Oil prices started the week moving upwards after geopolitical tensions threatened both Iranian and Saudi Arabian oil, but a rising rig count on Friday has all but erased those gains.

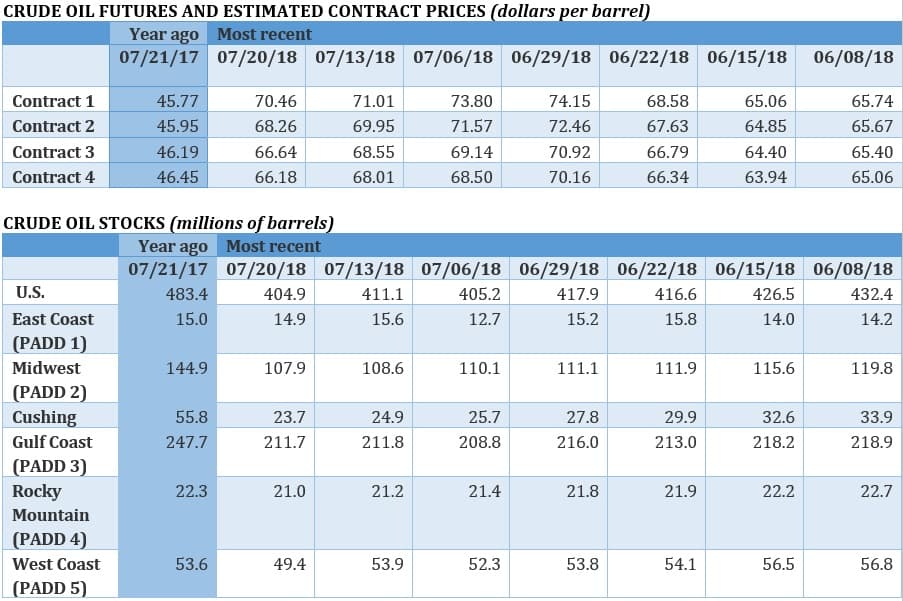

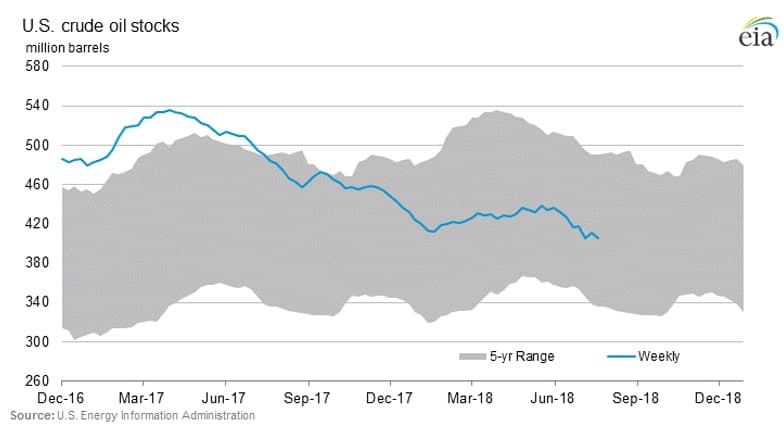

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

Friday, July 27, 2018

It was mostly a quiet week for oil prices, rising on the back of geopolitical tensions at the start of the week before losing those gains on Friday as the oil rig count increased. Earnings reports started trickling in this week, with strong performances across the board. The recovery of oil markets in the last year is starting to be reflected in earnings, although some share prices were battered as Wall Street had expected more.

Shell posts strong earnings, initiates $25 billion share buyback. Royal Dutch Shell (NYSE: RDS.A) nearly tripled its profits in the second quarter, year-on-year, and announced the beginning of a $25 billion share buyback program. Investors weren’t convinced, and Shell’s stock sunk nearly 4 percent on the news. The skepticism may have been the result of the 1.5 percent decline in production, which stemmed from field declines and asset sales. Also, Shell’s earnings came in a little under expectations. Shell’s gearing, or debt ratio to capitalization, declined from 24.7 percent in the first quarter to 23.6 percent in the second, another sign of progress.

BP to pay $10.5 billion for BHP shale assets. BP (NYSE: BP) agreed to purchase BHP’s (NYSE: BBL) shale assets for $10.5 billion. BHP has been trying to unload its shale assets for a while, after losing some $19 billion on shale, so the sale is welcome. For BP, the acquisition is an enormous splash, making it a major player in U.S. shale. The assets are located in the Eagle Ford, Permian and Haynesville shales. “This is a transformational acquisition for our (onshore U.S.) business, a major step in delivering our upstream strategy and a world-class addition to BP’s distinctive portfolio,” BP Chief Executive Bob Dudley said in a statement. BP also hiked its dividend for the first time in almost four years and also announced a $6 billion share buyback.

Related: The Three Best Oil Majors Of 2018

Chevron doubles earnings, Exxon’s up 18 percent. Chevron (NYSE: CVX) reported earnings of $3.8 billion for the second quarter, more than twice as much as a year earlier. Like some of the others, earnings still came in a bit under expectations – shares were down 2 percent on the news. Meanwhile, ExxonMobil (NYSE: XOM) fell 4 percent in early trading on Friday after undershooting expectations. The oil major said that production fell 7 percent in the second quarter, year-on-year, even as Permian and Bakken production jumped. Exxon earned just under $4 billion for the quarter, up 18 percent from a year earlier.

Saudi Arabia halted shipments through Bab el-Mandeb. Saudi Arabia halted shipments through the crucial chokepoint of Bab el-Mandeb this week after Houthi rebels attacked two Aramco tankers. Nearly 5 million barrels per day of oil volumes pass through the narrow strait between the horn of Africa and Yemen.

Airlines cutting capacity because of fuel costs. Many of the largest U.S. airline companies are trimming flights and raising fares in reaction to rising fuel prices.

Trump calls off trade war with Europe…maybe. President Trump boasted about a breakthrough in trade relations with Europe this week, seeming to support a free trade proposal that resembles the one that the Obama administration and Europe had been considering. He said the two sides would have talks on “zero tariffs, zero non-tariff barriers, and zero subsidies on non-auto industrial goods.” Trump also suggested that Europe would buy up American soybeans – hit hard in the current trade fight with China – and American LNG. Light on details, the market did not know what to make of the announcement, but welcomed the easing of relations. But already, the vague breakthrough is running into trouble, with both sides far apart on whether or not agriculture should even be considered as part of the negotiations.

Saudi Arabia pressures Aramco to take on debt. With the IPO of Saudi Aramco on ice, the Saudi government is pressing Aramco to raise tens of billions of dollars in debt to fund the country’s economic transformation, according to the WSJ. Saudi officials want Aramco to raise debt to buy a controlling stake in SABIC, a Saudi petrochemical company, currently owned by the sovereign wealth fund. The move would effectively transfer $50 to $70 billion to the Saudi sovereign wealth fund, handing a mountain of cash to the government.

CNPC to spend $22 billion through 2020 to boost production. China’s state-owned CNPC announced plans to spend $22 billion by 2020 to boost oil and gas production in its western region of Xinjiang, according to Reuters. The move would help offset declining production from mature fields in China’s northeast.

Related: The Most Important Waterway In The Oil World

Occidental Petroleum considers sale of pipeline assets. Occidental Petroleum (NYSE: OXY) is exploring the sale of its pipeline assets, which could be worth as much as $5 billion. The move would give the company resources to boost exploration and production. The sale of pipeline assets is timely given the high valuation for midstream assets.

Indian refiner cancels purchase of Iranian oil. India’s Hindustan Petroleum Corp. cancelled the purchase of an Iranian oil cargo because it couldn’t obtain insurance for the shipment, due to U.S. sanctions. The cancellation suggests U.S. sanctions will be more effective than once thought.

Deepwater drilling picks up. “The broad-based recovery is now also reaching the offshore market,” Patrick Schorn, executive vice-president of wells at Schlumberger (NYSE: SLB), told analysts last week. “We are preparing ourselves further for deepwater.” Schlumberger, along with Halliburton (NYSE: HAL), warned investors that the Permian could see a slowdown. But Schlumberger, more internationally-focused than Halliburton, struck a more optimistic tone regarding offshore drilling, noting that drilling could rise by 10 percent this year. According to analysts at Bernstein, there could be 40 final investment decisions on offshore projects this year, up from just 29 in 2017 and 14 in 2016.

Chesapeake Energy to sell $2 billion Utica assets. Chesapeake Energy (NYSE: CHK) is selling its remaining assets in the Utica shale for $2 billion in order to slash the company’s debt.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- Strong Dollar Could Cap Oil Prices

- Are Oil Markets Underestimating Iran’s Threats?

- Oil Prices Slip As Rig Count Inches Higher

I'm afraid I don't see much to celebrate in the oil-producing world. . . unless it's the Saudis who aim to get their economy diversified away from utter oil dependency.

The world needs to clean itself up, and measure progress differently than profits for a relatively few, for a relatively brief period of time.