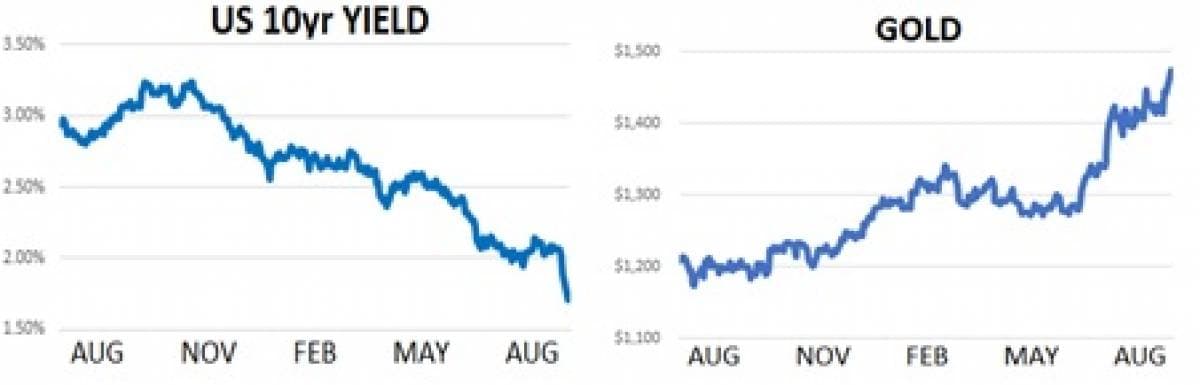

Markets convulsed early this week as traders saw US/China relations take a sharp turn for the worse. The gyrations were massive with Brent crude oil moving below $59 while the S&P 500 sank more than 230 points off its recent record high and Shanghai Composite fell more than 4%. Meanwhile in a flight to ‘safety’ gold spiked above $1,470, Bitcoin rallied above $12,000 and the US 10yr yield hit a 3yr low at just 1.70%.

So why the market panic? Harsh words and tariffs between US and Chinese leadership are nothing new, but the conflict took a decidedly negative shift this week when the PBOC- in response to another round of tariffs on Chinese imports set to begin on September 1st - allowed the offshore Yuan to sink to its lowest level against the US Dollar on record. The key move in markets this week wasn’t in commodities, stocks or bonds but in currency markets where the Chinese central bank sent the offshore USD / CNY skyrocketing above 7.0. Weakness in China’s currency was greeted by harsh Tweets from Donald Trump who then labeled China a currency manipulator and implored the US Fed to lower rates. Elsewhere, Japan’s policy and banking leadership noted they would move to depreciate the Yen to avoid hiccups for their export-driven economy.

Has the trade war become a currency war? It might depend on who you ask at this point. The key occupant of the White House certainly feels that China is not playing fair in global markets and seems increasingly comfortable gambling…

Markets convulsed early this week as traders saw US/China relations take a sharp turn for the worse. The gyrations were massive with Brent crude oil moving below $59 while the S&P 500 sank more than 230 points off its recent record high and Shanghai Composite fell more than 4%. Meanwhile in a flight to ‘safety’ gold spiked above $1,470, Bitcoin rallied above $12,000 and the US 10yr yield hit a 3yr low at just 1.70%.

So why the market panic? Harsh words and tariffs between US and Chinese leadership are nothing new, but the conflict took a decidedly negative shift this week when the PBOC- in response to another round of tariffs on Chinese imports set to begin on September 1st - allowed the offshore Yuan to sink to its lowest level against the US Dollar on record. The key move in markets this week wasn’t in commodities, stocks or bonds but in currency markets where the Chinese central bank sent the offshore USD / CNY skyrocketing above 7.0. Weakness in China’s currency was greeted by harsh Tweets from Donald Trump who then labeled China a currency manipulator and implored the US Fed to lower rates. Elsewhere, Japan’s policy and banking leadership noted they would move to depreciate the Yen to avoid hiccups for their export-driven economy.

Has the trade war become a currency war? It might depend on who you ask at this point. The key occupant of the White House certainly feels that China is not playing fair in global markets and seems increasingly comfortable gambling with the health of the US economy- and his re-election odds- in pursuit of a favorable trade deal. Trump clearly feels the US economy has enough relative strength to withstand another round of battles even though he is a democratically elected official who must answer to voters while his Chinese counterpart has essentially been appointed a lifetime dictatorship. Trump may have the negotiating edge in terms of relative economic health, but Xi isn’t held accountable to his constituents and that will ultimately make him an extremely hard person to ‘beat’ in this game of global economic chicken. Goldman Sachs’ economics team revised their macro predictions in accordance with the recent spat by predicting that a trade deal will not occur before the 2020 US election and the US Fed will have to cut rates by 25 basis points yet again in October.

Looking ahead, it’s difficult to see a clear path higher for oil with the US/China deterioration and falling demand growth dominating headlines. On Tuesday China’s central bank put a temporary halt on the Yuan’s decline which stopped some of the bleeding in risk assets but there is no question the global macro outlook has been dampened now that two of the world’s major economies are in the early stages of a currency war. As for oil fundamentals, the recent provocation could also open a lane for China to pursue more imports from Iran which could exert more bearish pressure on crude. No matter what happens in the Middle East, US/China relations have clearly taken the driver seat for the oil market for the time being and we’ll be subject to its headlines for at least the next few weeks.

Quick Hits

- Brent crude prices continued their bearish trend this week slipping below $59/bbl. Brent is now comfortably below its 50-, 100- and 200-day moving averages. WTI traded near $55/bbl. Brent’s low print represented a loss of more than 20% from its April highs which many define as official bear market territory.

- In currency markets the US Dollar traded at record levels against the Yuan after the PBOC allowed their currency to decline against its usual peg levels. Investors then sold the US Dollar against major currencies on the expectation the US Fed will lower rates in response.

- As for actual oil fundamentals, prompt Brent spreads also tumbled lower this week with the front 1-month diff moving from +60 cents to +40 cents.

- Traders also went on a massive buying spree on US Government bonds this week sending the US 10yr yield to 1.70% for the first time in three years.

- Hedge funds were net sellers of NYMEX WTI futures and options last week to the tune of 3k contracts moving the spec net long to 168k and net buyers of ICE Brent for 20k contracts moving their net long to 276k. Net length in WTI is currently 20% below its 1yr average while net length held by funds in ICE Brent is 9% below its 1yr average.

- The EIA lowered its 2019 US crude oil production growth target by 120k bpd to 1.28m bpd forecasting US production at an average of 12.27m bpd for the year.

- Gold and Bitcoin also saw massive buying with the precious metal hitting a six-year high above $1,470 while the cryptocurrency moved back above $12,000.

DOE Wrap Up

- US crude stocks tumbled yet again last week falling 8.5m bbls to 437m. Overall US crude stocks are higher y/y by 10% over the last four week period.

- Crude oil inventories in the Cushing, OK delivery hub also fell last week moving down 1.5m bbls to 48.9m for their lowest mark since May.

- US crude production bounced back sharply following last week’s shut-ins due to the hurricane in the US Gulf Coast. Overall output hit 12.2m bpd for a 900k bpd w/w increase and just 200k bpd shy of its all-time record in May.

- Unfortunately, US refiner demand continued to print at bearish levels coming in at 16.99m bpd last week. Demand has averaged 17.2m bpd over the last month which is lower y/y by 200k bpd.

- The US currently has 25.4 days of crude oil supply on hand versus 23.5 days at the same point last year.

- Traders imported 6.7m bpd of crude into the US last week and exported 2.6m bpd for net imports of 4.1m bpd. Imports have averaged 7.1m bpd so far in 2019 while exports have averaged 2.9m bpd.

- US gasoline stocks declined by 1.8m bbls last week to 230.7m and are lower y/y by 2% over the last four weeks.

- The US currently has 24.2 days of gasoline supply on hand which is higher y/y by 0.3 days.

- US domestic gasoline demand + exports printed 10.4m bpd last week and is lower y/y by 230k bpd over the last four week period.

- US distillate stocks also fell last week moving lower by 900k bbls to 136m. Distillate inventories are higher y/y by 11% over the last four weeks.