Friday January 26, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Shell catching up with Exxon

(Click to enlarge)

- Royal Dutch Shell (NYSE: RDS.A) is expected to post $16 billion in earnings for 2017 when it reports financials next week, a figure that could eclipse ExxonMobil’s (NYSE: XOM) earnings of $15.7 billion. If so, it would be the first time Shell took in more profits than its American rival in more than two decades.

- Shell’s rise is largely the result of its purchase of BG Group, a $53 billion acquisition that is now paying off. The purchase gave Shell large LNG assets in Australia and offshore oil assets in Brazil.

- Shell’s shares have returned more than five times that of Exxon’s, notes Bloomberg, making it a better vehicle for investors than Exxon.

- Shell is closing the gap on Exxon in terms of market share. In early 2015, before the BG deal, Exxon’s market cap exceeded Shell’s by $180 billion. Shell has since close the gap to just $73 billion.

- Exxon’s production has eroded a bit while Shell’s is rising, suggesting the two will continue to converge. “At the moment we are number two and we are closing in on number one,” Shell CEO Ben van Beurden recently said. “We almost have the tiger by…

Friday January 26, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Shell catching up with Exxon

(Click to enlarge)

- Royal Dutch Shell (NYSE: RDS.A) is expected to post $16 billion in earnings for 2017 when it reports financials next week, a figure that could eclipse ExxonMobil’s (NYSE: XOM) earnings of $15.7 billion. If so, it would be the first time Shell took in more profits than its American rival in more than two decades.

- Shell’s rise is largely the result of its purchase of BG Group, a $53 billion acquisition that is now paying off. The purchase gave Shell large LNG assets in Australia and offshore oil assets in Brazil.

- Shell’s shares have returned more than five times that of Exxon’s, notes Bloomberg, making it a better vehicle for investors than Exxon.

- Shell is closing the gap on Exxon in terms of market share. In early 2015, before the BG deal, Exxon’s market cap exceeded Shell’s by $180 billion. Shell has since close the gap to just $73 billion.

- Exxon’s production has eroded a bit while Shell’s is rising, suggesting the two will continue to converge. “At the moment we are number two and we are closing in on number one,” Shell CEO Ben van Beurden recently said. “We almost have the tiger by the tail.”

2. Geopolitical unrest looms over oil

(Click to enlarge)

- Geopolitical uncertainty has returned to the oil market over the past few months, both because of an uptick in supply outages as well as the ongoing slide in inventories.

- “When you have enormous stockpiles, these stockpiles serve to dampen and insulate the commodity from idiosyncratic shocks like supply disruptions, like geopolitical risk,” Mark Keenan, global commodities strategist at Societe Generale SA, told Bloomberg.

- With inventories falling towards the five-year average, there is less of a buffer to guard against outages.

- In July 2017, supply outages dropped to 1.2 mb/d, the lowest level in more than four years.

- Citigroup predicts the outages could rise to more than 3 mb/d, with unexpected losses coming from Venezuela, Libya, Iraq, Iran, Kuwait and Nigeria.

- That could send prices up to $70-$80 in the first half of this year, Citi says.

3. Delayed projects getting the greenlight

(Click to enlarge)

- The collapse of oil prices in 2014 led to a massive backlog of upstream oil and gas projects that were put on ice.

- The number of delayed projects hit a peak in January 2017 at 111, which represented a combined $326 billion of capex and 43 billion barrels of oil equivalent sitting on the sidelines, according to Rystad Energy.

- However, the oil industry started to move forward on some of these projects last year, a sign of growing confidence in the health of the market. 18 major projects that were once delayed were given final investment decisions in 2017, compared to just 2 in 2015 and 5 in 2016.

- Overall, the 25 projects that received FIDs since 2014 represent 16 billion boe and $87 billion in investment.

- “The industry has put in a lot of spadework to advance these delayed projects,” Readul Islam, a research analyst at Rystad, said in the report. “With over 100 projects still in our tracker as we enter 2018, the hard work must continue to maintain 2017’s momentum.”

4. Trump targets imported solar panels

(Click to enlarge)

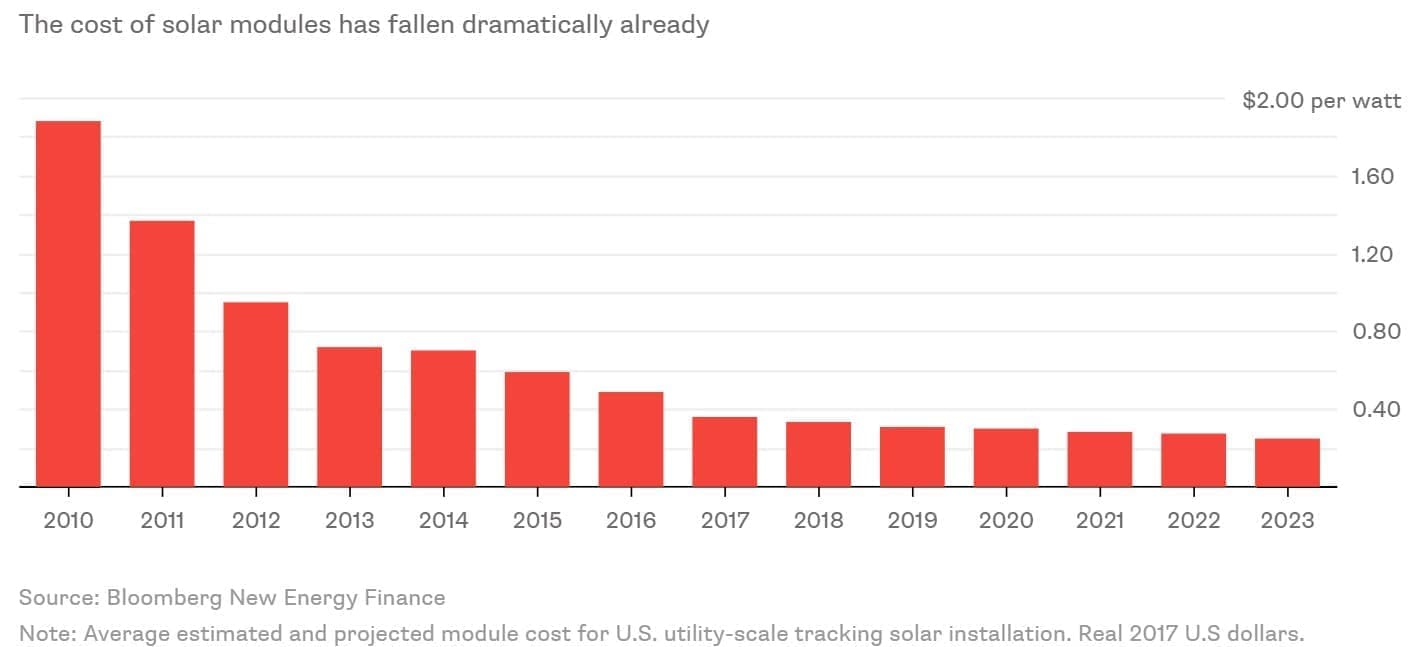

- President Trump slapped tariffs on imported solar panels this week, raising the ire of even some in his own party. The 30 percent tariff on imported solar panels will hit the solar industry hard, particularly because the U.S. solar industry relies on imported panels for 80 percent of its supply.

- The Solar Energy Industries Association said the move would eliminate 23,000 solar jobs.

- But independent analysts say the move won’t kill the industry. Solar panels only makeup a fraction of the total cost of a solar project.

- The tariffs could raise the cost of solar by 10 cents per watt to 43 cents/watt, which essentially sets the industry back to the cost levels of 2016 – a time when the industry was still doing well.

- Few analysts, if any, expect an uptick in solar manufacturing from the tariffs.

- In essence, the policy is the worst of all worlds – it will damage solar projects, but not do enough to revive domestic solar manufacturing at all.

5. Inventories continue to fall

(Click to enlarge)

- Oil prices received a boost this week when the EIA reported a surprise drawdown in crude inventories after an API forecast predicted an increase.

- Crude stocks dropped to 411.6 million barrels, their lowest level since early 2015 and are getting close to the five-year average. Stocks in Cushing dipped below 40 million barrels for the first time in three years.

- There was a very large jump in U.S. oil production, but the squeeze on inventories provided a boost to prices.

- “The report is mixed, due to the further rise in domestic production to 9.9 million bpd, but the large decline in Gulf Coast crude oil inventories and the continued fairly rapid decline at Cushing, Oklahoma is offsetting,” John Kilduff, partner at energy hedge fund Again Capital LLC, told Reuters.

- Still, most analysts predict a return to inventory increases in the coming weeks, which could test the durability of the current rally.

6. Weaker dollar pushing up oil

(Click to enlarge)

- The dollar has declined significantly since December, with a steep drop this week on comments from U.S. Treasury Secretary Steven Mnuchin, who seemingly voiced support for a weaker greenback. The dollar slid after he said a weaker currency would help exports.

- The dollar index, which measures the USD against a basket of major currencies, has declined by about 5 percent in the past two months.

- The dollar index briefly dropped below 88.5, the lowest level since late 2014.

- The fall of the dollar has helped push up oil prices. Because crude contracts are denominated in dollars, a weaker dollar makes crude relatively more affordable to the rest of the world, pushing up its price.

- Looking forward, more support to weaken the U.S. currency would be bullish for oil. But Washington could walk back its position about a weaker dollar.

- More importantly, the Federal Reserve is expected to continue monetary tightening, which could create pitfalls for crude prices.

7. Natural gas stocks continue to plunge

(Click to enlarge)

- Natural gas inventories plunged by 288 Bcf for the week ending on January 19, which puts total stocks at 2,296 Bcf, or 519 Bcf below last year’s levels and 486 Bcf below the five-year average.

- In fact, inventories are now below even the lower end of the five-year range.

- Natural gas prices on the Nymex surged to $3.50/MMBtu from about $3/MMBtu just a few weeks ago. On Tuesday alone, prices jumped by nearly 7 percent.

- Another bout of cold weather is in store, raising concerns about a market that is tightening too much. “Storage is low—precariously low,” Bill Perkins, who runs the natural gas-focused fund Skylar Capital Management LP, told the WSJ.

- Still, given how low inventories have declined, prices remain relatively subdued. The market expects a wave of new supply this year from shale gas drillers, which should take production up to fresh record highs.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.