Oil markets got a modest bounce at the end of last week on headlines that OPEC+ will likely extend their current supply cut agreement and cooperation between the US and Mexico which will likely prevent hefty tariffs. On the OPEC+ front, Saudi Oil Minister Al-Falih met with his Russian counterpart then promised reporters the group would continue to work on supply cuts to counteract the threat of slowing global demand. On the trade side, markets are still highly anxious about the fragile state of the global trade flows and Trump’s Twitter feed, but the threat of the US putting a 5% tariff on all Mexican goods is dormant for now. Unfortunately, overall market sentiment remains negative with hedge funds maintaining an unenthused position on crude while market commentary is increasingly concerned with the global economy’s growth prospects.

First, let’s quickly review what’s going on with hedge funds and oil. It hasn’t been pretty. Speculators have cut their combined net long position in ICE Brent and NYMEX WTI contracts by 45% since late April corresponding with a roughly $10 decrease in prices for both grades. In looking at the amount of length that funds have sold over the last six weeks we see a large amount of market pain which had been driven by expectations that the Trump administration’s decision to end the Iran waiver program would send prices skyrocketing, only to be met with the reality that Iran would continue to export barrels, global crude inventories would continue…

Oil markets got a modest bounce at the end of last week on headlines that OPEC+ will likely extend their current supply cut agreement and cooperation between the US and Mexico which will likely prevent hefty tariffs. On the OPEC+ front, Saudi Oil Minister Al-Falih met with his Russian counterpart then promised reporters the group would continue to work on supply cuts to counteract the threat of slowing global demand. On the trade side, markets are still highly anxious about the fragile state of the global trade flows and Trump’s Twitter feed, but the threat of the US putting a 5% tariff on all Mexican goods is dormant for now. Unfortunately, overall market sentiment remains negative with hedge funds maintaining an unenthused position on crude while market commentary is increasingly concerned with the global economy’s growth prospects.

First, let’s quickly review what’s going on with hedge funds and oil. It hasn’t been pretty. Speculators have cut their combined net long position in ICE Brent and NYMEX WTI contracts by 45% since late April corresponding with a roughly $10 decrease in prices for both grades. In looking at the amount of length that funds have sold over the last six weeks we see a large amount of market pain which had been driven by expectations that the Trump administration’s decision to end the Iran waiver program would send prices skyrocketing, only to be met with the reality that Iran would continue to export barrels, global crude inventories would continue to expand and US/China trade talks would unexpectedly deteriorate forming a potent bearish cocktail. Hedge funds were Long & Wrong back in April and appear unenthusiastic about oil’s prospects in the near term after being burned in the spring. The current state of affairs has net length in NYMEX WTI contracts at 183k (37% below its 2yr average) while ICE Brent net length at 304k contracts is 34% below its 2yr average. The message is clear- speculators aren’t bullish on oil despite supply cuts from OPEC+ and geopolitical storms brewing from Tehran to Caracas.

Crude oil commentary soured in the last month with a variety of research agencies forecasting substantial inventory builds in 2020. The IEA is set to release their next global oil market summary on Friday and the buzz around town is that it will have a bearish focus on slowing global demand. The report would add to a chorus of negativity in the last month led by S&P Global Platts’ prediction of ~400k bpd builds in 2020 while the EIA forecasts builds of 100k bpd, Energy Aspects sees builds of 500k bpd and IHS Markit predicts builds of 800k bpd next year (via Bloomberg.)

With every hedge fund aggressively exiting their bullish crude positions and the entire commentary world turning negative- we must ask, just for fun, is it time to consider going long oil? We aren’t prepared to offer a bullish forecast on crude but we are obliged to say that when everyone is just so absolutely sure of the future of the market, a contrarian bet can work nicely. Afterall, Brent spreads still see decent global inventory draws through the balance of 2019 and geopolitical turmoil is festering across the Middle East, Africa and Latin America. As we see it, there is still potential volatility in both directions.

Quick Hits

- Brent and WTI are slightly lower to begin the week as global inventories continue to rise and US/China tariffs depress risk asset prices.

- Brent traded near $62/bbl on Tuesday while WTI was near $53/bbl.

- As we discussed in our first section, hedge funds have been aggressive sellers of crude oil derivatives since the most recent market top in late April. Net length in Brent futures and options held by speculators is down by roughly 50% over the last six weeks. Net length in WTI is down by about 42%.

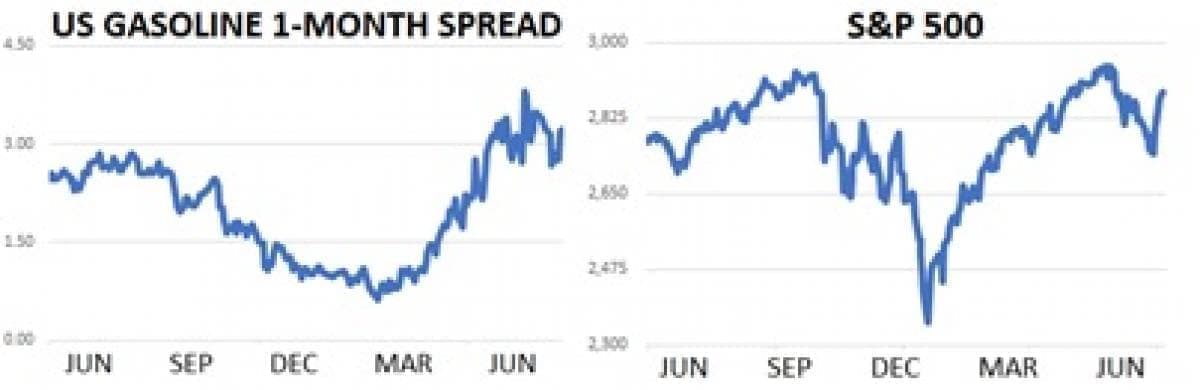

- For a more sanguine outlook, it’s important to remember that prompt Brent crude and US gasoline spreads are still in healthy backwardation. The structure- where prompt prices command higher prices than later dated ones- implies traders are broadly bullish on near term fundamentals.

- Recent comments from Vladimir Putin have given oil traders reason to be concerned that Saudi Arabia and Russia may part ways on managing the oil market down the road. The Russian President reiterated that he is happy with oil prices near $60. We still think that Russia’s budgetary need of $40 oil will make long term cooperation difficult given the Saudi need for $85 oil to balance their finances. In the short term, however, we still think the two sides will agree to more supply cuts for the rest of 2019 at their next official meeting in July.

- President Trump repeated claims that he will not execute a trade agreement with China unless the two signs can return to the basic terms the US had demand in the winter. Trump also threatened a 25% tariff on another $300b worth of Chinese imports if Xi does not meet with him at the Summer G20 in Japan.

- US Treasury yields continued to plod along at rock-bottom levels this week ahead of the Fed’s next interest rate announcement on June 19th. The US 10yr yield was trading near 2.14% midweek.

- US stocks traded back towards record-high levels this week and we frankly aren’t sure what to make of it. Yes, there is cause for optimism that the US Fed will lower rates next week but aren’t we still concerned about slowing global growth and US/China?

DOE Wrap Up

- US crude oil inventories had a massive build last week jumping more than 6.5m bbls on a surge in imports. Overall US crude stocks stand at 483.3m bbls and are higher y/y by 10% over the last month despite strong efforts from OPEC+ to shrink global inventories. US oil inventories have increased by nearly 44m bbls so far in 2019.

- The US currently has 28.9 days of supply of crude oil on hand and has averaged 28.8 days over the last month which is higher y/y by about 11%.

- Cushing, OK supplies increased more than 1.7m bbls last week to 50.8m which is their highest level since December ’17. WTI spreads have weakened considerably as a result of the buildup of oil in the US delivery hub.

- Production also played a part in last week’s build with oil companies pumping an average of 12.4m bpd- yet another US supply record. US crude production has averaged 12.1m bpd so far in 2019 after averaging 10.8m bpd in 2018.

- On the demand side we finally saw a healthy uptick in US refinery runs but overall levels are still shy of their seasonal norms. US refiners processed 16.9m bpd last week and have averaged 16.75m bpd over the last month for a y/y decrease of 200k bpd. We remain flummoxed by this lower number as refiner margins in the US still top $20/bbl for most parts of the barrel.

- On the trade side, our aforementioned surge in imports was 7.9m bpd last week which was their highest level since January. Crude imports have averaged 7.0m bpd in 2019. Meanwhile, exports were flat at 3.3m bpdm, putting net imports at 4.6 bpd.

- As for refined products, US gasoline inventories continued to jump adding about 3.2m bbls last week to 234m. Overall gasoline stocks are now lower y/y by about 2%.

- Distillate inventories also increased sharply last week moving higher by about 4.5m bbls to 129m. Overall distillate stocks are higher y/y by 10%.