Friday July 27, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Shell’s profits triple

(Click to enlarge)

- Royal Dutch Shell (NYSE: RDS.A) saw its second quarter profits nearly triple compared to a year earlier, a sign that the oil industry is on the upswing after years of steady improvement.

- Shell’s quarterly profit hit $5.2 billion, up from $1.9 billion in the second quarter of 2017.

- Shell has cut its total debt pile – once one of the largest in the world – sufficiently that it initiated a $25 billion share buyback program.

- “The whole sector’s gone through this three- or four-year transition to make the business model work at $50 a barrel and as soon as we got there the oil price shot up,” RBC analyst Biraj Borkhataria, told the Wall Street Journal. “You’re in the sweet spot.”

- Investors are still not entirely pleased; Shell’s share price fell 4 percent after the earnings release, due to missed expectations.

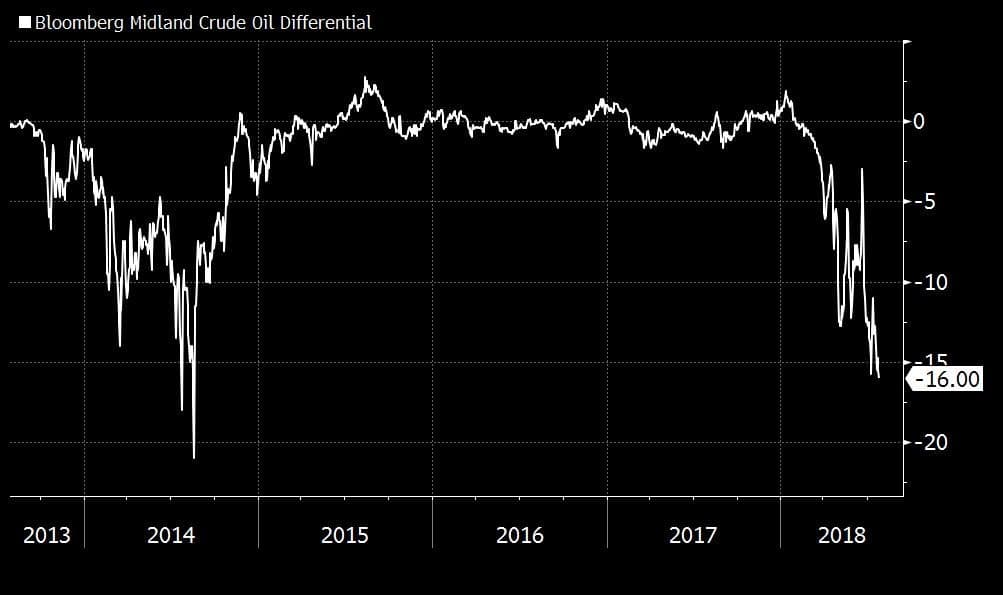

2. Midland prices sink deeper

(Click to enlarge)

- Midland oil prices sunk to a $16-per-barrel discount relative to WTI in Cushing this week, the largest discount since 2014.

- The problem is that the pipeline woes are not going away for at least another year. This week,…

Friday July 27, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Shell’s profits triple

(Click to enlarge)

- Royal Dutch Shell (NYSE: RDS.A) saw its second quarter profits nearly triple compared to a year earlier, a sign that the oil industry is on the upswing after years of steady improvement.

- Shell’s quarterly profit hit $5.2 billion, up from $1.9 billion in the second quarter of 2017.

- Shell has cut its total debt pile – once one of the largest in the world – sufficiently that it initiated a $25 billion share buyback program.

- “The whole sector’s gone through this three- or four-year transition to make the business model work at $50 a barrel and as soon as we got there the oil price shot up,” RBC analyst Biraj Borkhataria, told the Wall Street Journal. “You’re in the sweet spot.”

- Investors are still not entirely pleased; Shell’s share price fell 4 percent after the earnings release, due to missed expectations.

2. Midland prices sink deeper

(Click to enlarge)

- Midland oil prices sunk to a $16-per-barrel discount relative to WTI in Cushing this week, the largest discount since 2014.

- The problem is that the pipeline woes are not going away for at least another year. This week, top oilfield service giants Halliburton (NYSE: HAL) and Schlumberger (NYSE: SLB) warned about a slowdown in the Permian.

- The Permian has around 3.2 mb/d of takeaway capacity, a figure that probably won’t edge up until sometime in 2019. Wood Mackenzie just published a report predicting that midstream relief may not come until 2020 due to delays at the handful of pipeline projects underway.

- The Midland discount could deepen if Permian producers continue to push up production.

- The WTI dips, or the Midland discount grows larger, Permian producers without secured pipeline space could soon be fetching less than $50 per barrel for their oil.

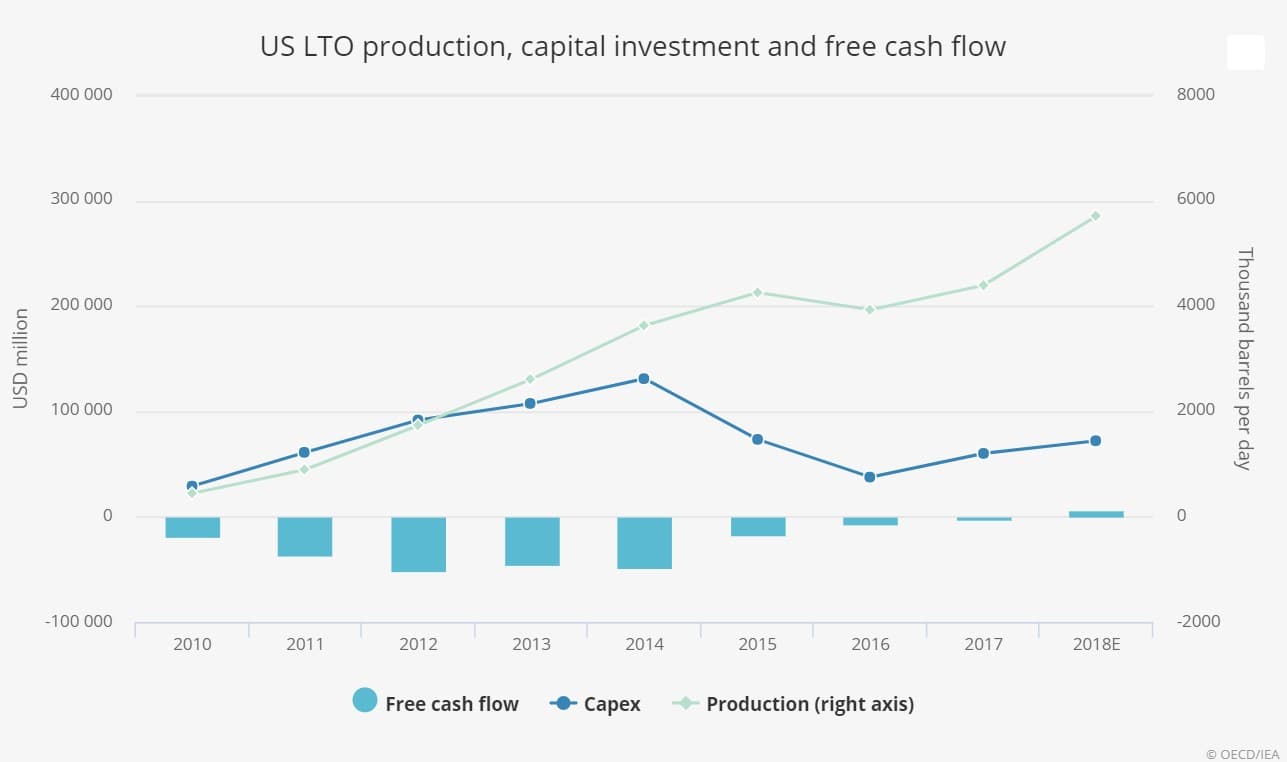

3. U.S. shale to become cash flow positive

- The U.S. shale industry is set to become cash flow positive “for the first time in its history,” according to the IEA.

- Investment in U.S. shale quadrupled between 2010 and 2014, allowing production to spike from 0.44 mb/d to 3.6 mb/d. However, the industry racked up $200 billion in negative cash flow over that timeframe.

- A severe contraction in spending following the market downturn in 2014 helped reduce the hemorrhaging, but even through 2017 the shale industry posted a collective negative cash flow.

- This year could be different. Higher oil prices, lower breakeven prices, and only minor cost inflation could mean that the entire shale industry becomes collectively cash flow positive, but only slightly.

4. Permian-exposed Halliburton trading at discount

(Click to enlarge)

- Halliburton (NYSE: HAL) posted solid profits for the second quarter, but warned shareholders that it is seeing some customers decamp from the Permian for other shale basins.

- Halliburton is the largest service company in the Permian, and its share price has been battered because of the coming slowdown in drilling.

- Halliburton trades at a 35 percent discount to Schlumberger (NYSE: SLB), its larger competitor. The reason is that Schlumberger is much more internationally-focused, so the Permian woes are dragging down Halliburton’s share price.

- That’s the largest discount since 2016, when the shale industry hit its nadir.

- Halliburton will likely make up ground when new pipelines come online next year.

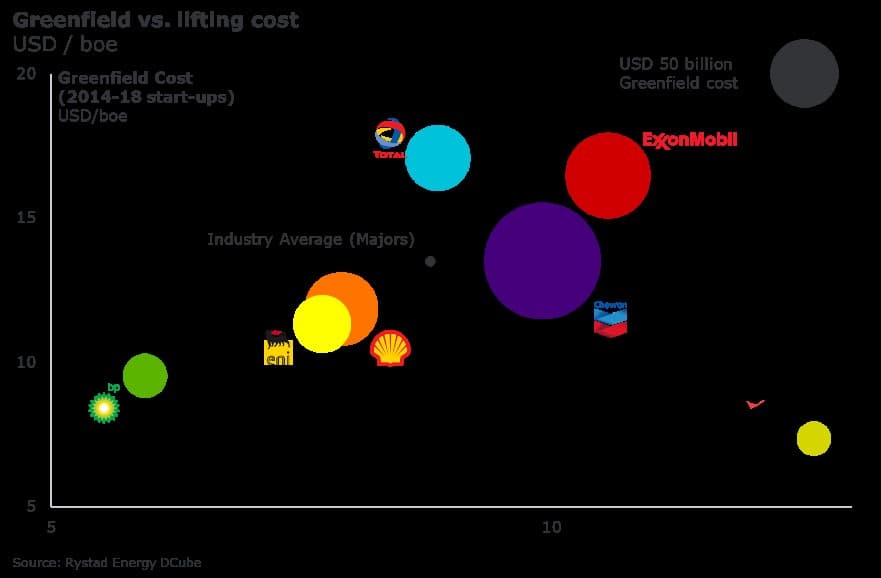

5. BP, Eni and Shell best-in-class

(Click to enlarge)

- BP (NYSE: BP), Eni (NYSE: E) and Royal Dutch Shell (NYSE: RDS.A) are the “best-in-class” in terms of greenfield development, according to Rystad Energy.

- For projects that have started up since 2014, the oil majors have collective average greenfield costs of $13.50 per barrel of oil equivalent. Those development costs come in addition to the average $8.80-per-barrel lifting cost in 2017.

- Rystad says the European majors are outperforming Chevron (NYSE: CVX) and ExxonMobil (NYSE: XOM) on these metrics.

- “It is remarkable that BP, Eni and Shell introduced over $109 billion of new greenfield projects below the industry average greenfield cost and still were able to still achieve industry-leading lifting costs in 2017,” Matthew Fitzsimmons, Vice President at Rystad, said in a statement. “BP’s $6.0 billion investment in the Khazzan Phase 1 and Makarem projects in Oman highlighted their execution excellence by achieving greenfield costs below $5 per barrel of oil equivalent.”

- Exxon, on the other hand, started up nearly $75 billion worth of projects, and their costs have deteriorated and trail the industry average. Exxon has held back on greenlighting new projects while the European majors have moved forward much more aggressively.

6. Shale industry steps up spending despite capital discipline

(Click to enlarge)

- The U.S. shale industry still plans on stepping up spending this year, despite promises of capital discipline.

- A sample of the top 40 E&Ps finds that spending is set to increase by 9 percent in 2018, with 23 large-caps planning a spending increase of 13 percent.

- The bulk of that is occurring in the Permian (up 19 percent), according to Barclays, while “gassy” E&Ps (those with a production mix heavily weighted towards natural gas) plan to cut capex by 11 percent.

- Still, overall, capital discipline has “taken hold,” Barclays said in a note, pointing out that the “plowback ratio” has fallen below 100 percent.

7. Chokepoints in focus

(Click to enlarge)

- Saudi Arabia suspended oil shipments through the strait of Bab el-Mandeb this week after Houthi rebels attacked two Saudi Aramco tankers, each carrying 1 million barrels.

- The action came just days after Iran threatened to shut the Strait of Hormuz, and U.S. President Trump fired back in a tweet with a threat of his own. The events led to speculation about the possibility of an outage at the world’s most significant chokepoint.

- Hormuz sees 18.5 mb/d of oil supply pass through a narrow 20-mile bottleneck every day. It also happens to be located in an unstable neighborhood, with oil from Iran, Iraq, Saudi Arabia, Qatar, Bahrain and the UAE passing through the Strait. An outage in Hormuz for any period of time longer than a few days would quickly send oil price up to triple digits.

- Other important chokepoints include the Strait of Malacca (16 mb/d) between Indonesia and Malaysia; the Suez Canal and SUMED pipeline in Egypt (5.5 mb/d); the Bab el-Mandeb Strait between the horn of Africa and Yemen (4.8 mb/d); along with a series of smaller and less vulnerable chokepoints elsewhere.

- “Disruptions to these routes could affect oil prices and add thousands of miles of transit in alternative routes,” according to the EIA.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.