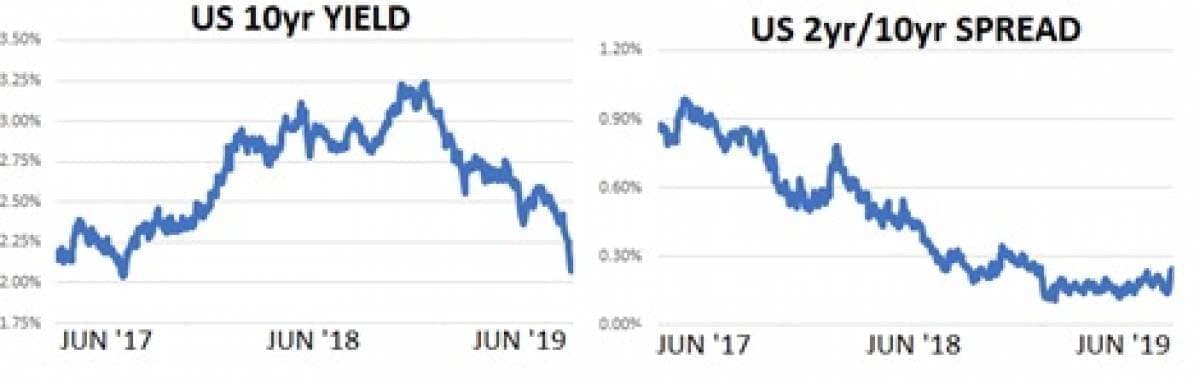

Recent financial market headlines have been dominated by stories covering the plunge in global interest rates. And for good reason. Government bond yields have been sinking like a stone lead by a move in the US 10yr yield down to 2.1% for an 18-month low. Meanwhile, in overnight markets, the 3-month LIBOR has dropped from 2.8% in December to 2.5% this week. So why are investors flocking to bonds? Simple- heated rhetoric between Washington and Beijing is making a US/China trade pact seem less and less likely every day and raising concerns that elevated tariffs could trigger a global recession.

Concern that the two sides are only moving farther from a deal is justified. Rhetoric from the Trump administration is taking a hard line, no compromise attitude towards the negotiations which could be difficult to reverse. In Beijing, President Xi is now using the tougher US stance to generate nationalist support arguing the US is maligning the Chinese and threatening their sovereignty. The Chinese newspaper People’s Daily has taken an extremely aggressive path in generating support of a non-cooperative trade attitude writing “we advise the US side not to underestimate the Chinese side’s ability to safeguard its development rights and interests. Don’t say we didn’t warn you!” Chinese officials have also threatened to cut off exports of rare earth materials used by the US to make electronics, defense materials and electric vehicles. The issue here, of course, is that both sides…

Recent financial market headlines have been dominated by stories covering the plunge in global interest rates. And for good reason. Government bond yields have been sinking like a stone lead by a move in the US 10yr yield down to 2.1% for an 18-month low. Meanwhile, in overnight markets, the 3-month LIBOR has dropped from 2.8% in December to 2.5% this week. So why are investors flocking to bonds? Simple- heated rhetoric between Washington and Beijing is making a US/China trade pact seem less and less likely every day and raising concerns that elevated tariffs could trigger a global recession.

Concern that the two sides are only moving farther from a deal is justified. Rhetoric from the Trump administration is taking a hard line, no compromise attitude towards the negotiations which could be difficult to reverse. In Beijing, President Xi is now using the tougher US stance to generate nationalist support arguing the US is maligning the Chinese and threatening their sovereignty. The Chinese newspaper People’s Daily has taken an extremely aggressive path in generating support of a non-cooperative trade attitude writing “we advise the US side not to underestimate the Chinese side’s ability to safeguard its development rights and interests. Don’t say we didn’t warn you!” Chinese officials have also threatened to cut off exports of rare earth materials used by the US to make electronics, defense materials and electric vehicles. The issue here, of course, is that both sides seem to have left the negotiating table in a manner that will make it hard to return by making overtures to their supporters at home rather than to each other. While a 2019 trade pact is certainly still possible, financial markets are putting lower and lower probabilities on a deal being struck.

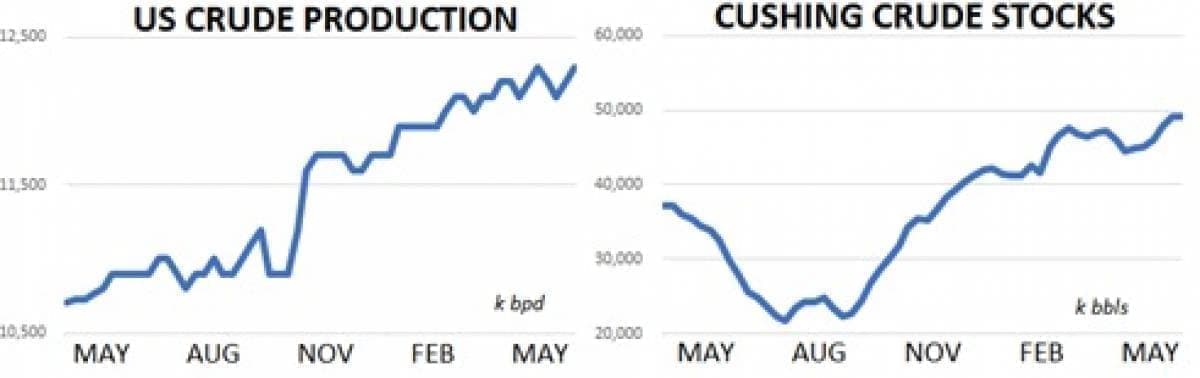

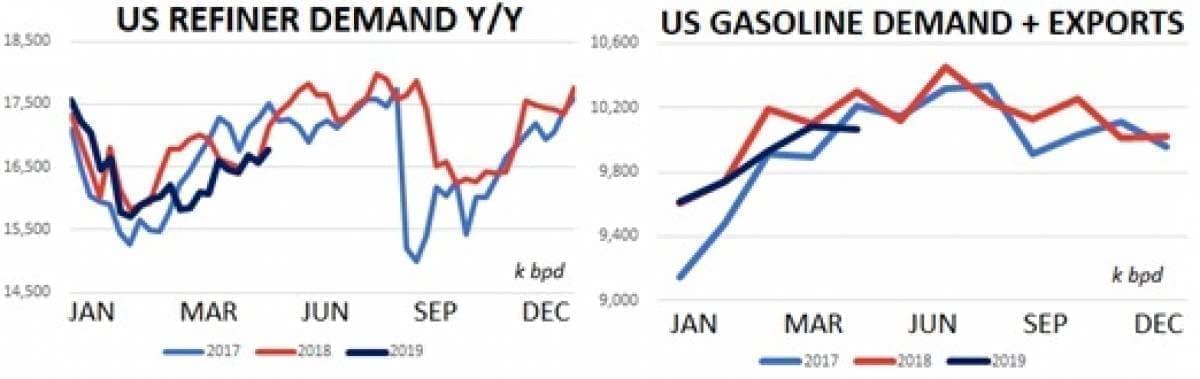

So why should oil traders care about the increasingly bearish macro picture? After all, we’ve had low-interest rates correspond with a wide range of oil prices in the past. In fact, we can’t find any sort of statistically meaningful relationship between interest rates and oil prices over the last ten years. Low-interest rates don’t have to mean low or high oil prices. However, we can say with a high degree of confidence in current circumstances that US/China tensions will persist as a bearish input in a market where demand growth is already seriously lacking and global crude inventories are rising. Remember that current oil supply/demand balances are bearish despite a myriad of geopolitical risks and aggressive OPEC+ supply cuts. In the face of all the bullish headlines in 2019, US crude inventories are still higher by more than 36m bbls YTD while US refiner demand is lower by more than 200k bpd y/y. At the end-user level US domestic gasoline consumption + exports are down more than 100k bpd y/y. The oil markets simply lack the fundamentals to materially strengthen without hope of a US/China trade deal. We won’t offer an opinion on when the two sides may work to cool the rhetoric and return to negotiations, but we are confident that crude prices will face serious bearish headwinds so long as they stay away from the table.

Away from the bond market, Saudi Arabia’s Energy Minister made headlines this week by strongly implying that OPEC+ will continue to cooperate on oil supply cuts in the second half of the year. We were also interested to see Boris Johnson getting traction in polls to become Britain’s next Prime Minister while US central bankers suggested that rate cuts could be on the horizon.

Quick Hits

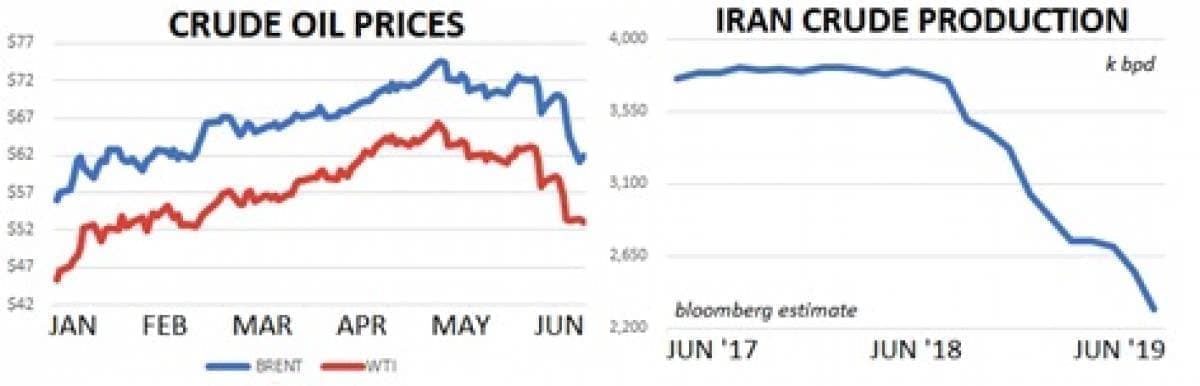

- Oil markets opened sharply lower then flattened out this week with Brent near $61.50 and WTI trading $53. Brent crude is now lower by $14 since late April when a US/China trade deal seemed imminent, OPEC+ was demonstrating strong cut-discipline and the Trump administration surprisingly ended the Iran crude waiver program. Since then it’s been a non-stop bearish story driven by the deterioration of US/China trade talks and chronic inventory builds in US crude supplies.

- Estimates for OPEC’s May production efforts are rolling in and we’re obviously taking a sharp interest in Iran’s current efforts. Bloomberg estimated the nation’s production at 2.32m bpd in May for a 230k bpd reduction m/m. The mark represents a 1.5m bpd decrease from just 12 months ago. Away from Iran, Saudi output increased 160k bpd to 9.96m bpd, Iraqi output increased 50k bpd to 4.68m bpd, Nigerian production fell 40k bpd to 1.86m bpd and Venezuelan production fell 30k bpd to 810k bpd. The cartel’s total production was flat m/m at 30.3m bpd.

- Given that the macroeconomic scene is currently driving crude oil prices lower we thought it would be a good use of time to pay extra attention to what’s currently going on in government bond markets. As we illustrate, the US 10yr yield is in free fall moving from 3.25% last fall to 2.10% at present.

- Perhaps even more importantly, the US 2yr/10yr bond spread has completely collapsed implying bond traders expect interest rates to remain low for an extended period. This structure reveals a large amount of pessimism on the growth prospects of the global economy.

- It isn’t just bond traders who are concerned about what the US/China trade war is doing to the health of the economy. This week Australia’s central bank cut their key rate to 1.25%- representing an all-time low- as storm clouds gather over the Chinese economy. Meanwhile in the US 12-month Treasury yield sank at an incredibly fast rate moving from 2.3% to 2.1% after US Fed Chief Jerome Powell and St. Louis Fed President James Bullard gave what bond traders interpreted as dovish comments. US Fed Fund Futures now predict two US rate cuts in the second half of 2019.

DOE Wrap Up

- US crude production jumped higher by 100k bpd w/w to 12.3m and tied its record high mark in the process.

- US crude inventories moved lower by about 280k bbls last week to 476.5m. Overall crude stocks are higher by 9% y/y over the last four weeks.

- Inventories in the Cushing delivery hub were essentially unchanged at 49m bbls this week.

- US refiner demand improved by about 200k bpd w/w to 16.8m bpd and but is lower y/y/ by 125k bpd over the last four weeks. Refiner demand is lower by 200k bpd y/y so far in 2019 despite reasonably strong margins in the low $20s.

- The US currently has 28.7 days of supply of crude oil on hand versus 26.0 at the same point last year- a powerful metric in revealing how far OPEC+ has to go if they wish to tighten the market.

- As for trade, US crude imports fell slightly to 6.9m bpd last week while imports moved higher to 3.3m bpd. US crude imports have averaged 7.0m bpd so far in 2019 while exports have averaged 2.7m bpd yielding Net Imports of 4.7m bpd. Net Imports averaged 5.9m bpd in 2018.

- US gasoline inventories increased by 2.2m bbls w/w to 231m and are lower y/y by about 2.5% over the last four weeks.

- US distillate stocks fell 1.6m bbls last week but are higher y/y by about 10% over the last four weeks.

- US gasoline demand + exports printed 10.1m bpd last week and averaged 10.06m bpd in May- lower by an incredible 240k bpd versus May of 2018.