An all-stock acquisition in the Permian basin this week has made headlines for the two companies involved—Callon Petroleum and Carrizo Oil & Gas—but the implied value of the deal is multiple times lower than it would have been five years ago during the first wave of the U.S. shale boom.

Pressured by meager returns, if at all, and lower—if any—returns to shareholders, smaller U.S. shale players are looking for economies of scale and acreage positions close to their current ‘sweet-spot’ operations.

Those on the hunt for deals are carefully looking for quality over quantity and are not buying acreage that doesn’t materially improve the quality of their shale assets portfolio, Ryan Luther, a senior analyst with RS Energy, told Forbes contributor Christopher Helman. The analyst was commenting on the M&As in the U.S. shale patch and on this week’s announcement that Callon Petroleum and Carrizo Oil & Gas approved a definitive agreement under which Callon would buy Carrizo in an all-stock transaction valued at US$3.2 billion, including Carrizo’s debt.

The highly complementary deal is expected to realize primary annual run-rate synergies of US$100 million-US$125 million and create a mid-cap company focused on the development of premier Texas…

An all-stock acquisition in the Permian basin this week has made headlines for the two companies involved—Callon Petroleum and Carrizo Oil & Gas—but the implied value of the deal is multiple times lower than it would have been five years ago during the first wave of the U.S. shale boom.

Pressured by meager returns, if at all, and lower—if any—returns to shareholders, smaller U.S. shale players are looking for economies of scale and acreage positions close to their current ‘sweet-spot’ operations.

Yet, the mergers and acquisitions (M&A) scene across the U.S. shale patch hasn’t been thriving this year, except for a one-time huge deal between large-cap companies, the Occidental/Anadarko tie-up, the likes of which occur once in half a decade.

Even with the current low deal multiples and low valuations, smaller companies aren’t rushing to close deals.

Those on the hunt for deals are carefully looking for quality over quantity and are not buying acreage that doesn’t materially improve the quality of their shale assets portfolio, Ryan Luther, a senior analyst with RS Energy, told Forbes contributor Christopher Helman. The analyst was commenting on the M&As in the U.S. shale patch and on this week’s announcement that Callon Petroleum and Carrizo Oil & Gas approved a definitive agreement under which Callon would buy Carrizo in an all-stock transaction valued at US$3.2 billion, including Carrizo’s debt.

The highly complementary deal is expected to realize primary annual run-rate synergies of US$100 million-US$125 million and create a mid-cap company focused on the development of premier Texas shale assets, the companies say.

In a letter to employees explaining the deal rationale, S.P. "Chip" Johnson, IV, President and CEO at Carrizo, noted:

“As the shale basins continue to mature, it has become evident that large co-development projects represent the optimal development strategy. We believe that size and scale drive the efficiencies that are critical to this strategy and the long term success of an E&P company.”

“The combination of Callon and Carrizo should form a stronger company with positions of scale in the Permian Basin and Eagle Ford Shale, providing an extensive runway of high rate-of-return drilling locations and the potential to realize meaningful synergies and generate significant free cash flow,” Johnson added.

The cash-flow holy grail could in theory prompt increased M&A activity across the shale patch.

After oil prices crashed in the fourth quarter of 2018, many independent producers trimmed their spending budgets for this year, but investors continue to be unconvinced that they will see steady healthy returns.

While the largest players, including supermajors Exxon and Chevron, are expanding their Permian presence and aim to grow production volumes significantly over the next few years, small, third-tier exploration and production companies have been struggling even when WTI Crude prices were above $60 a barrel. Related: Colombia’s Push To Triple Proven Oil & Gas Reserves

Some small players who have been relying on borrowings to finance drilling are now finding themselves in a position to look for options to restructure debt, including by seeking Chapter 11 bankruptcy protection.

Yet, the total value of oil and gas M&A deals in the U.S. in Q1 2019 slumped to its lowest level in ten years as the deals market failed to recover from the oil price and equities slump in Q4, figures from energy data analytics company Drillinginfo showed.

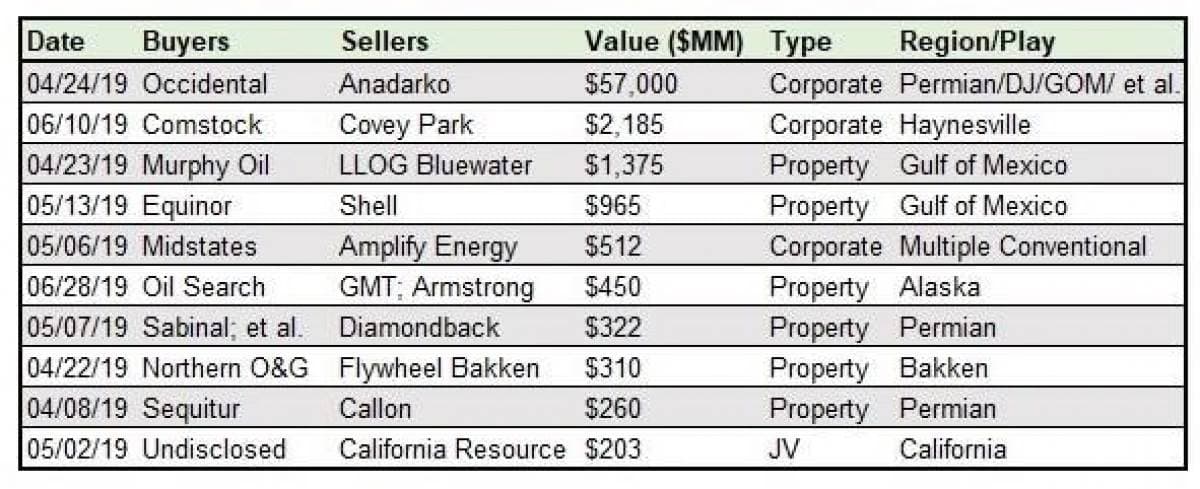

In Q2, the value of oil and gas M&As was greater than in Q1, but still unremarkable, considering that almost 90 percent of deals was a single proposed transaction—the Oxy-Anadarko tie-up, Drillinginfo said earlier this month.

“While deals rebounded off historic lows in Q1 to reach $65 billion, analysts caution the value was overwhelmingly driven by Occidental’s $57 billion acquisition of Anadarko, which is the fourth-largest oil and gas upstream deal ever. That single acquisition contributed 88 percent of total deal value in Q2,” Drillinginfo said.

Source: Drillinginfo

Going forward, Drillinginfo expects that further “mergers of equals” could take place in the U.S. oil and gas sector, but noted:

“Commentary from market participants including management at the majors indicates the wide expectations in price between buyers and sellers makes deals challenging.”

By Tsvetana Paraskova for Oilprice.com

More Top Reads From Oilprice.com: