The past week was one of the weakest for crude markets this year – virtually everything combined together to create a highly powerful downward momentum. The oil market worries about the state of global trade were aggravated by the nearing prospect of Chinese retaliatory tariffs entering into vigor on June 01, whilst President Trump threatened Mexico with a set of new restrictive measures, adding to the overwhelmingly negative market sentiment. Add to this Russia’s alleged reluctance to extend the OPEC+ production cuts as the country is waking up from its spring field maintenance season and you get a sense of why crude futures fell to their lowest since February 2019.

The overall market sentiment was eased somewhat Tuesday afternoon by the prospect of China and the US assuaging the tonality of mutual denunciations, as well as hopes that the Federal Reserve may cut interest rates, bringing global benchmark Brent prices in the 61.8-62 USD per barrel interval, whilst WTI traded around 53-53.2 USD per barrel.

1. Saudi Aramco Hikes Asian Prices, Drops Rest

- The Saudi state oil company Saudi Aramco hiked all its Asia-bound July-loading cargoes to unprecedented levels, riding high on the wave of crude dearth in Asia.

- The Arab Light OSP at +2.7 USD per barrel against the Oman/Dubai average is the highest in more than 5 years, whilst the July OSPs for Arab Heavy and Medium are the highest in more than 7 years.

- Saudi Aramco reacted…

The past week was one of the weakest for crude markets this year – virtually everything combined together to create a highly powerful downward momentum. The oil market worries about the state of global trade were aggravated by the nearing prospect of Chinese retaliatory tariffs entering into vigor on June 01, whilst President Trump threatened Mexico with a set of new restrictive measures, adding to the overwhelmingly negative market sentiment. Add to this Russia’s alleged reluctance to extend the OPEC+ production cuts as the country is waking up from its spring field maintenance season and you get a sense of why crude futures fell to their lowest since February 2019.

The overall market sentiment was eased somewhat Tuesday afternoon by the prospect of China and the US assuaging the tonality of mutual denunciations, as well as hopes that the Federal Reserve may cut interest rates, bringing global benchmark Brent prices in the 61.8-62 USD per barrel interval, whilst WTI traded around 53-53.2 USD per barrel.

1. Saudi Aramco Hikes Asian Prices, Drops Rest

- The Saudi state oil company Saudi Aramco hiked all its Asia-bound July-loading cargoes to unprecedented levels, riding high on the wave of crude dearth in Asia.

- The Arab Light OSP at +2.7 USD per barrel against the Oman/Dubai average is the highest in more than 5 years, whilst the July OSPs for Arab Heavy and Medium are the highest in more than 7 years.

- Saudi Aramco reacted promptly on the weakening of Urals in the Baltic, decreasing NW Europe OSPs for July by 1-1.2 USD per barrel.

- The m-o-m price cuts for Mediterranean-bound cargoes were much less palpable as Saudi Aramco dropped them by some 0.1-0.4 USD per barrel, not wishing to lose competition to still robust (albeit already discounted to Brent) Med Urals.

- The US-destined July-loading OSPs witnessed a more nuanced approach to the American market, where Arab Extra Light rose by 0.3 USD per barrel whilst all other grades were cut by 0.3 USD per barrel.

- The time lag between Saudi Aramco issuing its July OSPs and SOMO/NIOC following suit will most probably be longer than usual due to the Ramadan, giving ample time to Middle Eastern NOCs to calibrate their price strategy.

2. Chinese Pipeline Reform Expected Soon

- China’s National Development and Reform Commission (NDRC) has now officially launched the project of liberalizing the country’s oil and gas pipeline sector, tasking the National Energy Administration to create the legal framework for it.

- This would entail the creation of a new state-owned pipeline company that would sweep up all inter-regional pipeline-related assets of China’s leading companies – CNPC, Sinopec and CNOOC.

- Pipeline operators, be they involved in oil or gas, would be compelled to publish information about their spare transportation capacity, transmission fees and other heretofore confidential data.

- As part of the pipeline reform, the NDRC has also mandated that China move towards gas’ heat-value measurement, instead of the previously used volume-based measurements.

- The gas pipeline transmission reform also includes a drive to start pipeline capacity trading, although no specific timeline was set for the objective.

- The only area to be liberalized (of which the Chinese government has so far steered clear) is China’s upstream, where the „big three” still dominate the game.

3. China Stops Buying US Grades… for Now

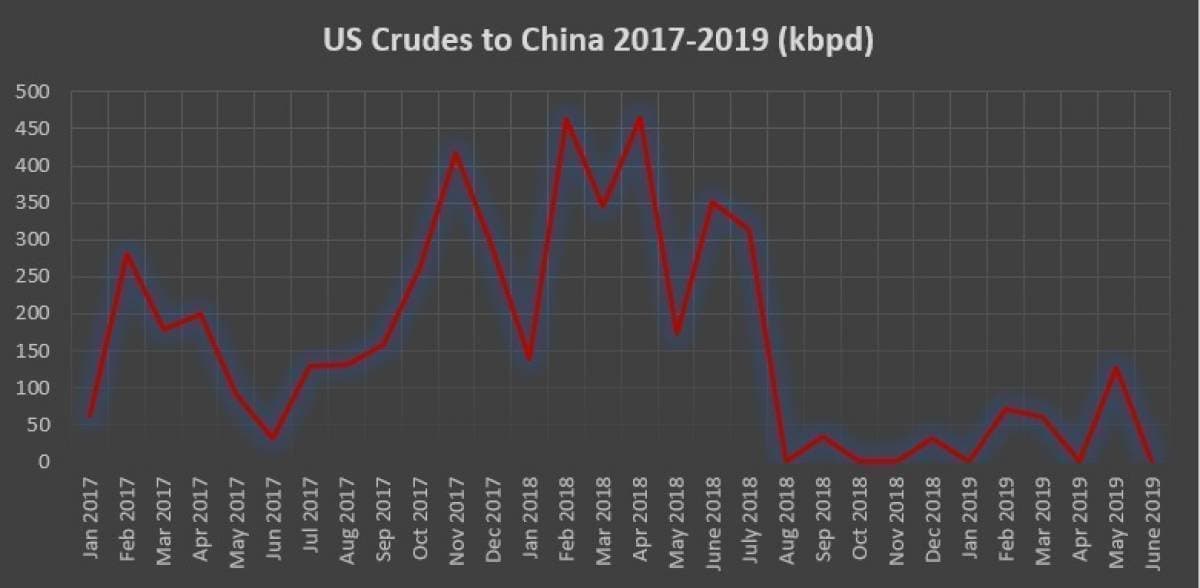

- It seems that Chinese buyers will no longer buy US crude cargoes until the China-US trade war reaches an amicable resolution, with US crude exports to China expected to hit zero this month.

- So far this year China has been buying a mere 42kbpd of American crude, equalling to a roughly fivefold drop in imported volumes from the 2018 average of 192kbpd.

- The last month which saw more than two cargoes of US crude departing for Chinese ports was July 2018, despite a volumetric spike this May.

- This was largely due to Unipec (the only Chinese major dealing with US crudes) taking two VLCCs, one from LOOP and the other from Galveston, aboard MT Maran Ajax and MT Coswisdom Lake.

- Both vessels are en route to Shandong province, to the ports of Lanshan and Qingdao – their discharge will most probably be followed by a pause in exports.

4. New Brunei Refinery Commissioned Soon

- The 175kbpd Hengyi Refinery, a joint venture between Brunei’s state (30 percent) and the Chinese Zhejiang Hengyi (70 percent), is about to start up this month as it has seen an increased intake of West African crudes.

- The primary aim of the new petrochemicals-oriented complex would be to supply other Hengyi sites with aromatics, all the while satiating Brunei’s domestic product demand.

- Located at the island of Muara Besar, the refinery will run predominantly on domestic Brunei crude (Sepia) and West African grades.

- It saw its first imported crude arrive in May (originating from Nigeria), with the second cargo sailing towards Brunei as we speak.

- Hengyi is bringing home a cargo of Zafiro, a 30 API and 0.25 percent Sulphur crude from Equatorial Guinea, attesting that full-scale production is getting increasingly closer.

- The Hengyi refinery’s first phase will see a 8mtpa production capacity, however the sides intend to extend it to 22 mtpa in a planned second-round expansion.

5. Libya OSPs Increases Modest Despite Summer Demand

- The Libyan national oil company hiked all its official selling prices (OSPs) for June-loading cargoes, with Es Sider, Brega and Mesla increased by as much as 15 cents per barrel m-o-m.

- Libya’s NOC did not want to change the OSPs of its sour crudes significantly – rolling over Urals Med-linked Bouri and increasing the price of similarly Urals-pegged Al Jurf by 5 cents per barrel.

- The June price increase could have been more tangible – regional peer Sonatrach hiked its June prices by 35 cents per barrel – yet internal political risks are compelling the Libyan leadership to be modest.

- Demand for Libyan grades is certain to be robust in June as European refiners struggle to satiate the gasoline market after the month-long Urals contamination.

- Even though Libya’s production remains well above 1mbpd, the head of Libya’s NOC Mustafa Sanalla continues to warn against a total collapse in output should hostilities persist.

6. Uganda’s 2nd Licensing Round Hits First Roadblock

- No sooner had the Ugandan government launched its second licensing round than environmentalist groups attacked it for trespassing into a UNESCO world heritage site.

- Among the 6 blocks offered for bidding May 08 was Ngaji, a block that should have been initially allocated in the first licensing round, yet even then advocacy groups ringed the tocsin.

- The Ngaji block combines parts of Lake Edward which is the border of the Virunga national park, one of the most visited places of neighboring Democratic Republic of Congo.

- Environmentalist state that drilling around Lake Edward would have nefarious effects on biodiversity in the DRC national park, one of the last remaining sanctuaries for mountain gorillas.

- Ugandan President Yoweri Museveni claimed that the Ngaji Block would be carried out in any way, yet most probably no drilling-savvy Western company would agree to develop.

- Tullow Oil, which is already active in Uganda, already stated that it will steer clear from any projects that might endanger UNESCO heritage sites, including Ngaji.

7. ENI’s Fifth Angolan Discovery in Past 12 Months

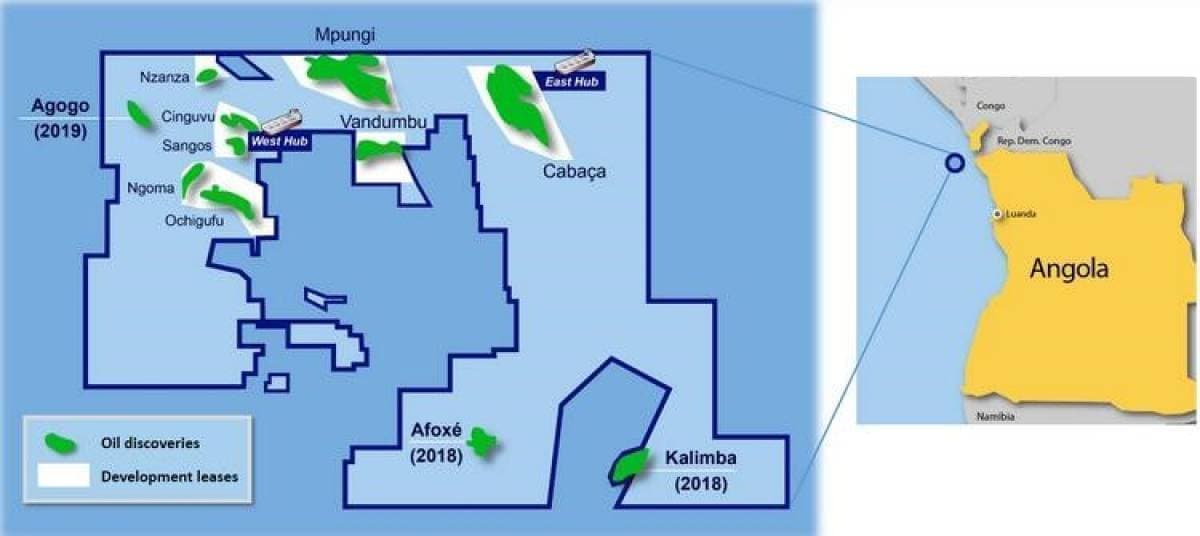

- The Italian major ENI has continued its hot streak with Angolan oil discoveries, adding some 300-400 MMbbls to its aggregate tally within the 15/06 Block in Angola’s offshore.

- The Agidigbo well has been drilled to a total depth of 3800 meters, hitting an net oil pay of some 100 meters.

- Similarly to the Ndungu field discovered last month (oil reserves of at least 250 MMbbls), Agidigbo is located in the vicinity of the East Hub of Block 15/06, rendering its commissioning easier.

- The light sweet Agidigbo will be part of the Olombendo crude stream (35-36 degrees API), named after the East Hub’s FPSO.

- Block 15/06 production, in which ENI acts as an operator, currently stands at 155kbpd, yet the past 12 months’ 5 discoveries – Kalimba, Afoxé, Agogo, Ndungu and Agidigbo - will provide a much-needed boost to the block’s long-term output numbers.