Friday December 1, 2017

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. OPEC extends cuts to target inventories

(Click to enlarge)

- OPEC’s main objective is to bring OECD crude and product inventories back to the five-year average.

- The production limits had a limited effect at the beginning of the year (in part because of the ramp up in production and exports at the end of 2016), but the drawdowns really picked up pace in the second and third quarter.

- Total crude and refined product stocks are now only about 140 million barrels above the five-year average, less than half of the surplus that was seen at the start of the year.

- Still, OPEC wants to bring that total back to average levels, an objective that was used as the justification for the extension of the production cuts.

2. Hedge funds trim bets ahead of OPEC meeting

(Click to enlarge)

- Hedge funds and other money managers cut their bullish bets on Brent for the second week in a row, just ahead of the OPEC meeting.

- Speculators had taken their net-long bets on crude to record levels in recent weeks, but there is now some tentative evidence that they are growing skittish.

- With little room on the upside, and the 9-month OPEC…

Friday December 1, 2017

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. OPEC extends cuts to target inventories

(Click to enlarge)

- OPEC’s main objective is to bring OECD crude and product inventories back to the five-year average.

- The production limits had a limited effect at the beginning of the year (in part because of the ramp up in production and exports at the end of 2016), but the drawdowns really picked up pace in the second and third quarter.

- Total crude and refined product stocks are now only about 140 million barrels above the five-year average, less than half of the surplus that was seen at the start of the year.

- Still, OPEC wants to bring that total back to average levels, an objective that was used as the justification for the extension of the production cuts.

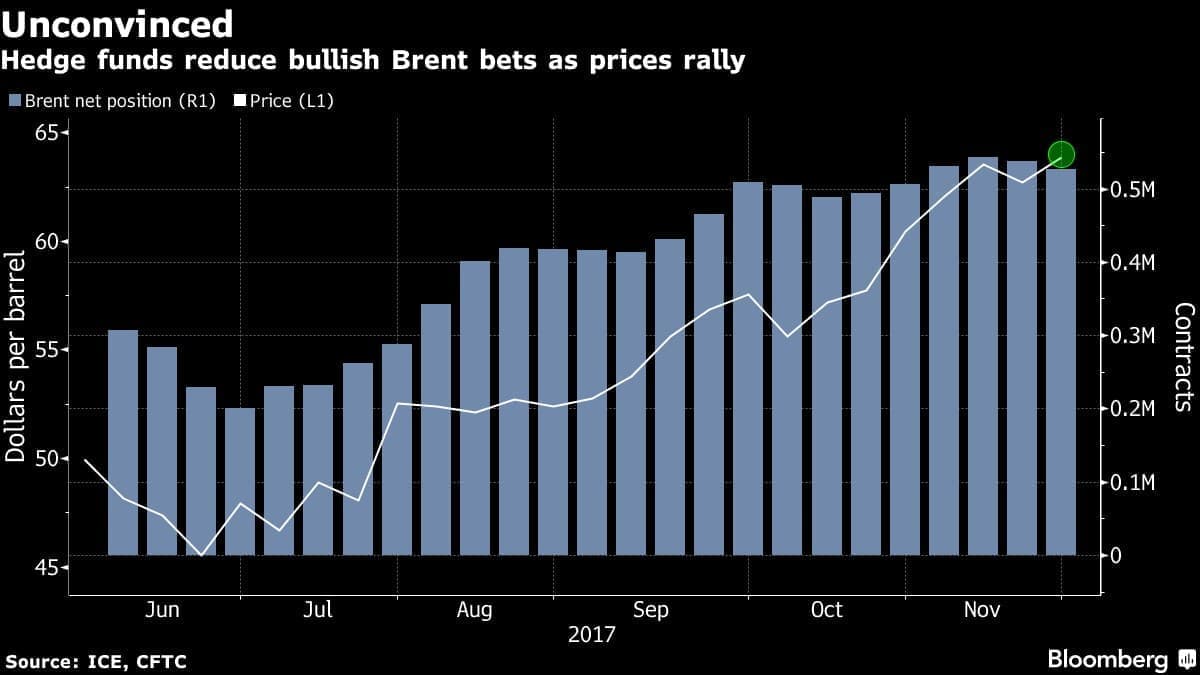

2. Hedge funds trim bets ahead of OPEC meeting

(Click to enlarge)

- Hedge funds and other money managers cut their bullish bets on Brent for the second week in a row, just ahead of the OPEC meeting.

- Speculators had taken their net-long bets on crude to record levels in recent weeks, but there is now some tentative evidence that they are growing skittish.

- With little room on the upside, and the 9-month OPEC extension priced in, investors trimmed their bets, fearing disappointment.

- “There has been a considerable run-up in prices already,” Tamar Essner, an energy analyst at Nasdaq Inc., told Bloomberg. “Even if OPEC does exactly what they say they’re going to do, the market wants more shock and awe.

- The oil market largely shrugged at the OPEC extension, with the meeting producing the expected result. Prices did see a significant rally on Friday morning however.

3. Shell makes a comeback

(Click to enlarge)

- One of the most indebted oil companies in the world (behind Petrobras), Royal Dutch Shell (NYSE: RDS.A), has had its share of skeptics in the last few years. The $50 billion price tag for BG Group put Shell’s debt into precarious territory.

- But since then, Shell has severely cut costs, disposed of assets, paid down debt and boosted cash flow. Investors have rewarded the Anglo-Dutch oil major – its share price is up 40 percent in the past two years.

- Shell announced a return to a full cash dividend after two years of scrip.

- Shell also increased its free cash flow guidance to a range of $25 to $30 billion by 2020, an increase of $5 billion from its prior outlook.

- Shell has survived the worst of the downturn and is back on solid ground.

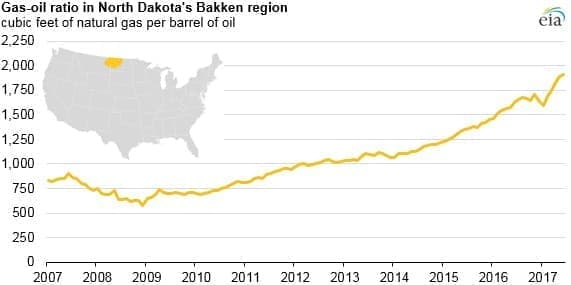

4. Bakken production skewing towards gas

(Click to enlarge)

- The ratio of natural gas to oil production (the gas-to-oil ratio) in the Bakken has been climbing since 2008, but has increased sharply in the past two years.

- North Dakota oil output peaked in December 2014 at 1.2 million barrels per day (mb/d), dropping more recently to 1.07 mb/d.

- But natural gas production continues to rise, hitting a record high 1.94 Bcf/d in August 2017.

- Over time, the gas-to-oil ratio tends to rise, but the recent spike in the ratio could be something to keep an eye on for oil investors.

- A higher-than-expected gas-to-oil ratio in the Permian spooked investors of Pioneer Natural Resources (NYSE: PXD) this past summer.

5. China’s gas consumption surges

(Click to enlarge)

- China has made a concerted effort to increase natural gas consumption so that it can shut down dirty old coal plants. 2017 has been a turning point.

- Natural gas consumption in China is up 19 percent through October from a year earlier, and that comes even before peak winter demand. Sanford C. Bernstein & Co. declared it a “golden age” for gas in China.

- LNG imports have jumped by 48 percent year-on-year through October.

- But the spike in consumption is causing shortages in certain areas. Bloomberg reports that Hebei province has shortages of 10 to 20 percent.

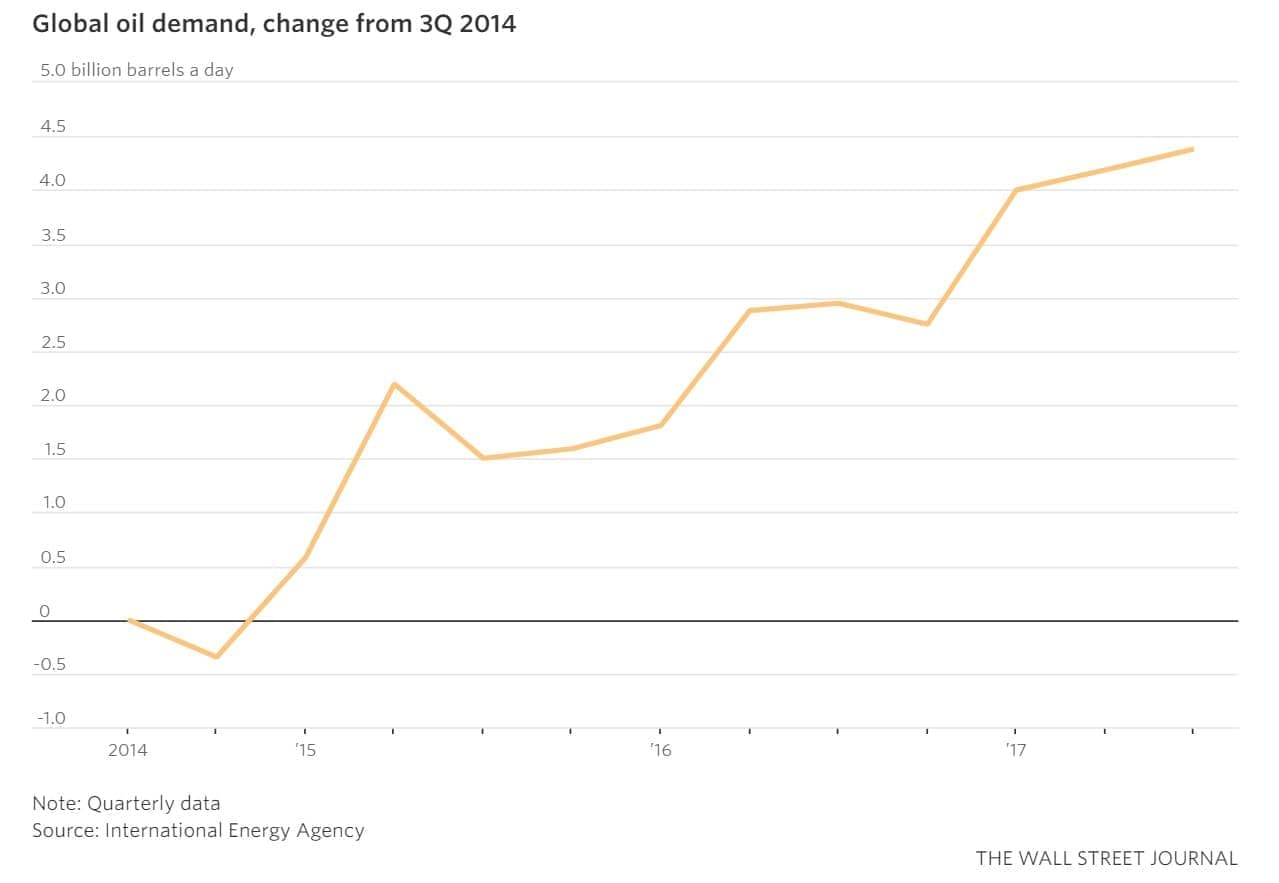

6. Oil demand on the rise

(Click to enlarge)

- The IEA nearly derailed the oil rally a couple of weeks ago when it downgraded its assessment for global oil demand growth for 2017 and 2018.

- Despite the fears, oil demand is growing briskly, turbocharged over the last three years by low prices.

- The IEA sees demand hitting 98.2 million barrels per day (mb/d) in the fourth quarter, up 1.5 mb/d from a year earlier.

- But demand is up a whopping 4.5 mb/d since the 3rd quarter of 2014, when oil prices began their descent.

- That has soaked up much of the supply glut, which should ease fears of another downturn.

7. U.S. oil imports plunging

(CIick to enlarge)

- U.S. net oil imports, which includes refined products, plunged to just 1.77 mb/d last week, the lowest level since data collection began in 1990.

- On a monthly basis, the U.S. is on track to record its lowest net-import total since the Arab oil embargo in 1973, Bloomberg notes.

- The peak of net imports was hit in 2005 at 14 mb/d.

- The more U.S. shale grows, the more that net-import total will shrink. “Every barrel the U.S. is able to grow now is a barrel that needs to be exported,” Roger Diwan, an analyst at IHS Markit, told Bloomberg.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.