After years of neglect due to low oil prices, oil companies are again beginning to devote capex to the offshore, and deepwater sectors. They are able to do this for two reasons.

- Retooled project portfolios with breakeven costs in the $30-40 range.

- New technology cutting well drilling and completion time by as much as 50%, meaning rig days charged to a well have been cut by half.

This is having an effect on the supply of ready-to-work offshore drilling units as Kurt Hallead, of RBC capital markets recently noted. He sees it as a positive sign of change that companies are starting to reactivate stacked units to meet demand.

“If there were ample supply, an oil company would wait for an active rig to become available rather than contracting one that’s been sitting on a beach for two years.”

Given this fact, I thought it was time to take a look at the offshore deepwater drilling sector for investing opportunities, and recently established a long position in Transocean. Here is a closer look at the fundamentals I believe will drive them higher in the coming months.

Ownership Thesis for Transocean

Transocean, (NYSE: RIG) is solely focused on servicing the deep, (DW) and ultra-deepwater, (UDW) market segments of the offshore drilling sector, (OSD). In the past few years, for reasons well known to market participants, this has meant that the company has struggled to generate adequate returns, and the stock price has suffered as a result.

From…

After years of neglect due to low oil prices, oil companies are again beginning to devote capex to the offshore, and deepwater sectors. They are able to do this for two reasons.

- Retooled project portfolios with breakeven costs in the $30-40 range.

- New technology cutting well drilling and completion time by as much as 50%, meaning rig days charged to a well have been cut by half.

This is having an effect on the supply of ready-to-work offshore drilling units as Kurt Hallead, of RBC capital markets recently noted. He sees it as a positive sign of change that companies are starting to reactivate stacked units to meet demand.

“If there were ample supply, an oil company would wait for an active rig to become available rather than contracting one that’s been sitting on a beach for two years.”

Given this fact, I thought it was time to take a look at the offshore deepwater drilling sector for investing opportunities, and recently established a long position in Transocean. Here is a closer look at the fundamentals I believe will drive them higher in the coming months.

Ownership Thesis for Transocean

Transocean, (NYSE: RIG) is solely focused on servicing the deep, (DW) and ultra-deepwater, (UDW) market segments of the offshore drilling sector, (OSD). In the past few years, for reasons well known to market participants, this has meant that the company has struggled to generate adequate returns, and the stock price has suffered as a result.

From the lows of December, 24th 2018 RIG has rebounded about 30%, consistent with other industry players. Worries in the investment community about the market for deepwater drilling, have kept it around the $9.00 resistance level for several months. Recently analysts have changed their perception about prospects for growth in the OSD sector due, in large part, to Brent approaching and then rising past the $70 USD mark. Notable among this analyst cadre are Barclays and Evercore ISI.

Given this change in the outlook for oil, I think a case can be made that the worst days are behind them. That being the case, current pricing sub $9.00/share represents an attractive entry point for investors with a moderate to aggressive tolerance for risk.

Transocean the company

The Transocean of today bears little resemblance to the company of five years ago. In the intervening time it has helped to consolidate the industry by acquiring first, Songa Offshore, and most recently Ocean Rig. These transactions drew a mix of praise and criticism, but I will not be arguing the individual aspects of each in this article. Their immediate impact on Transocean, however, has been two-fold.

The Songa deal brought ~$4.0 billion in a very lucrative backlog with Equinor (NYSE: EQNR) and made it the leader in North Sea Harsh Environment (HE) rigs. The Ocean Rig deal further enhanced its lead in the UDW and HE categories. The slide below highlights RIG’s current market position versus their competitors.

Of course, a lot of debt came along with these deals, and that adds to the overhang on the stock. As I am mentioning debt, I should also mention that RIG’s backlog of ~$12.0 billion is about 4X their nearest competitors.

One reason for the precarious situation that the OSD group finds itself in is a drastic over-supply of fixtures dedicated to deepwater. This is a legacy of the last boom that ended in 2014, where the oil price topped out near $120/bbl. The slide above shows Transocean’s estimate for the total global supply of competitive vessels. It reveals a very lackluster ~52% activity rate for the global fleet. Basically, operators have two rigs available for every opportunity, a classic buyer’s market.

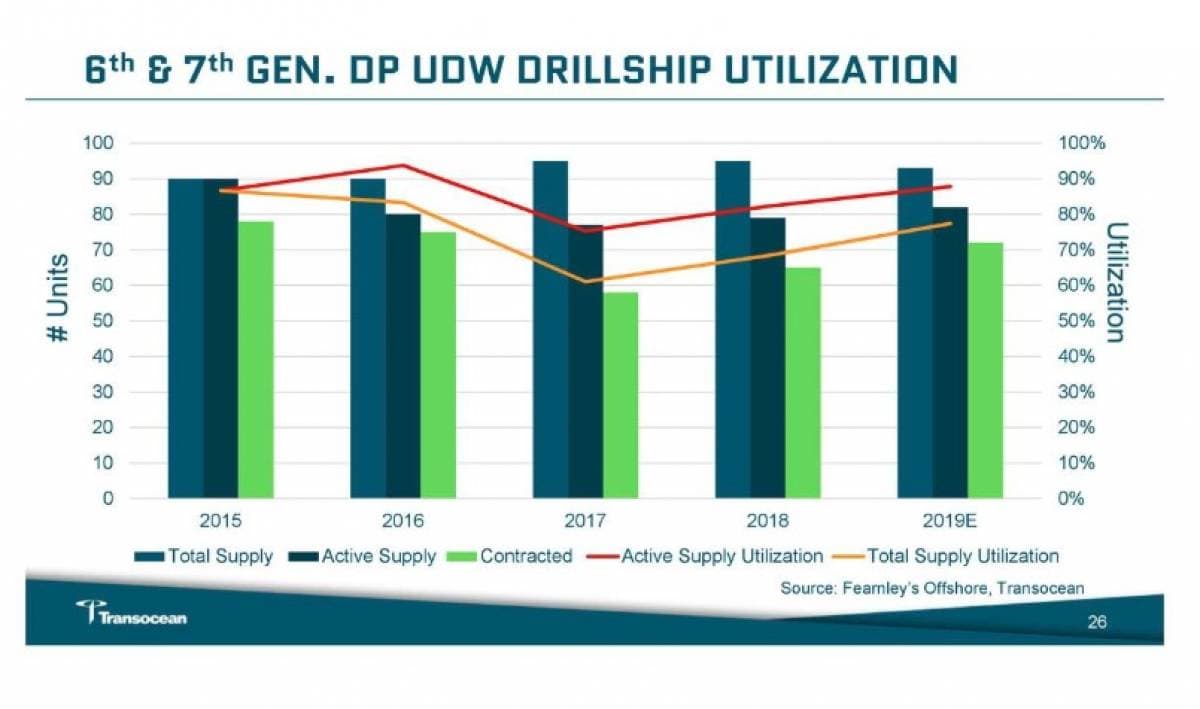

The next slide shows that Transocean’s thesis for the Songa and Ocean Rig may have been right on target with the trends developing in the industry today. Utilization rates are above 70%, presenting a more limited set of choices for prospective clients. This is bullish for the UDW sector.

Furthermore, the industry, due to the nature of the work it is attempting in harsh environments and in extreme water depths, is exhibiting a decided preference for more modern and efficient rigs.

Why is the industry returning to deepwater?

McKinsey, a leading market research firm put out a report last year that highlighted the rationale for returning to the marine environment. About half the new production needed by 2030 will come from deepwater (Ex-1) and from projects still waiting to be sanctioned. More interestingly, it discussed where much of this new oil would be produced geographically, with the U.S. Gulf of Mexico and Brazil contributing much of the increase (Ex-2).

Exhibit 1

Exhibit-2

Summary

Transocean and other industry players have seen some hard times in the last few years. RIG has spent this time pruning its fleet of older rigs that don’t deliver the performance clients are demanding, and buying the best of the competition. It should be noted though, there is more work to do here.

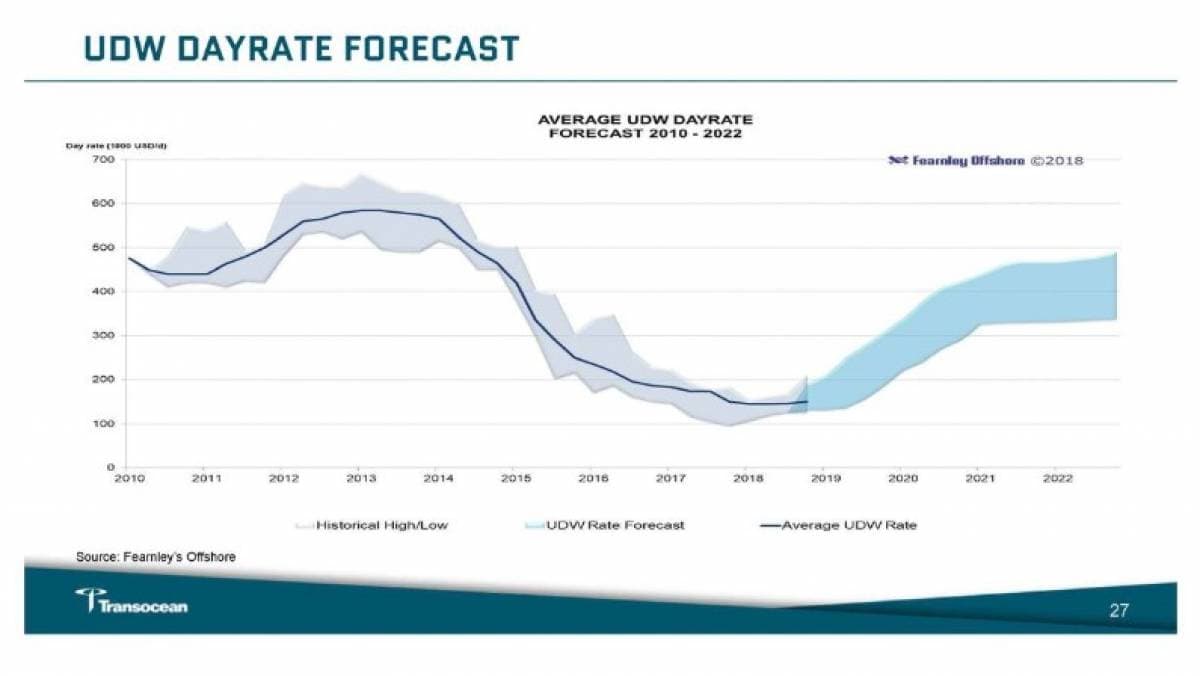

It has positioned itself to be the ‘best in breed’ in the DW and UDW categories through size and superior technology - as evidenced by the recent award from Chevron for a 20K psi drill ship. If the analyst upgrades and general upward trends for oil prices continue, then the company should see improved day rates going forward, with the attendant profitability that follows.

It is important to understand that Transocean remains a speculative investment, whose fortunes are directly tied to the oil price conditions we are currently seeing. Among the risks that investors should consider are $2.0 billion in debt and bond maturities in 2023 that could consume most of the company’s roughly $3.0 billion in cash. The company is banking on improved day rates to avoid a dilutive equity raise, or new debt issuance.

Transocean is currently trading at around $8.60/share. I think it can be bought at this level but would only establish a half position. RIG can bounce around quite a bit, and opportunities to buy down in the $8.00 range may present themselves.

Once day rates begin to improve, possibly in the second half of this year, I expect RIG will quickly double from present levels. A ten year average price for the stock is in the mid-thirties, giving us a likely range for Transocean over the next 3-5 years.