Friday March 23, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Oil demand soaring

(Click to enlarge)

- Oil demand rose by 1.5 million barrels per day (mb/d) in 2017, up from 1.3 mb/d in 2016, and sharply higher than the 0.9 mb/d annual average between 2006 and 2015.

- Cheap oil led to a spike in auto sales, with some parts of the developing world and even Europe starting to gain a taste for less fuel-efficient SUVs rather than compact cars.

- Strong oil demand ultimately meant that global greenhouse gas emissions jumped in 2017 for the first time in three years.

- China and India accounted for 40 percent of the emissions increase, while the U.S. actually posted another year of declining emissions, thanks to renewable energy and natural gas edging coal out of the market.

2. FERC tax change hits MLPs hard

(Click to enlarge)

- The U.S. Federal Energy Regulatory Commission (FERC) issued an obscure ruling that takes away one of the key tax benefits offered by master-limited partnerships (MLPs). MLPs had proliferated as an attractive corporate structure in recent years, particularly in the pipeline business.

- Until last week’s ruling, MLPs could essentially pay little to no corporate tax,…

Friday March 23, 2018

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Oil demand soaring

(Click to enlarge)

- Oil demand rose by 1.5 million barrels per day (mb/d) in 2017, up from 1.3 mb/d in 2016, and sharply higher than the 0.9 mb/d annual average between 2006 and 2015.

- Cheap oil led to a spike in auto sales, with some parts of the developing world and even Europe starting to gain a taste for less fuel-efficient SUVs rather than compact cars.

- Strong oil demand ultimately meant that global greenhouse gas emissions jumped in 2017 for the first time in three years.

- China and India accounted for 40 percent of the emissions increase, while the U.S. actually posted another year of declining emissions, thanks to renewable energy and natural gas edging coal out of the market.

2. FERC tax change hits MLPs hard

(Click to enlarge)

- The U.S. Federal Energy Regulatory Commission (FERC) issued an obscure ruling that takes away one of the key tax benefits offered by master-limited partnerships (MLPs). MLPs had proliferated as an attractive corporate structure in recent years, particularly in the pipeline business.

- Until last week’s ruling, MLPs could essentially pay little to no corporate tax, and they funneled cash to shareholders. MLPs are credited with bolstering the enormous pipeline buildout in the U.S. over the past few years.

- The FERC ruling was met with a selloff by pipeline companies.

- The Alerian MLP Index (INDEXNYSEGIS: AMZ) is down almost 8 percent since last week’s ruling.

- Individual pipeline companies were also hit, and haven’t recovered. Williams Cos. (NYSE: WMB) is down more than 7 percent and Spectra Energy Partners (NYSE: SEP) is down a whopping 17 percent, for example.

3. Fight over oil data

(Click to enlarge)

- Drilling oil and gas wells is becoming a lot more sophisticated, with digitalization, automation, Big Data, robotics, etc., increasingly common. As Bloomberg reports, oilfield service giants are battling with their clients – oil producers – for control of all that data generated during drilling operations.

- “There’s no doubt to me, we are producing two resources: the oil and gas, and the data,” Philippe Herve of SparkCognition told Bloomberg. “The oil and gas is very clear: it belongs to the operator. But who owns the data?”

- A 2015 study by Oxford Economics and Cisco Consulting Services estimated that the full digitalization of an oil field could add $1 trillion to the global economy by 2025.

- Some of the leading oil producers have invested in that data, rather than outsourcing it to oilfield services companies.

- The oilfield service giants are now investing heavily in Big Data, which is becoming an increasingly profitable area for them. At the same time, control of such data is becoming a core feature of contracts between producers and service companies.

4. Brent time spreads turn bullish

(Click to enlarge)

- The Brent futures market took a bullish turn in the past two weeks, moving back into a state of backwardation after a brief period in contango.

- The 1st-to-7th month spread jumped above $2.50 per barrel recently, Reuters reports, up from just $1.65 per barrel on March 13. The same spread was below -$6 per barrel in mid-February.

- The return of backwardation – in which front month contracts trade at a premium to longer-dated futures – indicates expectations of tightness in the oil market.

- The period of contango in February coincided with a downturn in spot oil prices. The return to backwardation suggests that price increases could be forthcoming. Indeed, WTI and Brent rallied this week before Thursday’s loss.

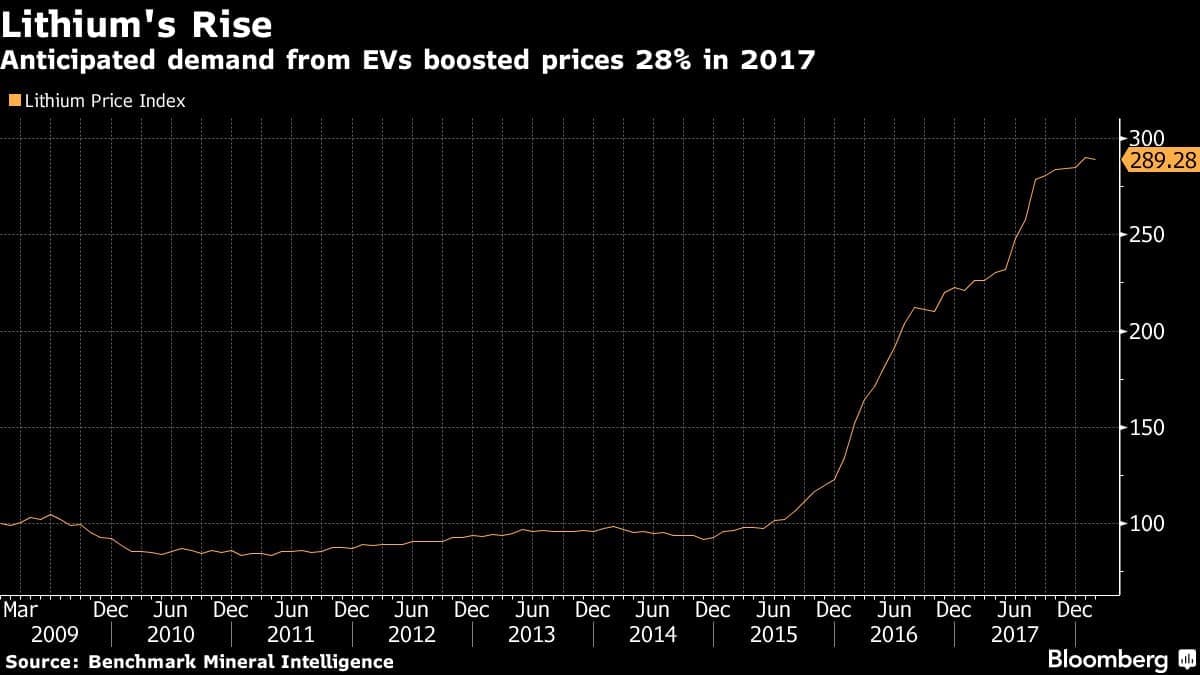

5. Lithium demand for EVs soaring

(Click to enlarge)

- Lithium demand for electric vehicles has skyrocketed since 2015. The Lithium Price Index has nearly tripled in less than three years, according to Bloomberg.

- Lithium demand is expected to jump 38-fold by 2030 to 7,845 metric tons annually, up from just 200 metric tons in 2016.

- The oil majors are starting to step up investments in batteries, renewable energy and electric vehicle infrastructure as a hedge on the evolving nature of the oil market.

- Some argue that lithium mining would be a perfect way for the oil majors to diversify. “Their specialty is resource extraction,” Jeff McDermott, managing partner of Greentech Capital Advisors LLC told Bloomberg. “They should buy lithium miners, get involved in the upstream of core battery technology.”

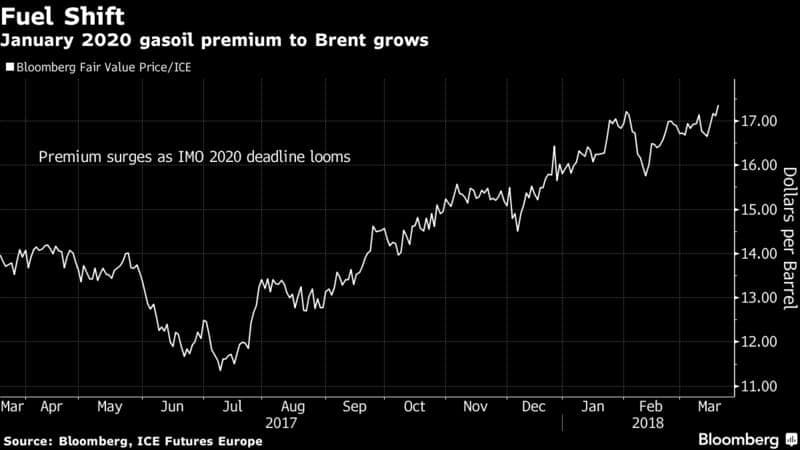

6. Complex refineries to benefit from marine fuel regulation

(Click to enlarge)

- The International Maritime Organization (IMO) has major regulations set to take effect at the start of 2020, requiring ship owners to burn fuel with a lot less sulfur. Sulfur content must drop from 3.5 percent to 0.5 percent.

- That means they will have to get off of dirty fuel oil, and switch to either LNG, distillate fuel or install scrubbers to remove sulfur from existing fuels.

- Scrubbers and LNG are expensive, and a lot of them will opt for distillates.

- That means that complex refineries, located along the U.S. Gulf Coast, Europe and Asia, could benefit enormously from the fuel switch.

- These refineries, unlike simple ones, can produce marine gasoil, which is similar to diesel, without left over residual fuel oil, according to Wood Mackenzie.

- Complex refineries can process different types of oil, and tweak inputs depending on what the market demands.

- “They’ll print money,” Alan Gelder, vice president for refining, chemicals and oil markets at Wood Mackenzie, said in a Bloomberg interview. “If the shipping industry needs more clean fuels, then that’s good for refining.”

- BP (NYSE: BP) and Repsol (BME: REP) is best situated among the European oil majors. Refineries equipped to run medium sour oil could be hit hard.

7. North Sea pulling out of “death spiral”

(Click to enlarge)

- The UK North Sea is seeing a little bit of a revival in fortunes after what appeared to be an existential crisis from the oil market downturn that began in 2014.

- The oil industry in the UK North Sea is set to greenlight 12 to 16 oil and gas projects this year, compared to just 17 projects that were sanctioned in the previous four years combined.

- Since 2014, UK North Sea oil production has ticked up by 16 percent, reversing a 14-year decline. 33 new projects came online between 2014 and 2017, adding 635,000 bpd of peak production.

- However, much of the increase in output came from projects sanctioned before 2014.

- Several years of cost savings and efficiency drives have made the North Sea more competitive, leading to a strong FID pipeline this year. More will be needed if the North Sea is to avoid production declines beyond 2019.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.