s resource potential might be as high as 1 BBbls of oil.

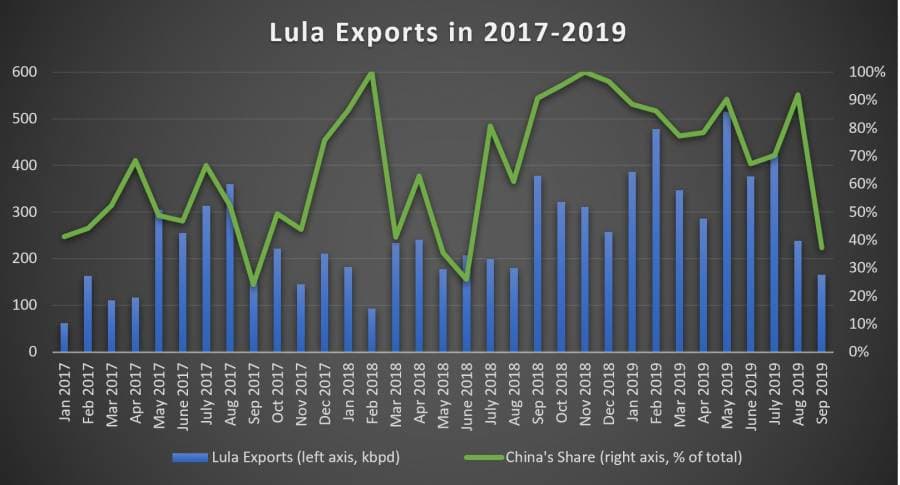

6. Brazil Tries to Market New Grade to Chinese Teapots

- Brazil’s national oil company is trying to move one of its recent portfolio additions, the medium heavy sweet Tartaruga (27° API, 0.6 percent Sulphur content), to Asian markets.

- The Lula grade was Petrobras’ main export stream towards China and the Asia Pacific in general, yet Venezuela sanctions have increased global demand for the slightly sweeter grade.

- Petrobras tried to promote Buzios, roughly of similar quality to Lula, to the Chinese market yet the volatile quality parameters of the crude have dissuaded Chinese teapot refiners from taking in more.

- Now Petrobras is having another go at the East Asian market, promoting Tartaruga as a refinery-tested grade that could be a handy supplement to Lula.

- Petrobras produced the first barrels of Tartaruga in the summer of 2018 yet has refrained so far from exporting it, opting to refine it domestically instead.

- Tartaruga will most probably trade below Lula due to its higher sulphur content, yet might still wield hefty premiums as heavy sweet distillate-rich crudes now boast the highest premiums in Asia ahead of IMO 2020.

7. Mexico Still Flirts with Idea of Fracking

- The Mexican government is seeking to kickstart its first-ever project that involves hydraulic fracturing in the Burgos Basin.

- Presidential advisor Abel Hibert, part of AMLO’s more business-oriented wing, claimed that such a pilot could assess the environmental risks inherent in fracking and calibrate its shale policy better.

- This runs counter to President Lopez Obrador cancelling Mexico’s first shale licensing round this February and repeatedly stating that fracking is inadmissible due to environmental concerns.

- At some point, however, PEMEX ought to deal with its sizeable shale reserves (estimated at 60 billion boe) – the 2020 corporate budget already includes evaluation of 6 shale plays across the country.

- Mexico might also be buoyed by the recent adjustments in Colombia where the high court clarified that despite upholding the general ban on fracking one-off pilot projects will be allowed.