Oil prices have dropped to their lowest level in 7 months this week and are threatening to break their annual low if the market fails to find something to cling onto. Compared to the relative lull of past weeks, the most recent week-on-week change was drastic – with Brent losing more than 10 percent of its value. The nosedive started when President Trump tweeted his intention to slap a further 10 percent tariff on Chinese imports from September 01 and further deteriorated when market participants started worrying about crude demand faltering in H2 2019.

Rumors that China will not seek to include crude in its retaliatory tariffs have soothed the nervous atmosphere somewhat, yet it will take days if not weeks for the market to see whether or not the global supply-demand balance is better than its participants perceive. As of Wednesday afternoon, global benchmark Dated Brent was assessed around $57 per barrel, whilst the American WTI traded within the $51.5-51.8 per barrel interval.

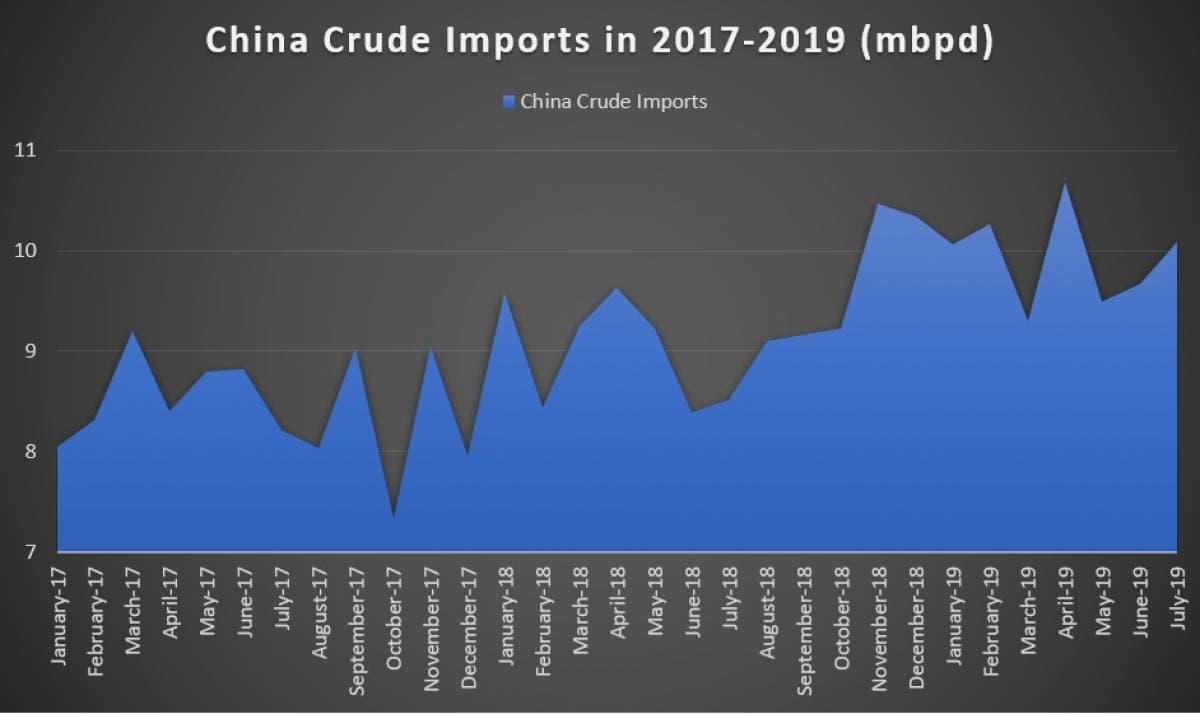

1. China Crude Imports Bounce Back in July

- China’s crude imports have bounced back in July to 10.08mbpd from a rather lacklustre May-June 2019 which saw refinery maintenance season ?urb domestic demand.

- Ever since the Hengli Refinery went full capacity in May, Saudi Arabia - with whom the Chinese refiner has a long-term supply contract - saw its exports to China surge to an all-time high of 1.8mbpd.

- As a result, Saudi exports to China have increased…

Oil prices have dropped to their lowest level in 7 months this week and are threatening to break their annual low if the market fails to find something to cling onto. Compared to the relative lull of past weeks, the most recent week-on-week change was drastic – with Brent losing more than 10 percent of its value. The nosedive started when President Trump tweeted his intention to slap a further 10 percent tariff on Chinese imports from September 01 and further deteriorated when market participants started worrying about crude demand faltering in H2 2019.

Rumors that China will not seek to include crude in its retaliatory tariffs have soothed the nervous atmosphere somewhat, yet it will take days if not weeks for the market to see whether or not the global supply-demand balance is better than its participants perceive. As of Wednesday afternoon, global benchmark Dated Brent was assessed around $57 per barrel, whilst the American WTI traded within the $51.5-51.8 per barrel interval.

1. China Crude Imports Bounce Back in July

- China’s crude imports have bounced back in July to 10.08mbpd from a rather lacklustre May-June 2019 which saw refinery maintenance season ?urb domestic demand.

- Ever since the Hengli Refinery went full capacity in May, Saudi Arabia - with whom the Chinese refiner has a long-term supply contract - saw its exports to China surge to an all-time high of 1.8mbpd.

- As a result, Saudi exports to China have increased 250 percent year-on-year (July 2018 saw 0.7mbpd of Aramco exports) and will continue to do so.

- The Rongsheng Refinery, similarly to Hengli wielding a 400kbpd capacity, will be up and running by the end of year, pushing Saudi exports to China even higher as it, too, is contract-bound with Aramco.

- China saw the arrival of 3 VLCCs laden with US crude in July, certainly a step up from zero in July, however just a prelude before the 3 VLCCs and 3 Suezmaxes expected to arrive in August.

2. Saudi Aramco Drops Asia Prices, Hikes European OSPs for September

- Saudi national oil company Saudi Aramco has cut its official selling prices for September-loading cargoes destined for Asian consumers as the premium of Dubai front-month to third-month prices narrowed last month.

- Saudi Aramco has cut Asia-bound OSPs for Arab Super Light and Extra Light by $1.40 and $0.95 per barrel respectively, with Arab Heavy witnessing the lowest m-o-m cut by $20 cents to a 0.65 premium to the Oman/Dubai average.

- European OSPs saw one of the most remarkable rebounds in recent pricing history as Saudi Aramco hiked NW European prices by $2.25-2.95 per barrel, the lighter the grade the higher the increase.

- Similarly, September-loading cargoes destined for the Mediterranean were increased by $2.35-2.85 per barrel, mirroring the recent appreciation of Urals both in the Med and Baltics.

- Against the background of Saudi exports to the US edging even lower to 0.295mbpd in July 2019 (down 0.9mbpd year-on-year), Saudi Aramco rolled over August OSPs for US-bound cargoes into September.

3. Urals Med Reaches All-Time High

- Russian flagship crude Urals has moved to an all-time high territory against the Dated Brent, trading at a $1.2 premium vs Dated on Tuesday-Wednesday.

- As recently as end-June, Med Urals was traded at a $2 per barrel discount to Brent (the Russian Energy Ministry routinely assesses the Urals-Brent spread at $-1.5 per barrel).

- It was overall expected that August would see a strengthening Urals on the back of a tighter loading schedule, down 7 percent from July, however most of the tightness is to occur in the Baltic ports, not in the Mediterranean.

- Interest for the medium sour Urals grade was sparked by a recent hike in HSFO prices in the Mediterranean, with the Med-Baltics spread surging to a double of its usual, at 6 USD per ton.

- The European Urals tightness will persist for some weeks ahead, all the more so as firm demand is still pulling some volumes to China – last week saw the 2Mbbls loading of the Xin Tong Yang VLCC en route to Guangdong.

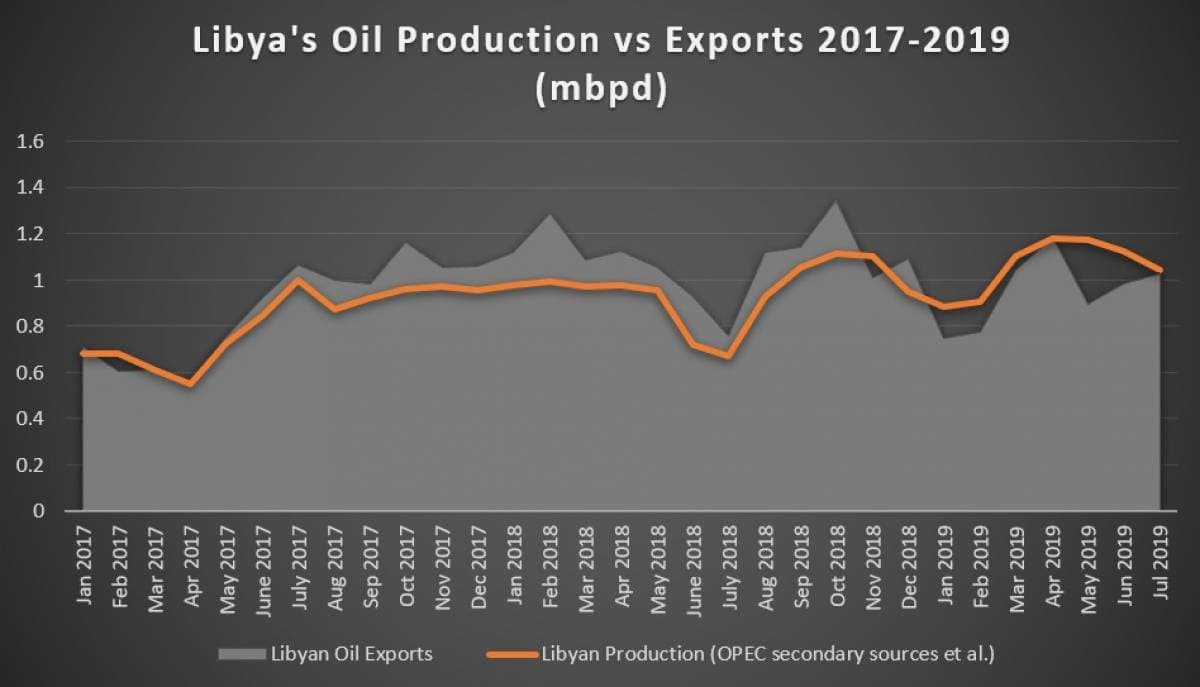

4. NOC’s August OSPs Reflect Libya’s Shaky State

- The Libyan national oil company (NOC) has increased the official selling prices of August-loading Es Sider cargoes, its main stream of export, whilst committing to drastic cuts on the Melittah and Esharara streams.

- Melittah was generally expected to be lowered as regional peers CPC and Saharan Blend are now trading lower, further pressurized by incoming flows of WTI into Italy (6 cargoes loaded in July en route to Italian ports).

- Mid-size streams like Brega, Bu Attifel, Mesla or Sirtica were rolled over from last month, whilst Es Sider and Zueitina were hiked 10 cents per barrel month-on-month.

- Esharara’s price decrease stems from its recent production volatility – on July 31, NOC had to declare force majeure on its exports again following another valve closure on the Esharara-Zawia terminal pipeline.

- Due to frequent disruptions on key infrastructure hubs, Libya’s crude exports averaged 1.02mbpd, 4 percent higher month-on-month yet still 0.16mbpd away from the April 2019 level.

- In the meantime, Libya has been mulling the diversification of its producing assets with long-standing strategic partner ENI – the Italian major pledged to launch renewable projects in the North African country.

5. Venezuela Sanctions Take Down Cuban Crude Supply

- Cuba’s crude supply has been seriously endangered by the extensive US sanctions vis-a-vis Venezuela as its prime supplier remains severely constrained in both production and export terms.

- This July has seen no crude imports whatsoever as Cuban authorities struggle to contain a fuel shortage amid prices subjected to price controls, a rare occurrence last seen in February 2015.

- Cuba has imported 24kbpd of crude 2019 YTD, roughly half of what it imported previously (44kbpd in both 2018 and 2019).

- Venezuela’s status as main supplier of Cuba has eroded over the years – in 2017 PDVSA provided 87 percent of Cuba’s needs, which dropped in 2018-2019 to 60-65 percent.

- With regime-change hawks back in action in the Trump Administration, the White House has slapped a new round of sanctions on entities affiliated to the Cuban military.

6. Total Takes a Significant Cyprus Upstream Position

- The government of Cyprus has awarded its offshore Block 7 block to a consortium of European majors ENI and Total, selecting it over ExxonMobil’s bid.

- The two majors have effectively split up Cyprus’ offshore between themselves as the ENI-Total consortium now controls 6 out of the total 13 blocks (with 4 unallotted).

- By relying on the Italo-French tandem, Cyprus is essentially betting on the EU safeguarding its exclusive economic zone parts of which have been repeatedly claimed by Turkey.

- Block 7, which saw a quite prompt government response after ENI-Total applied for the license last November, is amongst the licensing blocks claimed by Turkey to be illegally managed by Cyprus.

- Turkey claims that Blocks 1, 4, 6 and 7 ought to be developed under Turkish control.

- To raise the stakes even higher, Block 7 is adjacent to the hitherto largest gas find in Cyprus’ offshore zone, the 6.4 TCf Calypso field.

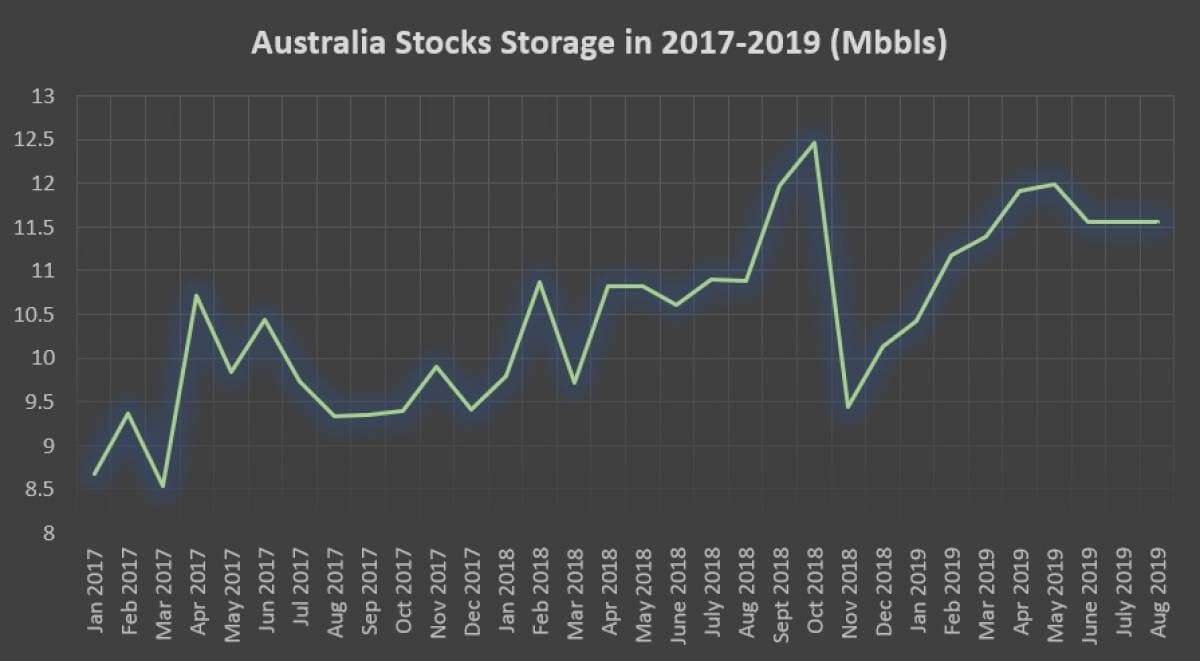

7. Australia Wants US Strategic Reserves

- One of the International Energy Agency’s notorious infractors in terms of required oil product stocks, Australia has been negotiating a one-of-a-kind SPR access deal with the United States.

- Australia seeks access to the US SPR in order to be finally able to meet the IEA requirement that all member states meet 90 days worth of consumption with their product stocks.

- Throughout the 2010s Australia has been storing 50-55 days’ worth of products, routinely undershooting its obligations.

- As the US Strategic Petroleum Reserve currently holds some 0.65 Bbbls of inventories, providing ample space for any potential ticketing cooperation.

- Australia’s woes stem from its chronic dependence on product imports, having only 0.45mbpd worth of refining capacity despite consuming around 1mbpd of products.