The penultimate full trading week of 2018 brought no clear indication of where oil markets would go in the upcoming weeks. On one hand, the OPEC/OPEC+ deal placated fears that Q1 2019 would end up in an oversupplied market, on the other hand signals of demand weakening in China amid slower-than-expected economic growth figures and decelerating refinery throughput have largely resulted in oil teetering around the same levels as it was last week.

Brent closed the week trading around 61 USD per barrel, whilst WTI traded in the 52-52.5 USD per barrel interval on Friday. As it seems, global crude prices will not react to the Vienna Agreement until the states effectuate the production cuts and traders see actual changes in inventories – a development that is expected to surface only in January-February 2019.

1. US Commercial Crude Stocks: Every Little Helps

(Click to enlarge)

- US Commercial crude stocks have continued their decrease after last week’s trend reversal, dropping 1.2 MMbbl week-on-week to 442 MMbbl.

- Confirming our last week’s prediction, the US went back into net crude importer category after exports dropped 929kbpd and imports grew by 1.1mbpd w-o-w.

- The overall slowdown in stock draws is a worrisome prospect as the US energy sector needs at least 3mbpd exports to keep stock levels in a manageable range, yet exports are far too volatile to attain that.

- Gasoline stock levels surged 2.1 MMBbl w-o-w to 228.3 MMBbl,…

The penultimate full trading week of 2018 brought no clear indication of where oil markets would go in the upcoming weeks. On one hand, the OPEC/OPEC+ deal placated fears that Q1 2019 would end up in an oversupplied market, on the other hand signals of demand weakening in China amid slower-than-expected economic growth figures and decelerating refinery throughput have largely resulted in oil teetering around the same levels as it was last week.

Brent closed the week trading around 61 USD per barrel, whilst WTI traded in the 52-52.5 USD per barrel interval on Friday. As it seems, global crude prices will not react to the Vienna Agreement until the states effectuate the production cuts and traders see actual changes in inventories – a development that is expected to surface only in January-February 2019.

1. US Commercial Crude Stocks: Every Little Helps

(Click to enlarge)

- US Commercial crude stocks have continued their decrease after last week’s trend reversal, dropping 1.2 MMbbl week-on-week to 442 MMbbl.

- Confirming our last week’s prediction, the US went back into net crude importer category after exports dropped 929kbpd and imports grew by 1.1mbpd w-o-w.

- The overall slowdown in stock draws is a worrisome prospect as the US energy sector needs at least 3mbpd exports to keep stock levels in a manageable range, yet exports are far too volatile to attain that.

- Gasoline stock levels surged 2.1 MMBbl w-o-w to 228.3 MMBbl, surpassing last year’s same-week levels by 0.3 MMBbl, largely due to a 800kbpd on the week increase in gasoline production.

- US distillate inventories decreased by 1.5 MMBbl w-o-w after two weeks of increases, totalling 124.1 MMBbl.

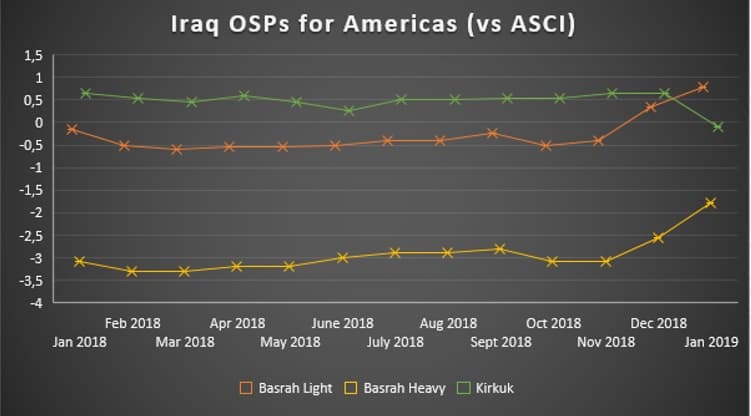

2. Iraq Joins the Race for Asia with its January OSPs

- SOMO, the state oil marketing company of Iraq, has raised official selling prices for January-loading cargoes destined for Europe and the United States, whilst sweetening a bit its Asian prices.

- Asia-bound January Basrah Light cargoes would be allocated at 0 USD per barrel premium to the Oman/Dubai average, whilst the Basrah Heavy dropped by 10 cents to -2.5 USD per barrel.

(Click to enlarge)

- Somewhat unexpectedly for European refiners, SOMO hiked its European prices by 0.6-1.3 USD per barrel for all three marketed grades.

- The newly marketed Kirkuk (3 cargoes offered in the December tender) saw the biggest jump, as December’s -4 USD per barrel OSP moved to -2.7 USD per barrel vs Dated Brent.

(Click to enlarge)

- SOMO seems to have set the Kirkuk price based on the results of the Dec tender, where the winner (Litasco) has bid around -3 USD per barrel to Brent.

(Click to enlarge)

- Since the onset of Iranian sanctions, Basrah prices have been rising gradually for Europe and the US, contrary to Asian developments.

- Interestingly, amid US Energy Secretary Rick Perry pushing for higher Northern Iraqi output (as a consequence, higher Kirkuk export volume) SOMO has lowered Kirkuk prices to the United States.

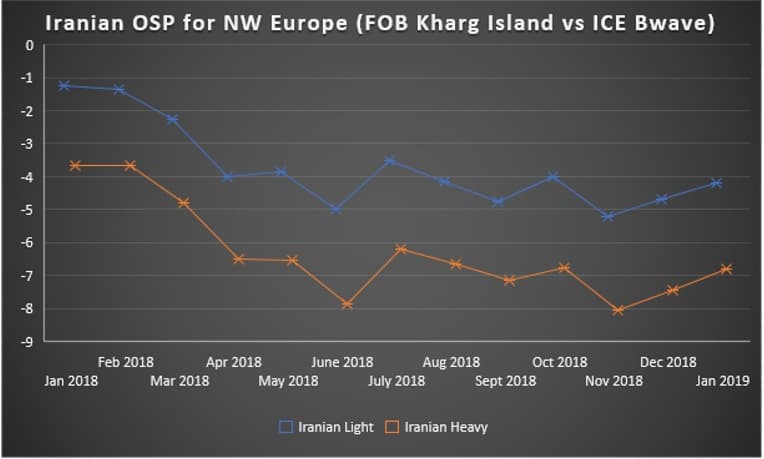

3. Iran’s January OSPs Keep in Line with Saudi Aramco

- Following Saudi Aramco’s aggressive OSP cuts last week, the Iranian national oil company NIOC maintained wide discounts to Saudi grades.

- For 3rd month in a row, the Iranian Light discount to rival Arab Light amounts to 30 US cents per barrel, the widest differential between the two in the last 20 years.

(Click to enlarge)

- The Asia-destined OSP for Iranian Light decreased by 1 USD per barrel to 0.3 USD per barrel vs Oman/Dubai average, whilst Iranian Heavy dropped by 0.75 USD to -1.3 USD per barrel.

- Soroosh was cut even harder to a two-year lowpoint of -7.4 USD per barrel vs Oman/Dubai average.

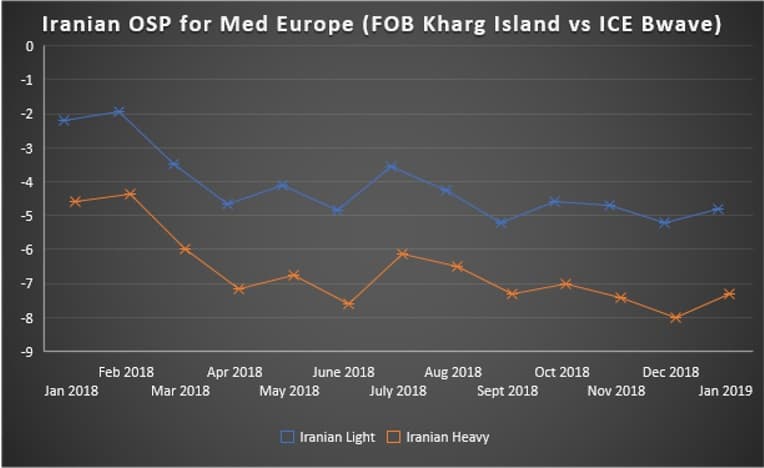

- Europe-bound official prices for Iranian Light and Iranian Heavy were hiked by 40-70 cents per barrel.

(Click to enlarge)

- The Iranian Light price to the Mediterranean rose to -4.8 USD per barrel to ICE Bwave, whilst Iranian Heavy increased to -7.3 USD per barrel.

(Click to enlarge)

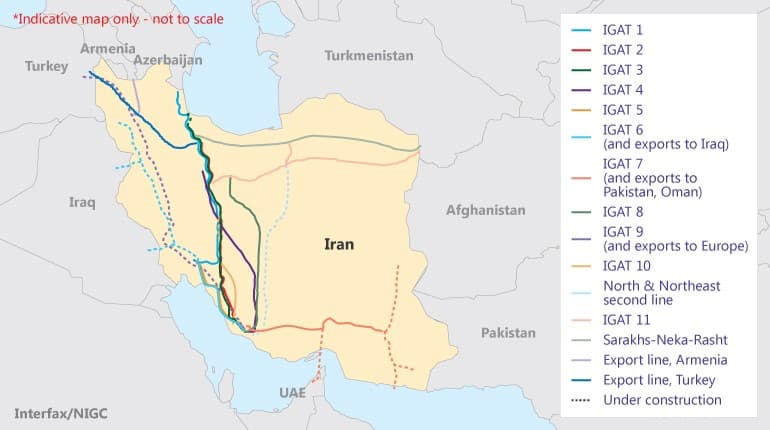

4. Iran Restarts Gas Exports to Iraq

(Click to enlarge)

- This Monday Iran restarted gas exports to adjacent Iraq, both on the Shalamcheh-Basrah and the Naft Shahr-Baghdad lines, following an earthquake-induced shutdown in November.

- As predicted in our November 21 edition of the Oil Insider, Iran seems to be very eager to use one of the few remaining market outlets for its hydrocarbons, Iraq via the IGAT 6 pipeline.

- The restart takes place several days before the US State Department is bound to decide on the prolongation of Iraq’s waiver rights, after the previous 45-day period runs out Dec 20.

- Wary of a new wave of protests as seen in Basrah this year, the Baghdad government is pushing forward for the insulation of Iranian gas supplies from any further US sanctions.

- US Energy secretary Rick Perry is pressurizing Baghdad into renouncing on Iranian gas, however Iraqi officials state it would take at least 2 years to attain that.

- The Iraqi waiver is generally expected to be prolonged on December 20.

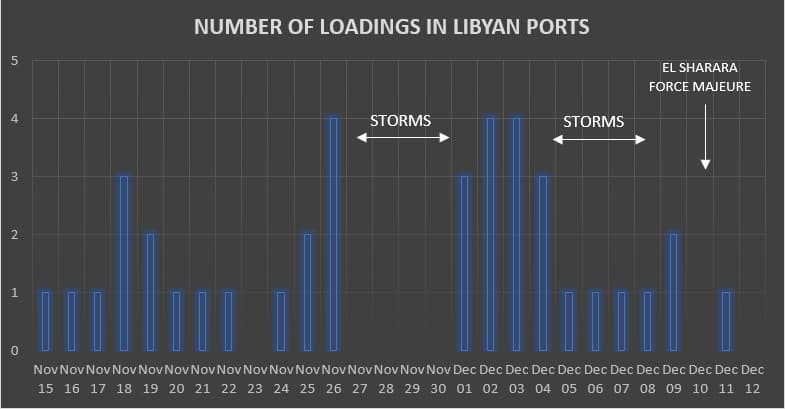

5. OPEC Output Cut Exemption Does Not Help Libya to Regain its Mojo

(Click to enlarge)

- The Libyan National Oil Corporation was forced to declare force majeure on its largest producing oil field El Sharara after militants close to the Petroleum Facilities Guard seized the field.

- As a consequence, Libya lost 400kbpd worth of output as it stopped production at the 315kbpd El Sharara and the adjacent 73kbpd El Feel oilfields.

- Mustafa Sanallah demanded the immediate withdrawal of the militia, claiming that the unnecessary shutdown would cost $32.5 million per day, to no avail so far.

- Libya has been suffering from bad weather throughout the first half of December, which, combined with the El Sharara troubles, have brought national oil production down by 0.4mbpd to 0.9mbpd currently.

- This is not the first case El Sharara bursts into protests, late October tribesmen demanding better living conditions tried to get hold of the field.

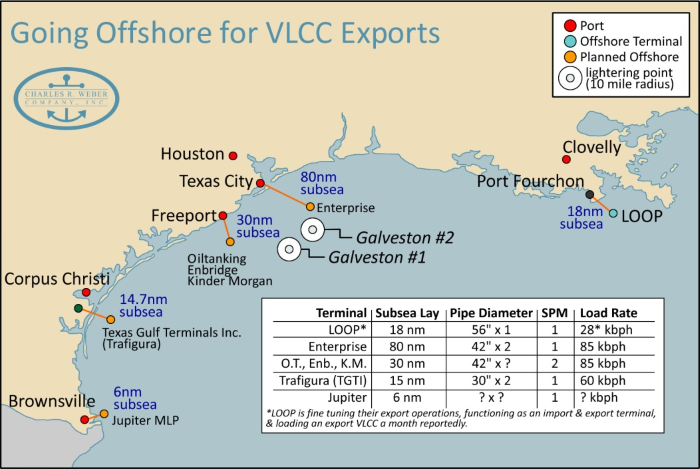

6. Enbridge to Build VLCC Terminal in Texas

(Click to enlarge)

- Enbridge intends to join the offshore port construction frenzy and build by 2022 a terminal capable of loading VLCCs.

- Built along with Kinder Morgan and Oiltanking, the Texas Colt offshore terminal, located next to Freeport, Texas, would receive crude from the 800kbpd throughput capacity Gray Oak pipeline.

- Gray Oak itself will come onstream in late 2019 or early 2020, bringing crude from the Permian basin in West Texas to Corpus Christi and Freeport.

- Currently only the Louisiana Offshore Oil Port (LOOP) is capable of loading VLCCs – yet within a couple of years up to 4 new offshore terminals might join its ranks.

- LOOP loaded its first-ever VLCC this February (9 cargoes were loaded heretofore), with a burst of activity in early December when 3 cargoes loaded – two for India, one for South Korea.

7. Drilling Activity Reaches New Low in British Shelf

(Click to enlarge)

Source: UK Oil & Gas Authority.

Exploration and appraisal drilling activity hit rock bottom in the United Kingdom, amid fears that the mature basin has largely run out of attractive drilling spots.

- The UK Oil and Gas Authority expects a mere 9 exploration and 6 appraisal wells to be drilled this year – a saddening result on the back of just 2 previous discoveries having been brought onstream this year.

Despite attaining a better result than the 13 percent reserve replacement ratio in 2016, the 69 percent result of 2017 still paints a grim picture for UK North Sea production.

- The only period in the 21st century when the reserve replacement ratio was above 100 percent occurred in 2010-2012, before and especially after it fluctuated between 50-80 percent.